[quote=MUM,Sep 8 2019, 01:14 PM]

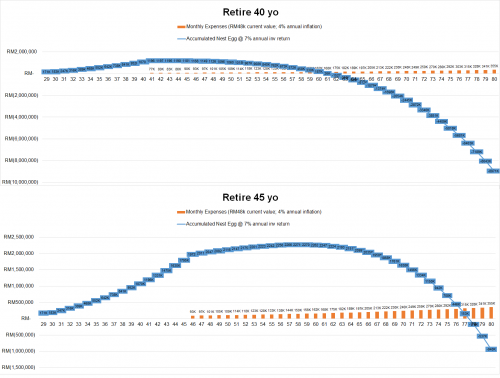

you are now 29, target is 40, thus 11 yrs to go.

you have 110k in FD,

40k in stocks and

21k in mutual fund

fresh saving RM4000 pm....

unknown to your monthly required expenses,...just try to reduce the FD of 110k to 6 months of yr expenses, use the surplus to put into stocks.

as for the RM4k pm,...If you have parents, try to put all that into their EPF a/c.....under self contribution

I don't suggest putting MORE in FD to generate passive income...for the amount required is too big to generate sufficient amount and returns is too low to be effective for a 11 yrs time frame

[/quote

I would consider to use my monthly saving to purchase some reits and stocks with 5-6% annual return, hope can getting more nearer to my target by compound interest within this 11 years. Thanks bro for your kind sharing on financial.

[/quote]

you are doing very well! just keep doing what you are doing right now and keep on growing your portfolio

just some advice, try to invest into your financial knowledge and look for investments out of the country.. it will work as a hedging purpose as well

Sep 11 2019, 08:29 PM

Sep 11 2019, 08:29 PM

Quote

Quote

0.0174sec

0.0174sec

0.61

0.61

6 queries

6 queries

GZIP Disabled

GZIP Disabled