Outline ·

[ Standard ] ·

Linear+

FI/RE - Financial Independence / Retire Early, Share your experience

|

Yggdrasil

|

Aug 21 2019, 01:39 AM Aug 21 2019, 01:39 AM

|

|

Hello!

I see some of you talking about investing in S&P500 ETF. Unfortunately, I don't know what is the best way for a Malaysian to invest in it. I'm looking at TDameritrade but unfortunately they have problems with their W8-Ben form and I am unable to complete registration.

Can someone enlighten me what is the best way or any alternative methods for me to invest in the S&P500? I am seeking for the lowest cost and hopefully no holding/admin fees.

Thanks

|

|

|

|

|

|

cherroy

|

Aug 21 2019, 11:06 AM Aug 21 2019, 11:06 AM

|

20k VIP Club

|

QUOTE(howszat @ Aug 20 2019, 11:49 PM) We agree actually: "You can retire early or not, up to you." Yes, it is up to you, it should not be an objective in itself. RE is up to each individual, not a defined or meaningful objective. Just focus on FI. I agreed. That's why since beginning of this thread, I am more into FI instead of FIRE. FI - we can have lot of discussion, brainstorming about financial issue. RE - It is personal decision and choice, nothing much to discuss. Argue until cow come home also no use, as each individual life style preference is different.  |

|

|

|

|

|

johnnyzai89

|

Aug 21 2019, 11:20 AM Aug 21 2019, 11:20 AM

|

|

QUOTE(Yggdrasil @ Aug 21 2019, 02:39 AM) Hello! I see some of you talking about investing in S&P500 ETF. Unfortunately, I don't know what is the best way for a Malaysian to invest in it. I'm looking at TDameritrade but unfortunately they have problems with their W8-Ben form and I am unable to complete registration. Can someone enlighten me what is the best way or any alternative methods for me to invest in the S&P500? I am seeking for the lowest cost and hopefully no holding/admin fees. Thanks what problems are you encountering with your W8 form? |

|

|

|

|

|

Yggdrasil

|

Aug 21 2019, 01:27 PM Aug 21 2019, 01:27 PM

|

|

QUOTE(johnnyzai89 @ Aug 21 2019, 11:20 AM) what problems are you encountering with your W8 form? It's their website problem. It just won't load. |

|

|

|

|

|

frostfrench

|

Aug 21 2019, 02:21 PM Aug 21 2019, 02:21 PM

|

|

QUOTE(Jordy @ Aug 20 2019, 03:47 PM) Do sure to open a SSPN-i account as early as possible to take advantage of the income tax deduction and also maximise the compounding effect the earlier you start. Do not have to worry as you may withdraw the cash at any time should you later decide that your son is not interested to further his studies or are interested to start a business instead. The money saved could be used to fund his business start up. SPY is the acronym for SPDR S&P 500 ETF, one of the best performing S&P 500 index fund there is listed in the US. Thank you very much. |

|

|

|

|

|

blackseed202

|

Aug 21 2019, 02:38 PM Aug 21 2019, 02:38 PM

|

Getting Started

|

QUOTE(Jordy @ Aug 20 2019, 03:47 PM) Do sure to open a SSPN-i account as early as possible to take advantage of the income tax deduction and also maximise the compounding effect the earlier you start. Do not have to worry as you may withdraw the cash at any time should you later decide that your son is not interested to further his studies or are interested to start a business instead. The money saved could be used to fund his business start up. SPY is the acronym for SPDR S&P 500 ETF, one of the best performing S&P 500 index fund there is listed in the US. When withdraw later we don't have to declare right? What if we don't have any children now? |

|

|

|

|

|

Ramjade

|

Aug 21 2019, 02:49 PM Aug 21 2019, 02:49 PM

|

|

QUOTE(blackseed202 @ Aug 21 2019, 02:38 PM) When withdraw later we don't have to declare right? What if we don't have any children now? No tax relief if self contribute. This post has been edited by Ramjade: Aug 21 2019, 03:18 PM |

|

|

|

|

|

MUM

|

Aug 21 2019, 02:51 PM Aug 21 2019, 02:51 PM

|

|

QUOTE(blackseed202 @ Aug 21 2019, 02:38 PM) When withdraw later we don't have to declare right? What if we don't have any children now? while waiting for value added responses....try read this for some info..... 3. Apakah keistimewaan SSPN-i? 4. Adakah akaun SSPN-i boleh dibuka oleh seseorang yang masih bujang atau ibubapa yang tiada tanggungan anak di IPT? 5. Apakah syarat-syarat penyertaan SSPN-i? 12. Bilakah simpanan SSPN-i boleh dikeluarkan? 13. Bagaimanakah cara untuk mengeluarkan simpanan SSPN-i? 14. Adakah sebarang caj dikenakan jika mengeluarkan simpanan SSPN-i? https://www.ptptn.gov.my/faq-simpanan-side/faq-sspn-i |

|

|

|

|

|

Hansel

|

Aug 21 2019, 02:59 PM Aug 21 2019, 02:59 PM

|

|

QUOTE(Ramjade @ Aug 21 2019, 02:49 PM) No children cannot open up SSPN lo. What if children studying in foreign IPTs ? Can still enjoy these benefits ? |

|

|

|

|

|

SUSyklooi

|

Aug 21 2019, 03:06 PM Aug 21 2019, 03:06 PM

|

|

QUOTE(Hansel @ Aug 21 2019, 02:59 PM) What if children studying in foreign IPTs ? Can still enjoy these benefits ? the tax benefits is when parents or legal guardian contribute to the education saving in SSPN. the withdraw is when the child had been accepted for further studies..... if had been studying already?.....  but i "think" if he is still below 29,..then is ok https://www.ptptn.gov.my/syarat-buka-akaun-sspn-i-side |

|

|

|

|

|

utellme

|

Aug 21 2019, 03:36 PM Aug 21 2019, 03:36 PM

|

|

QUOTE(Hansel @ Aug 21 2019, 02:59 PM) What if children studying in foreign IPTs ? Can still enjoy these benefits ? As long your kids is below 25 age old, you can continue contribute to both SSPN-I & SSPN i plus account for your tax rebate. anyway, tax rebate incentive will be end at year 2020 unless GOV give extension. |

|

|

|

|

|

utellme

|

Aug 21 2019, 03:38 PM Aug 21 2019, 03:38 PM

|

|

wow.. 29 year old.

|

|

|

|

|

|

Hansel

|

Aug 21 2019, 04:42 PM Aug 21 2019, 04:42 PM

|

|

QUOTE(yklooi @ Aug 21 2019, 03:06 PM) the tax benefits is when parents or legal guardian contribute to the education saving in SSPN. the withdraw is when the child had been accepted for further studies..... if had been studying already?.....  but i "think" if he is still below 29,..then is ok https://www.ptptn.gov.my/syarat-buka-akaun-sspn-i-sideQUOTE(utellme @ Aug 21 2019, 03:36 PM) As long your kids is below 25 age old, you can continue contribute to both SSPN-I & SSPN i plus account for your tax rebate. anyway, tax rebate incentive will be end at year 2020 unless GOV give extension. Tq bros,... how abt the withdrawal when the child has been accepted into a foreign IPT ? Can the savings be withdrawn ? Or is the SSPN only to be used for studies in a local IPT ? |

|

|

|

|

|

Jordy

|

Aug 21 2019, 05:34 PM Aug 21 2019, 05:34 PM

|

Entrepreneur

|

QUOTE(Hansel @ Aug 21 2019, 04:42 PM) Tq bros,... how abt the withdrawal when the child has been accepted into a foreign IPT ? Can the savings be withdrawn ? Or is the SSPN only to be used for studies in a local IPT ? It doesn't really matter that much where the child is studying, because the withdrawal can be done by the child at any time. It will be withdrawn in cash, so it can be used for any purpose. If you are a parent, you can open a SSPN-i account under your child's name to receive the tax allowance of up to RM8k per annum. Best of all, several accounts can be opened under your child's name (but each account must have a different payor). So you and your wife can open an account each for the same child and claim RM8k tax allowance for EACH payor. Your child can also open an account for himself, but he won't be eligible for tax deduction. |

|

|

|

|

|

MUM

|

Aug 21 2019, 05:35 PM Aug 21 2019, 05:35 PM

|

|

QUOTE(Hansel @ Aug 21 2019, 04:42 PM) Tq bros,... how abt the withdrawal when the child has been accepted into a foreign IPT ? Can the savings be withdrawn ? Or is the SSPN only to be used for studies in a local IPT ? I think it should be easy as there had been forummers doing yearly deposit in Dec and withdrawal in Jan routine... to capture the tax benefit and reinvest that money for 11 months... |

|

|

|

|

|

Hansel

|

Aug 21 2019, 05:46 PM Aug 21 2019, 05:46 PM

|

|

QUOTE(Jordy @ Aug 21 2019, 05:34 PM) It doesn't really matter that much where the child is studying, because the withdrawal can be done by the child at any time. It will be withdrawn in cash, so it can be used for any purpose. If you are a parent, you can open a SSPN-i account under your child's name to receive the tax allowance of up to RM8k per annum. Best of all, several accounts can be opened under your child's name (but each account must have a different payor). So you and your wife can open an account each for the same child and claim RM8k tax allowance for EACH payor. Your child can also open an account for himself, but he won't be eligible for tax deduction. QUOTE(MUM @ Aug 21 2019, 05:35 PM) I think it should be easy as there had been forummers doing yearly deposit in Dec and withdrawal in Jan routine... to capture the tax benefit and reinvest that money for 11 months... Ok,... tq bro and MUM,... |

|

|

|

|

|

Showtime747

|

Aug 21 2019, 06:35 PM Aug 21 2019, 06:35 PM

|

|

QUOTE(Jordy @ Aug 21 2019, 05:34 PM) It doesn't really matter that much where the child is studying, because the withdrawal can be done by the child at any time. It will be withdrawn in cash, so it can be used for any purpose. If you are a parent, you can open a SSPN-i account under your child's name to receive the tax allowance of up to RM8k per annum. Best of all, several accounts can be opened under your child's name (but each account must have a different payor). So you and your wife can open an account each for the same child and claim RM8k tax allowance for EACH payor. Your child can also open an account for himself, but he won't be eligible for tax deduction. Any link to SSPN website for what you said, ie max 8k and both parents can claim RM8k for the same child ? |

|

|

|

|

|

MUM

|

Aug 21 2019, 06:53 PM Aug 21 2019, 06:53 PM

|

|

QUOTE(Showtime747 @ Aug 21 2019, 06:35 PM) Any link to SSPN website for what you said, ie max 8k and both parents can claim RM8k for the same child ? Ibu bapa yang membuat taksiran berasingan dan telah membuka akaun simpanan SSPN-i berasingan atas anak yang sama diberikan pelepasan sehingga maksimum RM8,000.00 seorang setahun; https://www.ptptn.gov.my/pelepasan-taksiran...kai-sspn-i-side |

|

|

|

|

|

Showtime747

|

Aug 21 2019, 07:11 PM Aug 21 2019, 07:11 PM

|

|

QUOTE(MUM @ Aug 21 2019, 06:53 PM) Ibu bapa yang membuat taksiran berasingan dan telah membuka akaun simpanan SSPN-i berasingan atas anak yang sama diberikan pelepasan sehingga maksimum RM8,000.00 seorang setahun; https://www.ptptn.gov.my/pelepasan-taksiran...kai-sspn-i-sideThanks !  |

|

|

|

|

|

MGM

|

Aug 21 2019, 08:02 PM Aug 21 2019, 08:02 PM

|

|

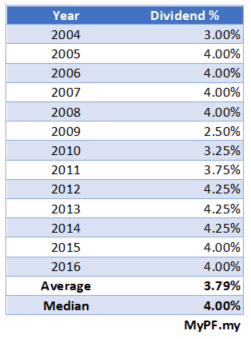

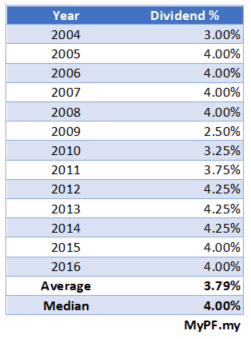

For those who r good at investing (>8%), sspn returns might not be as good for long term (>10 years) even with tax relief of rm8000 and tax bracket of 25%. CMIIAW. https://mypf.my/2017/05/11/should-you-invest-in-sspn/ This post has been edited by MGM: Aug 21 2019, 08:03 PM This post has been edited by MGM: Aug 21 2019, 08:03 PM |

|

|

|

|

Aug 21 2019, 01:39 AM

Aug 21 2019, 01:39 AM

Quote

Quote

0.0244sec

0.0244sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled