8.5 cent dividend, gooding? TG. PE38. hmm. too high?

BWC

BWC

|

|

Sep 17 2020, 01:41 PM Sep 17 2020, 01:41 PM

|

Senior Member

1,692 posts Joined: Feb 2017 |

8.5 cent dividend, gooding? TG. PE38. hmm. too high?

|

|

|

|

|

|

Sep 17 2020, 01:54 PM Sep 17 2020, 01:54 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

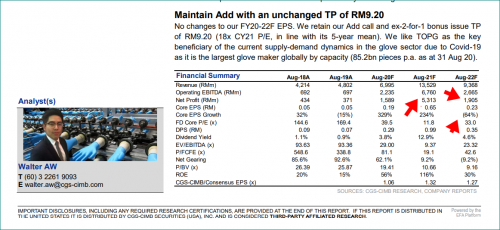

QUOTE(TheLegend27 @ Sep 17 2020, 01:41 PM) 8.5 sen divide by current share price = indicative dividend yield lo... good?The other day... CIMB leng chai...  FY 21 estimate profits = 5.313 billion or 1.325 billion profit per quarter. Beat expectations or more the less meet expectation? pe38? cannot use like that cos of the explosive profit growth. yes... the profits were really, really, really good.... but as good as it is... the profits were only as expected.... |

|

|

Sep 17 2020, 01:58 PM Sep 17 2020, 01:58 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(yhtan @ Sep 15 2020, 03:17 PM) Few incidents can raise alarm liao Oooh...... looked into the BS......> spent 200mil on share buy back, give dividend also at least 2 cent for each share > appear in media last friday (8tv) > US start to punish glove maker especially topglove, NZ top supplier withdraw their stock If u look at the chart, trendline sudah broker and still trading below, forming like a head and shoulder. Sendiri pannai pannai if trade this counter. and the bloody elephant in the room is that TG has its hand in the money market funds..... normally it's ok .... to put some extra money into market funds... but this TG ..... i think is way too aggressive.... it's got some 1.6 BILLION ringgit in money market funds... and when the company put in so much money in, you think they would be more transparent and describe clearly what type of money market fund does 1.6 Billion ringgit buy!!! scary |

|

|

Sep 17 2020, 02:02 PM Sep 17 2020, 02:02 PM

|

Senior Member

3,496 posts Joined: Dec 2007 |

QUOTE(Boon3 @ Sep 17 2020, 01:58 PM) Oooh...... looked into the BS...... RISK ON !!! Turn it up to the max.and the bloody elephant in the room is that TG has its hand in the money market funds..... normally it's ok .... to put some extra money into market funds... but this TG ..... i think is way too aggressive.... it's got some 1.6 BILLION ringgit in money market funds... and when the company put in so much money in, you think they would be more transparent and describe clearly what type of money market fund does 1.6 Billion ringgit buy!!! scary Anyway the next question is where does it go from here. Maybe another goreng, another leg up ? Will this round be more fund coming in from retailer ? Institutional ? Will just have to see |

|

|

Sep 17 2020, 02:03 PM Sep 17 2020, 02:03 PM

|

Senior Member

8,650 posts Joined: Sep 2005 From: lolyat |

QUOTE(Boon3 @ Sep 17 2020, 01:58 PM) Oooh...... looked into the BS...... As i know market market fund could be under USD and able to obtain higher interest rate than bank institution. and the bloody elephant in the room is that TG has its hand in the money market funds..... normally it's ok .... to put some extra money into market funds... but this TG ..... i think is way too aggressive.... it's got some 1.6 BILLION ringgit in money market funds... and when the company put in so much money in, you think they would be more transparent and describe clearly what type of money market fund does 1.6 Billion ringgit buy!!! scary Even Warren Buffett huge cash pile is in US treasury notes and not under bank, for the very cash rich corporation they think holding US treasury bond is safer than place at bank. Bank anytime can collapse but US government little chances can collapse. |

|

|

Sep 17 2020, 02:05 PM Sep 17 2020, 02:05 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(yhtan @ Sep 17 2020, 02:03 PM) As i know market market fund could be under USD and able to obtain higher interest rate than bank institution. Oh yes.... you are right but the problem is that TG is not saying what type of money market fund (which is simply way too general) .....Even Warren Buffett huge cash pile is in US treasury notes and not under bank, for the very cash rich corporation they think holding US treasury bond is safer than place at bank. Bank anytime can collapse but US government little chances can collapse. so are we to guess what? |

|

|

|

|

|

Sep 17 2020, 02:07 PM Sep 17 2020, 02:07 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(ChAOoz @ Sep 17 2020, 02:02 PM) RISK ON !!! Turn it up to the max. First.... did TG beat expectation? of did it meet the expectation?Anyway the next question is where does it go from here. Maybe another goreng, another leg up ? Will this round be more fund coming in from retailer ? Institutional ? Will just have to see me? Basing on the CIMB numbers, it's just about meet expectation only nia..... so .... isn't this a meh? |

|

|

Sep 17 2020, 06:13 PM Sep 17 2020, 06:13 PM

Show posts by this member only | IPv6 | Post

#3128

|

Junior Member

101 posts Joined: Sep 2009 |

Boon3, your prediction is correct... just curious, with 1.3Bil net profit announced, what should be the decent price for current situation and what P/E considered reasonable.

|

|

|

Sep 18 2020, 06:57 AM Sep 18 2020, 06:57 AM

Show posts by this member only | IPv6 | Post

#3129

|

Senior Member

1,013 posts Joined: Sep 2014 |

QUOTE(Boon3 @ Sep 17 2020, 02:07 PM) First.... did TG beat expectation? of did it meet the expectation? Yup. Exact reason why price dropped yesterday. Market is already priced in because they expected to get pat and revenue way beyond forecasted. me? Basing on the CIMB numbers, it's just about meet expectation only nia..... so .... isn't this a meh? But when real numbers come out, pat and revenue is in line with their forecast. Remember, price is for numbers more than forecasted. When doesn't happen, price will go down to a level suitable for the actual pat and revenue |

|

|

Sep 18 2020, 09:31 AM Sep 18 2020, 09:31 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(hybr1d3d @ Sep 17 2020, 06:13 PM) Boon3, your prediction is correct... just curious, with 1.3Bil net profit announced, what should be the decent price for current situation and what P/E considered reasonable. It wasn't really a prediction. It was based on my interpretation (which might be wrong) that the glove market was driven so high early on based on way too optimistic earnings projections. When one by one, started missing the earnings projection, despite really fantastic earnings, I felt we are at the point where the market is way, way ahead. Meeting earnings projection is not gonna be enough. It's got to beat these analysts projections to make them go WOW and force these buggers to rewrite a whole new script with much higher numbers (which will ultimately leads to higher TPs ... which leads to higher stock prices) Without it... it's a meh.... It's what they predicted.... so ... there's nothing new really. That's how I saw it... Now looking ahead... TG earnings is really great. No doubt.... but like I said... it's all been projected that TG will earn so much already (which is why TG trading at such high prices..... anyway.... the concern now is .... 1. The ASP issue... this for me... is the main driver .... I wrote this b4... as it is... I am not a believer one can increase ASP all the time... sooner or later ... the customer will give u the finger and esp. when the customers read all about the insane profits glove makers are churning out... customers are not stupid..... this is what I have always believe in the business world.... .... and brokerage houses like MacQuarie and even CIMB recognizes this issue.... so in their core number tables, one can see the sharp downtrend comes fy22. this was even reflected in Harta's news... https://www.theedgemarkets.com/article/hart...analysts-expect QUOTE "The analysts are correct [on the earnings forecasts]. But when it comes to the third year, after 2021, they start to give us [earnings] contraction... and [it's] a very sharp contraction. "I mean this is an opinion, right? They can be right at the end of the day. I do not know. But by my guidance, what the analysts have said cannot be right,” Hartalega's executive chairman Kuan Kam Hon told the media after the group's annual general meeting yesterday when asked to comment on analysts' earnings forecasts. A bit of irony there.... cos for Harta's own performances.... the analysts were way too optimistic as Harta greatly underperformed .... But anyway..... the key.... is that sharp contraction.... Which puts us in a very unique situation... which is we could see continued strong earnings performance but these earnings performances is like a time bomb.... it could just end just like that when ASP starts falling.... Take TG.... next reporting quarter is 2021 Q1 ..... the profits is projected to contract/ease/plunge ....come fy 2022.... this is THE MAIN RISK...... which you need to ask if the RISK/REWARD is worthwhile for you to trade/invest in it now...... Yes... sooner or later ... the ASP will come down. Once it does, profits will contract.... and when you factor in the fact every Ali, Muthu and Ah Seng is jumping into the glove making bandwagon, you get over capacity and you know these extra ordinary times would come to an end... ie ... the boom boom profit growth will be gone (ah.. not saying glove makers would lose money but just saying their profits could return back to pre C19 days) ..... meanwhile.... I have no idea how the stock would trade.... yehlai liked this post

|

|

|

Sep 18 2020, 02:07 PM Sep 18 2020, 02:07 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

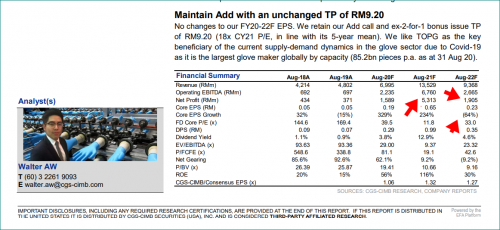

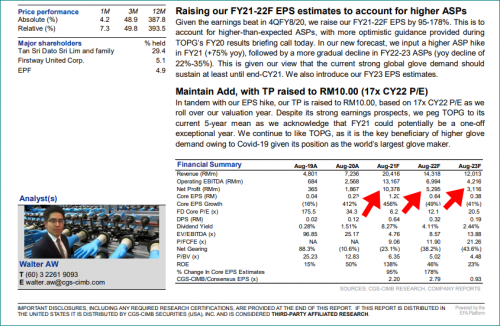

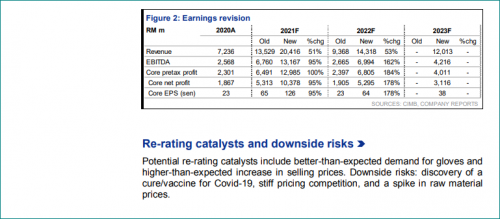

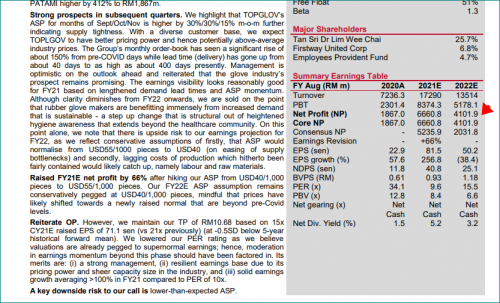

Was dying to get CIMB rocket report.....

Well? It's own estimates table is still saying the same thing... once the boom ends, the profit will contract/ease/plunge sharply.... Of course.... that leng chai dared not to mention... yup... he left it there for you the reader to figure it out...  so what he did was ... to 'rewrite' the fy21 numbers higher.... so much higher.... profits are now estimated to be 10 billion for the year... see how they did it below....  see how extremely high they raised the bar? That's easily 2 billion in profit per quarter for fy 21!!! LOL!!!!!!! and... when TG next reports a profit of 1.8 billion for the next quarter, which is utterly fantastic, but the numbers is falling way short of estimates.... LOL!.... another meh moment.... BUT GET THIS..... see how the earnings will contract after that? Isn't this the big elephant in the room risk? If the profit could contract so sharply, why isn't CIMB declaring it as a downside risk? Let me say this about the ASP..... no business can simply increase and increase and increase the ASP lwithout a care in the world.... and certainly not when the eyes of the world read you just made 1.3 billion in profits. Customers are not stupid..... Some are very spiteful... some believe in Karma.... there will be consequences!!! this was the previous report...  and yeah... the other thing that certainly doesn't make sense is the fy 21 numbers.... see their old numbers is 5.313 billion? The new revised numbers is 10.378 billion? What doesn't make sense is they revised the profit from 5.313 billion to 10.378 billion.... 95% increase.... if CIMB lengchai truly believes that the profit can increase so much, why the TP only increase from 9,20 to 10.00? LOL!! Yup... cannot brain. |

|

|

Sep 18 2020, 02:22 PM Sep 18 2020, 02:22 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

and this is Kenanga report...

Same same.... Huge profit for fy 21 estimated.... but just like MacQauarie and CIMB.... Kenanga has finally introduces/shows its fy 22 estimates.... and it too shows sharp contraction.... But CIMB leng chai should at least learn some integrity by declaring that lower than expected ASP is a downside risk! and yeah... so unrealistic... CIMB and Kenanga still basing the TP on fy 21 numbers! LOL! isn't it extremely short sighted? |

|

|

Sep 18 2020, 02:42 PM Sep 18 2020, 02:42 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

Question for CIMB and Kenanga... 6 months down the road .... your target price will be based on fy 21 or fy 22 numbers ah? Get this issue/problem/risk? If they base on fy 22 numbers ..... won't the TP price forced to be much lower? mitodna liked this post

|

|

|

|

|

|

Sep 18 2020, 03:51 PM Sep 18 2020, 03:51 PM

|

All Stars

24,448 posts Joined: Nov 2010 |

QUOTE(Boon3 @ Sep 18 2020, 02:42 PM) Question for CIMB and Kenanga... even 3 months down the road, after another round of Qrs, there will be diff visibility and guidance.6 months down the road .... your target price will be based on fy 21 or fy 22 numbers ah? Get this issue/problem/risk? If they base on fy 22 numbers ..... won't the TP price forced to be much lower? sure it will be CY2022, maybe 2023 if their backlogs are still 500-600 days. |

|

|

Sep 18 2020, 07:17 PM Sep 18 2020, 07:17 PM

Show posts by this member only | IPv6 | Post

#3135

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Sep 18 2020, 03:51 PM) even 3 months down the road, after another round of Qrs, there will be diff visibility and guidance. So how many research houses are saying the same earnings trend for fy22? (which is just 5 quarters away?)sure it will be CY2022, maybe 2023 if their backlogs are still 500-600 days. M, CIMB and Kenanga? And M is the only one calling it as it is based on fy22 estimates? If I have came out with those earnings estimates, the right thing to do is call it..... |

|

|

Sep 18 2020, 08:38 PM Sep 18 2020, 08:38 PM

|

All Stars

24,448 posts Joined: Nov 2010 |

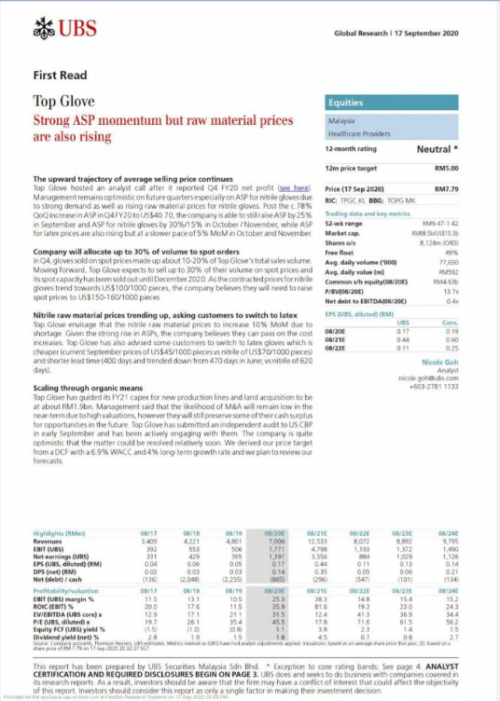

QUOTE(Boon3 @ Sep 18 2020, 07:17 PM) So how many research houses are saying the same earnings trend for fy22? (which is just 5 quarters away?) i came across 5 new TG TP's today... looks like all of them want to say something after QR. M, CIMB and Kenanga? And M is the only one calling it as it is based on fy22 estimates? If I have came out with those earnings estimates, the right thing to do is call it..... i dunno if they use 2020, 2021 or 2022. 1. UBS gave new TP of rm5.00.... u shud be interested in how they derived it - seems to me some method using statistical variances of last 4 years stock price. http://research.ibb.ubs.com/openaccess/com...8800_1_new.html 2. credit suisse - rm16.20... i can't find the actual source. 3. TA - rm10.80 - i have the pdf but forgot where the link came from. 4, HLB - rm13.00 5. MIDF - rm9.31. u can find the full details, i m sure. anyway, think i'll come back after 3 months, after the next QR's, new visibility, new guidance... if any. see how those scientists and mathematicians wud have changed their minds or not. |

|

|

Sep 18 2020, 09:55 PM Sep 18 2020, 09:55 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Sep 18 2020, 08:38 PM) i came across 5 new TG TP's today... looks like all of them want to say something after QR. You are very focused on the TP set. i dunno if they use 2020, 2021 or 2022. 1. UBS gave new TP of rm5.00.... u shud be interested in how they derived it - seems to me some method using statistical variances of last 4 years stock price. http://research.ibb.ubs.com/openaccess/com...8800_1_new.html 2. credit suisse - rm16.20... i can't find the actual source. 3. TA - rm10.80 - i have the pdf but forgot where the link came from. 4, HLB - rm13.00 5. MIDF - rm9.31. u can find the full details, i m sure. anyway, think i'll come back after 3 months, after the next QR's, new visibility, new guidance... if any. see how those scientists and mathematicians wud have changed their minds or not. I rather see how and what are the perimeters used in deriving the TP, ie I rather look at the estimated profits and the earnings multiple they used. Let's do the first one. My Google search is based on 'Credit Suisse Top Glove target price'. I used it because right away I see something amiss. Anyway... http://www.google.com/search?source=androi...0target%20price Straightaway I see the 37. Which is somewhat closer what I remembered browsing the news. This is the article to read... https://www.theedgemarkets.com/article/cred...cts-record-fy21 Rm23 tp... That was very high then, yes? 1."According to management, some of these orders were priced above US$100 per 1000 pieces, which is more than three times higher than the current blended ASP for the normal orders," Cheah said. This is what he got from the management.. which is also reflected/mentioned in another Edge article... Quote: KUALA LUMPUR (Sept 17): Top Glove Corp Bhd has guided that the average selling price (ASP) for its nitrile gloves will increase by 30% in October, 15% in November and perhaps another 10% after November, as outlook for the group and the glove industry remains promising. *and it again reflects the very strong role ASP plays in this extraordinary profit growth stage * **do check pre covid prices - again.. my simplistic argument is how long they can play this increasing ASP price game. Are their customers so ignorant the insane profit windfall for glove makers blah blah blah.. * 2. In addition, while the company was previously guiding for 5%-10% increases in ASP every quarter, given the further squeeze in demand-supply for gloves, it was now guiding for a monthly double-digit ASP increase at least for the next two months. "Given the revised strategy and ASP guidance by the company, we have raised our FY20 (financial year 2020)-FY22 earnings per share by 20%-135%. We now expect the group's earnings to grow 182% in FY20, a further 122% in FY21 but decline by 63% in FY22 as ASP normalises. Aha... See? They are all saying the same thing. Once ASP normalises, earnings will decline by 63%. This risk is noted in June.... But guess what? Everyone was focused on the nice TP of 23...they totally ignored the risk.... Now it's slowly being in focused. Oops! Lol I realised its not UBS. Yup somehow I searched credit Suisse instead of UBS. Can't find the UBS link but saw the image. Lol.  And as you can see.. it's the same story... Fy22 earnings declines as ASP normalises... Well... like it or not... That's one of the main risk now. |

|

|

Sep 19 2020, 10:38 AM Sep 19 2020, 10:38 AM

|

All Stars

24,448 posts Joined: Nov 2010 |

QUOTE(Boon3 @ Sep 18 2020, 09:55 PM) And as you can see.. it's the same story... Fy22 earnings declines as ASP normalises... yep, all the banks tell a similar story, incl this:Well... like it or not... That's one of the main risk now. https://www.theedgemarkets.com/article/bull...21-falling-fy22 a matter of how much prices and/or demand will change in 2022 and after. we should get a clearer picture in Nov-Dec. |

|

|

Sep 19 2020, 12:08 PM Sep 19 2020, 12:08 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Sep 19 2020, 10:38 AM) yep, all the banks tell a similar story, incl this: 1) Come the next quarter, company like TG will be reporting FY 21 Q1 so will Superman.https://www.theedgemarkets.com/article/bull...21-falling-fy22 a matter of how much prices and/or demand will change in 2022 and after. we should get a clearer picture in Nov-Dec. So logically speaking, these scientists can no longer based their TP on FY 21 numbers. It HAS TO BASE THEIR TP OB FY22 numbers.... 2) ASP, ASP, ASP ..... this is the VERY ESSSENCE of the profit growth. The MULTIPLIER effect on the profit. 2 b) Just yesterday.... https://www.theedgemarkets.com/article/asp-...-says-top-glove Quote: Top Glove Corp Bhd has guided that the average selling price (ASP) for its nitrile gloves will increase by 30% in October, 15% in November and perhaps another 10% after November, as outlook for the group and the glove industry remains promising. As of this month, the group's ASP for nitrile gloves stands at US$70 per 1,000 pieces. Nitrile gloves production occupied almost 60% of the total group's production, while the remainder comprised latex and vinyl gloves. TG own guidance hor.... 70 X 1.3 x 1.15 ~ US104.65 per 1000 pcs. and from this Edge article... we can make comparison.... https://www.theedgemarkets.com/article/sell...w-signs-peaking Quote: On average, the current ASPs of nitrile and rubber gloves are US$50, and US$30 to US$40 per 1,000 gloves — more than double the pre-Covid-19 levels of US$21 and US$17 respectively. ASP will be more than triple come end of the year.... This is the boom boom boom factor in my opinion. Which clearly in business, such ASP can not be sustained.. the prices are absolutely insane.... Profiteering in times of crisis? 3) So without this multiplier effect... ie... when the ASP normalises back .... the decline in profits will be drastic...... That is LOGICALLY the risk. 4) So how long do you think glove makers customers will be held to this exorbitant rise in prices? As I said b4... in the business world... buyers are not that water fish .... if the the glove makers do not show restrain in controlling the spiraling ASP, buyers will. and the consequences will be ugly in the future. 5) Good reference is the MPI case of the glory semicond bull days.... I do not have the data but from what I was told... MPI run, which was so much more glorious than the current glove makers, ended despite it reporting profit growth... yup... the stock declined before MPI's earnings started to decline... again not saying this will be the case for the glove makers... but an understanding of past rise and fall of the glory stocks would not hurt one's awareness. take care..... these glove comments are getting too tedious for me.... I just wanna shake my legs.... This post has been edited by Boon3: Sep 19 2020, 12:10 PM |

|

|

Sep 21 2020, 10:18 AM Sep 21 2020, 10:18 AM

|

Junior Member

672 posts Joined: Sep 2011 |

TG still worth to hold ?

|

| Change to: |  0.0353sec 0.0353sec

1.21 1.21

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 05:41 AM |