Hi my colleague would like to increase her Life Cover protection. Any good plans out there to recommend?

Thank you.

Insurance Talk V5!, Anything and everything about Insurance

Insurance Talk V5!, Anything and everything about Insurance

|

|

Apr 15 2019, 10:02 AM Apr 15 2019, 10:02 AM

|

Junior Member

220 posts Joined: Jul 2009 |

Hi my colleague would like to increase her Life Cover protection. Any good plans out there to recommend?

Thank you. |

|

|

|

|

|

Apr 15 2019, 10:08 AM Apr 15 2019, 10:08 AM

|

All Stars

14,964 posts Joined: Mar 2015 |

QUOTE(zest168 @ Apr 15 2019, 10:02 AM) Hi my colleague would like to increase her Life Cover protection. Any good plans out there to recommend? what does she has? Thank you. what does she lacked? what does she need? what is her age? does she has dependents? Does she has a spouse? surplus budget? etc etc i think that are just some of the things that would be useful to real sifus out there to start to recommend |

|

|

Apr 15 2019, 10:50 AM Apr 15 2019, 10:50 AM

|

Junior Member

358 posts Joined: Dec 2007 |

|

|

|

Apr 15 2019, 10:55 AM Apr 15 2019, 10:55 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 15 2019, 10:58 AM Apr 15 2019, 10:58 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Apr 15 2019, 11:01 AM Apr 15 2019, 11:01 AM

|

Junior Member

220 posts Joined: Jul 2009 |

QUOTE(lifebalance @ Apr 15 2019, 10:58 AM) She said her existing life cover is not much, therefore would like to top up a bit. She is around 45 yo, working in office environment and maybe a RM500 monthly premium top up for a start of the conversation be good. |

|

|

|

|

|

Apr 15 2019, 11:03 AM Apr 15 2019, 11:03 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(zest168 @ Apr 15 2019, 11:01 AM) She said her existing life cover is not much, therefore would like to top up a bit. She is around 45 yo, working in office environment and maybe a RM500 monthly premium top up for a start of the conversation be good. |

|

|

Apr 15 2019, 11:41 AM Apr 15 2019, 11:41 AM

Show posts by this member only | IPv6 | Post

#728

|

Junior Member

58 posts Joined: Apr 2011 |

|

|

|

Apr 15 2019, 11:42 AM Apr 15 2019, 11:42 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Apr 15 2019, 12:05 PM Apr 15 2019, 12:05 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

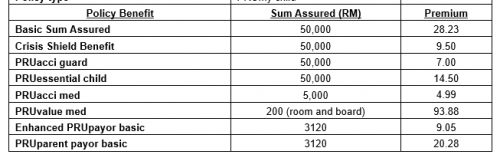

QUOTE(attentional @ Apr 14 2019, 11:23 PM) Any prudential insurance agent here? This is the package my wife sign up to insure my kid from birth. Is it too much? I'm paying RM188 per month. If you are asking for policy/certificate efficiency, the only way to find out is to make comparisons, just like how you would do the same when buying your gadgets or singing your mortgages. The RM188 is your resource, however it is subdivided and assigned to the policy and its riders is up to you and the agent.  QUOTE(cherroy @ Apr 15 2019, 09:27 AM) This is the same for both traditional/standalone and ILP medical. The problem is that the premium/contribution for ILP is cut by the company upfront, when the cost of insurance is the cheapest. whatever the difference between the COI and Premium could have been invested directlyBoth cost of insurance definitely will rise together with ages one. Just in ILP, they utilise (or in other word withdraw/redeem) the unit trust to pay for it. |

|

|

Apr 15 2019, 12:12 PM Apr 15 2019, 12:12 PM

Show posts by this member only | IPv6 | Post

#731

|

Junior Member

58 posts Joined: Apr 2011 |

QUOTE(MUM @ Apr 15 2019, 09:15 AM) Pru wealth is an ILP....(investment linked protection plan) Thank you.comparing it with a non ILP? read up from last page...there had been some discussion about it very recently......especially those by HoNeYdEwBoY then,....as normally suggested. a) You should assess the affordability and suitability of the product (including optional benefits) in relation to your financial goals and risk appetite. b) Buying life insurance policy is a long term financial commitment. c) You are advised to choose the type of product(s) that best suits your financial needs. d) You are advised to read and understand the insurance policy To achieve this, may i recommend that you speak to your agent and preferably if possible from another companies to perform a needs analysis and discussion and assist you in making an informed decision. |

|

|

Apr 15 2019, 02:01 PM Apr 15 2019, 02:01 PM

Show posts by this member only | IPv6 | Post

#732

|

Senior Member

1,762 posts Joined: Sep 2007 From: White Base |

|

|

|

Apr 15 2019, 02:03 PM Apr 15 2019, 02:03 PM

Show posts by this member only | IPv6 | Post

#733

|

Senior Member

1,762 posts Joined: Sep 2007 From: White Base |

|

|

|

|

|

|

Apr 15 2019, 06:02 PM Apr 15 2019, 06:02 PM

|

Junior Member

32 posts Joined: Mar 2017 |

Hi, this is regarding fire insurance for shop house which is rented out.

Can it be insured floor-by-floor so the premium is less? Because: Ground floor is currently empty. 1st floor - storage of general merchandise 2nd floor- dwelling The agent simply gave quotation based on the whole shop house used for retail of general merchandise, which I think carries a higher tariff rate. |

|

|

Apr 15 2019, 06:06 PM Apr 15 2019, 06:06 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(willwen @ Apr 15 2019, 06:02 PM) Hi, this is regarding fire insurance for shop house which is rented out. I am not sure, the insurance company will normally assess the usage of the overall building and quote accordingly rather than the purpose of each "floor" as they can't ascertain what is each floor used for in the future.Can it be insured floor-by-floor so the premium is less? Because: Ground floor is currently empty. 1st floor - storage of general merchandise 2nd floor- dwelling The agent simply gave quotation based on the whole shop house used for retail of general merchandise, which I think carries a higher tariff rate. |

|

|

Apr 15 2019, 08:07 PM Apr 15 2019, 08:07 PM

Show posts by this member only | IPv6 | Post

#736

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

QUOTE(willwen @ Apr 15 2019, 06:02 PM) Hi, this is regarding fire insurance for shop house which is rented out. You can insure floor by floor. Just fire happen only cover the floor u r insured. Can it be insured floor-by-floor so the premium is less? Because: Ground floor is currently empty. 1st floor - storage of general merchandise 2nd floor- dwelling The agent simply gave quotation based on the whole shop house used for retail of general merchandise, which I think carries a higher tariff rate. Fire insurance can include value of stock and what items you would like to choose to cover eg burgarly, stock value, building etc |

|

|

Apr 16 2019, 12:01 PM Apr 16 2019, 12:01 PM

|

Senior Member

1,145 posts Joined: Oct 2009 |

Is there any medical card + critical illness + life insurance all in one plan?

I don't have any personal insurance yet. Planning to get 1. Thanks in advance |

|

|

Apr 16 2019, 12:03 PM Apr 16 2019, 12:03 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Apr 16 2019, 12:35 PM Apr 16 2019, 12:35 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(chronous @ Apr 16 2019, 12:01 PM) Is there any medical card + critical illness + life insurance all in one plan? Yes there is, it's known as an investment link plan which you have the main coverage Death & Disability, within the policy, you can add on riders such as Medical Card, Critical Illness, etcI don't have any personal insurance yet. Planning to get 1. Thanks in advance |

|

|

Apr 16 2019, 04:24 PM Apr 16 2019, 04:24 PM

Show posts by this member only | IPv6 | Post

#740

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(Rain88 @ Apr 15 2019, 01:19 AM) Dear sifus, my Prudential agent introduced me a cash value life insurance plan called Pru-wealth. Is it a better plan compared to a conventional term life insurance plan? Any other insurance company selling similar product? do you buy because of the cash value or because of the life insurance? if u buy because of cash value, then you might be disappointed. if you buy because of the life insurance then yes that is a good plan. buying intention is very important so you make clear decision.Thank you, Rain |

|

Topic ClosedOptions

|

| Change to: |  0.0321sec 0.0321sec

0.64 0.64

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 11:38 AM |