QUOTE(GrumpyNooby @ Sep 30 2020, 04:26 PM)

Itu i panggil dia bossku 😆😆😆😆Matlamat hidupku

This post has been edited by ironman16: Sep 30 2020, 05:32 PM

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Sep 30 2020, 05:31 PM Sep 30 2020, 05:31 PM

Show posts by this member only | IPv6 | Post

#23321

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

Sep 30 2020, 05:45 PM Sep 30 2020, 05:45 PM

|

Junior Member

540 posts Joined: Sep 2010 |

any promo investing in PRS from fundsupermart?

|

|

|

Sep 30 2020, 05:46 PM Sep 30 2020, 05:46 PM

Show posts by this member only | IPv6 | Post

#23323

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:03 PM |

|

|

Sep 30 2020, 05:48 PM Sep 30 2020, 05:48 PM

|

Junior Member

540 posts Joined: Sep 2010 |

QUOTE(GrumpyNooby @ Sep 30 2020, 05:46 PM) No promotion for the mean time; even for normal unit trust. Thanks for the prompt reply. Guess have to wait till end of the year. I rmb last year they give touch n go credit RM30 .Gotta wait for the promotion then.Wait till December. Usually they will have some campaign for PRS. |

|

|

Sep 30 2020, 07:04 PM Sep 30 2020, 07:04 PM

Show posts by this member only | IPv6 | Post

#23325

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:03 PM |

|

|

Oct 1 2020, 10:49 AM Oct 1 2020, 10:49 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(GrumpyNooby @ Sep 30 2020, 04:26 PM) #Fakenews. Not networth, is liquid asset lah! Networth include liquid asset + fixed asset wor. BTW Sep 2020 month suxs, liquid asset jatuh below the watermark liao Xuzen woonsc and wongmunkeong liked this post

|

|

|

|

|

|

Oct 1 2020, 10:51 AM Oct 1 2020, 10:51 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:03 PM |

|

|

Oct 1 2020, 10:52 AM Oct 1 2020, 10:52 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

Oct 1 2020, 11:28 AM Oct 1 2020, 11:28 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(xuzen @ Oct 1 2020, 10:49 AM) #Fakenews. investment portfolio asset last i remembered.. much more than 1x M (in RM) leh Not networth, is liquid asset lah! Networth include liquid asset + fixed asset wor. BTW Sep 2020 month suxs, liquid asset jatuh below the watermark liao Xuzen and markets have generally recovered from the 30%+/- mid March madness - mana oo below watermark that much ar |

|

|

Oct 1 2020, 02:33 PM Oct 1 2020, 02:33 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(wongmunkeong @ Oct 1 2020, 11:28 AM) investment portfolio asset last i remembered.. much more than 1x M (in RM) leh What I meant was as of now, port has gone down from the high watermark point back in Aug 2020. If compare versus Apr 2020 ( during MCO ) of course has recovered lah!and markets have generally recovered from the 30%+/- mid March madness - mana oo below watermark that much ar Xuzen |

|

|

Oct 1 2020, 04:55 PM Oct 1 2020, 04:55 PM

|

Junior Member

790 posts Joined: Sep 2013 From: Selangor |

My total FSM investment returns drop 1% for the month of September

|

|

|

Oct 1 2020, 05:10 PM Oct 1 2020, 05:10 PM

|

Senior Member

749 posts Joined: Jul 2010 From: Kuala Lumpur, Malaysia |

QUOTE(GrumpyNooby @ Sep 30 2020, 07:04 PM) FSM Fund Choice: RHB Shariah China Focus Fund [October 2020] Thank you. Sticked with Eastspring Investment Dinasti Ekuiti for now.China equity markets have performed decently during 2020, likely contributed by its better containment measures compared to its global peers. In this article, we look to reiterate China as an investment avenue and its room for further growth. .gif) Takeaway All in all, as we began to digest the economic impact and the eventual recovery of the COVID pandemic, China is likely to experience the fastest recovery in terms of economic growth. Strict containment measures have contributed to a resumption of the economy and the subsequent rebound in economic data relatively quickly compared to its global peers. While we are optimistic about the growth opportunities of China, RHB Shariah China Focus Fund would be an appropriate choice at this current juncture for investors who are mindful of the risks such as the US presidential election will bring. Article link: https://www.fundsupermart.com.my/fsmone/art...d-October-2020- Fund link: https://www.fundsupermart.com.my/fsmone/fun...-Focus-Fund-MYR |

|

|

Oct 1 2020, 05:13 PM Oct 1 2020, 05:13 PM

Show posts by this member only | IPv6 | Post

#23333

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:03 PM |

|

|

|

|

|

Oct 1 2020, 07:35 PM Oct 1 2020, 07:35 PM

|

Senior Member

749 posts Joined: Jul 2010 From: Kuala Lumpur, Malaysia |

|

|

|

Oct 1 2020, 07:36 PM Oct 1 2020, 07:36 PM

Show posts by this member only | IPv6 | Post

#23335

|

Senior Member

8,188 posts Joined: Apr 2013 |

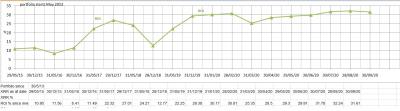

MoM for my DIY port is abt -0.6% MoM for moderately aggressive Managed Port abt -4.6% MoM for my spouse PM portfolio is abt -6.8% different composition & risk level so cannot judge This post has been edited by yklooi: Oct 1 2020, 07:39 PM Attached thumbnail(s)

encikbuta liked this post

|

|

|

Oct 1 2020, 07:53 PM Oct 1 2020, 07:53 PM

Show posts by this member only | IPv6 | Post

#23336

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:04 PM |

|

|

Oct 1 2020, 08:58 PM Oct 1 2020, 08:58 PM

Show posts by this member only | IPv6 | Post

#23337

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Oct 1 2020, 08:59 PM Oct 1 2020, 08:59 PM

Show posts by this member only | IPv6 | Post

#23338

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:55 AM |

|

|

Oct 1 2020, 09:13 PM Oct 1 2020, 09:13 PM

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Oct 1 2020, 09:13 PM Oct 1 2020, 09:13 PM

Show posts by this member only | IPv6 | Post

#23340

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:55 AM |

| Change to: |  0.0341sec 0.0341sec

0.58 0.58

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 01:40 PM |