Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

backspace66

|

Mar 11 2021, 02:58 AM Mar 11 2021, 02:58 AM

|

|

QUOTE(honsiong @ Mar 11 2021, 02:06 AM) Deposited and executed on Monday night. Rebalancing mechanism sold IJR on Tuesday. Now stocks are in the red and they buying them again. So you deposited on monday itself? I need to figure why my buy order execution keep getting worse. In the other end, someone on this thread treating it like there is no delay and can buy exactly on the day they want it. |

|

|

|

|

|

backspace66

|

Mar 11 2021, 06:52 AM Mar 11 2021, 06:52 AM

|

|

Nope, i have 2 different 36%. Old US centric is one of them.  |

|

|

|

|

|

backspace66

|

Mar 11 2021, 12:19 PM Mar 11 2021, 12:19 PM

|

|

QUOTE(honsiong @ Mar 11 2021, 11:08 AM) Sorry I use stashaway singapore. You are using robo advisor so you can't time the market with this tool, if you care about timing please consider opening CIMB Singapore + Tiger Brokers. x faham Yerp, i know cant really time due to delay. But previous experience create a certain expectation that it can be done without delay. So my first 15 or so transaction was ok but the last few was not. So just to confirm SA singapore is faster than SA Malaysia yeah? |

|

|

|

|

|

backspace66

|

Mar 18 2021, 05:44 AM Mar 18 2021, 05:44 AM

|

|

https://fintechnews.my/26573/wealthtech-mal...a-robo-advisor/Kenanga Investment Bank revealed on Monday that it had received a Digital Investment Manager license from Securities Commission Malaysia. The newly granted license allows for Kenanga to operate a robo advisor. Getting pretty crowded soon. Hopefully Kenanga is taking the etf route rather than the unit trust route which would be the easiest for them and also contributing to the earning of their own fund house.

|

|

|

|

|

|

backspace66

|

Mar 19 2021, 08:30 AM Mar 19 2021, 08:30 AM

|

|

QUOTE(kelvinfixx @ Mar 19 2021, 07:49 AM) I hope with the competition, the fees can to lower. Lower fees and faster response time, and if kenanga use the same approach, my money will go to kenanga |

|

|

|

|

|

backspace66

|

Mar 24 2021, 09:58 AM Mar 24 2021, 09:58 AM

|

|

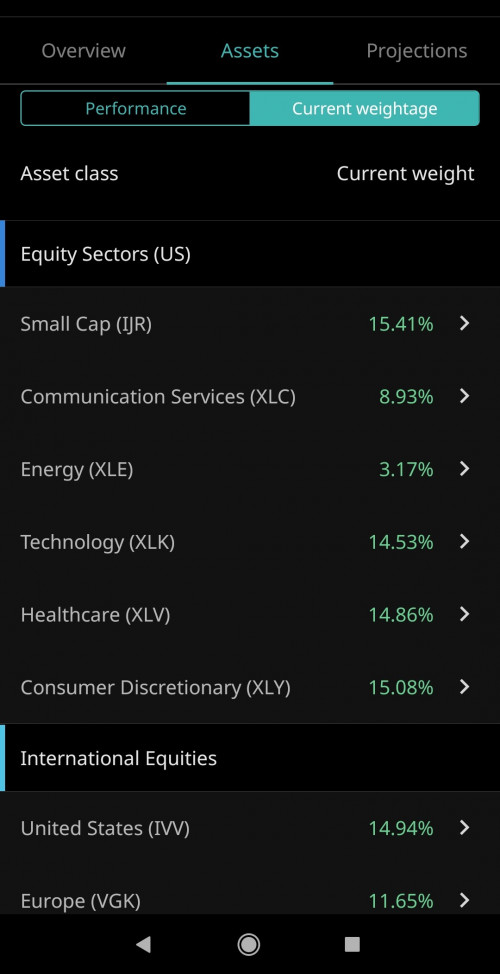

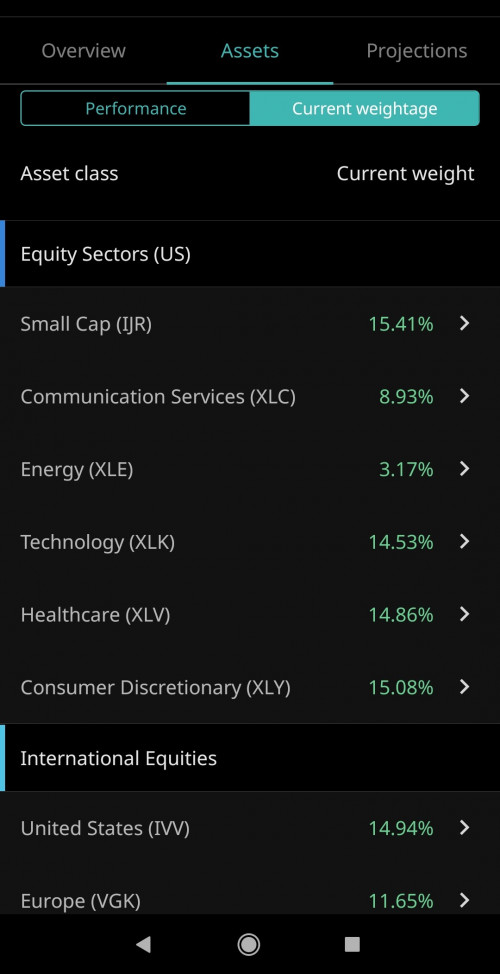

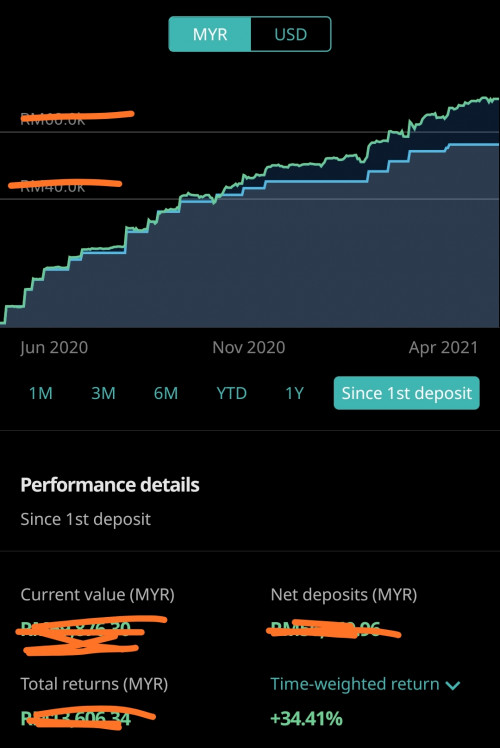

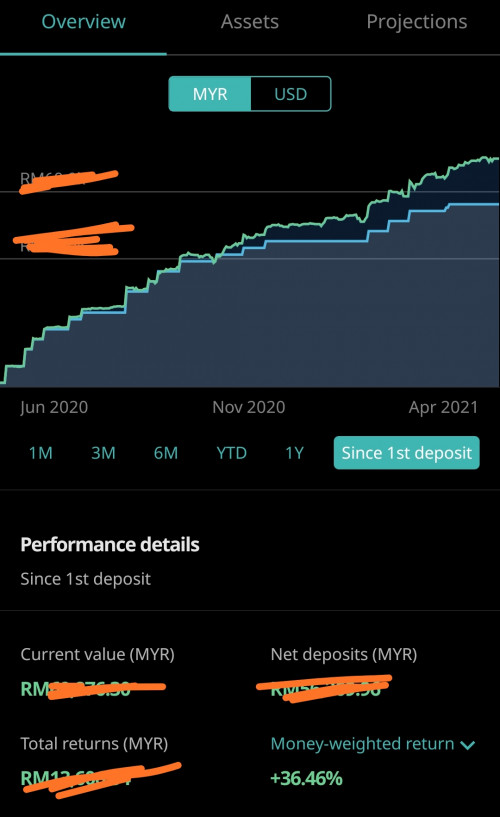

Just one of the portfolio (36%)  |

|

|

|

|

|

backspace66

|

Mar 28 2021, 11:28 AM Mar 28 2021, 11:28 AM

|

|

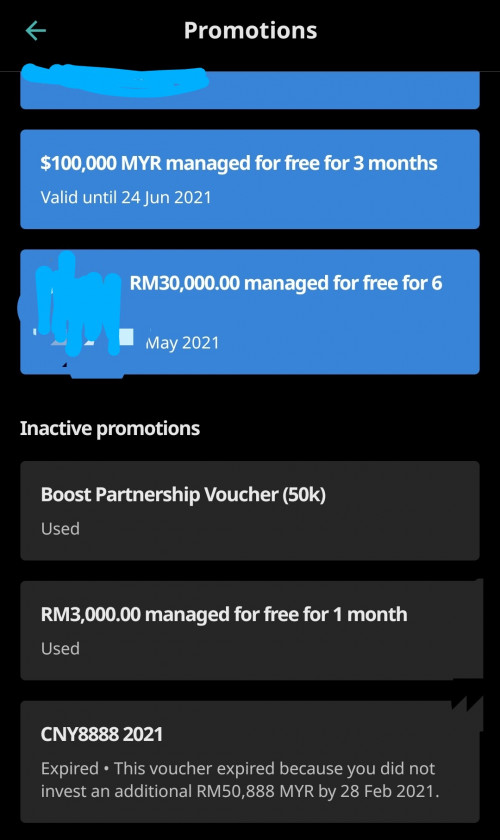

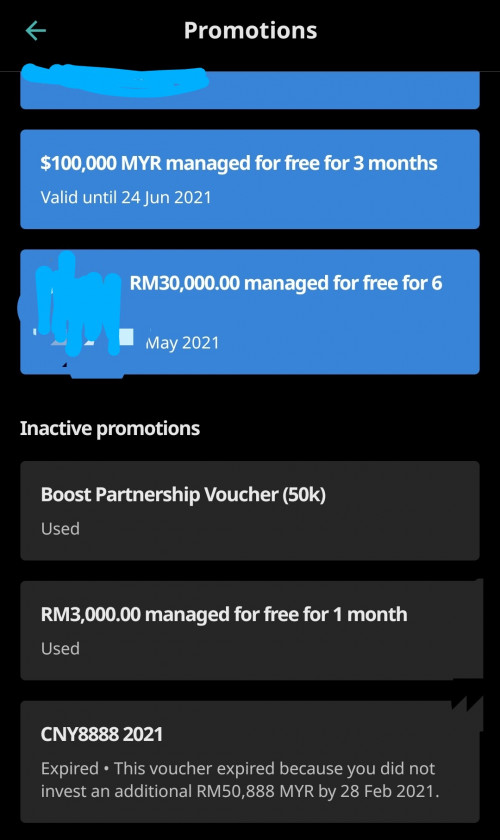

No need to think too much laa. Once you see promo, just key in as some really got a time limit. Thanks to the guy who provide BFM code.  |

|

|

|

|

|

backspace66

|

Mar 29 2021, 10:50 PM Mar 29 2021, 10:50 PM

|

|

If you accept optimization then you have to accept whatever was included in that new portfolio including GLD. No point complaining.

|

|

|

|

|

|

backspace66

|

Mar 29 2021, 11:01 PM Mar 29 2021, 11:01 PM

|

|

QUOTE(lee82gx @ Mar 29 2021, 10:55 PM) this is not even optimization, this is just regular portfolio rebalancing, you have no choice but to accept. Optimization is when a new fund is added, some old funds are completely removed. At that time you are really presented with the choice. Err, i do know that. I was talking about the optimization done back on may 2020 IIRC. There was no gold prior to that. And no i did not accept opmization back then and now i have both old and new portfolio. If you accepted the optimization the whole old portolio will be sold to rebuy the new portfolio. The point is someone accepted the optimization back then and now complaining. This post has been edited by backspace66: Mar 29 2021, 11:03 PM |

|

|

|

|

|

backspace66

|

Mar 29 2021, 11:05 PM Mar 29 2021, 11:05 PM

|

|

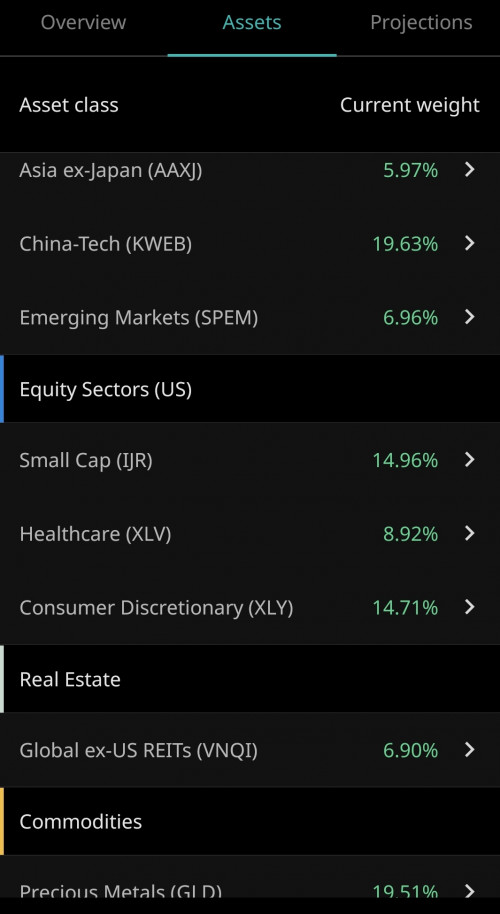

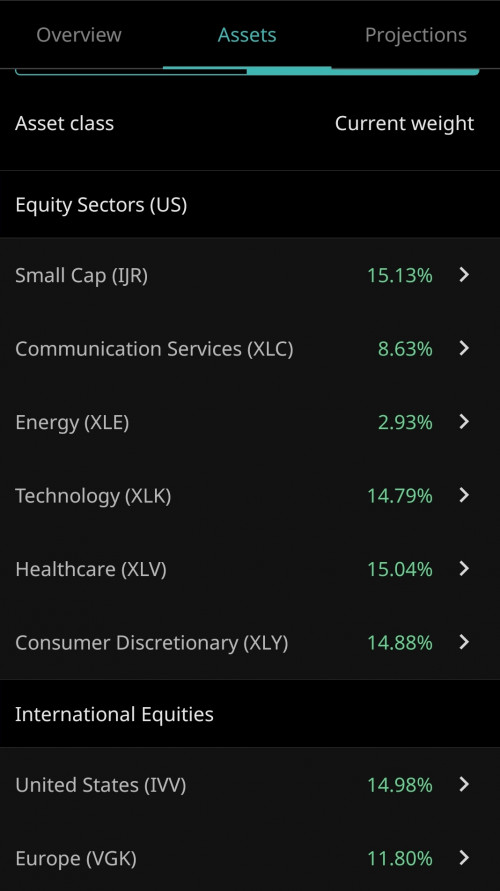

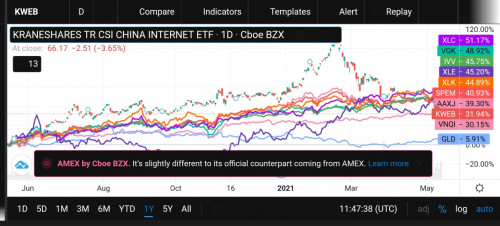

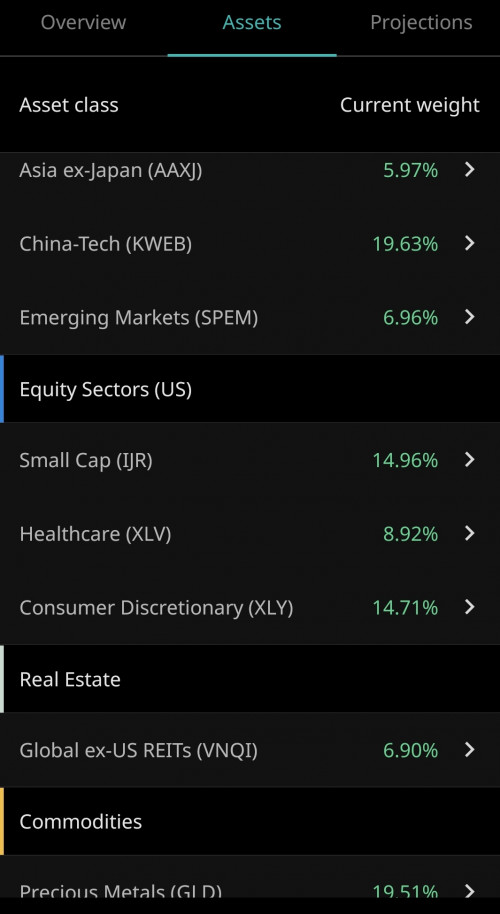

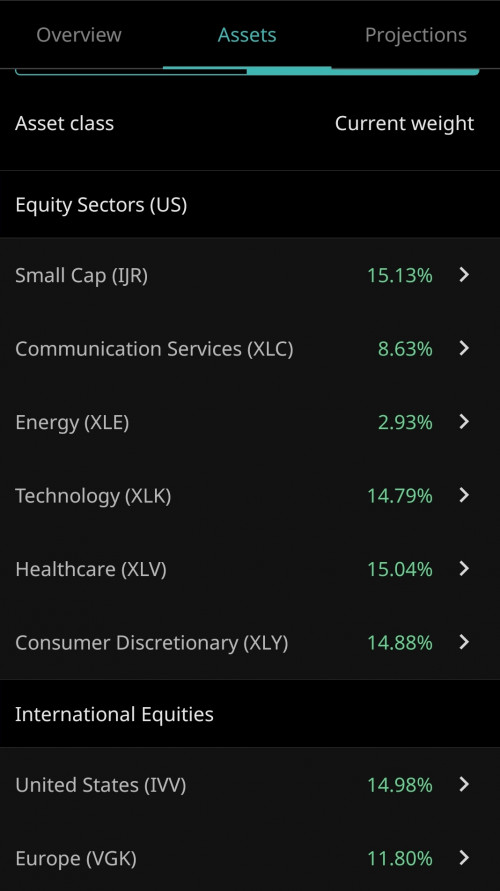

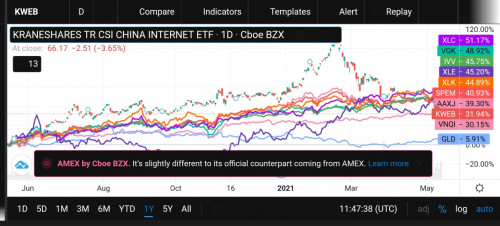

QUOTE(honsiong @ Mar 29 2021, 11:04 PM) RI 36%, weekly deposit. KWEB tanked further last week. My portfolio thicc enough, coz I don't have any EPF/CPF, and only KWEB is below target allocation I suppose. Gold is included into portfolio in the 1st reoptimisation in 2017 iirc. Then they increase allocation to gold in May 2020. I did not have gld for my old 36%. I only play 36% chief.   This is my current port both 36% This post has been edited by backspace66: Mar 29 2021, 11:09 PM |

|

|

|

|

|

backspace66

|

Apr 7 2021, 11:12 AM Apr 7 2021, 11:12 AM

|

|

Lol, s&p -0.1% , after going up more than 2.5% in just one week and breaking 4000 mark. Houston, we have got a problem. I thought someone call it just a blip in the long term yeah?

No one can predict the future, it might as well drop another 30% to 50 % within 6 months but i dont care, most of my money is in PNB fixed priced fund and can always put more. I know some try to stay out of the market completely by saying market is at ATH.

This post has been edited by backspace66: Apr 7 2021, 12:01 PM

|

|

|

|

|

|

backspace66

|

Apr 7 2021, 04:18 PM Apr 7 2021, 04:18 PM

|

|

QUOTE(lee82gx @ Apr 7 2021, 12:50 PM) Are you sure you're in the right thread.. fi asn is up further on the road. Lol, who cares someone trumpeting the pullback of 0.1% of s&p 500 as a win for their portfolio. Sorry i dont know who that is. LOL Basic math as -0.1% funny AF. This post has been edited by backspace66: Apr 7 2021, 04:19 PM |

|

|

|

|

|

backspace66

|

Apr 10 2021, 06:29 AM Apr 10 2021, 06:29 AM

|

|

QUOTE(djhenry91 @ Apr 9 2021, 10:53 PM)  Okay la.. so far so good.. No more DCA? |

|

|

|

|

|

backspace66

|

Apr 11 2021, 10:24 AM Apr 11 2021, 10:24 AM

|

|

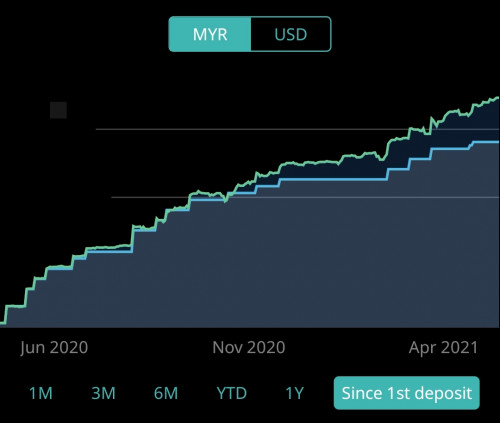

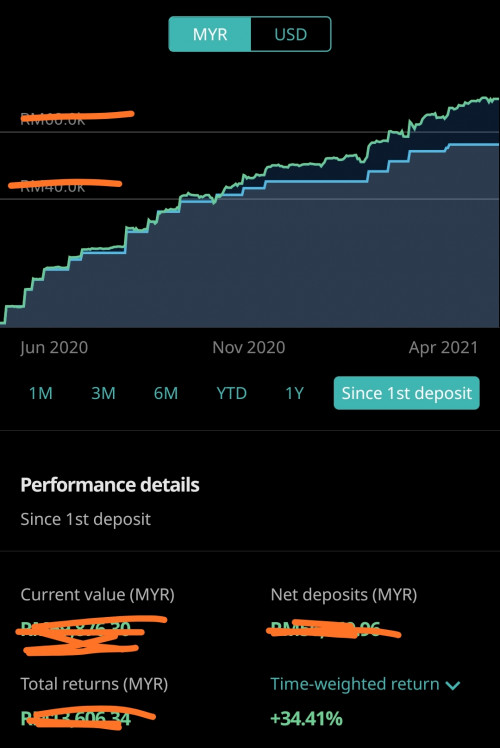

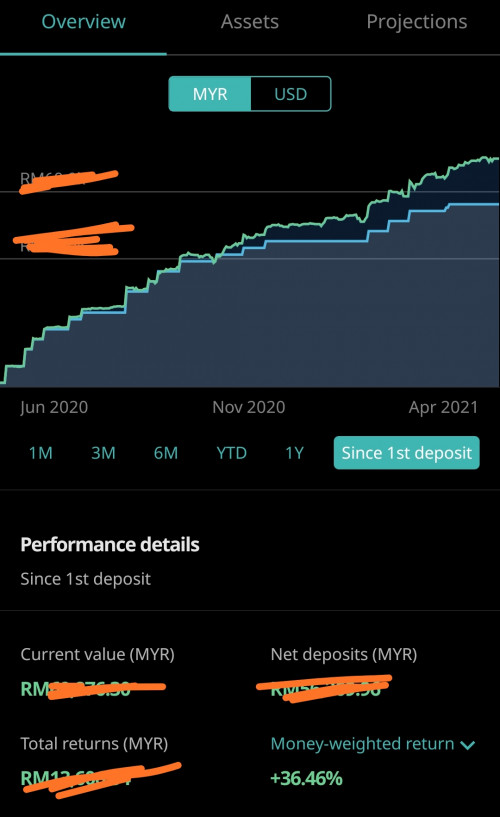

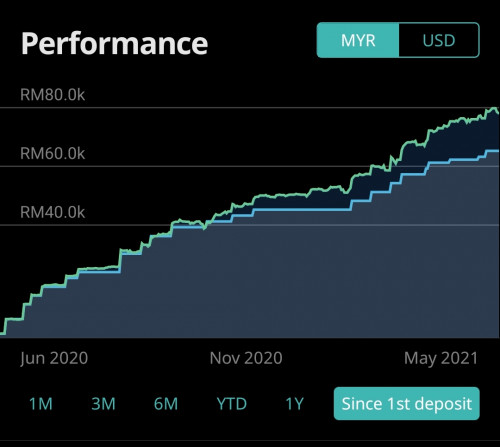

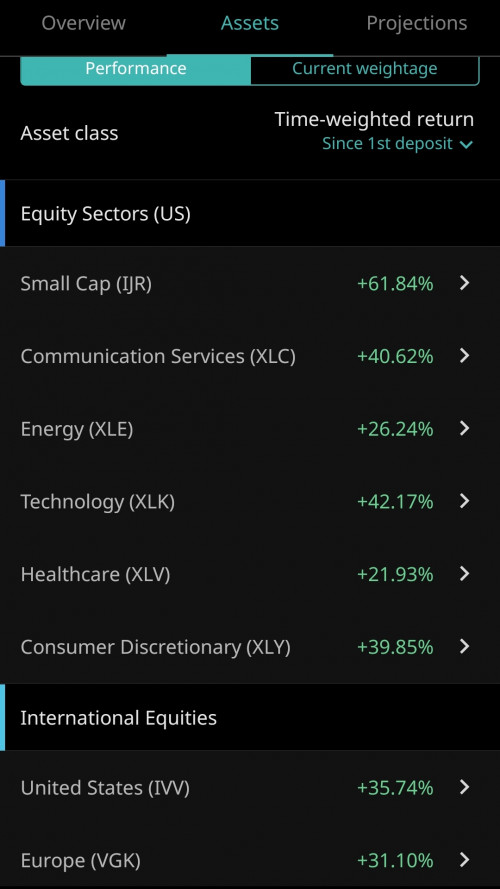

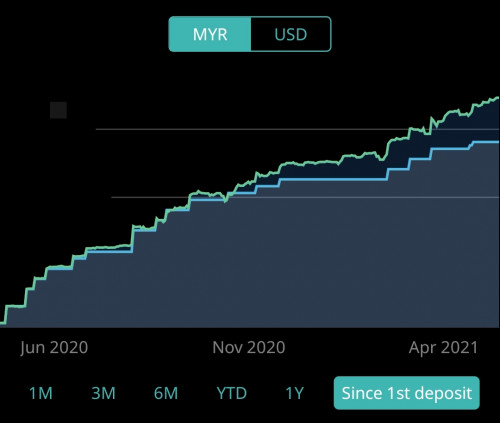

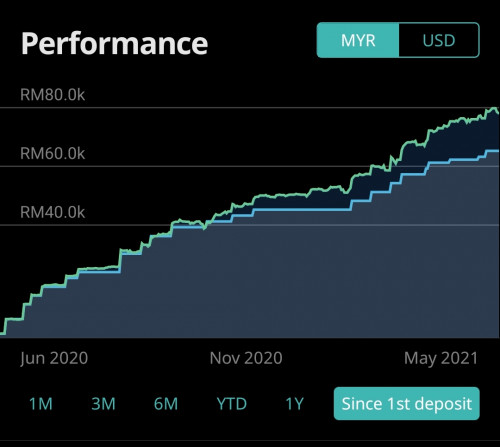

Just to share the current performance of my oldest uninterrupted portfolio in SA,from June 2020, no redemption/withdrawal/transfer to another portolio. Although i am starting to feel annoyed with SA lag time. I will continue until a better competitor appear. Here hoping that kenanga trying to enable cheaper access to US market and if that is not the case at least their robo will make use of etf instead of unit trust. [url=https://pictr.com/image/7qrbbQ]  [/url]  |

|

|

|

|

|

backspace66

|

Apr 11 2021, 12:10 PM Apr 11 2021, 12:10 PM

|

|

QUOTE(tbgreen @ Apr 11 2021, 10:30 AM) Appreciate your sharing. I always curious and follow your update of the old US heavy profile. Can you share your thoughts on the next re-Optimization and will you switch your current 1st (US heavy) and /or 2nd (KWEB heavy) profile to the incoming new portfolio with ESG heavy? Thanks in advance for your advise and sharing. I most likely keep the old two( US heavy 36% and KWEB heavy 36%) and add the new portfolio as well as part of diversification. Since there is no confirmation on the actual composition of the new portfolio, i cant really say much on the proportion or ratio between the three. |

|

|

|

|

|

backspace66

|

Apr 28 2021, 09:51 AM Apr 28 2021, 09:51 AM

|

|

QUOTE(tiramisu83 @ Apr 28 2021, 12:54 AM) just curious..do you guys feel the return from SA (36%) is consider low compare to Wahed or other platform? my return is like only 5% out of my total deposit (since 2020 Jul). I did DCA quite frequent. Not too bad for me, this one from june 2020   |

