double good if they can do as some forummers had done....put in in Dec take out in Jan.

got tax relief + got >8% roi for 11 months..

FI/RE - Financial Independence / Retire Early, Share your experience

FI/RE - Financial Independence / Retire Early, Share your experience

|

|

Aug 21 2019, 08:06 PM Aug 21 2019, 08:06 PM

|

All Stars

14,867 posts Joined: Mar 2015 |

double good if they can do as some forummers had done....put in in Dec take out in Jan.

got tax relief + got >8% roi for 11 months.. |

|

|

|

|

|

Aug 21 2019, 08:52 PM Aug 21 2019, 08:52 PM

Show posts by this member only | IPv6 | Post

#1122

|

Senior Member

1,181 posts Joined: May 2005 |

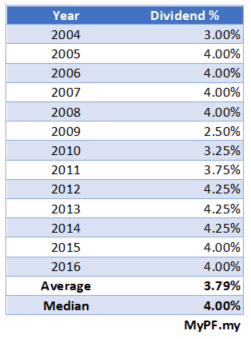

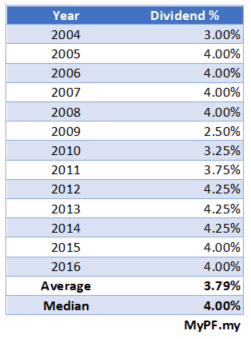

QUOTE(MGM @ Aug 21 2019, 08:02 PM) For those who r good at investing (>8%), sspn returns might not be as good for long term (>10 years) even with tax relief of rm8000 and tax bracket of 25%. CMIIAW. Effective return for 25% annual rebate and 4% annual return is equivalent to 10% return per annumhttps://mypf.my/2017/05/11/should-you-invest-in-sspn/  |

|

|

Aug 21 2019, 09:32 PM Aug 21 2019, 09:32 PM

|

All Stars

18,410 posts Joined: Oct 2010 |

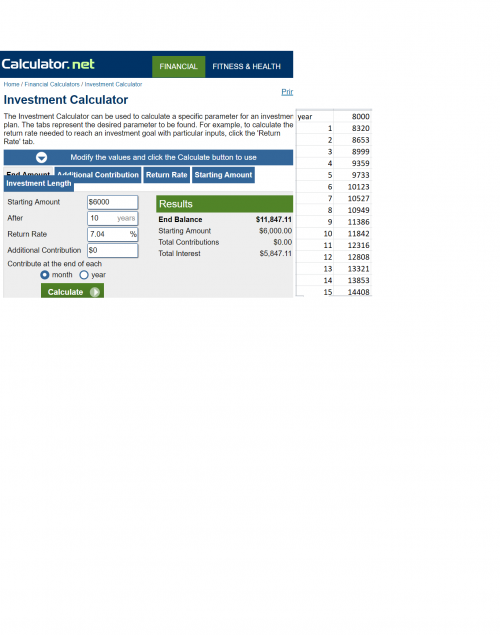

QUOTE(MGM @ Aug 21 2019, 08:02 PM) For those who r good at investing (>8%), sspn returns might not be as good for long term (>10 years) even with tax relief of rm8000 and tax bracket of 25%. CMIIAW. https://mypf.my/2017/05/11/should-you-invest-in-sspn/  QUOTE(kbandito @ Aug 21 2019, 08:52 PM) With tax relief of rm8000 and tax bracket of 25%, tax savings is rm2000.Effectively starting amount is rm8000-2000=6000, average SSPN annual return of 4% on rm8000 after 10 years becomes rm11842. So using the financial calculator with these figures gives a return of 7.04% per annum. Please correct me if I am wrong.  This post has been edited by MGM: Aug 21 2019, 09:33 PM |

|

|

Aug 21 2019, 09:40 PM Aug 21 2019, 09:40 PM

|

Probation

3 posts Joined: Aug 2019 |

https://terrencenotes.com/2019/07/30/how-to...e-in-singapore/

May look at the numbers in this post to see how you can achieve financial freedom by just converting their S$ to RM. |

|

|

Aug 21 2019, 10:34 PM Aug 21 2019, 10:34 PM

|

All Stars

18,410 posts Joined: Oct 2010 |

QUOTE(doggieinvestor @ Aug 21 2019, 09:40 PM) https://terrencenotes.com/2019/07/30/how-to...e-in-singapore/ https://terrencenotes.com/2019/08/01/how-to...-singapore-2-0/May look at the numbers in this post to see how you can achieve financial freedom by just converting their S$ to RM. All the more reason for one to stay in JB and work in Singapore, if only travelling to-and-fro is convenient, where is the RTS? |

|

|

Aug 21 2019, 10:49 PM Aug 21 2019, 10:49 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(MGM @ Aug 21 2019, 09:32 PM) With tax relief of rm8000 and tax bracket of 25%, tax savings is rm2000. Effectively starting amount is rm8000-2000=6000, average SSPN annual return of 4% on rm8000 after 10 years becomes rm11842. So using the financial calculator with these figures gives a return of 7.04% per annum. Please correct me if I am wrong. .... if i invest RM6k myself, how many % of ROI pa for 10 yrs, must i get recover that RM2000 (tax paid) and beat this SSPN? (assuming I used that RM2000 tax saving and put into FD at 4%pa if I were to go for the SSPN route) This post has been edited by yklooi: Aug 21 2019, 10:54 PM |

|

|

|

|

|

Aug 22 2019, 07:50 AM Aug 22 2019, 07:50 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(howszat @ Aug 20 2019, 11:49 PM) We agree actually: "You can retire early or not, up to you." Yes, it is up to you, it should not be an objective in itself. RE is up to each individual, not a defined or meaningful objective. Just focus on FI. what if the objective itself is "want to retire early (RE), by xx age?" (here RE is a defined objective, but meaningful or not is also up to that the definition of individual, nothing misguided) thus to be able to RE by xx age, one need to be FI by xx age Without FI, by xx age, there will be no RE by xx age With FI, there will be option to either RE or No RE at xx age (up to individual when reached that FI status) so which one is the main objective and sub objectives to the main objective? will "Just focus on FI", has the same content as your earlier post? from this..... QUOTE(howszat @ Aug 20 2019, 10:21 PM) No problems about FI being an objective. The problem bit is RE. to this? (just exchanged the RE to FI and vice versa)RE is just completely misguided as an objective. RE should not be an objective by itself. Examples are those who skimp on their food and affect their health later on in life. Examples are those who didn't do the fun things at the earlier age of their life, and find they are too old when they achieve RE to do those things. It's about balance and moderation and optimizing what is appropriate over your life span. Not some misguided objective about RE. (Quote) No problems about RE being an objective. The problem bit is FI. FI is just completely misguided as an objective. FI should not be an objective by itself. Examples are those who skimp on their food and affect their health later on in life. Examples are those who didn't do the fun things at the earlier age of their life, and find they are too old when they achieved FI to do those things. It's about balance and moderation and optimizing what is appropriate over your life span. Not some misguided objective about FI. (End Quote) This post has been edited by yklooi: Aug 22 2019, 08:41 AM |

|

|

Aug 22 2019, 08:50 AM Aug 22 2019, 08:50 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(tmdsad @ Aug 21 2019, 04:42 PM) Age 47. Manager ( property developer)RM8K/m You are so loaded. You should discuss it here! EPF 1,020,000 Cash @ FD - RM250k House DSL - Fully paid own stay Market value RM550K Condo - Fully paid, rental 1.1k, market value RM300K Flat - Fully paid rental RM650 market value RM140K Medium cost Apartment with land size 700sq f- Fully paid rental RM750 market value RM300K Business Income RM2.2K share profit with my kid / online buz car loan - zero other loan - zero Kids, one full time working buz partner ( stay outside) and one UK graduated last month ( Marry next year) Wife @ Full Time RM4k per month, divorce ( i stop her allowance since April 2019) and another condo give her free. Market Value RM800k Monthly household expenses - RM4K/m ( all from my income) Yes, why? No, why? Partial retire, why? |

|

|

Aug 22 2019, 09:02 AM Aug 22 2019, 09:02 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(aspartame @ Aug 20 2019, 10:42 PM) Ya, agree that it must not be extreme. there are some wanted to escape their current (extremely good) pay job that they had been doing, that they feel are going against their religion, personal beliefs or family tradition.On your points.. 1. Skimping food does not mean will affect their health e.g. if everyday they eat mixed rice, I don’t see how it is detrimental to health, on the contrary, eating steak, crab, salmon or carbonara everyday might die faster.. 2. Fun things in life ... it can be endless, the key is moderation, if everything also you want to spend on because YOLO, then you can forget about FIRE unless you are super earner and that also you must save in order to FIRE Consider this - those who aim for FIRE, they place a lot of value on freedom... to be financially independent is LIBERATING... this thought of waking up being free must be weighed against a YOLO lifestyle ...meaning, do you treasure consumption and enjoyment more, or do you treasure the feeling of freedom more... As in all things, like you say, moderation ... either end is no good. i had a friend, that had to quit & downgrade his income and lifestyle for he believes and feel that his previous job will lead him to hell or not so easy death if he did not quit. many others may not be born in a lucky family, countries, culture, environment or political situation......but i think in their mind, they too at times, do dreams of "getting away" from their predicaments. |

|

|

Aug 22 2019, 09:14 AM Aug 22 2019, 09:14 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(prophetjul @ Aug 22 2019, 08:50 AM) Yes, why? No, why? Partial retire, why? for ONLY he himself knows better of what he wants and don't want and what he can do and cannot do about RE (since he is already a lot better than most here financially to talk about retirement) is Early Retirement or early partial retirement his big dreams? maybe his big dreams is to accumulate as much assets as possible (or perhaps 10 mil) during his this lifetime? This post has been edited by yklooi: Aug 22 2019, 09:25 AM |

|

|

Aug 22 2019, 09:35 AM Aug 22 2019, 09:35 AM

Show posts by this member only | IPv6 | Post

#1131

|

Senior Member

1,181 posts Joined: May 2005 |

QUOTE(MGM @ Aug 21 2019, 09:32 PM) With tax relief of rm8000 and tax bracket of 25%, tax savings is rm2000. If you contribute RM8,000 pa for 10 years, at 4% annual return you get RM96,000 on 10th year.Effectively starting amount is rm8000-2000=6000, average SSPN annual return of 4% on rm8000 after 10 years becomes rm11842. So using the financial calculator with these figures gives a return of 7.04% per annum. Please correct me if I am wrong.  Now with the relief you only pay RM6,000 pa for 10 years, but you will get RM96,000 on 10th year still - that’s 10% equivalent. |

|

|

Aug 22 2019, 10:04 AM Aug 22 2019, 10:04 AM

|

All Stars

18,410 posts Joined: Oct 2010 |

QUOTE(kbandito @ Aug 22 2019, 09:35 AM) If you contribute RM8,000 pa for 10 years, at 4% annual return you get RM96,000 on 10th year. Take each rm8000 separately for calculation. Tax relief amount always changing.Now with the relief you only pay RM6,000 pa for 10 years, but you will get RM96,000 on 10th year still - that’s 10% equivalent. This post has been edited by MGM: Aug 22 2019, 10:09 AM |

|

|

Aug 22 2019, 10:10 AM Aug 22 2019, 10:10 AM

|

Senior Member

833 posts Joined: Sep 2012 From: Earth |

QUOTE(MGM @ Aug 21 2019, 10:34 PM) https://terrencenotes.com/2019/08/01/how-to...-singapore-2-0/ I don't quite understand his calculation but anyway,All the more reason for one to stay in JB and work in Singapore, if only travelling to-and-fro is convenient, where is the RTS? MM2H by an ex-Malaysian converted to Singaporean. Is that possible? |

|

|

|

|

|

Aug 22 2019, 10:21 AM Aug 22 2019, 10:21 AM

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

Aug 22 2019, 10:59 AM Aug 22 2019, 10:59 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

FI is almost every wage earner's dream. The path to fi could be long and tedious, often longer than one's working life. For reasons, only about 3.5% of adults in this country have over us$100k net worth.

FI basically has two components i.e income and expenses and two stages i.e pre-fi and fi. In pre fi, income - expenses go-to fi funds. In fi, fi funds income or drawdown > expected expenses. Whether one should retire early is a matter of individual preference. This post has been edited by icemanfx: Aug 22 2019, 11:02 AM |

|

|

Aug 22 2019, 12:59 PM Aug 22 2019, 12:59 PM

|

Senior Member

919 posts Joined: May 2005 |

|

|

|

Aug 22 2019, 03:38 PM Aug 22 2019, 03:38 PM

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Aug 22 2019, 03:47 PM Aug 22 2019, 03:47 PM

|

Senior Member

1,147 posts Joined: Aug 2013 |

|

|

|

Aug 22 2019, 04:09 PM Aug 22 2019, 04:09 PM

|

Senior Member

919 posts Joined: May 2005 |

QUOTE(icemanfx @ Aug 22 2019, 10:59 AM) FI is almost every wage earner's dream. The path to fi could be long and tedious, often longer than one's working life. For reasons, only about 3.5% of adults in this country have over us$100k net worth. Hi Iceman,FI basically has two components i.e income and expenses and two stages i.e pre-fi and fi. In pre fi, income - expenses go-to fi funds. In fi, fi funds income or drawdown > expected expenses. Whether one should retire early is a matter of individual preference. Mind to share the news where you get the 3.5% of adults in this country have over us$100k net worth. TIA |

|

|

Aug 22 2019, 04:43 PM Aug 22 2019, 04:43 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0231sec 0.0231sec

0.56 0.56

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 11:50 PM |