QUOTE(vin_ann @ Jun 17 2019, 04:06 PM)

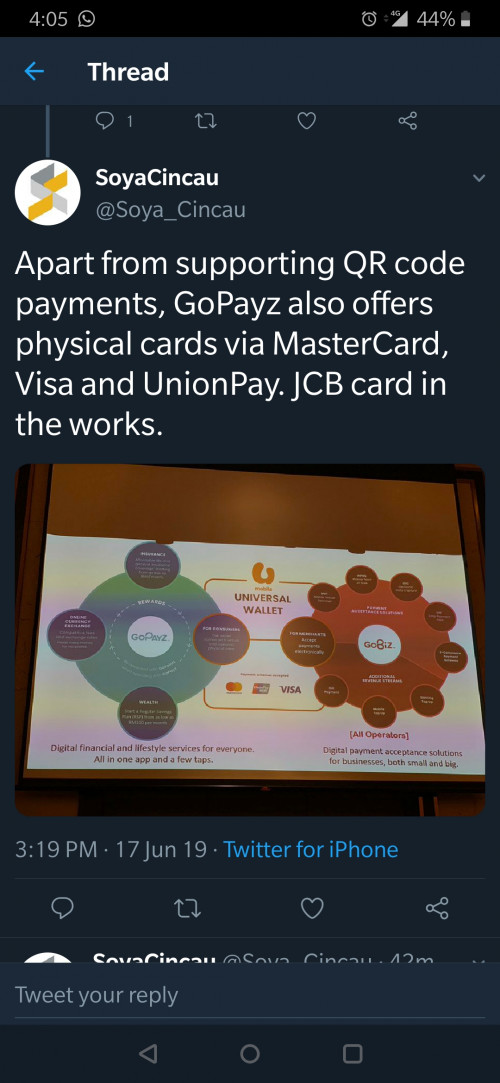

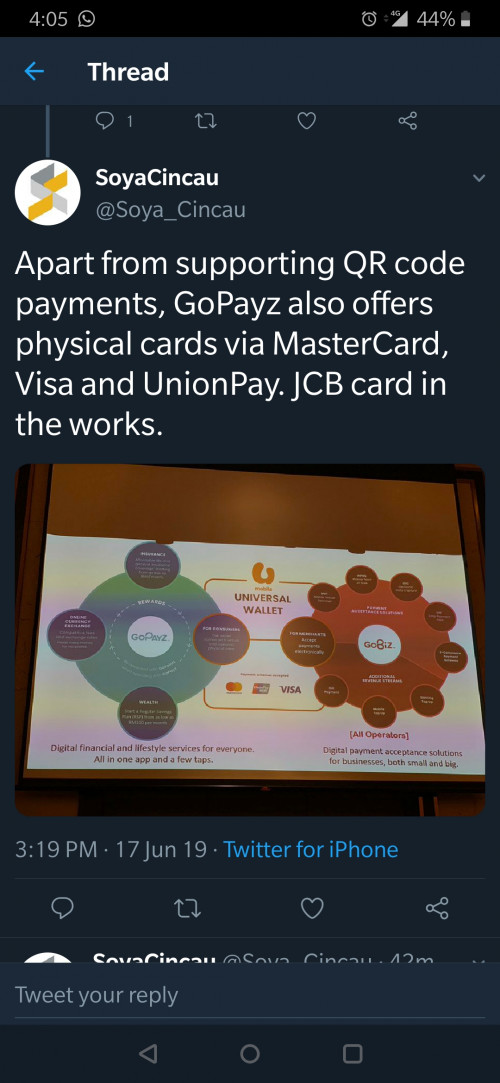

Umobile launching e-wallet today

Look like similar to BigPay....

More info soyacincau Twitter

Having Unionpay and JCB as options are tempting though, I would probably ditch Bigpay because of this.

QUOTE(Chanmei89 @ Jun 18 2019, 05:26 PM)

This is what im worried abt.... is it really safe to use ewallet. I'm maybe paranoid, but i rather stay safe.

The apps also alot but u have to use different wallet for different merchant. Isnt it the same just using cc?. Thats abit discouraging.

QUOTE(the7signals @ Jun 18 2019, 05:39 PM)

I think e-wallet and cc is a bit different. For cc, visa or mc, irregardless from which bank, as long as merchant accept visa/mc, it can be used in any merchants.

However for e-wallets, some merchant accept boost, some accept touch n go, etc, so one will need to sign up to a few e-wallets.

QUOTE(the7signals @ Jun 18 2019, 05:42 PM)

I wonder how safe is their server? I am a bit worried on this.

The only e wallets that you should have in your phone are Boost, Grabpay, TnG and Favepay...because they have a huge merchant base, and will be growing from time to time, don't forget that these are also the e wallets that provide decent rewards (TnG is seasonal though)...

Having these 4 e wallets are already enough (not saying that you should use all 4 of them but only consider these 4 if you wanna join the e wallet community), cuz you can use whichever that you wanna use during certain times and many merchants nowadays accept more than one e wallet (usually these 4), and when one is down, you have another one as backup.

The whole purpose for e wallets is for convenience and paying by just using your phone, and also getting rewards by making payments sometimes. Yes, our e wallets have a long way to go to be up to par with what China has, but it wouldn't hurt to give it a try and embrace the cashless society for the future.

E wallets here are all following regulations under BNM, so there's no need to worry about their server. If people are worried about e wallets, then why do people still use banking apps, how do you know it's completely safe? Just because it's a bank, but then you get CIMB with their occasional data leak and stuff, but people are still using it anyways. If you say banking apps are safer cuz they follow regulations under BNM, then it's the same thing with e wallers as well.

This post has been edited by xperiaDROID: Jun 18 2019, 06:00 PM

Mar 8 2019, 08:00 PM

Mar 8 2019, 08:00 PM

Quote

Quote

0.0453sec

0.0453sec

0.33

0.33

8 queries

8 queries

GZIP Disabled

GZIP Disabled