|

|

|

|

|

backspace66

|

May 13 2021, 07:24 AM May 13 2021, 07:24 AM

|

|

2k of profit already wiped out, maybe another 2k after the update today.  |

|

|

|

|

|

backspace66

|

May 13 2021, 07:43 AM May 13 2021, 07:43 AM

|

|

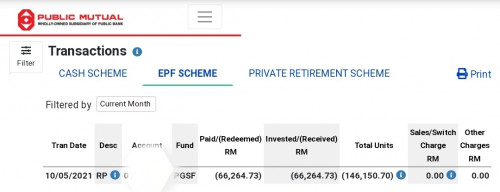

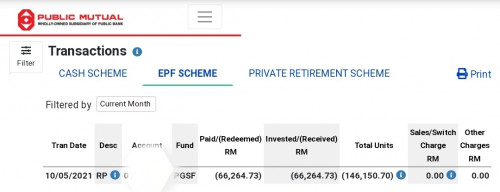

QUOTE(ChessRook @ May 13 2021, 07:36 AM) This reminds me of 2018. In times like this, i try not to look at my port performance frequently. Maybe every 4 months. This helps to calm me down and for me to make better investment decisions You do you. For me i am ok to look at my investment since i have experience it way back in 2008 as well other than 2011, 2018 and 2020. 2008 was way more painful due to how deep it is and the time it takes to recover. It is better to take a look at the market so you dont miss any opportunity when it comes. Withdraw from US market back on monday for my invesment using epf-mis in PGSF but not withdrawing from US heavy SA port.  This post has been edited by backspace66: May 13 2021, 09:37 AM This post has been edited by backspace66: May 13 2021, 09:37 AM |

|

|

|

|

|

backspace66

|

May 14 2021, 07:51 PM May 14 2021, 07:51 PM

|

|

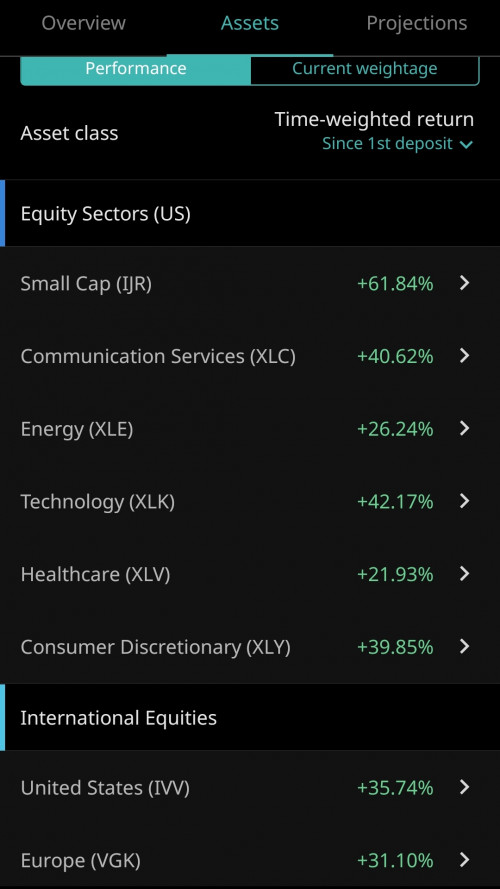

Just a fact check since 1 year from reoptimization, only considering 36% port over here  While i am not considering any weightage and overlap such as XLV, XLY and star performer IJR which exist in both old and new portfolio. The newer portfolio etf is currently the bottom 5. This post has been edited by backspace66: May 14 2021, 07:53 PM |

|

|

|

|

|

backspace66

|

May 16 2021, 08:45 AM May 16 2021, 08:45 AM

|

|

It is not about SA having live data. No one need that. SA need to update after the market close. For a company that boast about tech, robo and shit, they need to at least make the update automated ,obviously after the market close.

This post has been edited by backspace66: May 16 2021, 08:45 AM

|

|

|

|

|

Mar 11 2021, 02:58 AM

Mar 11 2021, 02:58 AM

Quote

Quote

[/url]

[/url]

0.0457sec

0.0457sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled