QUOTE(FinalHistory @ Jan 31 2023, 08:48 AM)

Thank you so much for such a great idea. I remember the same Form 17A is to fill up in order to select either 9% or 11% contribution. I have never thought of changing it through this form, I thought I personally self contribute like a thousand from my own saving acc, now after you mentioned it, I realised that going through the employer will be better as it will not be taxable.

I forgot one point above. There is still the yearly 60k EPF top-up that you can do. So if you can't even fill up the 60k/year, no need 17A. Just keep your cash liquid.QUOTE(doremon @ Jan 31 2023, 08:56 AM)

Question: Can we self-adjust employee contributions from 11% to say 20% or 30% while the employer retains 13% (force saving for the employee)?

Yes, can go up all the way to 90% or somewhere there (just check is 89%). Doesn't sound right but yes can do that. Some may have sugar mommy/daddy that don't need to touch the monthly salary Singapore employee CPF is around 20% while our EPF is 11%

QUOTE(gashout @ Jan 31 2023, 09:43 AM)

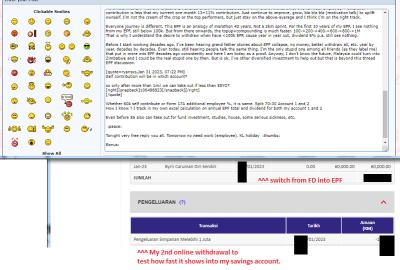

Keep it up bro ! Motivate each another Why I say IBG cause it takes few working days for 2nd online withdrawal and subsequent ones to show in my savings account. It's not IFT/DuitNow immediate within the same day.

QUOTE(Wedchar2912 @ Jan 31 2023, 12:15 PM)

Yes you can. Again it is subject to whether your HR wants to help you (which they should, but you know it is.... ) and subject to your net salary remaining in the positive.

proof: basically I've done it previously when still working

Correct. I recall it must be submitted by the Employer HR dept. You cannot submit Form 17A on your own directly to EPF, as it needs HR signature/chop or something.proof: basically I've done it previously when still working

Jan 31 2023, 11:09 PM

Jan 31 2023, 11:09 PM

Quote

Quote

0.0228sec

0.0228sec

0.16

0.16

6 queries

6 queries

GZIP Disabled

GZIP Disabled