Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

ky33li

|

Jan 14 2021, 11:15 AM Jan 14 2021, 11:15 AM

|

|

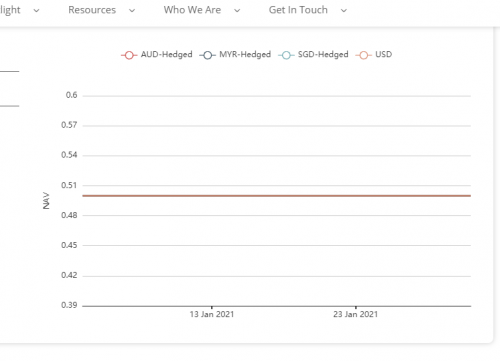

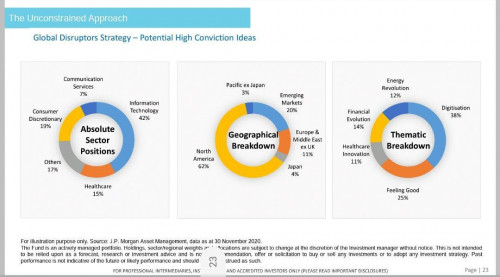

QUOTE(xcxa23 @ Jan 14 2021, 10:45 AM) For Malaysia, my view probably small rally until August. Hence I'm still holding kgo. Not gonna top up since myself also actively trading in bursa Based on my knowledge, as of now the performing UT that heavily in HK are Principal Asia Pacific Dynamic Income. So I'm still holding with monthly DCA. Just to show you Principal Asia Dynamic Income Fund is worst performing fund in FSM Singapore for past one month. Attached thumbnail(s)

|

|

|

|

|

|

ky33li

|

Jan 14 2021, 11:22 AM Jan 14 2021, 11:22 AM

|

|

QUOTE(MUM @ Jan 14 2021, 11:19 AM) due to the distribution of unit splits? The last dividend yield declared is only 5.6% as compared to drop of 37%? hmmmm This post has been edited by ky33li: Jan 14 2021, 11:24 AM |

|

|

|

|

|

ky33li

|

Jan 14 2021, 12:37 PM Jan 14 2021, 12:37 PM

|

|

QUOTE(killdavid @ Jan 14 2021, 12:25 PM) This thread is out of balanced. Everyone is a bull. Warren buffett say when everyone partying, that's when you have to be afraid. I want to be the bear 🐻🐻🐻 Warren buffet investment strategy could be out of date, he himself also said s&p returns outperform his portfolio. Yes, there will b bear. Questionis will you dare to top up when market fell by 30%? |

|

|

|

|

|

ky33li

|

Jan 15 2021, 03:39 PM Jan 15 2021, 03:39 PM

|

|

QUOTE(MUM @ Jan 15 2021, 03:10 PM) gone are the good ROI of FI like amanahraya, nomura, etc as in 2020? Reflation flashes red for Indonesia, Malaysia debt https://www.thestar.com.my/business/busines...a-malaysia-debttime to reassess and reposition? actually the acceptable return for bond funds should be around 4-5%, which i think amanahraya still can give us that kind of return. |

|

|

|

|

|

ky33li

|

Jan 17 2021, 09:10 AM Jan 17 2021, 09:10 AM

|

|

QUOTE(MUM @ Jan 16 2021, 08:32 PM) you can google Blackrock Next Generation Fund, another tech fund worth exploring. i own this in FSM Singapore |

|

|

|

|

|

ky33li

|

Jan 17 2021, 03:46 PM Jan 17 2021, 03:46 PM

|

|

QUOTE(ganesh1696 @ Jan 17 2021, 01:36 PM) Hi thanks your info. But can I only have FSMONE MALAYSIA ACCOUNT. As a foreigner residing in MALAYSIA can I open FSMONE SINGAPORE ACCOUNT from MALAYSIA? If can how can I link my MALAYSIA BANK ACCOUNT or is it possible to link FSMONE MALAYSIA and SINGAPORE ACCOUNT? Thanks. Yes you can. i am actually working in Malaysia. I transfer funds using Instarem/Sunway Money to CIMB Singapore account. However both FSM Malaysia and FSM Singapore operates separately. However you can also remit money straightaway to FSM Singapore, the customer service is very friendly and they will immediately respond to you. Actually 90% of my unit trust is in Singapore for 2 simple reasons : i) zero sales charge, ii) Much more choices for types of funds. Even the 4G that someone mention earlier, i bought in December and now is almost 10% return. Blackrock is around 8% because i top up in January. I also own Nikko Ark Innovation Fund in Singapore. |

|

|

|

|

|

ky33li

|

Jan 17 2021, 03:51 PM Jan 17 2021, 03:51 PM

|

|

QUOTE(ganesh1696 @ Jan 17 2021, 01:52 PM) Hi, Is the newly launched fund will be feeding into "target fund"(blackrock global funds - next generation technology fund) as the =(Affin Hwang World Series-Next Generation Technology Fund) does? Thanks. Yes. This is consider a feeder fund. 80%-90% invested in the fund while remanning are cash. You can find similar funds in Am-China A shares (Allianz China-A Shares) and RHB Artificial Intelligence Fund (Allianz Artificial Intelligence Fund). You may wonder why all these funds are not available in Malaysia. Very simple reason, this is to protect local fund houses/managers. The reality is local fund managers do not perform as well as overseas fund managers for very simple reason. For example Nikko Ark Innovation Fund - fund size is USD7billion, which allows them to invest plus they would have much more relevant sectors information than local fund managers. Hence the creation of feeder funds which i hope will be available more in future. Downside is sales charge of 1.5% but if you buy in FSM Singapore it is 0%. |

|

|

|

|

|

ky33li

|

Jan 17 2021, 07:31 PM Jan 17 2021, 07:31 PM

|

|

QUOTE(ironman16 @ Jan 17 2021, 05:49 PM) 1) Sales charge for fund purchases or switching: 0% for all unit trusts permanently2) Platform fee: Units trusts paid by cash and SRS (IA) 0.05% per quarter (FI) 0.0875% per quarter(On your Equity fund holdings - first S$300,000 ) 0.05% per quarter (On your Equity fund holdings – next S$300,000 and above) https://secure.fundsupermart.com/fsm/advice...vices/faq/3747/    u wan? Even with platform fees i still think it is worth it. Max in total 0.35% a year, negligible if let say u buy nikko ark fund >130% already. If you want total zero percent sales charge, you can go for Eunittrust Singapore but not a very user friendly platform. I still think the zero sales charge win FSM Malaysia by so many times!! Imagine everytime you top up you are charged 1.5%. Plus FSM Malaysia charge platform fees too when you buy Managed Funds or Retail bonds. Those feeder funds how sure are you local fund houses didnt charge extra by buying through them? There is no free lunch in this world, only cheaper cost. This post has been edited by ky33li: Jan 17 2021, 07:33 PM |

|

|

|

|

|

ky33li

|

Jan 17 2021, 07:56 PM Jan 17 2021, 07:56 PM

|

|

another push factor for me to buy in FSM Singapore is because I am of the view long term MYR will depreciate and Singapore dollar will remain stronger as compared to MYR.

|

|

|

|

|

|

ky33li

|

Jan 19 2021, 01:37 PM Jan 19 2021, 01:37 PM

|

|

QUOTE(monkey9926 @ Jan 19 2021, 12:19 PM) even with the US blacklist? any reason why? The effect US blacklisting is not going to be long term. China will be the fastest to recover in terms of economic growth. |

|

|

|

|

|

ky33li

|

Jan 19 2021, 01:38 PM Jan 19 2021, 01:38 PM

|

|

QUOTE(Mr.Beanster @ Jan 19 2021, 12:10 PM) Thanks for the info bro. Will prepare some bullet and probably going to enter China A-Share. Yeah, Am-China A-share became the top performing funds for China based fund, surpassing earlier RHB Syariah Focus Fund. |

|

|

|

|

|

ky33li

|

Jan 19 2021, 02:33 PM Jan 19 2021, 02:33 PM

|

|

QUOTE(ky33li @ Jan 19 2021, 01:38 PM) Yeah, Am-China A-share became the top performing funds for China based fund, surpassing earlier RHB Syariah Focus Fund. China's GDP surpassing 100 trillion yuan. |

|

|

|

|

|

ky33li

|

Jan 19 2021, 04:19 PM Jan 19 2021, 04:19 PM

|

|

QUOTE(monkey9926 @ Jan 19 2021, 03:36 PM) which one u choose, myr or myr hedged? I went into both.... |

|

|

|

|

|

ky33li

|

Jan 21 2021, 04:40 PM Jan 21 2021, 04:40 PM

|

|

QUOTE(Fledgeling @ Jan 21 2021, 04:36 PM) Since there was some discussions earlier about 0% sales charge, I am just sharing some info that I just saw today. Eunittrust 28 funds at 0% sales charge https://www.eunittrust.com.my/https://www.eunittrust.com.my/Home/Chinese-...-Year-PromotionDisclaimer: I am not affiliated with Eunittrust in any way and this is not a recommendation. It is merely sharing of info for those who could be interested. yup bought ark fund at 0% sales charge |

|

|

|

|

|

ky33li

|

Jan 21 2021, 08:47 PM Jan 21 2021, 08:47 PM

|

|

QUOTE(kweil @ Jan 21 2021, 06:55 PM) May I know which fund related to ark fund?? Affin Hwang World Series Disruptive Innovation fund |

|

|

|

|

|

ky33li

|

Jan 22 2021, 02:30 PM Jan 22 2021, 02:30 PM

|

|

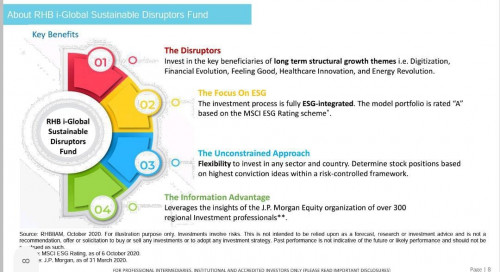

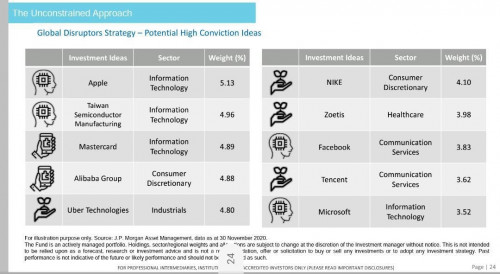

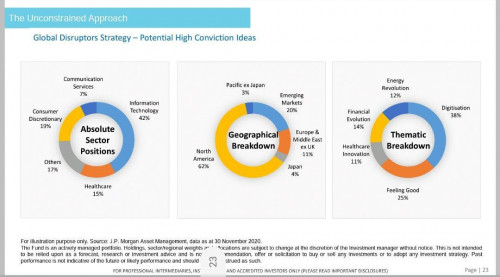

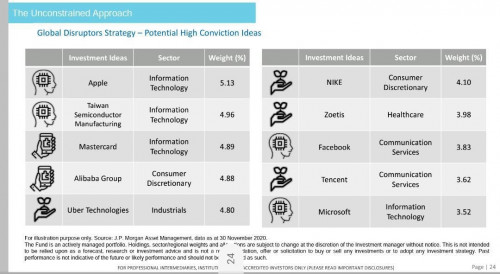

QUOTE(ganesh1696 @ Jan 22 2021, 01:19 PM) Hi thinking of investing in RHB i-Global Sustainable Disruptors during the promo period . What's your thoughts guys ? Opinions most welcome.      Unless it is a feeder fund, otherwise I won't consider because i doubt RHB fund manager's performance. |

|

|

|

|

|

ky33li

|

Jan 22 2021, 07:48 PM Jan 22 2021, 07:48 PM

|

|

QUOTE(ganesh1696 @ Jan 22 2021, 07:22 PM) Hi guys, these are my current portfolio. Looking to more diversify my allocation. 1) Affin Hwang World Series - Global Disruptive Innovation Fund MYR Hedged 2)United malaysia fund 3)amdynamic bond 4)amanahraya syariah trust fund 5)am china a shares myr-hedged 6)principal islamic lifetime enhanced sukuk fund 7)interpac dana safi. Planning to more diversify my allocation . planning to add on some cash. waiting for (Affin Hwang World Series-Next Generation Technology Fund) but it seems FSMONE will launch this fund sometime later . Any other suggestions guys? very similar to my portfolio. I ady next generation tech fund in fsm singapore. I also hv RHB Artificial Intelligence Fund and Kaf Core Income Fund |

|

|

|

|

|

ky33li

|

Jan 27 2021, 09:21 PM Jan 27 2021, 09:21 PM

|

|

QUOTE(Gatsby IT @ Jan 27 2021, 07:42 PM) Hi guys , new to the fund market . Currently looking more into local fund that invest into overseas market , currently saw a few interesting china fund . Eastspring Investments Dinasti Equity Fund AmChina A-Shares - MYR CIMB Principal China Direct Opportunities Fund - MYR CIMB Principal Greater China Fund Hope to have some US alternative as well or some fund that actually mixed equity of both country and provide close to index fund nature . Was actually looking for purely index fund but seemed no fund houses here offer that . Anyone know if FSMOne is regulated by Malaysia ? safe platform for super long term investment ? FSM is just the middle man to distribute funds. The funds that you arte invested into are managed by respective fund houses. Perhaps you shouls google more about FSM and do more research on that. |

|

|

|

|

|

ky33li

|

Feb 3 2021, 10:49 AM Feb 3 2021, 10:49 AM

|

|

QUOTE(ganesh1696 @ Feb 3 2021, 09:24 AM) Can anyone explain why there's no price change in this fund since its inception. Affin Hwang World Series - Next Generation Technology Fund - MYR Hedged.  It is a feeder fund. It is buying into Blackrock Next Generation Technology Fund. You can check the relevant blackrock funds in Bloomberg. I bought this fund in FSM Singapore earn more than 20% day since last October 2020. |

|

|

|

|

|

ky33li

|

Feb 3 2021, 10:52 AM Feb 3 2021, 10:52 AM

|

|

QUOTE(Gatsby IT @ Feb 2 2021, 09:17 PM) anyone made comparison between FSMone SG and Malaysia yet ? does SG FSMone offer the exact same fund or different ? FSM Malaysia - Sales charge : 1.5%, no funds from fund managers like JP Morgan, Blackrock, Allianz. Most funds underperform compared to FSM Singapore FSM Singapore - Sales charge : 0%, better fund managers and can tap local malaysia ones. |

|

|

|

|

Jan 14 2021, 11:15 AM

Jan 14 2021, 11:15 AM

Quote

Quote

0.0959sec

0.0959sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled