Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

ky33li

|

Dec 9 2020, 09:12 PM Dec 9 2020, 09:12 PM

|

|

QUOTE(ironman16 @ Dec 9 2020, 09:05 PM) Nvm...... I oso purchase sikit2 public punya public e-artificial intelligence fund...... Although not same, at least boleh la..... 😝😝😝 Best part is rm100 only can buy liao n i move my e-flexi allocation fund into it..... 😁😁😁 actually another AI fund also not bad RHB Artificial Intelligence Fund which is feeder fund to Allianz Artificial Intelligence Fund. Min 1k only... i think on the safe side for unit trust in malaysia go for the feeder funds cos they have better fund managers. |

|

|

|

|

|

ky33li

|

Dec 9 2020, 09:37 PM Dec 9 2020, 09:37 PM

|

|

Anyone who like to understand more on nikko ark can refer to this: https://www.nikkoam.com.sg/sp/nikkoam-ark-d...ovation-fund-lp |

|

|

|

|

|

ky33li

|

Dec 9 2020, 10:05 PM Dec 9 2020, 10:05 PM

|

|

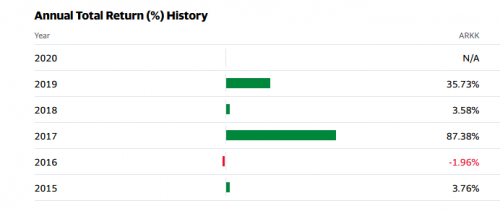

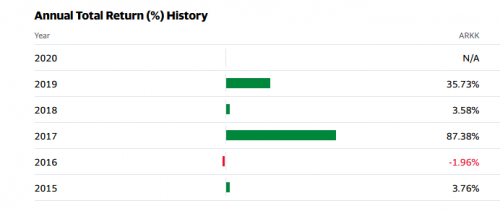

just to show u the performance of the ark etf, against s&p 500, you will be like WOW Attached thumbnail(s)

|

|

|

|

|

|

ky33li

|

Dec 9 2020, 10:28 PM Dec 9 2020, 10:28 PM

|

|

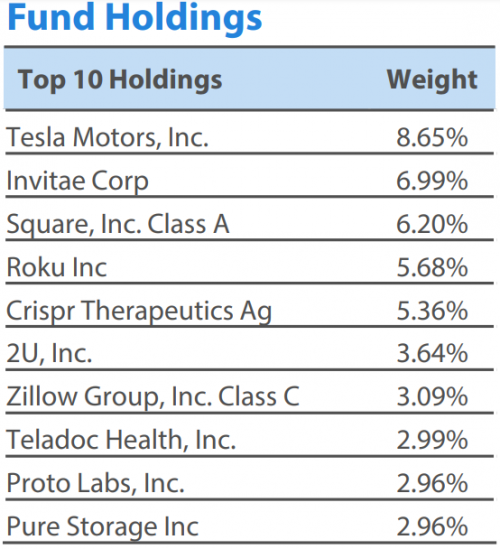

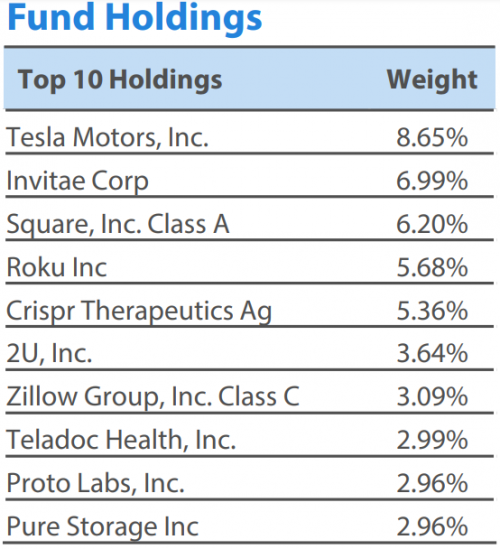

QUOTE(WhitE LighteR @ Dec 9 2020, 10:21 PM) https://finance.yahoo.com/quote/ARKK/performance?p=ARKK the performance from year to year seems like a magnified version of nasdaq 100 This is not your typical tech fund. Ark fund is focusing on the future, autonomous driving, digital printing, genomics, all these invention are going to change human lives! This is not your typical goreng stock kind of return. This is believing in the growth of technologies and inventions! Ark fund already invested into Tesla more than 3 years ago and you should understand their investment methodologies. Comparing to Catherine Wood, I think Warren Buffet investment style may not be relevant at current time anymore. |

|

|

|

|

|

ky33li

|

Dec 9 2020, 10:49 PM Dec 9 2020, 10:49 PM

|

|

QUOTE(GrumpyNooby @ Dec 9 2020, 10:34 PM) Correct on the part for not a typical tech fund as the holdings of the fund can say so:  Even though, the Tesla name is familiar but they're into electric car and autonomous car not typical car from Toyota and Honda. i saw over youtube that cost of batteries in 10 years time will be 10% of today's cost. Singapore has foresight they have already invited Hyundai to set up EV battery manufacturing plant. lately i saw Singapore also invited companies to tender for charging station! Once battery cost is cheap enough, electric cars will be popular. Many countries are promoting the usage of EV. Oil and gas industry is seriously under threat if this were to happen. Imagine the cost of battery is so cheap that drilling oil from seas becomes so much more expensive. In fact Tesla had the vision of cutting out the middle man of servicing cars, technically you can do updates by just using computers. It may not be possible now but in 10 year's time? Look at Nokia and Blackberry, how it got defeated by smart phone invention? Nokia was once the monopoly of phone market. This post has been edited by ky33li: Dec 9 2020, 10:50 PM |

|

|

|

|

|

ky33li

|

Dec 10 2020, 11:29 AM Dec 10 2020, 11:29 AM

|

|

QUOTE(memorylane @ Dec 10 2020, 08:48 AM) no doubt this fund performance is really super... however, it is in all time high at the moment ... risk is too high for big lump sum ... it depends on your portfolio allocation. Like this year all countries hit by covid, market only crash one time 30% in March 2020 and it has been up ever since. Does it makes sense? We can never time the market and when market is fearful we should consider adding the portfolio. Most important is we are in it for long term. I am showing you an alternative to look at tech the other way, technologies that can change human lives. Up to you whether you want to be exposed to that. This post has been edited by ky33li: Dec 10 2020, 12:52 PM |

|

|

|

|

|

ky33li

|

Dec 10 2020, 03:30 PM Dec 10 2020, 03:30 PM

|

|

QUOTE(GrumpyNooby @ Dec 10 2020, 03:26 PM) Anything should we be worry for? AmanahRaya's fund management inefficient, in deficit from 2008 to 2019 — Auditor-General's ReportKUALA LUMPUR (Dec 10): AmanahRaya Bhd’s fund management was found to be inefficient as the fund had experienced a deficit from 2008 to 2019, according to the Auditor-General's Report (LKAN) 2019 Series 1. The report, which was tabled in Parliament today, concluded that the current year's net income could not cover the total income distribution, and the investment performance of the Kumpulan Wang Bersama (KWB) was also inefficient. However, it noted that AmanahRaya has been making efforts towards the recovery of the KWB fund starting from 2019. “AmanahRaya needs to depend on the government's guarantee for its inability to perform as a trustee to cover the KWB fund deficit of RM1.02 billion when there is a demand," it said. https://www.theedgemarkets.com/article/aman...generals-reportTo be honest i think there is governance issue. You and I know how well the GLCs are being managed. |

|

|

|

|

|

ky33li

|

Dec 10 2020, 04:19 PM Dec 10 2020, 04:19 PM

|

|

So maybe have to relook at Amanahraya Syariah Trust Fund

|

|

|

|

|

|

ky33li

|

Dec 31 2020, 07:31 PM Dec 31 2020, 07:31 PM

|

|

QUOTE(dopp @ Dec 31 2020, 08:41 AM) However Affin Hwang World Series - Global Disruptive Innovation Fund falling like crazy. if u follow catherine wood's video she did mention about possibility of profit taking happening. https://www.google.com.my/amp/s/www.bloombe...tflow-on-record |

|

|

|

|

|

ky33li

|

Jan 5 2021, 08:07 PM Jan 5 2021, 08:07 PM

|

|

Any thoughts on KAF Core Income Fund? Why the exceptional return in Malaysia equities?

|

|

|

|

|

|

ky33li

|

Jan 6 2021, 09:59 AM Jan 6 2021, 09:59 AM

|

|

QUOTE(ganesh1696 @ Jan 6 2021, 09:29 AM) I'm GANESH KUMAR and not GANESHWARAN KANA. Out of my portfolio of RM35k these are my allocations. 1) Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged=14.28% 2) AmanahRaya Syariah Trust Fund=16.5% 3) AmDynamic Bond=19.00% 4) InterPac Dana Safi=8.57% 5) Principal Islamic Lifetime Enhanced Sukuk Fund=18.76% 6) United Malaysia Fund = 22% now thinking of adding AM CHINA A-SHARES MYR HEDGED to my portfolio. Need some opinions I am quite heavy on Am China A Shares. I am of the view that China will be the key driver of economic growth in future. in addition, Amchina shares fund manager is actually Allianz, you can compare this fund outperform other China funds in FSM. |

|

|

|

|

|

ky33li

|

Jan 6 2021, 10:21 AM Jan 6 2021, 10:21 AM

|

|

QUOTE(killdavid @ Jan 6 2021, 10:09 AM) He said the grouses of foreign equity investors have mainly been on issues around political uncertainties and governance, the latter which happened to be one of the reasons for the Fitch downgrade to BBB+ recently. Malaysia fiscal position wasnt great. On and off you read news GLCs cash out money and recent news Prasarana not paying contractors for LRT project. No need to compare far, you look at Thailand foreign reserves, surprisingly is 3 times of Malaysia. Most foreign direct investment went to Thailand.. Hence I am not surprise Thai Baht to MYR will be Thai Baht 5/RM1 soon... currently is Thai Baht 7/RM1 |

|

|

|

|

|

ky33li

|

Jan 9 2021, 03:25 PM Jan 9 2021, 03:25 PM

|

|

QUOTE(WhitE LighteR @ Jan 9 2021, 03:03 PM) the problem with disruptive tech stock is that most of them dont have earnings. they are flying of hopes and dream, same like bitcoin. how long before reality sets in and some whale start shorting it. i think if you are conservative person, chasing such growth stocks can only be a tactical move within a strategic asset allocation. i disagree with you. Have you watch Cathie Wood interview on disruptive innovations? What do you mean by flying hopes and dream? China is going to be 100% EV by 2035 and Tesla sold most cars in China. The demand for cloud is going to be growing in future with WFH and with companies able to save more cost on rental by renting smaller spaces? Genomic is about researching cure for cancers via DNA sequencing. All these require heavy capex at initial stage hence u see most of these tech companies or startups incurring losses. We are going through an era where disruptions are already happening. The whole word is persuing renewable energy and we saw new jobs such as data analyst data science coming up. In future more jobs will be obsolete as a result of these disruptions. No need to look far, google SHELL, Exonmobil or Petronas, job cuts and shifting away from fossil fuel. Yes they wouldnt happen immediately but in 10 years time? Elon Musk is confident of producing battery of 10% cost today and what does that translates into EV cars, possible cheaper and more energy efficient? Is it more condusive to use battery or sending vessels deep in the ocean to extract fossil fuel? Is it not possible that one day whole world is going to be on EV? By the way you should google on China on use of EV... all these are happening already and expedited by covid. You may argue Malaysia doesnt have infrastructure to do so but the disruptions are coming at rapid pace and we are still being complacent. Remember how invention of smart phones replaced the nokia phones, which had the largest users then? Don't say never. It will come and you are not ready to adapt to the changes. This post has been edited by ky33li: Jan 9 2021, 05:19 PM |

|

|

|

|

|

ky33li

|

Jan 13 2021, 04:14 PM Jan 13 2021, 04:14 PM

|

|

QUOTE(killdavid @ Jan 13 2021, 03:50 PM) Let me play devil's advocate here just to stimulate some discussion. This pandemic has challenged us and we can out and showed that work and business can function to a degree through internet when physical locations are closed down. This area is ripe for a disruption. What do you think the long term prospect will be for commercial real estates and REITS ? if you ask me more companies opt to WFH more can save more on rentals, electricity, operating expenses and etc. you can buy REITS now but have to wait 2-3 years to rebound. |

|

|

|

|

|

ky33li

|

Jan 13 2021, 09:30 PM Jan 13 2021, 09:30 PM

|

|

This week china funds perform but Amchina outperform all china funds. if you buy in December 2020 you will achieve >15% return already.

|

|

|

|

|

|

ky33li

|

Jan 13 2021, 10:12 PM Jan 13 2021, 10:12 PM

|

|

QUOTE(whirlwind @ Jan 13 2021, 09:50 PM) And RHB shariah China came from behind steered pass Am China 🤔 Only for this week but in terms of consistency amchina always outperform for past 1 year. |

|

|

|

|

|

ky33li

|

Jan 13 2021, 10:13 PM Jan 13 2021, 10:13 PM

|

|

QUOTE(debonairs91 @ Jan 13 2021, 09:56 PM) Anyone can explain what is wrap account? Is it worth it compare to buy and manage ut yourself using fsm? Dont bother wrap account charges you extra 1% on top of the sales charge that you have to pay. Unless you are really lazy in managing your own funds i suggest opt out of this. |

|

|

|

|

|

ky33li

|

Jan 14 2021, 09:14 AM Jan 14 2021, 09:14 AM

|

|

QUOTE(xcxa23 @ Jan 14 2021, 07:25 AM) yup and i am expecting it to rally until CNY... been adding position into china fund since last year I am of the view that China will be the fastest to recover if vaccine works! Who is willing to spend and travel if none other than the Chinese? So if there is dip in China funds can consider topping up. Internally China has also been recovering also and not to mention it has 1 billion population to drive the growth. |

|

|

|

|

|

ky33li

|

Jan 14 2021, 09:16 AM Jan 14 2021, 09:16 AM

|

|

QUOTE(WhitE LighteR @ Jan 13 2021, 10:57 PM) I think u are thinking of managed account. Not wrap account. A financial planner from IFast offer me wrap fee of 1% before. Expected annual return of 6-8% from the portfolio it suggested. |

|

|

|

|

|

ky33li

|

Jan 14 2021, 10:06 AM Jan 14 2021, 10:06 AM

|

|

QUOTE(lee82gx @ Jan 14 2021, 09:28 AM) Management fees from each individual fund is still applicable right? Wrap account is attractive if you have a lot of capital in iFast and at the same time, have a strong preference to DIY. Seriously though, 1% + fund charges, to nett a 6-8% return is kinda meh. I wonder if they quoted you the historical volatility / sharpe ratio. i prefer to DIY myself. Only invested in 2 feeder funds in FSM cos i serioualy think local fund managers cannot make it. After i got to know a way to invest in FSM Singapore and it has more interesting sectors like Sustainable energy, climate change, tech, china disruptive, future transport and ETC, I deploy more of my funds there, best part is zero sale charge there!!! The choice is very obvious isnt it. This post has been edited by ky33li: Jan 14 2021, 10:07 AM |

|

|

|

|

Dec 9 2020, 09:12 PM

Dec 9 2020, 09:12 PM

Quote

Quote

0.0649sec

0.0649sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled