QUOTE(BWassup @ Feb 25 2023, 04:08 PM)

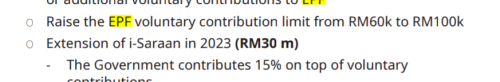

If there was gonna be an increase from 60k to 100k, wouldn't it have to be in the Proposed Budget first? Parliament is only gonna approve what Anwar has proposed in his paper yesterday. How would they be able to insert an additional proposal at the parliament sitting or announce it in fb without it being in the Proposed Budget?

I can't see anything about the 100k in the Touchpoints or in the Star paper either (unless I missed reading it).

So I don't see anything "wrong", and just take it that there isn't gonna be any increase this year.

😅

Unless he proposed an amendment during the bajet debat then they can change and amend during then but for now what is proposed is already set in stone I can't see anything about the 100k in the Touchpoints or in the Star paper either (unless I missed reading it).

So I don't see anything "wrong", and just take it that there isn't gonna be any increase this year.

😅

To make those changes EPF Act have to be amended hence more headache now because the time is tight for PMX doing things with 3 months to spare 🤦♀️

Feb 25 2023, 04:15 PM

Feb 25 2023, 04:15 PM

Quote

Quote

0.0281sec

0.0281sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled