QUOTE(max_cavalera @ Aug 27 2019, 08:38 PM)

So young already semi retire.. maybe go travel and get to know different culture, travel can easily become a hobby if affordable. FI/RE - Financial Independence / Retire Early, Share your experience

FI/RE - Financial Independence / Retire Early, Share your experience

|

|

Aug 27 2019, 08:55 PM Aug 27 2019, 08:55 PM

Return to original view | Post

#1

|

Junior Member

120 posts Joined: Jun 2019 |

|

|

|

|

|

|

Aug 31 2019, 08:37 PM Aug 31 2019, 08:37 PM

Return to original view | Post

#2

|

Junior Member

120 posts Joined: Jun 2019 |

Hi Sifus, just wanna ask is it possible for me to achieve FI at my 40, aim for passive income of 4k. Currently I'm 29 years old, have 110k in FD, 40k in stocks and 21k in mutual fund etc. I'm able to save 4k per month after deducting my commitment and expenses. Any advice if I'm invest my monthly saving into high dividend stocks? Seem impossible to achieve my target in my age 40 right?

|

|

|

Sep 9 2019, 11:10 PM Sep 9 2019, 11:10 PM

Return to original view | Post

#3

|

Junior Member

120 posts Joined: Jun 2019 |

QUOTE(chonghe @ Sep 8 2019, 11:12 AM) Any property that generates passive income? Yeah. The fd rate might be another drop which might below 3%. Like you say, I'm would try to focus and buy some good dividends stock instead of saving in FD. Bought a house but still expenses as monthly commitment. Thanks bro for your advice.4k/month translates to RM 1.6M in FD (assuming 3% p.a.). Need to strategize to make your cash/assets worth RM1.6M in 11 years. Seems possible, but need to invest more to generate better returns, and combine with dividends from stocks maybe. And by the way, for discussions with FD interest, we should be bear in mind that future FD rates just will not be at 3%, it is getting lower, let alone BNM is expected to further lower 25 points by Dec 2019. So when calculating for interest from FD in future, I will tend to be more conservative. |

|

|

Sep 9 2019, 11:16 PM Sep 9 2019, 11:16 PM

Return to original view | Post

#4

|

Junior Member

120 posts Joined: Jun 2019 |

[quote=MUM,Sep 8 2019, 01:14 PM]

you are now 29, target is 40, thus 11 yrs to go. you have 110k in FD, 40k in stocks and 21k in mutual fund fresh saving RM4000 pm.... unknown to your monthly required expenses,...just try to reduce the FD of 110k to 6 months of yr expenses, use the surplus to put into stocks. as for the RM4k pm,...If you have parents, try to put all that into their EPF a/c.....under self contribution I don't suggest putting MORE in FD to generate passive income...for the amount required is too big to generate sufficient amount and returns is too low to be effective for a 11 yrs time frame [/quote I would consider to use my monthly saving to purchase some reits and stocks with 5-6% annual return, hope can getting more nearer to my target by compound interest within this 11 years. Thanks bro for your kind sharing on financial. |

|

|

Sep 10 2019, 12:35 PM Sep 10 2019, 12:35 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

120 posts Joined: Jun 2019 |

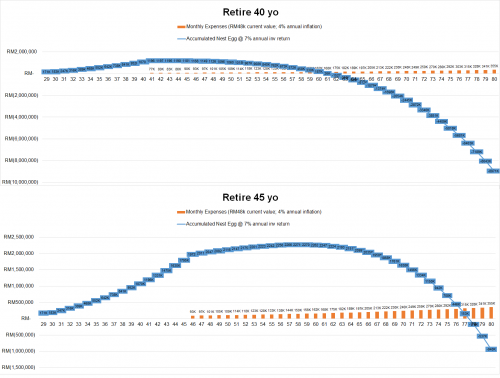

QUOTE(kbandito @ Sep 10 2019, 11:16 AM)  Assuming 4% inflation and 7% investment return, you should get c. RM1.2 mil by 40 yo, but that can only last you until c. 60 yo before you dried up you money. Keep working until 45 yo then then you can extend that to 77 yo. But mind you, 7% consistent investment return is not easy, and you need to factor in extra for medical expenses when you are old. Medical cost goes up for way more than 4% per annum. |

|

|

Sep 11 2019, 11:19 PM Sep 11 2019, 11:19 PM

Return to original view | Post

#6

|

Junior Member

120 posts Joined: Jun 2019 |

QUOTE(johnnyzai89 @ Sep 11 2019, 08:29 PM) you are doing very well! just keep doing what you are doing right now and keep on growing your portfolio Thanks bro for your advice. I would go kinokuniya get some financial books improving myself. 😆just some advice, try to invest into your financial knowledge and look for investments out of the country.. it will work as a hedging purpose as well |

|

Topic ClosedOptions

|

| Change to: |  0.0992sec 0.0992sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 12:10 PM |