QUOTE(Ilnov @ Apr 20 2019, 11:18 AM)

Yes, it seems everything else is the same except Pru have co insurance.

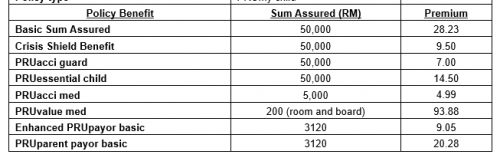

1. Annual limit: GE - RM1,320,000 and Pru no annual limit when I asked my agent

2. Lifetime limit: GE unlimited and Pru goes by MVP RM1mil, is that my lifetime limit with Pru?

3. Both also same room and board of RM200

How do you state that having full coverage can end up being expensive? Maybe I am zero knowledge about this insurance thing. I seeing both monthly premium of med card is the same amount.

Because when there are no co-insurances, clients will more likely drop by the hospitals and enjoy their services for the slightest of illness. That is fine, nothing illegal with that.

But insurance works based on law of large numbers. When the numbers of contributors are not large enough to cover the claims, the rates have to be increased across the board

With co-insurance the insurance company gets to reduce the in-patient claims by limiting or reducing the claimants to only those who are seriously ill

Also note that there are people who abuse their insurances. If caught there will be repercussions, but if the abuse is prevalent and not controlled, the cost of claims will increase for the company and you can expect that the company will increase their rates for all their customers

It is important to buy insurance from companies that are known for their good management. Because if the management is not strong, they may not have a good claim controls, and when that happens the funds will deplete quickly.

One sign (and i am not pointing fingers) to bad management is that the company is run badly that it couldn't survive on its own - thus they get bought over.

This post has been edited by wild_card_my: Apr 20 2019, 11:33 AM

Apr 12 2019, 09:59 AM

Apr 12 2019, 09:59 AM

Quote

Quote

0.1097sec

0.1097sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled