QUOTE(-kytz- @ May 5 2019, 05:17 PM)

"Doctors told his family

he had a month to live and recommended seeking treatment elsewhere, as the

latest treatment was not available in the country.

The family from Selangor rushed to Singapore to seek a special treatment called

chimeric antigen receptor (CAR) T-cell therapy. It involves using the body's own immune cells to recognise and attack malignant cells."

https://www.nst.com.my/news/nation/2019/05/...icken-msian-boyTo quote my previous comment above again:

I've been looking around at different medical plans from various insurance companies but have narrowed down to a few plans which

at least cover medical treatment in Singapore/overseas. This is just a precautionary measure as I would still get treatment in Malaysia first and if something does happen down the line where an advanced treatment is only available in Singapore and not in Malaysia.

1) Allianz Medisafe Infinite Xtra (ILP Medical plan)Pros: - Covers medical treatment in Singapore based on

Reasonable & Customary Charges in Singapore

- No lifetime limit for treatment in Singapore (?)

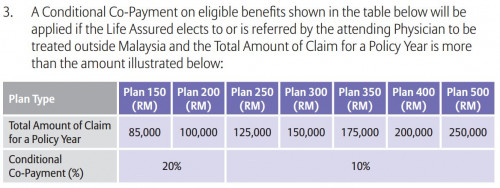

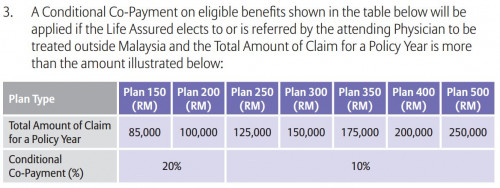

Cons: - Co-payment charges of 10% if the total claim per year exceeds a certain amount. Look below:

- "Limit" of RM125k for Plan250 (to not incur co-payment charges) might be little?

https://www.allianz.com.my/documents/144671...f6-030d918adee7

https://www.allianz.com.my/documents/144671...f6-030d918adee7_______________________________________________________________________________________________

2) Prudential PRU Medic Overseas (rider)Pros: - Seek treatment in Singapore, China and Hong Kong

- No co-payment charges

Cons: - Limited coverage of only 5 illnesses (Surgery related to cancer, Neurosurgery, Coronary artery bypass surgery, Heart valve surgery, Organ transplant - kidney, lung, liver, heart, pancreas or bone marrow transplant).

- There is a lifetime limit of RM4 million for PMO Platinum

- Low annual limit of RM400k, but still more than Allianz.

https://www.prudential.com.my/export/sites/...verseas_Eng.pdf________________________________________________________________________________________________

3) AIA Life Signature Beyond (Life insurance with CI treatment overseas)Pros - Medical treatment in any country in the world??

- No co-payment charges

Cons

Cons- The limit depends on the coverage and any claim reduces the "account value" - Basically, a portion of the life insurance coverage will be used for CI treatment

- What does this "only the first critical illness claim is covered" mean?

https://www.aia.com.my/content/dam/my/en/do...brochure-fa.pdf

https://www.aia.com.my/content/dam/my/en/do...brochure-fa.pdf_________________________________________________________________________________________________

Appreciate inputs from the sifus here

This post has been edited by -kytz-: May 27 2019, 07:14 PM

Mar 31 2019, 06:14 PM

Mar 31 2019, 06:14 PM

Quote

Quote

0.1488sec

0.1488sec

0.95

0.95

7 queries

7 queries

GZIP Disabled

GZIP Disabled