QUOTE

Sorry, an error occurred. If you are unsure on how to use a feature, or don't know why you got this error message, try looking through the help files for more information.

The error returned was:

You may only tag up to 5 members in a post.

QUOTE(jasontoh @ Jan 31 2023, 05:10 PM)

How long did you take to hit the 1M mark?

Decades. How old am I ? Look at my LYN ID joined date. But I'm still young, ok ? Not yet 55

. Everyone starts at the same starting point. My official first EPF monthly is just 1-2 hundred every month, basic salary only 1.5k. At that time, one full year employee + employer contribution is less that my current one month 13+11% contribution. Just continue to improve, grow, bla bla bla (motivation talk) to uplift ownself. I'm not the cream of the crop or the top performers, but just stay on the above-average and I think I'm on the right track.

Everyone journey is different. This EPF is an analogy of marathon 42 years. Not a 2km sprint. For the first 10 years of my EPF, I see nothing from my EPF, still below 100k. But from there onwards, the topup+compounding is much faster. 100->200->400->600->800->1M

That is why I understand the desire to withdraw when have <100k EPF, cause year in year out, dividend 6% p.a. still see nothing.

Before I start working decades ago, I've been hearing grand father stories about EPF collapse, no money, better withdraw all, etc. year by year, decades by decades. Even today, still hearing people talk the same thing. I'm the only stupid one among all friends (as they label me) that put in more into EPF decades ago consistently and here I am today as a proof. Anyway, I don't know the future, Malaysia could turn into Zimbabwe and I could be the real stupid one by then. But is ok, I've other diversified investment to help out but that is beyond this thread EPF discussion.

QUOTE(ryansxs @ Jan 31 2023, 07:22 PM)

Self contribution will be in which account?

so only after more than 1mil we can take out if less than 55YO?

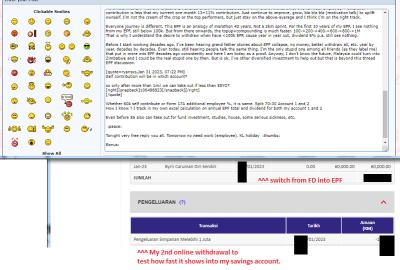

Whether 60k self contribute or Form 17A additional employee %, it is same. Split 70:30 Account 1 and 2

How I know ? I track in my own excel calculation on annual EPF total and dividend for both my account 1 and 2

Even before 55 also can take out for fund investment, studies, house, some serious sickness, etc.

Tonight very free reply you all. Tomorrow no need work (employee). KL holiday

Bonus:

» Click to show Spoiler - click again to hide... «

Nov 21 2019, 10:04 AM

Nov 21 2019, 10:04 AM

Quote

Quote

0.0286sec

0.0286sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled