QUOTE(whirlwind @ Nov 11 2020, 06:19 PM)

time to buy (wait few days)FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Nov 11 2020, 07:37 PM Nov 11 2020, 07:37 PM

|

Senior Member

7,560 posts Joined: May 2012 |

QUOTE(whirlwind @ Nov 11 2020, 06:19 PM) time to buy (wait few days) WhitE LighteR liked this post

|

|

|

|

|

|

Nov 11 2020, 07:44 PM Nov 11 2020, 07:44 PM

Show posts by this member only | IPv6 | Post

#23842

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 11 2020, 07:46 PM Nov 11 2020, 07:46 PM

Show posts by this member only | IPv6 | Post

#23843

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:24 AM |

|

|

Nov 11 2020, 07:57 PM Nov 11 2020, 07:57 PM

Show posts by this member only | IPv6 | Post

#23844

|

Senior Member

1,267 posts Joined: Oct 2009 |

QUOTE(whirlwind @ Nov 11 2020, 06:19 PM) It shows 3.8% drop to me encikbuta and WhitE LighteR liked this post

|

|

|

Nov 11 2020, 08:10 PM Nov 11 2020, 08:10 PM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(whirlwind @ Nov 11 2020, 06:19 PM) QUOTE(xcxa23 @ Nov 11 2020, 06:43 PM) 5% drop for -8k.Portfolio must be huge Jokes aside - just ride with the flow. Maybe can top up I just topped up my China Tech exposure given the recent shock (but not via FSM, I only do ETF now.) LoTek and wongmunkeong liked this post

|

|

|

Nov 11 2020, 08:19 PM Nov 11 2020, 08:19 PM

Show posts by this member only | IPv6 | Post

#23846

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:24 AM |

|

|

|

|

|

Nov 11 2020, 08:24 PM Nov 11 2020, 08:24 PM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(GrumpyNooby @ Nov 11 2020, 08:19 PM) HKG: 3067Lower expense ratio @ 0.25% (vs. 0.73%) And don't want to deal with 30% WHT And also don't want to deal with multiple currency layer KWEB: MYR >> HKD (ibkr doesn't accept MYR) >> USD to buy KWEB which invests in China equity >> RMB/HKD 3067: MYR >> HKD which invests in H-shares This post has been edited by polarzbearz: Nov 11 2020, 08:32 PM |

|

|

Nov 11 2020, 08:49 PM Nov 11 2020, 08:49 PM

Show posts by this member only | IPv6 | Post

#23848

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(whirlwind @ Nov 11 2020, 07:44 PM) definitely, im gonna pump in more money, but too bad money only can reach on fri. QUOTE(polarzbearz @ Nov 11 2020, 08:10 PM) 5% drop for -8k. Portfolio must be huge Jokes aside - just ride with the flow. Maybe can top up I just topped up my China Tech exposure given the recent shock (but not via FSM, I only do ETF now.) im topping up for sure but had to wait until friday |

|

|

Nov 11 2020, 08:59 PM Nov 11 2020, 08:59 PM

Show posts by this member only | IPv6 | Post

#23849

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:24 AM |

|

|

Nov 11 2020, 09:54 PM Nov 11 2020, 09:54 PM

Show posts by this member only | IPv6 | Post

#23850

|

Senior Member

3,602 posts Joined: Jan 2003 |

Sorry for the Wrong info, actually NAV drop 0.05 = 3.8% (PGC)

And tomorrow we gonna see another drop 🙁 based on today’s news This post has been edited by whirlwind: Nov 11 2020, 10:06 PM |

|

|

Nov 11 2020, 09:55 PM Nov 11 2020, 09:55 PM

Show posts by this member only | IPv6 | Post

#23851

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 11 2020, 10:56 PM Nov 11 2020, 10:56 PM

|

Junior Member

659 posts Joined: May 2013 |

|

|

|

Nov 11 2020, 11:23 PM Nov 11 2020, 11:23 PM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(jonoave @ Nov 11 2020, 10:56 PM) Long term (30+ years) ok la. Imagine topping up during s&p peak at January 2020 and after 11 months only barely got back to original level wongmunkeong and WhitE LighteR liked this post

|

|

|

|

|

|

Nov 12 2020, 09:55 AM Nov 12 2020, 09:55 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(polarzbearz @ Nov 11 2020, 11:23 PM) Long term (30+ years) ok la. most of us will be investing for like.. omg.. 30-50 years, ie. even into our 20 (Standard)-40 (FIRE) years' retirement.Imagine topping up during s&p peak at January 2020 and after 11 months only barely got back to original level thus holistically speaking - eh? 1-3 year? no feel IF with proper (for self) asset allocation & location XD polarzbearz and WhitE LighteR liked this post

|

|

|

Nov 12 2020, 10:44 AM Nov 12 2020, 10:44 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:24 AM |

|

|

Nov 12 2020, 10:51 AM Nov 12 2020, 10:51 AM

Show posts by this member only | IPv6 | Post

#23856

|

All Stars

14,863 posts Joined: Mar 2015 |

QUOTE(GrumpyNooby @ Nov 12 2020, 10:44 AM) Southeast Asia stocks’ time to shine has finally arrived Missed rallies For UBS Group AG strategist Niall MacLeod, Southeast Asian stocks are finally reacting to the potential for a vaccine, after missing out on past rallies on the theme. That increases the possibility that at the very least they can outperform larger peers like China. “It might still be too early to call for a rotation where Southeast Asia leads the overall market,” he wrote in a note with colleagues Wednesday. “Nevertheless, the relative valuation and outperformance year-to-date suggest China and Taiwan could underperform the region on better vaccine news and broader opening up of the global economy.” https://www.theedgemarkets.com/article/sout...finally-arrived |

|

|

Nov 12 2020, 11:18 AM Nov 12 2020, 11:18 AM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(wongmunkeong @ Nov 12 2020, 09:55 AM) most of us will be investing for like.. omg.. 30-50 years, ie. even into our 20 (Standard)-40 (FIRE) years' retirement. So true thus holistically speaking - eh? 1-3 year? no feel IF with proper (for self) asset allocation & location XD I need to increase my China exposure. Too skewed towards US at this stage  This post has been edited by polarzbearz: Nov 12 2020, 11:20 AM wongmunkeong and WhitE LighteR liked this post

|

|

|

Nov 12 2020, 11:54 AM Nov 12 2020, 11:54 AM

Show posts by this member only | IPv6 | Post

#23858

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Nov 12 2020, 12:15 PM Nov 12 2020, 12:15 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

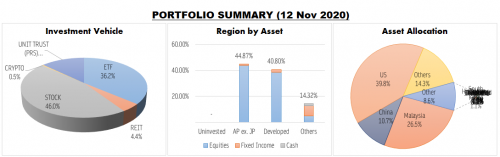

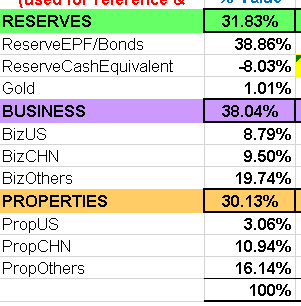

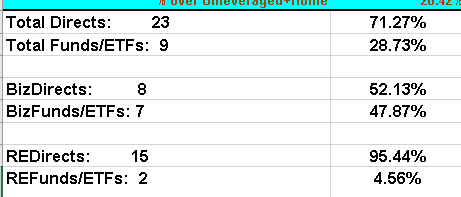

QUOTE(polarzbearz @ Nov 12 2020, 11:18 AM) whoa, very good allocation for a "youngster", heavy on equities.i see BTC in there. Nice - i havent had the gumption to do that yet as i still see BTC & Gold as off-shoots of currency paiseh paiseh. My own AA % of value held  and their % of value held in Vehicles (RE = Real Estate)  Going for a simple 1/3 in Reserves, Biz Equities & RE Equities - simple i can handle till nyanyuk XD This post has been edited by wongmunkeong: Nov 12 2020, 12:17 PM extinct_83, polarzbearz, and 1 other liked this post

|

|

|

Nov 12 2020, 12:16 PM Nov 12 2020, 12:16 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:25 AM |

| Change to: |  0.0285sec 0.0285sec

0.68 0.68

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 06:56 AM |