Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

ky33li

|

Feb 8 2021, 08:25 AM Feb 8 2021, 08:25 AM

|

|

QUOTE(yycclin @ Feb 7 2021, 09:16 PM) Sorry some typo mistake , will repost. SORRY.... My suggestion is to regroup your funds based on regions/sectors (China, Precious Metals, Tech, Asia Pacific), study the fund factsheet do analysis on portfolio holdings, you will notice overlapping of securities across different fund managers. China tends to overlap with Asia Pacific sometimes with shares like Tencent and Alibaba. So if you intend to own them mayb pick one will do. Sometimes they categorise Tencent and Alibaba as part of tech. Again analyse what kind of tech stocks you want in your funds. One way to do it is to study fund factsheet of all technology funds. This post has been edited by ky33li: Feb 8 2021, 08:47 AM |

|

|

|

|

|

ky33li

|

Feb 8 2021, 09:14 AM Feb 8 2021, 09:14 AM

|

|

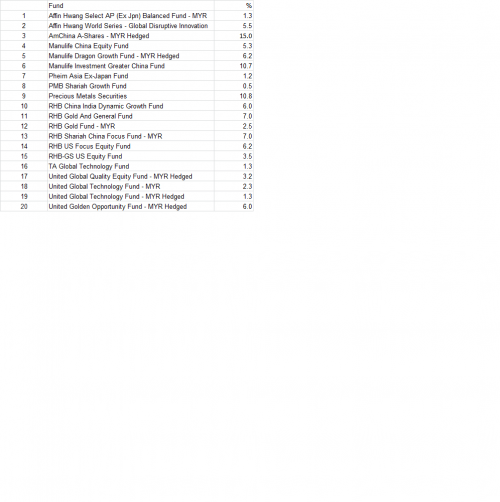

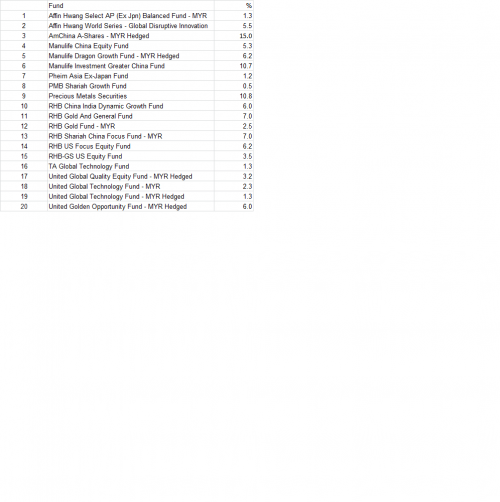

QUOTE(yycclin @ Feb 8 2021, 08:50 AM) Sorry, yesterday reached my daily post quota ( 3/day ) not able to update in time.. ;( Here is the updated data, pls comment for improvement  Tks.  This is my own preferences on picking funds not an indicative to buy or sell. China - Amchina A Shares (focus more on China A shares & feeder fund by Allianz) and RHB Syariah China Focus Fund (focus on healthcare sector in China). The rest of China funds do not perform as good as the above 2 funds. Tech - Affin Hwang World Series Global Disruptive Innovation (focus more towards innovative sectors of tech) and United Global Technology Fund Asia Pacific - Pheim Asia Ex-Japan Fund but I would pick Asia Pacific funds from Affin Hwang Precious Metal - If you handle the volatility in precious metals then i suggest you pump in more into tech. |

|

|

|

|

|

ky33li

|

Feb 9 2021, 10:11 AM Feb 9 2021, 10:11 AM

|

|

QUOTE(monkey9926 @ Feb 9 2021, 10:03 AM) 1. sales fee. 2. let's pray hard FSM is under IFAST Corporation Limited, a listed company in Singapore. FSM also has presence in Singapore, India, Hong Kong and has been in the market for many years. |

|

|

|

|

|

ky33li

|

Feb 9 2021, 01:55 PM Feb 9 2021, 01:55 PM

|

|

QUOTE(xcxa23 @ Feb 9 2021, 01:35 PM) Aren't the whole point of investing by ourselves is to beat or at least match EPF return? Don't hope for EPF return of 6% anymore, you will be lucky if you get 4% for next 2 years. |

|

|

|

|

|

ky33li

|

Feb 9 2021, 06:24 PM Feb 9 2021, 06:24 PM

|

|

|

|

|

|

|

|

ky33li

|

Feb 11 2021, 04:13 PM Feb 11 2021, 04:13 PM

|

|

QUOTE(george_dave91 @ Feb 11 2021, 04:08 PM) Hi guys. I see that fsm Singapore has a fee structure that uses an overall platform fee minus the sales charge. Similar to their current fee structure for the bond funds on the fsm Malaysia platform currently. My fear is that eventually the Malaysian platform may adopt a similar fee structure too, considering the bond fund changed from upfront sales charge to platform fee couple years back. This is concerning especially in my case since I plan to invest for the long term (at least 30 years ++). Based on the math an overall platform fee will have major impact on performance compared to one that has an upfront sales charge only (even if it is 5.5%). This is so for investments that exceed 20 years. In my case I would be accumulating for 25 years before having to withdraw funds. Does anyone else feel the same? Would it be better to just DCA into normal upfront sales charge funds. Of course at present there are no platform fees for equity/balanced funds (phew). Just a concern. I guess I’m being quite paranoid about something that has not even happened yet.  |

|

|

|

|

|

ky33li

|

Feb 11 2021, 04:16 PM Feb 11 2021, 04:16 PM

|

|

If you are worried about fees you should not invest in unit trusts at all, there is also annual management fee as well. You can opt for ETF overseas however you can only buy them through foreign brokers which also involve forex, commission. Unless you are good at picking stocks i suggest you leave it to the professional to do it and there is no free lunch in this world.

|

|

|

|

|

|

ky33li

|

Feb 11 2021, 11:31 PM Feb 11 2021, 11:31 PM

|

|

[quote=jorgsacul,Feb 11 2021, 11:28 PM] Those buy RHB UT please be careful. They have too much in mex 1 & 2 bonds even for equity funds and all have been downgraded. Mex 2 now abandon for 2 years and the fund now going to collapse due to concentrated risk. yes except for RHB Artificial Intelligence Fund which is a feeder fund... even the PRS doesnt perform as good. |

|

|

|

|

|

ky33li

|

Feb 12 2021, 09:01 AM Feb 12 2021, 09:01 AM

|

|

QUOTE(Conslow2020 @ Feb 12 2021, 12:38 AM) Damn AFFIN HWANG WORLD SERIES - GLOBAL DISRUPTIVE INNOVATION FUND is going down so much today is it because of correction or jolly take out money for Chinese new year? there has been some correction on nikko ark fund and prices reflected is late by additional 1 day. Yesterday it was up slightly. https://www.bloomberg.com/quote/NIKADBS:LX |

|

|

|

|

|

ky33li

|

Feb 12 2021, 05:12 PM Feb 12 2021, 05:12 PM

|

|

QUOTE(ericlaiys @ Feb 12 2021, 09:50 AM) huh? so much? Just slight dropped woh This fund has dropped 4 times at around 10%, the last drop is mainly due to Tesla. If you cant take volatility of this fund i suggest you do not buy this fund. |

|

|

|

|

|

ky33li

|

Feb 13 2021, 06:28 PM Feb 13 2021, 06:28 PM

|

|

QUOTE(matyrze @ Feb 13 2021, 06:21 PM) Just checked my managed portfolio, I think they just bought units in RHB i-Global Sustainable Disruptors very recently. No fact sheet as it is very new I guess. Should have similar concern? https://www.fsmone.com.my/funds/tools/facts...d?fund=MYRII006If it is not feeder fund then good luck. |

|

|

|

|

|

ky33li

|

Feb 13 2021, 08:08 PM Feb 13 2021, 08:08 PM

|

|

QUOTE(amateurinvestor @ Feb 13 2021, 07:38 PM) Hi all, I would like to ask about your opinion that some are saying stocks are at a high price. Most are saying in relation to US stocks. Hence, for unit trusts focusing on equities, do you think this is the same? Or Asean/Tech/China/Apac has still much room for growth? Reason I am asking is coz 95% of my money is in Amanah Saham (non-bumi), but everytime I think of putting more in unit trust, some are also saying everything is in the high price. Not sure if this is gonna be a continuous bull market for at least next two years, or a correction is soon. I understand no one can predict the future, but would appreciate any insights….so I can strategize my fund allocations considering the sub par dividends of amanah saham <4 percent… Thanksssss       For Year 2020, market contracted by 30% and since then it has been up. It is very hard to time the market. If you cant take the volatility in unit trust i suggest u try robo-advisors like stashaway, akru, wahed and etc which had been shared by others in the forum. |

|

|

|

|

|

ky33li

|

Feb 13 2021, 08:10 PM Feb 13 2021, 08:10 PM

|

|

QUOTE(matyrze @ Feb 13 2021, 06:21 PM) Just checked my managed portfolio, I think they just bought units in RHB i-Global Sustainable Disruptors very recently. No fact sheet as it is very new I guess. Should have similar concern? https://www.fsmone.com.my/funds/tools/facts...d?fund=MYRII006But to b fair it went up by 3.8% since launching in January 2021 but we dunno the stocks that the fund has invested in. |

|

|

|

|

|

ky33li

|

Feb 13 2021, 11:16 PM Feb 13 2021, 11:16 PM

|

|

QUOTE(matyrze @ Feb 13 2021, 08:28 PM) Correct, there is a bit of increment. I guess working with JO Morgan really worked!  For new funds, how long do we need to wait till the full factsheet is issued? Not sure because i only invested in feeder funds. it will take like at least half year for funds to publish interim report, not sure about fund factsheet. |

|

|

|

|

|

ky33li

|

Feb 14 2021, 12:04 AM Feb 14 2021, 12:04 AM

|

|

QUOTE(yycclin @ Feb 13 2021, 11:58 PM) I have few RHB China Funds , gold funds and especially their AI fund is giving out good returned !!! Need to worry RHB funds ?? rgds RHB China Fund is Blackrock China Fund RHB Artificial Intelligence Fund is Allianz Artificial Intelligence Fund. I think bad returns are referring to those funds managed by own RHB fund managers, not feeder funds |

|

|

|

|

|

ky33li

|

Feb 14 2021, 09:19 AM Feb 14 2021, 09:19 AM

|

|

QUOTE(yycclin @ Feb 14 2021, 12:11 AM) Mind to list out a few funds managed by RHB fund managers, only for forum discussions purposes only. Tks. I think when you buy any funds from RHB just read the fund factsheet, it will state how are funds being invested. For example RHB Artificial Intelligence Fund it will mention 98% of funds are invested in the Allianz Artificial Inteligence Fund. If it doesnt state so then it is managed by the local fund manager. I know past performance doesnt really reflect actual performance but if you filter best performing fund last one year, except for RHB Aritifical Intelligence Fund, RHB Syariah Focus China Fund (managed by RHB itself) and RHB Big Cap China Fund (managed by RHB itself), i dont think any other RHB fund are in the top 30 ones. This should be your guide on choosing the RHB funds. This post has been edited by ky33li: Feb 14 2021, 09:23 AM |

|

|

|

|

|

ky33li

|

Feb 14 2021, 10:32 PM Feb 14 2021, 10:32 PM

|

|

QUOTE(lee82gx @ Feb 14 2021, 09:56 PM) Makes sense, but the holders of the remaining units must be pissed. The highway itself is profitable however most funds are being channeled to holding company, leaving the company in tight cashflow hence unable to pay when bond is due. it will be helpful to scrutinize the annual report as well from time to time to understand the percentage of holdings in each bond This post has been edited by ky33li: Feb 14 2021, 10:40 PM |

|

|

|

|

|

ky33li

|

Feb 14 2021, 10:37 PM Feb 14 2021, 10:37 PM

|

|

Just look at RHB PRS fund performances as compared to other fund houses then you will know how well they perform. I pity RHB employees who are forced to contribute the 4% of salary into PRS instead of EPF. This post has been edited by ky33li: Feb 14 2021, 10:40 PM Attached File(s) PPA_Fund_Performance_page_detail_Jan_2021.pdf

PPA_Fund_Performance_page_detail_Jan_2021.pdf ( 74.71k )

Number of downloads: 44 |

|

|

|

|

|

ky33li

|

Feb 15 2021, 01:25 PM Feb 15 2021, 01:25 PM

|

|

QUOTE(ganesh1696 @ Feb 15 2021, 12:56 PM) Hi guys , These are my latest portfolio that I have adjust and add-on during "FSMONE ONE WEEK PROMO". 1) Affin Hwang World Series - Global Disruptive Innovation Fund MYR Hedged = 20.4% 2)United malaysia fund=15.4% 3)amdynamic bond=13.92% 4)amanahraya syariah trust fund=6.6% 5)am china a shares myr-hedged=10.67% 6)principal islamic lifetime enhanced sukuk fund=14.08% 7)interpac dana safi =7.7% 8)Affin Hwang World Series-Next Generation Technology Fund=10.43% Is this allocation suit better or need to diversify more ? Share your thoughts Opinions most welcome. just take note on following news for amanahraya https://www.theedgemarkets.com/article/aman...generals-report |

|

|

|

|

|

ky33li

|

Feb 15 2021, 03:34 PM Feb 15 2021, 03:34 PM

|

|

QUOTE(Holocene @ Feb 15 2021, 02:46 PM) I might be wrong but I don't think the auditor report is for AmanahRaya Investment Management Sdn Bhd (ARIM) which manages AmanahRaya Syariah Trust Fund. The news report said Amanahraya Berhad and Amanahraya Investment Management is a subsidiary as reflected in the website. https://www.amanahraya.my/our-subsidiaries/Even if it is not managing the fund, but if the asset management company itself having deficit in funding a worrying news? of course ultimately it is still tax payers who will bail out all these GLCs, as it had done so in the past. It specifically said the fund management in deficit of RM1bil and there is only one investment management subsidiary which is Amanahraya Investment Management. Dont you realise that whole unit trust industry only benefits the fund managers? Like how some of the comments earlier on RHB funds. Isnt RHB top bank in Malaysia and owned by EPF? So how come they still can invest into junk bonds and breach portfolio's mandate? Ultimately where is consumer rights in regards to this are we fully aware or been informed of everything? This post has been edited by ky33li: Feb 15 2021, 03:41 PM |

|

|

|

|

Feb 8 2021, 08:25 AM

Feb 8 2021, 08:25 AM

Quote

Quote

0.0650sec

0.0650sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled