QUOTE(Boon3 @ Dec 4 2020, 09:10 AM)

Oh my.. 3 white soldiers It's a bull market. Hentam anything chances of upside is close to 85 percent😂

This post has been edited by squarepilot: Dec 4 2020, 12:33 PM

BWC

|

|

Dec 4 2020, 12:32 PM Dec 4 2020, 12:32 PM

Show posts by this member only | IPv6 | Post

#3361

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

|

|

|

Dec 5 2020, 10:32 AM Dec 5 2020, 10:32 AM

|

Senior Member

1,075 posts Joined: Apr 2010 |

|

|

|

Dec 5 2020, 11:22 AM Dec 5 2020, 11:22 AM

Show posts by this member only | IPv6 | Post

#3363

|

Senior Member

1,060 posts Joined: Feb 2008 |

QUOTE(squarepilot @ Dec 5 2020, 10:32 AM)  how effective of using moving average/SMA/EMA with so many different range and types? this stock shows many trader use SMA50 to trade? Some trader use MA as support / resistance. They sometimes act as support or resistance within a trend; and in some cases, they are similar to trend lines. The main difference between MA & trend line will be ; MA is calculated, trend line is drawn by human. If you ask 10 people to draw trend line, you might get 10 slightly different trend lines. But if you ask 10 people to generate MA on the chart, all 10 should arrive at the same result. Some trader use the "golden cross" & "death cross" to catch big moves. However, they produce really infrequent signal. And it is not foolproof too. Some trader see when the stock price crossed MA 50 line with volume commitment, they long the stock, this could be the case for OCK. They place a bet on possible directional change in the market. But to me Moving average (MA), be it SMA / EMA / LWMA, to me is still a laggard indicator. It can be use as REFERENCEs, but dont jump into trade because MA told you to do so. It didn't yield much results Cheers P/S In terms of sensitivity, LWMA > EMA > SMA. Sometimes too much signal can become interference, ie noises. Less is more. This post has been edited by Smurfs: Dec 5 2020, 01:52 PM ellim33 liked this post

|

|

|

Dec 5 2020, 12:07 PM Dec 5 2020, 12:07 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Smurfs @ Dec 5 2020, 11:22 AM) Moving Averages(MA) presents a "smoothen" version of price's general direction, ie averages of stock prices. Man... I should retire. You explain so much better than me. Some trader use MA as support / resistance. They sometimes act as support or resistance within a trend; and in some cases, they are similar to trend lines. The main difference between MA & trend line will be ; MA is calculated, trend line is drawn by human. If you ask 10 people to draw trend line, you might get 10 slightly different trend lines. But if you ask 10 people to generate MA on the chart, all 10 should arrive at the same result. Some trader use the "golden cross" & "death cross" to catch big moves. However, they produce really infrequent signal. And it is not foolproof too. Some trader see when the stock price crossed MA 50 line with volume commitment, they long the stock, this could be the case for OCK. They place a bet on possible directional change in the market. But to me Moving average (MA), be it SMA / EMA / LWMA, to me is still a laggard indicator. It can be use REFERENCEs, but dont jump into trade because MA told you to do so. It didn't yield much results Cheers P/S In terms of sensitivity, LWMA > EMA > SMA. Sometimes too much signal can become interference, ie noises. Less is more. Yea... Less is more... Which is why my charts are so plain.. This post has been edited by Boon3: Dec 5 2020, 12:08 PM |

|

|

Dec 5 2020, 12:26 PM Dec 5 2020, 12:26 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Dec 5 2020, 12:59 PM Dec 5 2020, 12:59 PM

Show posts by this member only | IPv6 | Post

#3366

|

Senior Member

1,060 posts Joined: Feb 2008 |

QUOTE(Boon3 @ Dec 3 2020, 03:33 PM) MI ! anyway can see the descending triangle.. looks bearish at the moment. BUT the pull back was done on lower volume..and the stock is now consolidating. Have to watch 3.8x support level..if breakdown, it is likely to attract additional sellers. However, it can also be an opportunity to take position... P/S UWC more interesting |

|

|

|

|

|

Dec 5 2020, 01:19 PM Dec 5 2020, 01:19 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Smurfs @ Dec 5 2020, 12:59 PM) MI ! Lol!!! anyway can see the descending triangle.. looks bearish at the moment. BUT the pull back was done on lower volume..and the stock is now consolidating. Have to watch 3.8x support level..if breakdown, it is likely to attract additional sellers. However, it can also be an opportunity to take position... P/S UWC more interesting UWC already say too much. Yes, spot on. Such triangles are tricky. Bias is towards the downside. So atm, it's at no man's land. Watch that 3.8 level... or watch the breakout. This type of stock, cannot anticipate.. react is the better way. |

|

|

Dec 5 2020, 02:48 PM Dec 5 2020, 02:48 PM

|

Senior Member

3,373 posts Joined: Nov 2008 |

For trading wise especially during shorter timeframe, how's VWAP consistency? I've been doing backtesting and couldn't see much of a use for me but many are adoring this particular indicator. A simple trend line is much more useful for me. Lol. Anyway, how's everybody doing?

|

|

|

Dec 5 2020, 05:25 PM Dec 5 2020, 05:25 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(billy_overheat @ Dec 5 2020, 02:48 PM) For trading wise especially during shorter timeframe, how's VWAP consistency? I've been doing backtesting and couldn't see much of a use for me but many are adoring this particular indicator. A simple trend line is much more useful for me. Lol. Anyway, how's everybody doing? Asked and answered |

|

|

Dec 6 2020, 01:34 PM Dec 6 2020, 01:34 PM

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Smurfs @ Dec 5 2020, 11:22 AM) Moving Averages(MA) presents a "smoothen" version of price's general direction, ie averages of stock prices. i was thinking a lagging indicator will be a confirmation sign for entry Some trader use MA as support / resistance. They sometimes act as support or resistance within a trend; and in some cases, they are similar to trend lines. The main difference between MA & trend line will be ; MA is calculated, trend line is drawn by human. If you ask 10 people to draw trend line, you might get 10 slightly different trend lines. But if you ask 10 people to generate MA on the chart, all 10 should arrive at the same result. Some trader use the "golden cross" & "death cross" to catch big moves. However, they produce really infrequent signal. And it is not foolproof too. Some trader see when the stock price crossed MA 50 line with volume commitment, they long the stock, this could be the case for OCK. They place a bet on possible directional change in the market. But to me Moving average (MA), be it SMA / EMA / LWMA, to me is still a laggard indicator. It can be use as REFERENCEs, but dont jump into trade because MA told you to do so. It didn't yield much results Cheers P/S In terms of sensitivity, LWMA > EMA > SMA. Sometimes too much signal can become interference, ie noises. Less is more. QUOTE(billy_overheat @ Dec 5 2020, 02:48 PM) For trading wise especially during shorter timeframe, how's VWAP consistency? I've been doing backtesting and couldn't see much of a use for me but many are adoring this particular indicator. A simple trend line is much more useful for me. Lol. Anyway, how's everybody doing? VWAP is monitored to ensure no last minute price manipulating before market closing. especial using candlestick, some joker can really push/pull the price right below closing to create a fake buy/sell signal once VWAP is not suspicious, ok to trade based on signal. i guess? This post has been edited by squarepilot: Dec 6 2020, 01:35 PM |

|

|

Dec 6 2020, 01:36 PM Dec 6 2020, 01:36 PM

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Boon3 @ Dec 5 2020, 01:19 PM) Lol!!! MI last quarter was a big turn off. On what circumstances it will upside breakout?UWC already say too much. Yes, spot on. Such triangles are tricky. Bias is towards the downside. So atm, it's at no man's land. Watch that 3.8 level... or watch the breakout. This type of stock, cannot anticipate.. react is the better way. |

|

|

Dec 6 2020, 01:59 PM Dec 6 2020, 01:59 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Dec 7 2020, 09:43 AM Dec 7 2020, 09:43 AM

Show posts by this member only | IPv6 | Post

#3373

|

Senior Member

3,373 posts Joined: Nov 2008 |

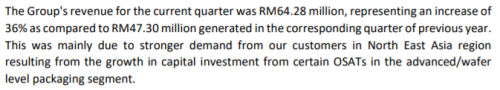

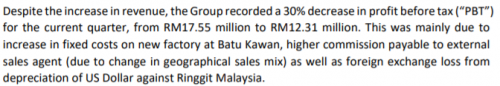

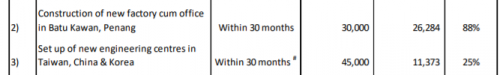

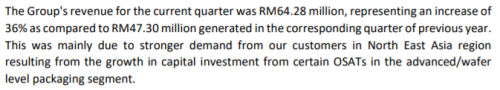

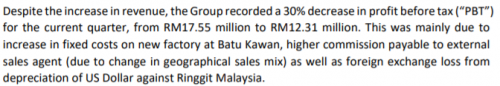

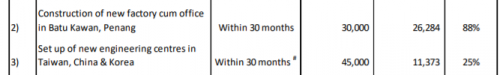

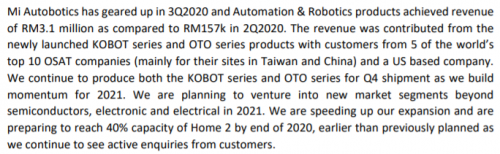

QUOTE(squarepilot @ Dec 6 2020, 01:34 PM) i was thinking a lagging indicator will be a confirmation sign for entry Based on what I've seen, the common use is to sell above VWAP and buy below VWAP in shorter timeframe to for reasonable price. But, what's reasonable price? Many have said that trading is a game of probability which winning more and losing less means a good game. But, I tend to disagree with this. Read too much of Boon's postings? VWAP is monitored to ensure no last minute price manipulating before market closing. especial using candlestick, some joker can really push/pull the price right below closing to create a fake buy/sell signal once VWAP is not suspicious, ok to trade based on signal. i guess? QUOTE(squarepilot @ Dec 6 2020, 01:36 PM) The revenue increased. Profit dropped due to expansion, higher commission and forex.  Progress of utilization.  Prospect.  Still looks good though. But, chart wise, it's been on short term downtrend, hence, nothing much to do as it is in consolidations stage?  |

|

|

|

|

|

Dec 7 2020, 06:12 PM Dec 7 2020, 06:12 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(billy_overheat @ Dec 7 2020, 09:43 AM) Based on what I've seen, the common use is to sell above VWAP and buy below VWAP in shorter timeframe to for reasonable price. But, what's reasonable price? Many have said that trading is a game of probability which winning more and losing less means a good game. But, I tend to disagree with this. Read too much of Boon's postings? Fulamak!!! Another pro liao. The revenue increased.  Profit dropped due to expansion, higher commission and forex.  Progress of utilization.  Prospect.  Still looks good though. But, chart wise, it's been on short term downtrend, hence, nothing much to do as it is in consolidations stage?  Okay man... |

|

|

Dec 7 2020, 07:03 PM Dec 7 2020, 07:03 PM

Show posts by this member only | IPv6 | Post

#3375

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Dec 8 2020, 03:20 PM Dec 8 2020, 03:20 PM

Show posts by this member only | IPv6 | Post

#3376

|

Junior Member

277 posts Joined: Jul 2020 |

How to trade stocks? In other word, goreng

|

|

|

Dec 8 2020, 03:23 PM Dec 8 2020, 03:23 PM

|

Senior Member

3,389 posts Joined: Sep 2019 |

|

|

|

Dec 8 2020, 03:45 PM Dec 8 2020, 03:45 PM

Show posts by this member only | IPv6 | Post

#3378

|

Junior Member

277 posts Joined: Jul 2020 |

|

|

|

Dec 8 2020, 06:15 PM Dec 8 2020, 06:15 PM

|

Senior Member

3,389 posts Joined: Sep 2019 |

|

|

|

Dec 8 2020, 06:37 PM Dec 8 2020, 06:37 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

| Change to: |  0.0240sec 0.0240sec

0.32 0.32

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 10:34 PM |