QUOTE(Hansel @ Jun 26 2018, 11:42 AM)

Sure, sure,... but after what I heard happening to many 'accounts' which suddenly got closed or forced to use Bitcoin in the world,... I would prefer to use DBS-lar,..

Secondly, an account in DBS is not solely for the purpose of funds transfer,... you don't need me to tell you all of the other benefits of having an SG DBS Account,...

Funds Transfer is BUT one of the facilities of a DBS Account.

If you don't have a minimum amt to maintain a DBS Account, why don't you close your DBS Account ? Why always talk abt your DBS Account ? NO money, don't do,... why force yourself and then start talking bad abt DBS and saying Transferwise is good ?

DBS let you open an account and you criticize like this,... close it then,... you are a Malaysian, you are not obligated to support Singapore in any way.

People have a good reason now (for now) to open a DBS Account, give people a chance-lar,... you think so easy to open-ah ???

And who said got fees to TT using a DBS Account ?

....... NO need to say cheaper, say FREE when TT'ing using a DBS Account.

And who said you can't transfer USDs using a DBS Account ?

YOU are under-informed !!!!!!!!!!

YOU laughed at me, I also laugh back at you !!!!

If you tell me to hold multucurrency, Transferwise can do that for free. So tell me why should I pay or give DBS free money? Multicurrency card? Many card offer better deal than DBS multicurrency card. Even created by our very own Malaysian company.

I don't like giving banks free money. Hence I will find ways to get things for as cheap as possible from the bank. Transferwise is offering masses a cheap option to hold multicurrency with ease. No need to go begging people.

Read the PDF. Incoming TT is charged. You may not be charged TT fees but you are charged marked up exchange rate. Don't believe me? Check out exchange rate offer by fintech vs DBS. I did and noticed the difference. Again why bother giving banks free and good money? Are they your relatives that you must help them? No. They are just glamorous money lenders.

Try moving USD to other bank in SG. If within DBS bank I am sure no problem. Try moving it to say UOB and OCBC via online. Not by RM or cheque. See if it can be done.

QUOTE(Hansel @ Jun 26 2018, 11:45 AM)

Maybe DBS should check ALL Malaysians who don't use their account, and advise for those accounts to be closed. People don't use their accounts because they don't like their accounts,... people like Ramjade.

Perhaps it will be more efficient for DBS to open accounts only for Malaysians who really have a need to use their account, rather than doing a total block against all Malaysians without a work permit or study permit.

I would use their account more often if they are more generous. Since they are so stingy, I am also stingy with them. If they are generous, I will be more generous with them.

Good example was Maybank MY. Back when they have eGIA which give 4.5%p.a with no lock in penalty, I parked my cash with them.

QUOTE(Hansel @ Jun 26 2018, 04:43 PM)

Using

DBS Remit is free, SGD is converted into MYR, then transfer back to, say, your Maybank Account in Msia. ALL THE WAY IS FREE. At this end, also no charge,... Transferring by using DBS Remit to any bank is Australia, The USA, Canada also no-charge.

How abt CIMB SG to CIMB MY ? Any charge at either end ?

The interesting part is,... there is also no charge by any intermediary bank,... I noticed this too,... but I'm still studying this. DBS has a lot of facilities if we know how to use it ! To me,... it's a great bank,... lots of facilities that other banks don't have.

Hence, if no charge at all, then the only thing we need to worry abt is the exchange rate.

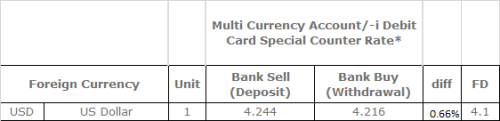

Agreed free but never let free fool you. Free is good but keep your eyes open on the exchange rate. I have surveyed their rates (other currencies). Definitely better than what Malaysian banks offer but not the best vs fintech. Now free transfer vs cheaper than free transfer, which would be a better pick?

PS I never laugh at you. But I am trying to open your eyes that better options exist.

Feb 22 2018, 09:29 PM, updated 7y ago

Feb 22 2018, 09:29 PM, updated 7y ago

Quote

Quote

0.0756sec

0.0756sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled