BWC

|

|

Oct 28 2020, 09:17 AM Oct 28 2020, 09:17 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

yehlai liked this post

|

|

|

|

|

|

Oct 28 2020, 12:31 PM Oct 28 2020, 12:31 PM

Show posts by this member only | IPv6 | Post

#3262

|

Senior Member

1,060 posts Joined: Feb 2008 |

Honestly i didnt expect this kind of drop for JFTECH... What i expect will be some consolidation near 4.4x area..

Nevertheless, the stock price has been doing quite well since MCO.  |

|

|

Oct 28 2020, 12:58 PM Oct 28 2020, 12:58 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

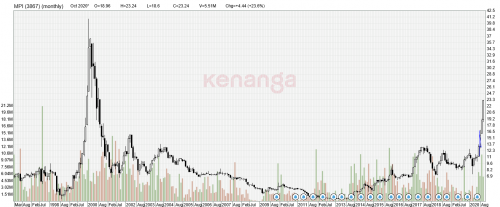

QUOTE(Smurfs @ Oct 28 2020, 12:31 PM) Honestly i didnt expect this kind of drop for JFTECH... What i expect will be some consolidation near 4.4x area.. YES!!! A lot of stocks had been doing well since MCO.  Nevertheless, the stock price has been doing quite well since MCO.  JF? This one? Way over rated (over the years, its earnings is really miniscule) .... I could be wrong but looks like its fried and dumped... and oh yeah... there's another stock which has almost the same pattern like PIE now.... ( errr.... just saying la ) |

|

|

Oct 28 2020, 01:59 PM Oct 28 2020, 01:59 PM

|

Senior Member

1,692 posts Joined: Feb 2017 |

so LCTITAN QR bomb incoming.

|

|

|

Oct 28 2020, 02:37 PM Oct 28 2020, 02:37 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Oct 7 2020, 11:47 AM) Aiyoooomah ! Hair all stand ..... Suicidal Guyso really want force me to see meh?........ nah.....  see ... a busuk one always busuk one.... straight away no like what I see..... 1. see the stock rally from end July to end Aug? 2. the very day LCTitan released its earnings, stock out of the blue, decides to mati kow kow ... on back of heavy volume.... see the arrows... 3. after that day.... see how the stock 'crashed'.... 4. now the stock is climbing back up... which makes me wonder.... is the stock gonna be pump up and then collapse again after its earnings? ps... you really remember my old postings on LC Titan eh? for those that don't know.... .... LC Titan chemical IPO price...... what was it? ..... 6.50 https://www.theedgemarkets.com/article/lott...below-ipo-price which is so similar with what happened to Titan Chemicals last time.... IPO at high price... all the good earnings promised.... never materialised.... stock of course ... plunged since listing.... then after few years.... taken private. LOL! Well LC Titan .... 1. High IPO ... check 2. Plunge after IPO .... check 3. Lousy earnings after listing .... check same same how do you expect me as you say not blacklist this stock? Just saw LCTitan QR. Once again... it disapppints.  and the stock tanks straight away ............................................................... But the points 1,2 and 3 .... I made in that posting..... same same isn't it if you put it into current prospective? stock shoots high.... and then come QR .... die cow cow........ see? having a blacklist is so, so, so important. Ignore what others say.... some stocks, you just don't want to touch at all ....... |

|

|

Oct 28 2020, 07:01 PM Oct 28 2020, 07:01 PM

Show posts by this member only | IPv6 | Post

#3266

|

Senior Member

1,060 posts Joined: Feb 2008 |

QUOTE(Boon3 @ Oct 26 2020, 01:18 PM) Corrected a fair bit... Update MI (5286)If I was late and only just got interested in the stock, I would have waited and watched out for a breakout play.... ( so lucky I did not follow this stock  and the breakout on heavy volume... looked 'okay' for me....  the trading data on Friday showed nothing out of the ordinary.... the 15 min time frame....  the stock drove higher sharply in the morning and then, in line with the general market, the stock pulled back just a little.... ... but overall this stock has done remarkedly well since listing in 2018. I see there's a one for 2 bonus issue last year too...  too bad .... I did not follow ...... The earning indeed disappointing the market...  Lower low and lower high with volume confirmation.. |

|

|

|

|

|

Oct 28 2020, 07:09 PM Oct 28 2020, 07:09 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Oct 28 2020, 07:55 PM Oct 28 2020, 07:55 PM

|

All Stars

24,449 posts Joined: Nov 2010 |

QUOTE(Boon3 @ Oct 28 2020, 07:09 PM) taikor, sometime ago, i remember saying AAX is worth zero... but u pleaded for 5 sen... or was it? it is now 3.5 sen. will be zero la... QUOTE Boeing to cut thousands of additional jobs through 2021 as it prepares for long air travel slump https://www.cnbc.com/2020/10/28/boeing-ba-e...gs-q3-2020.html parent AA is 56 sen, got sabah bank loan... wish them luck. p/s... too bored with covid-gloves... just wanna kacau u a bit. |

|

|

Oct 29 2020, 07:00 AM Oct 29 2020, 07:00 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Oct 28 2020, 07:55 PM) parent AA is 56 sen, got sabah bank loan... wish them luck. LOL! AAX...p/s... too bored with covid-gloves... just wanna kacau u a bit. Totally arrogant and again shows his ugly character which is highlighted with the latest MAHB lawsuit. Kudos to MAHB. Bravo. It is the right thing to do. The money is owed to MAHB. Even the courts of law agreed but what was surprising for me is that AAX has not paid (wonder what about AA). Such arrogance from TF. Already proven wrong and yet they still did not pay. Such arrogance! Now if AAX rescue plan fails due to MAHB lawsuit.... what lovely Karma! |

|

|

Oct 29 2020, 02:27 PM Oct 29 2020, 02:27 PM

Show posts by this member only | IPv6 | Post

#3270

|

Senior Member

1,060 posts Joined: Feb 2008 |

QUOTE(Smurfs @ May 19 2020, 08:50 PM) From the Quarterly report, it seems that SUNREIT changed their distribution frequency from quarterly to semi-annually. Reason being is to preserve cash, containment of cost and re-prioritizing CAPEX Update SUNREIT : From Current QR : Net Property Income for Retail : -11.2% yoy Net property Income for hotel : -34.6% yoy » Click to show Spoiler - click again to hide... « My wild guess DPU FY 2020 will be 7.70 sens. Hence : SUNREIT yield : 0.77/1.6 = 4.8% eFD promo rate : 2.59 % 10 yr MGS Yield : 2.91 % Now the question is, can buy ah? My 2 cents , please take it with a pinch of salt. Blow water only. » Click to show Spoiler - click again to hide... « DPU For FY 2020 = 7.33 sens SUNREIT Yield : 0.733/ 1.43 = 5.12% Current eFD promo rate : 2.30 % Current 10 Yrs MGS yield : 2.63 % Latest QR result:  DPU drop-> REIT price drop. The golden rule. Let says one invested in SUNREIT during 19th May 2020 ,with price 1.55, one will currently now sitting at loss Some of the highlight in the latest QR :    Borrowing increased too, for the acquisition of Sunway Pinnacle :   With current climate of prolonged global low interest rate environment, REIT will be the place for those yield chasing pension funds / institutional funds. Take a look at the largest 30 shareholders of REIT, mostly are those fund houses. A few % in yield different means almost nothing to individual investor, but for large institutional fund houses, we're talking about millions, or hundred of thousands perhaps?   However as an individual investor, the bet, or should i say investment strategy still remains, is to bet on its recovery. Here are some questions to ask ourself before investing in sunreit. - Why SUNREIT? - What is my expectation out of SUNREIT? - How do I react if the price of SUNREIT drop further? - Can the properties of SUNREIT earn me more DPU for years to come? - When will be the recovery? - What if it never recover? This post has been edited by Smurfs: Oct 29 2020, 08:52 PM Ahkwang liked this post

|

|

|

Oct 29 2020, 02:38 PM Oct 29 2020, 02:38 PM

Show posts by this member only | IPv6 | Post

#3271

|

Senior Member

1,060 posts Joined: Feb 2008 |

SUNREIT cont..

I remembered 2nd October...It was the 2nd day of continuous 3 digit Covid new infections in Malaysia..   No sign of consolidation yet..... |

|

|

Oct 29 2020, 06:34 PM Oct 29 2020, 06:34 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Smurfs @ Oct 29 2020, 02:27 PM) Update SUNREIT : Great stuff. DPU For FY 2020 = 7.33 sens SUNREIT Yield : 0.733/ 1.43 = 5.12% Current eFD promo rate : 2.30 % Current 10 Yrs MGS yield : 2.63 % Latest QR result:  DPU drop-> REIT price drop. The golden rule. Let says one invested in SUNREIT during 19th May 2020 ,with price 1.55, one will currently now sitting at loss -9.2 % Some of the highlight in the latest QR :    Borrowing increased too, for the acquisition of Sunway Pinnacle :   With current climate of prolonged global low interest rate environment, REIT will be the place for those yield chasing pension funds / institutional funds. Take a look at the largest 30 shareholders of REIT, mostly are those fund houses. A few % in yield different means almost nothing to individual investor, but for large institutional fund houses, we're talking about millions, or hundred of thousands perhaps?   However as an individual investor, the bet, or should i say investment strategy still remains, is to bet on its recovery. Here are some questions to ask ourself before investing in sunreit. - Why SUNREIT? - What is my expectation out of SUNREIT? - How do I react if the price of SUNREIT drop further? - Can the properties of SUNREIT earn me more DPU for years to come? - When will be the recovery? - What if it never recover? Yup... the declining DPU issue.... really golden rule... And if one bought around 1.90 before March 2020...the damage is severe. Where those ppl of previous times who boldly proclaimed that you can never lose money in Reits... |

|

|

Oct 30 2020, 11:35 AM Oct 30 2020, 11:35 AM

|

Junior Member

428 posts Joined: Aug 2018 |

sunreit @ 1.4x now

|

|

|

|

|

|

Oct 30 2020, 12:50 PM Oct 30 2020, 12:50 PM

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Boon3 @ Oct 29 2020, 06:34 PM) » Click to show Spoiler - click again to hide... « however this Covid was not anticipated 5 years back. Understand your point talking in a trader points of view but for retirees and pensioner. its a different school of thought This post has been edited by squarepilot: Oct 30 2020, 12:51 PM |

|

|

Oct 30 2020, 01:28 PM Oct 30 2020, 01:28 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(squarepilot @ Oct 30 2020, 12:50 PM) well. i have know few older folks prefer reits because of (probable) sustainable payout and gives higher returns compared to bank This point of view that 'lower DPU leads to lower stock price' is a fact based on market data. however this Covid was not anticipated 5 years back. Understand your point talking in a trader points of view but for retirees and pensioner. its a different school of thought That isn't a trader point of view. Who wants to own a stock which is giving less dividends back each year? Who wants to own a cow which is giving out less milk each year? Yeah, retirees might think differently too. So does many local investors who are poisoned deep deep with the mindset that dividends magic works best for their money in the stock market. Well? ... you want to make money or not? |

|

|

Oct 30 2020, 01:56 PM Oct 30 2020, 01:56 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(squarepilot @ Oct 30 2020, 12:50 PM) well. i have know few older folks prefer reits because of (probable) sustainable payout and gives higher returns compared to bank Come .... give me MRreits bought... 5 years ago.however this Covid was not anticipated 5 years back. Understand your point talking in a trader points of view but for retirees and pensioner. its a different school of thought Give me the date and the actual buying price. |

|

|

Oct 31 2020, 10:40 AM Oct 31 2020, 10:40 AM

Show posts by this member only | IPv6 | Post

#3277

|

Senior Member

3,373 posts Joined: Nov 2008 |

Bloodbath yesterday. How's everyone doing here ehh?

|

|

|

Oct 31 2020, 11:18 AM Oct 31 2020, 11:18 AM

Show posts by this member only | IPv6 | Post

#3278

|

Senior Member

1,450 posts Joined: Jul 2012 |

QUOTE(Boon3 @ Oct 28 2020, 12:58 PM) YES!!! A lot of stocks had been doing well since MCO. It does look like heavy manipulation to me . The extreme volatility. Right or not sifu boon.JF? This one? Way over rated (over the years, its earnings is really miniscule) .... I could be wrong but looks like its fried and dumped... and oh yeah... there's another stock which has almost the same pattern like PIE now.... ( errr.... just saying la ) |

|

|

Oct 31 2020, 01:27 PM Oct 31 2020, 01:27 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(anakMY @ Oct 31 2020, 11:18 AM) Dude do see inside... » Click to show Spoiler - click again to hide... « All I said was JFTech is way over rated (over the years, its earnings is really miniscule) .... I could be wrong but looks like its fried and dumped... Do search the info, see JF Tech's annual eps for the last 3 years..... Can you see how small the eps is? Add all 3 years eps, eps also don't have 10 sen. Which for me, it should not be worth more than rm1.00. Look at the price when it collapsed.... If that's not over valued... what is? and it traded above 5 bucks before it collapsed!  I have always maintained that any stocks can be fried .... Those in 2016 would have remembered the famous 4 stocks (which some dared to call 'fundamental stocks' (that's a farked up definition. so so situpdid to brand stocks as fundamental stocks, cos it makes no sense) that literally just plunged...... Let's see ..... ULI Corp (one very smelly stock) , OFI (oriental food) , SCGM and SLP all collapsed without 'reason' .....     If one is NOT a good trader, I strongly advise not to touch JF Tech for the time being..................................... This post has been edited by Boon3: Oct 31 2020, 01:28 PM |

|

|

Oct 31 2020, 02:04 PM Oct 31 2020, 02:04 PM

|

Senior Member

567 posts Joined: Feb 2006 |

QUOTE(Boon3 @ Oct 22 2020, 12:28 PM) QUOTE(Boon3 @ Oct 28 2020, 02:37 PM) Suicidal Guy Hi @Boon3Just saw LCTitan QR. Once again... it disapppints.  and the stock tanks straight away ............................................................... But the points 1,2 and 3 .... I made in that posting..... same same isn't it if you put it into current prospective? stock shoots high.... and then come QR .... die cow cow........ see? having a blacklist is so, so, so important. Ignore what others say.... some stocks, you just don't want to touch at all ....... Thanks for asking and thanks for your input.   On 20th, 15 min chart already showing warning signal. 15min chart making new low with increased volume. Daily close shows bottoming tail but volume is still not alarming. Usually there will be a rebound. So a trader would monitor 15min chart the next day to see if there is a rebound, and see if the rebound is weak or strong (consider to keep if rebound is strong). On 21st the next day, it is making new lows again with higher volume consecutively with no rebound. That would be the signal to exit. Daily chart shows increase in volume. If not monitoring the price on that day itself, the next day on 22nd would be the chance to exit. Also, the the subsequent rebound seen on daily chart from 26th onward is with low volume showing that it is weak. That would be the second chance to exit. Most of the time, a stock with public interest have a rebound after a big sell off. That is the chance to exit if things are not right. |

| Change to: |  0.0222sec 0.0222sec

0.19 0.19

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 01:09 AM |