QUOTE(!@#$%^ @ Mar 3 2023, 06:11 PM)

Check the 2nd link from the vibes portal.EPF - self contribution, need advise

EPF - self contribution, need advise

|

|

Mar 3 2023, 07:24 PM Mar 3 2023, 07:24 PM

Show posts by this member only | IPv6 | Post

#1301

|

Senior Member

2,215 posts Joined: Oct 2010 |

|

|

|

|

|

|

Mar 3 2023, 07:26 PM Mar 3 2023, 07:26 PM

Show posts by this member only | IPv6 | Post

#1302

|

Junior Member

800 posts Joined: Mar 2009 |

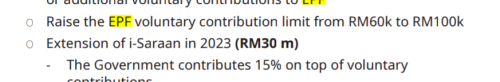

QUOTE(MUM @ Mar 3 2023, 07:02 PM) i googled and found this,.... https://budget.mof.gov.my/pdf/belanjawan202...pan/ub23-BI.pdf Yes, i think so too.  So it's confirmed then. 100k self contribution |

|

|

Mar 3 2023, 07:37 PM Mar 3 2023, 07:37 PM

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

QUOTE(sweetpea123 @ Mar 3 2023, 06:33 PM) That's so weird he didn't mention. I didn't listen but i just read online. Anyway, let me try to get confirmation from EPF. But reading today's projected 4.8% to 5.1%, suddenly not so gung-ho d. 🤣 Yes...https://www.msn.com/en-my/news/other/expect...rce/ar-AA188SZD The speculation rate is kinda disappointed 😞 |

|

|

Mar 4 2023, 05:34 PM Mar 4 2023, 05:34 PM

Show posts by this member only | IPv6 | Post

#1304

|

Junior Member

475 posts Joined: Feb 2010 |

Hi all, for self-contribution;

Is it better to: 1) Max out 60K on 1.1.23 2) Contribute last day of every month in 5K? I am new to this |

|

|

Mar 4 2023, 05:42 PM Mar 4 2023, 05:42 PM

Show posts by this member only | IPv6 | Post

#1305

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

Mar 4 2023, 06:13 PM Mar 4 2023, 06:13 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Mar 4 2023, 06:32 PM Mar 4 2023, 06:32 PM

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 4 2023, 06:35 PM Mar 4 2023, 06:35 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 4 2023, 06:37 PM Mar 4 2023, 06:37 PM

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

QUOTE(TOS @ Mar 4 2023, 06:35 PM) then ask someone u know (family or close friends) to ask behalf e-mail or kwsp ask elya TOS liked this post

|

|

|

Mar 4 2023, 06:39 PM Mar 4 2023, 06:39 PM

Show posts by this member only | IPv6 | Post

#1310

|

All Stars

14,922 posts Joined: Mar 2015 |

QUOTE(MystiqueLife @ Mar 4 2023, 05:34 PM) Hi all, for self-contribution; Is it better to: 1) Max out 60K on 1.1.23 If you got no issue with cash flow, then contribution 1 lumpsum at start of the year is better as it will generate more dividend for you. BTW max out on 1st of the month, or last day of the month will still gives you 1 day interest for that month. 2) Contribute last day of every month in 5K? preferably last week of the month. Just in case something happens on the last day, thus you will miss out on the dividend calculation I am new to this MystiqueLife liked this post

|

|

|

Mar 4 2023, 06:44 PM Mar 4 2023, 06:44 PM

Show posts by this member only | IPv6 | Post

#1311

|

All Stars

14,922 posts Joined: Mar 2015 |

QUOTE(TOS @ Mar 4 2023, 06:13 PM) So I should wait until bajet passed and EPF act amended then only I can contribute under i-saraan for 2023? I believes i saraan no need to amend epf act.It is a continuation...just need to change some tax relief matters with lhdn, as now proposed increase of tax relief to 300 from 250 |

|

|

Mar 4 2023, 07:18 PM Mar 4 2023, 07:18 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(MUM @ Mar 4 2023, 06:44 PM) I believes i saraan no need to amend epf act. I see. It is a continuation...just need to change some tax relief matters with lhdn, as now proposed increase of tax relief to 300 from 250 I notice the i-saraan description is missing from the official EPF page (it used to be under "Voluntary Contribution"). So as i-Suri. https://www.kwsp.gov.my/member/contribution But when I login to my CIMB account and select "EPF/KWSP Transfer", the i-Saraan/i-Suri option is still available. » Click to show Spoiler - click again to hide... « Kind of confusing people... This post has been edited by TOS: Mar 4 2023, 07:27 PM |

|

|

Mar 4 2023, 07:27 PM Mar 4 2023, 07:27 PM

Show posts by this member only | IPv6 | Post

#1313

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(TOS @ Mar 4 2023, 06:13 PM) So I should wait until bajet passed and EPF act amended then only I can contribute under i-saraan for 2023? I-Saraan will stay the same amount contribution as previous years Only thing you need to wait for bajet is the amount changes which has to be passed and amend the act as well QUOTE(nexona88 @ Mar 4 2023, 06:32 PM) for confirmation... No need to wait for bajet unless the amount increase or decrease 🤦♀️better ask EPF hotline directly... but personally.. I don't think need to wait for budget approvals... just dump straightaway |

|

|

|

|

|

Mar 4 2023, 07:31 PM Mar 4 2023, 07:31 PM

Show posts by this member only | IPv6 | Post

#1314

|

All Stars

14,922 posts Joined: Mar 2015 |

QUOTE(TOS @ Mar 4 2023, 07:18 PM) I see. just saw this in KWSP site,...I observed that i-saraan description is missing from the official EPF page (it used to be under "Voluntary Contribution"). So as i-Suri. https://www.kwsp.gov.my/member/contribution But when I login to my CIMB account and select "EPF/KWSP Transfer", the i-Saraan/i-Suri option is still available. » Click to show Spoiler - click again to hide... « Kind of confusing people... https://www.kwsp.gov.my/member/contribution...lf-contribution "The EPF contribution is not limited to those required under the EPF Act 1991. Voluntary participation of those who are not covered under the EPF Act is strongly encouraged. Furthermore, it is an advantage to have savings set aside for your future retirement." Those NOT covered under the EPF act can also contribute,...thus i also believes NO amendment to the EPF act is necessary if the gomen want to increase the self contribution limits from 60k to 100k. btw,...in EPF site under this page,... https://www.kwsp.gov.my/about-epf/resources/faq can still see they mentioned I- Suri & I-Saraan things. This post has been edited by MUM: Mar 4 2023, 07:34 PM Attached thumbnail(s)

|

|

|

Mar 4 2023, 08:02 PM Mar 4 2023, 08:02 PM

|

Senior Member

3,863 posts Joined: Jun 2022 |

|

|

|

Mar 4 2023, 09:13 PM Mar 4 2023, 09:13 PM

Show posts by this member only | IPv6 | Post

#1316

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Mar 4 2023, 09:31 PM Mar 4 2023, 09:31 PM

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Mar 4 2023, 09:45 PM Mar 4 2023, 09:45 PM

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 4 2023, 10:06 PM Mar 4 2023, 10:06 PM

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(nexona88 @ Mar 4 2023, 09:45 PM) Now I know why shariah one way lower... Historically, Shariah EPF dividend is always lower. Writedown loss making investment value around RM 2.5bil... They made bad investment decisions using the shariah portion $$$.... Shariah compliant equities are much lesser in the market also. Maybe if they split to another specialised fund manager (mentioned in Budget 2023) maybe can match Conventional dividends. |

|

|

Mar 4 2023, 10:13 PM Mar 4 2023, 10:13 PM

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

QUOTE(ronnie @ Mar 4 2023, 10:06 PM) Historically, Shariah EPF dividend is always lower. Yes...Shariah compliant equities are much lesser in the market also. Maybe if they split to another specialised fund manager (mentioned in Budget 2023) maybe can match Conventional dividends. It's lower... But this year got written losses of investment... So kinda huge writedown of investment... That's why... Need specialist fund manager to manage the shariah portion 💪 |

| Change to: |  0.0192sec 0.0192sec

0.72 0.72

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 06:54 PM |