Kenanga trying to play catch up ....

QUOTE

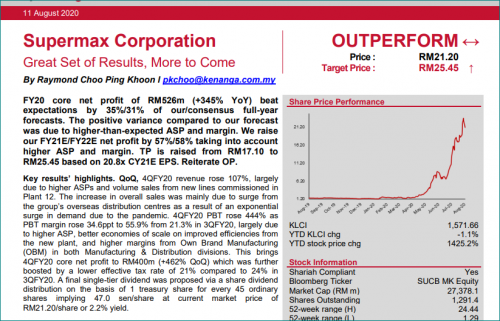

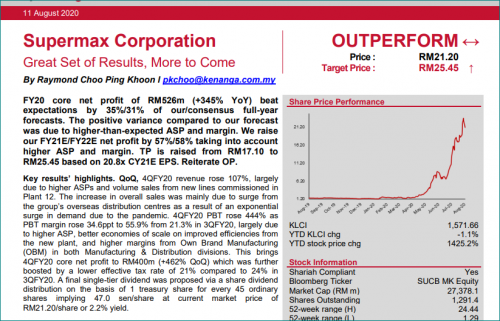

Undemanding FY21E PER valuation of 17x compared to expected

earnings growth of 200%. Correspondingly, our TP is raised from

RM17.10 to RM25.45 based on 20.8x CY21 revised EPS of 122.3 sen

(previously 22x) (at slightly below +2.0SD above the 5-year historical

forward mean). We like Supermax because: (i) the stock is trading at an

undemanding 17x FY21E EPS compared to expected explosive

earnings growth of >100%, and (ii) its OBM model enables it to extract

higher margin from distributor prices, compared to the OEM model at

lower factory prices. Reiterate Outperform

Comments.

1. wtf is 20.8x pe multiple?

LOL! 20x cannot meh? 22x cannot meh? why need to sound so geng using 20.8x.

So baffling! LOL!

2. Again is CY. WTF is wrong with these scientist. Grrrr..... why cannot stick to Fiscal year?

you susah susah make a research report and you want me to figure out WTF you are trying to say?

You be fired if I am the one you are writing for...

So CY 21 will consists of 2021 Q2, 2021 Q3, 2021 Q4, 2022 Q1 reports.

See how bloody confusing and ridiculous it is!

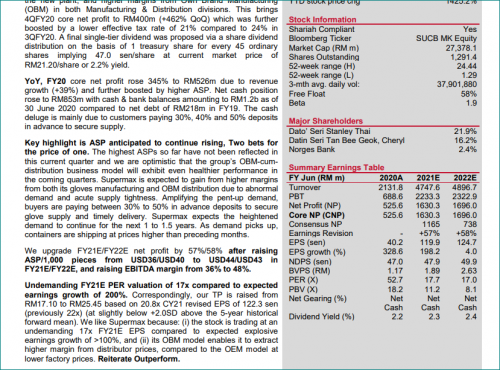

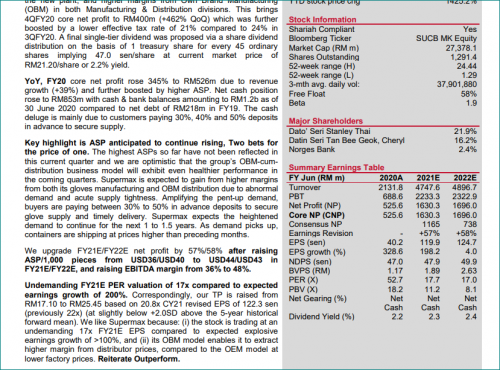

3. Estimate CY EPS is 122.3. The number of share outstanding they use is 1291 million shares.

Their estimate CY profit then should be 1576 million. Correct ah?

Yeah... damn... the user must count sendiri....

4. If only 1571 million... then annualised (divide by 4) ~ 394 million per quarter only wo....

Isn't the scientist behind the curve? or is the scientist suggesting no growth?

*** perhaps another report is coming... with bigger numbers?

** my counting correct ah?

Aug 11 2020, 08:57 AM

Aug 11 2020, 08:57 AM

Quote

Quote

0.0304sec

0.0304sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled