QUOTE(SwarmTroll @ Apr 14 2019, 08:42 PM)

Wait lemme understand more,

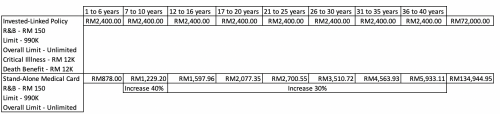

If I buy three standalones (Medical Card - Life Insurance - Critical Illness), it has a higher total premium than an ILP (with all three combined) only after 20 years?

In the excel you have shared, I see the ILP costs more for the first 20 years and then the standalone one will cost more after that. (This is assuming the generated returns from the ILP covers the increase in premium)?

But in your excel (Non-ILP) the medical card is only a medical card, without the addition of Life Insurance and Critical Illness. If the standalone were to consist of all three (Medical - LI - CI), would it still be lower in premium compared to ILP from the beginning?

If you calculate like that, standalone will be way cheaper than ILP. However, the main point of having ILP will be the additional riders on it and in a long run *touch wood* if you terkena TPD or CI then your "Waiver" rider can kick in then you don't need to pay rest of your life. The second scenario will be, if you having a standalone medical card and you forget to pay the premium or you have insufficient money to pay; which will cause your policy to be dismissed upon the payment date. But if you having ILP which has cash value in it, that will sustain the plan until you make the next payment and of course there will be a lapse date you need take note on.

Example of plan (Standalone):

Great Medic Extra 150Premium - RM 878 (Only can pay half yearly or yearly)

Room & Board - RM 150

Medical Limit - 990K (Include rider)

Overall Lifetime Limit - No limit

Accidental Death Benefit - RM 10,000

Smart LegacyPremium - RM 300 per month (A year RM 3600)

Sum Assured - RM 500,000

Additional Riders:

Critical Illness - RM 200,000 (Depending, can be adjust)

Waiver - (TPD/CI)

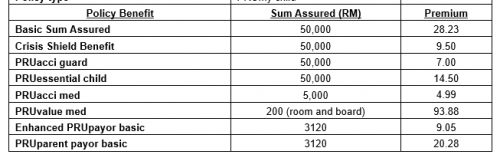

Example of plan (ILP):

SmartProtect Essential Insurance 2Premium - RM 200 per month (A year RM 2400)

Sum Assured - RM 12,000 (Minimum, can be adjust)

Additional Riders:

Critical Illness - RM 12,000 (Minimum, can be adjust)

Critical Illness Smart Early Pay Out - (Depending on how much)

Lady Illnesses

Waiver - (TPD/CI)

Hospitalisation Income Benefit

Accident Benefit

Smart LegacyPremium - RM 300 per month (A year RM 3600)

Sum Assured - RM 500,000

Additional Riders:

Critical Illness - RM 200,000 (Depending, can be adjust)

Waiver - (TPD/CI)

Apr 5 2019, 04:14 PM

Apr 5 2019, 04:14 PM

Quote

Quote

0.1059sec

0.1059sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled