» Click to show Spoiler - click again to hide... «

QUOTE(Boon3 @ Jul 24 2020, 12:44 PM)

Ah Koon's stupid statement...  yeah... since he called others stupid.... lets see if he himself clever or stupid or purely evilly cunning...

yeah... since he called others stupid.... lets see if he himself clever or stupid or purely evilly cunning...

I glanced thru....

1. Last year q4, Pharma suffered a huge loss, which dragged everything into deep red.... according they had to write off a huge chunk of inventory....

well... whatever it is... the stock suffered... it fell below 1.00

2. We price stocks to the future. Pharma last reported Q earnings was in May. It returned a very decent set of numbers. Sales improved to above 800m and profits is a respectable 22million or as Ah Koon would note an eps of 8.57sen.

Sales growth and the company 'returned' to profits.

3. This is where I find it very inconsistent. Remember how Ah Koon likes to use annualized eps, cos he consider it safe and conservative approach?

From Superman posting: https://klse.i3investor.com/blogs/koonyewyi...oon_Yew_Yin.jsp

Well? If he used that valuation method for Superman, why didn't he use the same for Pharma?

For Pharma, the annualized eps would be 8.5x4 = 34 sen...

And using his GOLD STANDARD of 20xPE, then macam mana ni?

Shouldn't Pharma be worth at least 20x34 = 6.80?

Correct or not?

Macam ni only consistent mah....

How can he value stocks he got vested interest this way and not other stocks?

I mean if he wants to point out the risk of blindly betting on Pharma on the assumption of C19, then at least do with class. Something like how Alex Lu did.

https://nexttrade.blogspot.com/2020/07/phar...venient_23.html

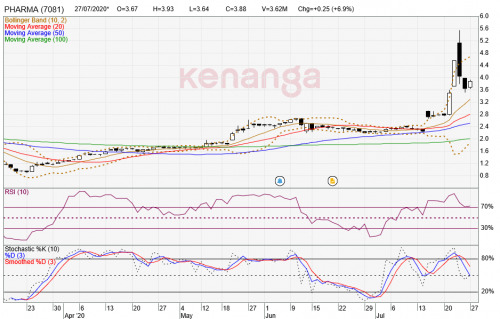

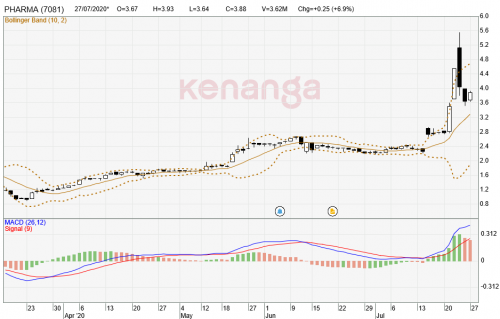

4. Charts wise. As stated earlier, that was a classical sign that Pharma should be retracing any time... No stocks can continue to climb vertically. Profit taking will cause the stock to retrace sharply.. yup. The smart traders will sell for a profit. The pullback today and yesterday wasn't unexpected and after all, the gaps needs to be closed...

5. "Pharmaniaga is only an agent to sell medicine" .... Aiyoh.

Kinda very malu la. If Ah Koon wants to bash a stock, he needs to do the least of homework and perhaps read the lasted QR report and see the breakdown of Pharmaniaga business. Check la the facts. Pharma does manufacturing too (although the PBT isn't very big).

Which for me it boils down to simple evilness. I feel that he wants all the speculative fund to be focused on what stock he has. After the politician statement on Pharma, there was indeed a buzz on pharma related stocks. That's causing him. And this is how I felt. He wants the punters to punt the stock he is buying...

and it's such a smart tactical move by Ah Koon. I bet he figured that there wasn't much downside since the probability is very great that Pharma would correct. And if and when Pharma corrects, it adds power to his name. See Ah Koon... he say this stock up, it up...he say that stock down, it down. Cunning evilness eh?

Pharma last traded 3.73.

wts6819 for your reading too....

I glanced thru....

1. Last year q4, Pharma suffered a huge loss, which dragged everything into deep red.... according they had to write off a huge chunk of inventory....

well... whatever it is... the stock suffered... it fell below 1.00

2. We price stocks to the future. Pharma last reported Q earnings was in May. It returned a very decent set of numbers. Sales improved to above 800m and profits is a respectable 22million or as Ah Koon would note an eps of 8.57sen.

Sales growth and the company 'returned' to profits.

3. This is where I find it very inconsistent. Remember how Ah Koon likes to use annualized eps, cos he consider it safe and conservative approach?

From Superman posting: https://klse.i3investor.com/blogs/koonyewyi...oon_Yew_Yin.jsp

Well? If he used that valuation method for Superman, why didn't he use the same for Pharma?

For Pharma, the annualized eps would be 8.5x4 = 34 sen...

And using his GOLD STANDARD of 20xPE, then macam mana ni?

Shouldn't Pharma be worth at least 20x34 = 6.80?

Correct or not?

Macam ni only consistent mah....

How can he value stocks he got vested interest this way and not other stocks?

I mean if he wants to point out the risk of blindly betting on Pharma on the assumption of C19, then at least do with class. Something like how Alex Lu did.

https://nexttrade.blogspot.com/2020/07/phar...venient_23.html

4. Charts wise. As stated earlier, that was a classical sign that Pharma should be retracing any time... No stocks can continue to climb vertically. Profit taking will cause the stock to retrace sharply.. yup. The smart traders will sell for a profit. The pullback today and yesterday wasn't unexpected and after all, the gaps needs to be closed...

5. "Pharmaniaga is only an agent to sell medicine" .... Aiyoh.

Kinda very malu la. If Ah Koon wants to bash a stock, he needs to do the least of homework and perhaps read the lasted QR report and see the breakdown of Pharmaniaga business. Check la the facts. Pharma does manufacturing too (although the PBT isn't very big).

Which for me it boils down to simple evilness. I feel that he wants all the speculative fund to be focused on what stock he has. After the politician statement on Pharma, there was indeed a buzz on pharma related stocks. That's causing him. And this is how I felt. He wants the punters to punt the stock he is buying...

and it's such a smart tactical move by Ah Koon. I bet he figured that there wasn't much downside since the probability is very great that Pharma would correct. And if and when Pharma corrects, it adds power to his name. See Ah Koon... he say this stock up, it up...he say that stock down, it down. Cunning evilness eh?

Pharma last traded 3.73.

wts6819 for your reading too....

Thanks for the enlightenment!

Jul 24 2020, 11:17 PM

Jul 24 2020, 11:17 PM

Quote

Quote

0.0452sec

0.0452sec

0.16

0.16

6 queries

6 queries

GZIP Disabled

GZIP Disabled