QUOTE(kbandito @ Aug 29 2019, 02:54 PM)

RM100k/month would be toying with ferrari (like his bosses) rather than bmw. believe his other income is substantially more than his salary.FI/RE - Financial Independence / Retire Early, Share your experience

FI/RE - Financial Independence / Retire Early, Share your experience

|

|

Aug 29 2019, 03:56 PM Aug 29 2019, 03:56 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

|

|

|

Aug 29 2019, 07:40 PM Aug 29 2019, 07:40 PM

Show posts by this member only | IPv6 | Post

#1162

|

Junior Member

538 posts Joined: Feb 2018 |

|

|

|

Aug 29 2019, 07:57 PM Aug 29 2019, 07:57 PM

|

Senior Member

2,429 posts Joined: Jul 2007 |

|

|

|

Aug 29 2019, 08:52 PM Aug 29 2019, 08:52 PM

|

Junior Member

183 posts Joined: Aug 2011 |

|

|

|

Aug 31 2019, 08:37 PM Aug 31 2019, 08:37 PM

|

Junior Member

120 posts Joined: Jun 2019 |

Hi Sifus, just wanna ask is it possible for me to achieve FI at my 40, aim for passive income of 4k. Currently I'm 29 years old, have 110k in FD, 40k in stocks and 21k in mutual fund etc. I'm able to save 4k per month after deducting my commitment and expenses. Any advice if I'm invest my monthly saving into high dividend stocks? Seem impossible to achieve my target in my age 40 right?

|

|

|

Sep 1 2019, 08:19 PM Sep 1 2019, 08:19 PM

|

Senior Member

1,902 posts Joined: Sep 2012 |

QUOTE(kingz113 @ Aug 19 2019, 01:22 AM) Thirdly he lost his mental sharpness as a result of the above. he was very successful when he was young and had accumulated alot of assets. QUOTE(max_cavalera @ Aug 28 2019, 11:03 PM) Honestly don’t say as early retirement....say semi retirement.... rm30k p.m. wont be enough to covered that kind of lifestyle. even rm100K also , well, I doubt itFor someone still below 50-60 years old..able body and mind.....trust me you will be damn bored on nothing to do.... Today I was wandering around with no aim and waste my time in cyber cafes.... Also Early Financial Independence is depend on your personal life expectation....I used to have a share partner and also part of the BOD...ex GM of very big public listed company...very gangster notorious style...used to earn rm25-35k a month....but at 60 once contract ended he say still have to work and find project...can’t afford to really retire.... Bcoz he have a very big appetite for luxury....he got like half to a dozen of those expensive Harley’s, BMW’s, etc big2 bikes...he drive an expensive cars ....I can feel even if he’s earning 20-30k a month still won’t be enough due to his kind of lifestyle....also a lot of expensive property that monthly still need to top up as the rental can’t cover the monthly cost.... but he resign and sold his shares already due to some fight with other BOD.... If u lead a simple life and don’t overcommit u can go semi - retirement/FI much earlier. I’ll try to limit having only 1 child for now.... once u have penchant for luxury stuff, it is hard to get back to the life that you used to live. This post has been edited by JimbeamofNRT: Sep 1 2019, 08:29 PM |

|

|

|

|

|

Sep 8 2019, 11:12 AM Sep 8 2019, 11:12 AM

|

Senior Member

853 posts Joined: Apr 2017 |

QUOTE(FutureBuilder @ Aug 31 2019, 08:37 PM) Hi Sifus, just wanna ask is it possible for me to achieve FI at my 40, aim for passive income of 4k. Currently I'm 29 years old, have 110k in FD, 40k in stocks and 21k in mutual fund etc. I'm able to save 4k per month after deducting my commitment and expenses. Any advice if I'm invest my monthly saving into high dividend stocks? Seem impossible to achieve my target in my age 40 right? Any property that generates passive income?4k/month translates to RM 1.6M in FD (assuming 3% p.a.). Need to strategize to make your cash/assets worth RM1.6M in 11 years. Seems possible, but need to invest more to generate better returns, and combine with dividends from stocks maybe. And by the way, for discussions with FD interest, we should be bear in mind that future FD rates just will not be at 3%, it is getting lower, let alone BNM is expected to further lower 25 points by Dec 2019. So when calculating for interest from FD in future, I will tend to be more conservative. |

|

|

Sep 8 2019, 01:14 PM Sep 8 2019, 01:14 PM

|

All Stars

14,909 posts Joined: Mar 2015 |

QUOTE(FutureBuilder @ Aug 31 2019, 08:37 PM) Hi Sifus, just wanna ask is it possible for me to achieve FI at my 40, aim for passive income of 4k. Currently I'm 29 years old, have 110k in FD, 40k in stocks and 21k in mutual fund etc. I'm able to save 4k per month after deducting my commitment and expenses. Any advice if I'm invest my monthly saving into high dividend stocks? Seem impossible to achieve my target in my age 40 right? you are now 29, target is 40, thus 11 yrs to go.you have 110k in FD, 40k in stocks and 21k in mutual fund fresh saving RM4000 pm.... unknown to your monthly required expenses,...just try to reduce the FD of 110k to 6 months of yr expenses, use the surplus to put into stocks. as for the RM4k pm,...If you have parents, try to put all that into their EPF a/c.....under self contribution I don't suggest putting MORE in FD to generate passive income...for the amount required is too big to generate sufficient amount and returns is too low to be effective for a 11 yrs time frame This post has been edited by MUM: Sep 8 2019, 01:18 PM |

|

|

Sep 8 2019, 04:52 PM Sep 8 2019, 04:52 PM

|

Junior Member

994 posts Joined: Mar 2019 |

Actually chucking in FD is very good..

Less troublesome.. confirm get interest.. pidm protected.. I saw a lot of my fren doing alot of investment.. Some made it.. but most busted it.. especially property.. Not only not making money, every mth is negative cash flow and lots of maintenance fee. Rental cant cover.. Those in Unit trust all see unit price dwindling 20% below.. FD one all happy and no stress Of cuz there r those who made it too. They put money into their business and grow it.. hands on with it. Some punted / investee in stock.. and get double / triple.. But how many percent can be in that category? Not much ooo... This post has been edited by Boomwick: Sep 8 2019, 04:53 PM |

|

|

Sep 8 2019, 05:03 PM Sep 8 2019, 05:03 PM

|

All Stars

14,909 posts Joined: Mar 2015 |

how many can afford to have passive income solely by relying on FD to built its next eggs or provides enough passive income for retirement?

|

|

|

Sep 8 2019, 07:40 PM Sep 8 2019, 07:40 PM

|

Senior Member

2,032 posts Joined: Jan 2014 From: Sabah, Malaysia |

|

|

|

Sep 8 2019, 11:51 PM Sep 8 2019, 11:51 PM

|

Junior Member

76 posts Joined: Aug 2018 |

QUOTE(MUM @ Sep 8 2019, 05:03 PM) how many can afford to have passive income solely by relying on FD to built its next eggs or provides enough passive income for retirement? I knew someone who had 10mil in fd when he passed away at aged of 49. His wife and next of kins were living solely on fd interests and rental incomes for the next 16 years and counting. |

|

|

Sep 9 2019, 12:39 AM Sep 9 2019, 12:39 AM

|

All Stars

14,909 posts Joined: Mar 2015 |

QUOTE(Ineedalaptopnow @ Sep 8 2019, 11:51 PM) I knew someone who had 10mil in fd when he passed away at aged of 49. His wife and next of kins were living solely on fd interests and rental incomes for the next 16 years and counting. that is why my question started with....."how many can afford....."btw, that person whom you knew as how many millions in investment vehicles? wow 10 millions in FD..... |

|

|

|

|

|

Sep 9 2019, 01:10 PM Sep 9 2019, 01:10 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

QUOTE(Ineedalaptopnow @ Sep 8 2019, 11:51 PM) I knew someone who had 10mil in fd when he passed away at aged of 49. His wife and next of kins were living solely on fd interests and rental incomes for the next 16 years and counting. QUOTE(MUM @ Sep 9 2019, 12:39 AM) that is why my question started with....."how many can afford....." Yes, if the nestegg (principal) is BIG enough, then it is viable to live off FD interest, which is nrxt to risk-free, IN THOSE DAYS !!!!!!!btw, that person whom you knew as how many millions in investment vehicles? wow 10 millions in FD..... BUT,... moving fwd, in a low-interest rate environment, an FD Retiree will need a bigger and bigger nestegg to maintain the same level of lifestyle ! Things are changing,... Or,... the Retiree needs to start learning higher-risk instruments,... I have a saying here :- 1) If got a lot of money - can our in FD. 2) If got reasonable amount of money - can put into multiple instruments in a diversified manner, and focus on fixed-income instruments. 3) If still building wealth and retirement funds, no choice - must go for capital gains. |

|

|

Sep 9 2019, 11:10 PM Sep 9 2019, 11:10 PM

|

Junior Member

120 posts Joined: Jun 2019 |

QUOTE(chonghe @ Sep 8 2019, 11:12 AM) Any property that generates passive income? Yeah. The fd rate might be another drop which might below 3%. Like you say, I'm would try to focus and buy some good dividends stock instead of saving in FD. Bought a house but still expenses as monthly commitment. Thanks bro for your advice.4k/month translates to RM 1.6M in FD (assuming 3% p.a.). Need to strategize to make your cash/assets worth RM1.6M in 11 years. Seems possible, but need to invest more to generate better returns, and combine with dividends from stocks maybe. And by the way, for discussions with FD interest, we should be bear in mind that future FD rates just will not be at 3%, it is getting lower, let alone BNM is expected to further lower 25 points by Dec 2019. So when calculating for interest from FD in future, I will tend to be more conservative. |

|

|

Sep 9 2019, 11:16 PM Sep 9 2019, 11:16 PM

|

Junior Member

120 posts Joined: Jun 2019 |

[quote=MUM,Sep 8 2019, 01:14 PM]

you are now 29, target is 40, thus 11 yrs to go. you have 110k in FD, 40k in stocks and 21k in mutual fund fresh saving RM4000 pm.... unknown to your monthly required expenses,...just try to reduce the FD of 110k to 6 months of yr expenses, use the surplus to put into stocks. as for the RM4k pm,...If you have parents, try to put all that into their EPF a/c.....under self contribution I don't suggest putting MORE in FD to generate passive income...for the amount required is too big to generate sufficient amount and returns is too low to be effective for a 11 yrs time frame [/quote I would consider to use my monthly saving to purchase some reits and stocks with 5-6% annual return, hope can getting more nearer to my target by compound interest within this 11 years. Thanks bro for your kind sharing on financial. |

|

|

Sep 10 2019, 11:16 AM Sep 10 2019, 11:16 AM

|

Senior Member

1,184 posts Joined: May 2005 |

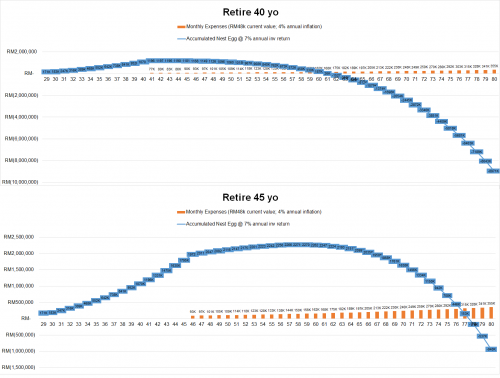

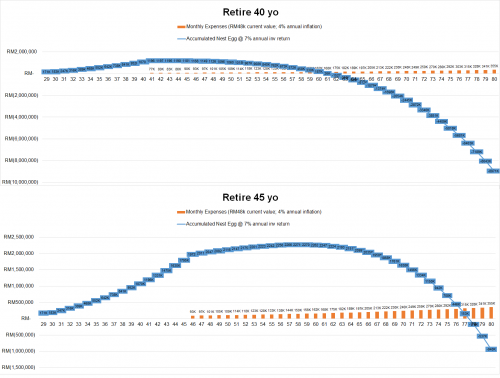

QUOTE(chonghe @ Sep 8 2019, 11:12 AM) Any property that generates passive income? 4k/month translates to RM 1.6M in FD (assuming 3% p.a.). Need to strategize to make your cash/assets worth RM1.6M in 11 years. Seems possible, but need to invest more to generate better returns, and combine with dividends from stocks maybe. And by the way, for discussions with FD interest, we should be bear in mind that future FD rates just will not be at 3%, it is getting lower, let alone BNM is expected to further lower 25 points by Dec 2019. So when calculating for interest from FD in future, I will tend to be more conservative.  Assuming 4% inflation and 7% investment return, you should get c. RM1.2 mil by 40 yo, but that can only last you until c. 60 yo before you dried up you money. Keep working until 45 yo then then you can extend that to 77 yo. But mind you, 7% consistent investment return is not easy, and you need to factor in extra for medical expenses when you are old. Medical cost goes up for way more than 4% per annum. |

|

|

Sep 10 2019, 12:35 PM Sep 10 2019, 12:35 PM

Show posts by this member only | IPv6 | Post

#1178

|

Junior Member

120 posts Joined: Jun 2019 |

QUOTE(kbandito @ Sep 10 2019, 11:16 AM)  Assuming 4% inflation and 7% investment return, you should get c. RM1.2 mil by 40 yo, but that can only last you until c. 60 yo before you dried up you money. Keep working until 45 yo then then you can extend that to 77 yo. But mind you, 7% consistent investment return is not easy, and you need to factor in extra for medical expenses when you are old. Medical cost goes up for way more than 4% per annum. |

|

|

Sep 11 2019, 05:58 PM Sep 11 2019, 05:58 PM

|

Senior Member

2,724 posts Joined: Nov 2012 |

QUOTE(meonkutu11 @ Jul 3 2018, 01:29 PM) All, there are active communities in oversea that working on FI/RE by hard saving, investing and living below our means. This has been the community and learnings that I have been looking forward, will now track this thread and start learning from all of you now. For sure there are also FI or already RE people in here. Appreciate to share your experience; Pre-FI/RE and Post-FI/RE life. Thanks #I’m working towards FI/RE and currently saving/invest 50-60% of my monthly salary. (On top of this around 20-25% spent for commitment like ASB loans and properties). I like to hear sharing from all who working towards FI/RE so we can learn in term of planning, lifestyle, achievement, obstacles and etc. -Update- FI/FF is the priority that we need to work on - planning, executions, monitoring and improvement RE - Decision is yours once achieved FI/FF ______ |

|

|

Sep 11 2019, 08:26 PM Sep 11 2019, 08:26 PM

|

Senior Member

1,444 posts Joined: Aug 2014 |

QUOTE(Boomwick @ Sep 8 2019, 05:52 PM) Actually chucking in FD is very good.. key is investing.. not punting or "trading"Less troublesome.. confirm get interest.. pidm protected.. I saw a lot of my fren doing alot of investment.. Some made it.. but most busted it.. especially property.. Not only not making money, every mth is negative cash flow and lots of maintenance fee. Rental cant cover.. Those in Unit trust all see unit price dwindling 20% below.. FD one all happy and no stress Of cuz there r those who made it too. They put money into their business and grow it.. hands on with it. Some punted / investee in stock.. and get double / triple.. But how many percent can be in that category? Not much ooo... do it right and you will be rewarded. do bear in mind as well that investing should not be limited to Malaysia (bursa) only |

|

Topic ClosedOptions

|

| Change to: |  0.0327sec 0.0327sec

0.63 0.63

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 10:18 PM |