QUOTE(Human Nature @ Mar 8 2022, 09:24 AM)

Mine too, early morning.EPF - self contribution, need advise

EPF - self contribution, need advise

|

|

Mar 8 2022, 01:05 PM Mar 8 2022, 01:05 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

2,192 posts Joined: Feb 2012 |

Human Nature liked this post

|

|

|

|

|

|

Mar 10 2022, 10:43 PM Mar 10 2022, 10:43 PM

Return to original view | Post

#2

|

Senior Member

2,192 posts Joined: Feb 2012 |

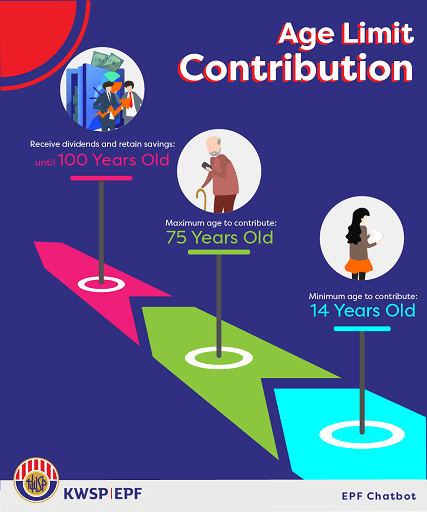

QUOTE(blibala @ Mar 10 2022, 10:39 PM) I want to ask on behalf my parent... He is 65 yo now. can he do self contributions with max RM60k/year and then withdraw small amount every month for spending? Any restrictions on number of withdrawal and amount? He wants to treat this as savings for self contribution Yes, until 75 |

|

|

Mar 11 2022, 04:48 PM Mar 11 2022, 04:48 PM

Return to original view | Post

#3

|

Senior Member

2,192 posts Joined: Feb 2012 |

|

|

|

Apr 7 2022, 10:47 AM Apr 7 2022, 10:47 AM

Return to original view | Post

#4

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(ericthai @ Apr 7 2022, 10:21 AM) Then the one year wait for the dividend to be paid out must be outrageous... |

|

|

Apr 7 2022, 11:35 AM Apr 7 2022, 11:35 AM

Return to original view | Post

#5

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(ericthai @ Apr 7 2022, 10:50 AM) The one year wait is normal if we put it under FD for 1 year. I guess you imposed the wrong expectations on kwsp, expecting it to behave like a bank, but it's not a bank.. it's a sovereign wealth fund.. they have little in common.. But they should pay out the dividend on January instead of Mar/April every year. Once you've adjusted your own understanding and expectations, then you will realize only thing needed here is to improve your knowledge, and the world is alright once again. g5sim and Human Nature liked this post

|

|

|

Apr 7 2022, 12:57 PM Apr 7 2022, 12:57 PM

Return to original view | Post

#6

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(Wedchar2912 @ Apr 7 2022, 12:35 PM) well... funds in EPF is not a deposit in the form of FD.... I was being sarcasticplus the minimum 2.5% return beats any FD around today.... immobile and Wedchar2912 liked this post

|

|

|

|

|

|

Oct 7 2022, 06:20 PM Oct 7 2022, 06:20 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

2,192 posts Joined: Feb 2012 |

|

|

|

Nov 11 2022, 11:02 PM Nov 11 2022, 11:02 PM

Return to original view | Post

#8

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(littleprawnReborn @ Nov 11 2022, 04:18 PM) Hi guys, if i want to self contribute thru Maybank2U, do i need to fill in any KWSP forms for this purpose? Just to add... not just your amount will be reflected, but also each contribution is a line item in your statement with the amount and date and labelled self contribution, just like your bank statement.Once i start self contribute, do i have to contribute every month or as and when i like? and last question, the self contribution amount will it be reflected in the KWSP statement on the online portal? Thanks in advance. |

|

|

Jan 10 2023, 11:14 AM Jan 10 2023, 11:14 AM

Return to original view | Post

#9

|

Senior Member

2,192 posts Joined: Feb 2012 |

For those who want to treat EPF as a flexi fund, I do believe there is this option of voluntary contribution of your RM60k to your parent's EPF account, which is probably already in Akaun 55 or EMAS and can be withdrawn at any time...

https://www.kwsp.gov.my/member/contribution...gs-contribution Forum experts - kindly feedback if incorrect. [ Edited - EPF T&C stated topup only for topee who are under 55, so you can contribute to parents until they are aged 54 ] This post has been edited by gooroojee: Jan 10 2023, 11:35 AM |

|

|

Jan 10 2023, 11:36 AM Jan 10 2023, 11:36 AM

Return to original view | Post

#10

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(MUM @ Jan 10 2023, 11:22 AM) And hopefully all your other siblings knows that those "extra" money in their parents epf accounts belongs to you. true... need strong family relationship... and no such issue if single child too... anyway I updated the above to reflect T&C - only valid for topee (recipient) aged below 55... MUM liked this post

|

|

|

Jan 10 2023, 12:10 PM Jan 10 2023, 12:10 PM

Return to original view | Post

#11

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(magika @ Jan 10 2023, 11:54 AM) Why need so troublesome use topup n topee method ? My nephew after my advise just transfered direct using voluntrary contribution to his mother (61 yrs old) unutilise account. Just ensure nomination is 100 % his. It will be complicated if two person with vested interest in it. I assume EPF views this as your sister's own self contribution? The impact is probably where the RM60k annual quota is being used up on. |

|

|

Jan 10 2023, 12:22 PM Jan 10 2023, 12:22 PM

Return to original view | Post

#12

|

Senior Member

2,192 posts Joined: Feb 2012 |

|

|

|

Jan 10 2023, 12:34 PM Jan 10 2023, 12:34 PM

Return to original view | Post

#13

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(magika @ Jan 10 2023, 11:54 AM) Why need so troublesome use topup n topee method ? My nephew after my advise just transfered direct using voluntrary contribution to his mother (61 yrs old) unutilise account. Just ensure nomination is 100 % his. It will be complicated if two person with vested interest in it. QUOTE(magika @ Jan 10 2023, 12:25 PM) ok thanks. that's interesting. i had assumed in below scenarios, each person has 60k to contribute to whichever account he's allowed to contribute to (self, spouse, children, parents):Scenario 1: - I have 60k, my son has 60k - i contribute 60k to my EPF account - my son contribute 60k to his EPF account - total contribution 120k, both me and son used up 60k quota Scenario 2: - I have 60k, my son has 60k - i contribute 60k to my EPF account - my son contribute 60k to my EPF account - total contribution 120k, both me and son used up 60k quota if topper and toppee share same quota due to contribution to others, then: Scenario 3: - I have 60k, my son has 60k - my son contribute 60k to my EPF account - total contribution 60k, both me and son used up 60k quota is the last scenario what you meant? or do you mean the below? Scenario 4: - I have 60k, my son has 60k - my son contribute 60k to my EPF account - total voluntary contribution to my account maxxed out at 60k, i cannot self-contribute further with your explanation, now my understanding is that it's based on 60k cap allowed into each individual's account per year then, which also makes sense. This post has been edited by gooroojee: Jan 10 2023, 12:49 PM |

|

|

|

|

|

Jan 10 2023, 12:49 PM Jan 10 2023, 12:49 PM

Return to original view | Post

#14

|

Senior Member

2,192 posts Joined: Feb 2012 |

|

|

|

Jan 10 2023, 12:59 PM Jan 10 2023, 12:59 PM

Return to original view | Post

#15

|

Senior Member

2,192 posts Joined: Feb 2012 |

|

|

|

Jan 29 2023, 11:48 PM Jan 29 2023, 11:48 PM

Return to original view | Post

#16

|

Senior Member

2,192 posts Joined: Feb 2012 |

|

|

|

Jan 31 2023, 08:21 PM Jan 31 2023, 08:21 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(ryansxs @ Jan 31 2023, 07:22 PM) Self contribution will be in which account? QUOTE(MUM @ Jan 31 2023, 07:32 PM) There's a caveat: QUOTE All EPF contributions to go into Account 1 to increase savings Minderjeet Kaur -November 24, 2021 12:03 PM KUALA LUMPUR: All Employees Provident Fund (EPF) contributions will, for now, go into Account 1 to replenish the savings of members, especially of those who have withdrawn funds to cushion the impact of Covid-19. Deputy finance minister Mohd Shahar Abdullah said RM101 billion had been withdrawn from EPF by members under i-Lestari, i-Sinar and i-Citra, part of the government’s stimulus packages. He said all new contributions would be credited to Account 1 until the amount that was withdrawn had been replaced. “After that, we will go back to the previous system of saving 70% in Account 1 and 30% in Account 2,” he said in the Dewan Rakyat. QUOTE(ryansxs @ Jan 31 2023, 07:22 PM) In general, withdrawals are allowed from your EPF account for home loans, to build a house, for studies, for medical treatment, etc., etc. Above 55 and above 1M are just two more allowed withdrawals. |

|

|

Feb 1 2023, 08:57 AM Feb 1 2023, 08:57 AM

Return to original view | IPv6 | Post

#18

|

Senior Member

2,192 posts Joined: Feb 2012 |

|

|

|

Feb 25 2023, 10:35 AM Feb 25 2023, 10:35 AM

Return to original view | IPv6 | Post

#19

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(magika @ Feb 25 2023, 10:19 AM) Two things are missing from the 2 diff pdf version. SSPN tax relief and epf add contribution. All M40 favourites. QUOTE(dlttdltt @ Feb 25 2023, 10:24 AM) KWSP Facebook updated with all budget incentives. No mention of 100k self contribution. Don't think it happened. |

|

|

Mar 24 2023, 10:19 PM Mar 24 2023, 10:19 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

2,192 posts Joined: Feb 2012 |

QUOTE(Cubalagi @ Mar 24 2023, 08:56 PM) Launch ASSB .. the additional S for Syariah nexona88 liked this post

|

| Change to: |  0.0291sec 0.0291sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 09:33 AM |