QUOTE(AVFAN @ Jul 31 2020, 06:27 PM)

First time ever. Epic!

That's why it was strange the other day. AA reported its shyte results but AAX didn't.

AA fell but AAX was trading pretty much unchanged at 0.095/0.10.

It was a big SHORT on my paper trade book (buku 555 la) ...

But anyway... TP zilo is a bit too evil from CIMB la...

They could give chance sikit and say 0.005 la....

half sen also can mah....

Anyhow... according to AAX notes, they had applied for a 500 million Danajamin PRIHATIN loan...

lifeline depend on the loan...

but with such balance sheet... with hardly any asset... percentage of planes flying (

and oh... they had returned one plane back to their lessor!!!

epic... and according to the notes...my interpretation is... they want to return more.... WOW!!

ini macam also can meh?

return to lessor wo...

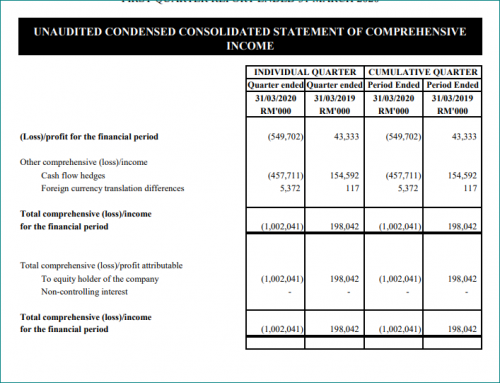

The fuel hedges comparison...

AAX remaining hedge is 3.459 million.

AirAsia is 5.3 million barrel.

Hmmm... AAX still got a lot of fuel hedges left!!!

In AirAsia notes, its out of the 5.3 million, 3.1 million is due less than 1 year is carrying a 'paper' loss of 794 million.

All AAX wrote is .... "As at 31 March 2020, outstanding number of barrels of Brent and fuel derivative contracts was 3,459,348 barrels"

Which means, it's paper loss for the remaining hedges is gonna be huge!

And then there is this article...

https://www.theedgemarkets.com/article/aax-...udited-net-loss

Huge deviation!!! Really huge...

Now back to the fuel hedges. Unlike AirAsia, did not write how much its fuel hedges losses were...

All I see is....

Did AAX just classified its fuel hedges as CASH FLOW HEDGES????

ChAOoz ... err .... can help see? Am I wrong there....

and also this 'cash flow hedges' loss total is 457 million.

How come this 457 million loss not included in AAX profit and loss...link to report

I mean did AAX under reported its losses? ie Shouldn't AAX losses be 1 billion.

anyway... like half bola.... give chance sikit to AAX la.... half sen TP lo...

This post has been edited by Boon3: Aug 1 2020, 10:25 AM

Aug 1 2020, 10:24 AM

Aug 1 2020, 10:24 AM

Quote

Quote

0.0179sec

0.0179sec

0.18

0.18

6 queries

6 queries

GZIP Disabled

GZIP Disabled