QUOTE(statikinetic @ Jan 21 2021, 09:29 AM)

if you shake too hard... market could turn all red. BWC

BWC

|

|

Jan 21 2021, 10:39 AM Jan 21 2021, 10:39 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 21 2021, 11:59 AM Jan 21 2021, 11:59 AM

Show posts by this member only | IPv6 | Post

#3742

|

Senior Member

1,060 posts Joined: Feb 2008 |

AXREIT 5106

2016 vs 2021   Gone were the days that bank offering risk free FD promo up to 4.5% during year 2015-2016   |

|

|

Jan 21 2021, 01:25 PM Jan 21 2021, 01:25 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 21 2021, 01:29 PM Jan 21 2021, 01:29 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 21 2021, 02:44 PM Jan 21 2021, 02:44 PM

Show posts by this member only | IPv6 | Post

#3745

|

Senior Member

1,060 posts Joined: Feb 2008 |

QUOTE(Boon3 @ Jan 21 2021, 01:25 PM) Yeah the yield is about that..Another way to comprehend the 4.4% yield is "double of 12month FD's interest rate !" QUOTE(Boon3 @ Jan 21 2021, 01:29 PM) Generally for REIT price to go up :1. DPU increase By means of acquiring more property. More property, more rental income. More rental income, more distribution to shareholders. AXREIT in the past has been doing quite well in terms of improving their earning and portfolio size. Even better is not doing any right issue (IIRC), but still manage to raise fund for new property acquisition via private placement. 2. Rental Revision 3. Macro economics factors : a. Bond yield drop b. Interest rate going down Reit yield should be always around 200~300 basis point above FD rate offering, to justify the risk taken. But with current global low yield environment, some are ok with REIT yield about 100-150 basis point above FD rate. But again, if portfolio size is tiny, individual investor usually didnt see much "meat" for the few % different in yields. Boon3 liked this post

|

|

|

Jan 21 2021, 08:33 PM Jan 21 2021, 08:33 PM

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Boon3 @ Jan 19 2021, 09:03 AM) I have to say that I'm impressed at this callhow did you conclude at that time? the tech counters today closing doesn't look convincing, but how do you managed to spot it on 19th? » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Jan 22 2021, 08:34 AM Jan 22 2021, 08:34 AM

Show posts by this member only | IPv6 | Post

#3747

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(Smurfs @ Jan 21 2021, 02:44 PM) Yeah the yield is about that.. Why bother with MReits when there is a lot more choicer Reits over the border? Another way to comprehend the 4.4% yield is "double of 12month FD's interest rate !" Generally for REIT price to go up : 1. DPU increase By means of acquiring more property. More property, more rental income. More rental income, more distribution to shareholders. AXREIT in the past has been doing quite well in terms of improving their earning and portfolio size. Even better is not doing any right issue (IIRC), but still manage to raise fund for new property acquisition via private placement. 2. Rental Revision 3. Macro economics factors : a. Bond yield drop b. Interest rate going down Reit yield should be always around 200~300 basis point above FD rate offering, to justify the risk taken. But with current global low yield environment, some are ok with REIT yield about 100-150 basis point above FD rate. But again, if portfolio size is tiny, individual investor usually didnt see much "meat" for the few % different in yields. Mreits are generally low yield and low growth. Stagnation. Plus there is tax on Mreits dividends. |

|

|

Jan 22 2021, 09:07 AM Jan 22 2021, 09:07 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(squarepilot @ Jan 21 2021, 08:33 PM) I have to say that I'm impressed at this call I asked me brother .... that bugger that shakes the coconuts .... how did you conclude at that time? the tech counters today closing doesn't look convincing, but how do you managed to spot it on 19th? » Click to show Spoiler - click again to hide... « |

|

|

Jan 22 2021, 09:26 AM Jan 22 2021, 09:26 AM

Show posts by this member only | IPv6 | Post

#3749

|

Senior Member

1,060 posts Joined: Feb 2008 |

QUOTE(prophetjul @ Jan 22 2021, 08:34 AM) Why bother with MReits when there is a lot more choicer Reits over the border? Yeah no doubt S-REIT has much better quality choices, and yield better return too Mreits are generally low yield and low growth. Stagnation. Plus there is tax on Mreits dividends. If one is residing in Malaysia, just needs to get himself access to SG bank account (Maybank iSavvy or CIMB SG), and trading platform (Tiger Brokers / IBKR / TD Ameritrade) then is good to go. And yeah, have to also familiar with fund transfer platform like instarem.. Some homework to do before investing in SREIT. This post has been edited by Smurfs: Jan 22 2021, 09:29 AM |

|

|

Jan 22 2021, 09:31 AM Jan 22 2021, 09:31 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(squarepilot @ Jan 21 2021, 08:33 PM) I have to say that I'm impressed at this call Ooops... see techs bouncing back... higher.... how did you conclude at that time? the tech counters today closing doesn't look convincing, but how do you managed to spot it on 19th? » Click to show Spoiler - click again to hide... « |

|

|

Jan 24 2021, 04:27 PM Jan 24 2021, 04:27 PM

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Jan 25 2021, 07:07 PM Jan 25 2021, 07:07 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(squarepilot @ Jan 24 2021, 04:27 PM) yeah. kinda unpredictable Yes but you have to take into consideration that the stock I traded is probably not the same as yours. that's why, when it reaches the cut profit/ cut loss point, sometimes i very hesitation to execute it. it could rebound in the next few minutes or next few days I traded only 2. UWC and PIE. Both surpassed what I had expected way too fast. Not comfortable. Hence, my selling. But you need also take into consideration my buying point. Yup, buying correctly solves most selling issues. |

|

|

Jan 25 2021, 07:40 PM Jan 25 2021, 07:40 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

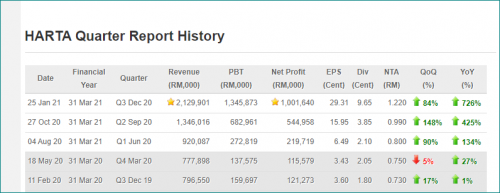

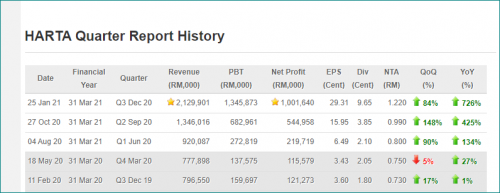

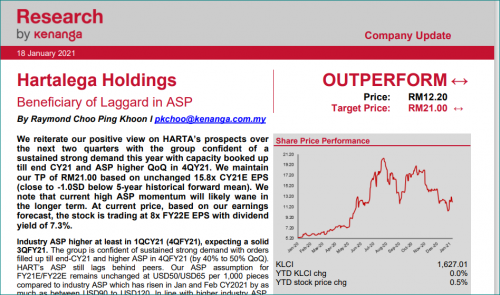

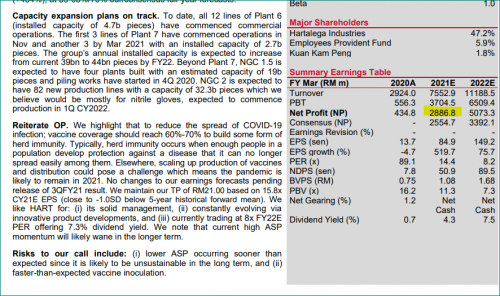

Oooooh..... I see Harta reported its earnings.

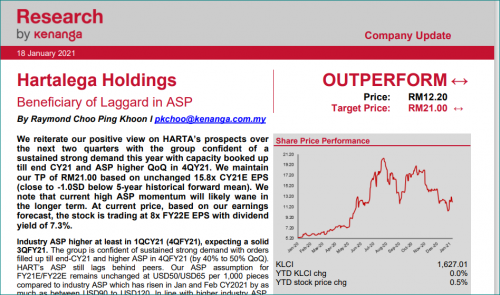

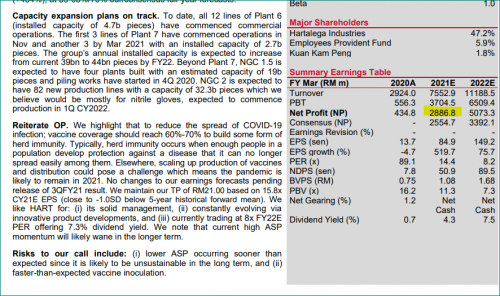

So 9 months net profit, Harta hit 1.76 billion. (everyone is expected fantastic profit this year la - no one is disputing that fact) When you have earnings like this, you need to ..... compare against what's expected. (that's the first thing to do la) Ok... the one copy I have is from Kenanga.  see the date ... it's fairly new. Now look at the earnings estimates...  Kenanga rocket calculator had it at 2.88 billion Harta now has 1.76 billion for 3 quarters.... Is this a blowout quarter? Some traders like to check the couple of days before the earnings announcement... just to check if there might be a possibility that some folks jumped early ... On 21st Harta, closed at 11.80. Today, it closed at 13.00. This post has been edited by Boon3: Jan 25 2021, 07:49 PM |

|

|

|

|

|

Jan 25 2021, 07:45 PM Jan 25 2021, 07:45 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

statikinetic ... we chatted on ESOS b4 right?

I saw this ... https://www.bursamalaysia.com/market_inform...?ann_id=3124171 The boss wife exercised some ESOS 1. Allotment of 371,700 shares via exercise of ESOS Options; and 2. Transfer of 100,000 shares to Lim Jin Feng via off market. See here for the Exercise prices... https://www.bursamalaysia.com/market_inform...?ann_id=3124165 |

|

|

Jan 25 2021, 07:50 PM Jan 25 2021, 07:50 PM

|

Junior Member

222 posts Joined: May 2010 |

[quote=Boon3,Jan 25 2021, 07:40 PM]

Oooooh..... I see Harta reported its earnings.  So 9 months net profit, Harta hit 1.76 billion. (everyone is expected fantastic profit this year la - no one is disputing that fact) When you have earnings like this, you need to ..... compare against what's expected. (that's the first thing to do la) Ok... the one copy I have is from Kenanga.  see the date ... it's fairly new. Now look at the earnings estimates...  Kenanga rocket calculator had it at 2.88 billion Harta now has 1.76 billion for 3 quarters.... Hi boon gor, Think is kenanga foresee 3rd q earned 1b, so 4th q also 1b without revise asp. Total 4q is bout 2.7-2.8b Almost there la.... 😁 |

|

|

Jan 25 2021, 07:57 PM Jan 25 2021, 07:57 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 25 2021, 08:03 PM Jan 25 2021, 08:03 PM

|

Senior Member

2,940 posts Joined: Jan 2010 |

QUOTE(Boon3 @ Jan 25 2021, 07:45 PM) statikinetic ... we chatted on ESOS b4 right? Man, those ESOS prices. The ones I usually see are 10 - 20% range of the market.I saw this ... https://www.bursamalaysia.com/market_inform...?ann_id=3124171 The boss wife exercised some ESOS 1. Allotment of 371,700 shares via exercise of ESOS Options; and 2. Transfer of 100,000 shares to Lim Jin Feng via off market. See here for the Exercise prices... https://www.bursamalaysia.com/market_inform...?ann_id=3124165 This one is literally a guaranteed skim cepat kaya. My portfolio kept sinking on average due to market weakness that I had to make a punt to try and prop up the portfolio value. I snuck into SPMX last week. If things keep sinking and goes contrary to the glove counters, I'll hedge em. |

|

|

Jan 26 2021, 08:57 AM Jan 26 2021, 08:57 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 25 2021, 08:03 PM) Man, those ESOS prices. The ones I usually see are 10 - 20% range of the market. You are in Superman. This one is literally a guaranteed skim cepat kaya. My portfolio kept sinking on average due to market weakness that I had to make a punt to try and prop up the portfolio value. I snuck into SPMX last week. If things keep sinking and goes contrary to the glove counters, I'll hedge em. Well, today's focus would be on Harta. Please refer post made earlier. As a trader those were the 2 points I would focus on. Was the earnings pretty much in line with expectations or was it a total blowout quarter (ie surprisingly good). If it's in line with expectations, generally the so called good earnings is already priced in. If it surprises to the upside, well, maybe you could get a big bang. And then... did the stock moved up before the earnings release? The ESOS ..... see this is one of the many reasons why I don't like about TopGlove. Already considered billionaire atas class already. Still need to enrich themselves with ESOS priced so low? |

|

|

Jan 26 2021, 09:09 AM Jan 26 2021, 09:09 AM

|

Senior Member

2,940 posts Joined: Jan 2010 |

QUOTE(Boon3 @ Jan 26 2021, 08:57 AM) And then... did the stock moved up before the earnings release? Gloves moved up on a block yesterday when everything is bleeding red.The ESOS ..... see this is one of the many reasons why I don't like about TopGlove. Already considered billionaire atas class already. Still need to enrich themselves with ESOS priced so low? I guess the assurance on the lockdown news is turning the market back green today morning with gloves as usual taking the opposite direction. Overall, feels like a market reaction to the MCO factor rather than an earnings reaction. TG taking so much media hits that it's making the other companies being seen as better alternatives. In terms on being a billionaire, I guess the dream of beating Maybank might be gone so why not replace it with individual wealth instead? |

|

|

Jan 26 2021, 09:20 AM Jan 26 2021, 09:20 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 26 2021, 09:09 AM) In terms on being a billionaire, I guess the dream of beating Maybank might be gone so why not replace it with individual wealth instead? the boss gets 335,097 ESOS shares too!! Ok, he is on a million dollar salary but does the company really need to issue so much ESOS to him too? https://www.topglove.com/App_ClientFile/7ff...2020_Latest.pdf pg. 62. |

| Change to: |  0.0381sec 0.0381sec

0.49 0.49

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 08:21 AM |