QUOTE(ganesh1696 @ Jan 26 2021, 04:39 PM)

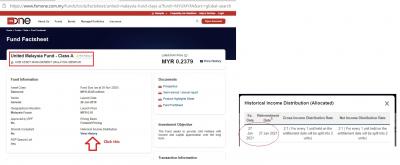

goto that fund info page....Attached thumbnail(s)

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 26 2021, 04:49 PM Jan 26 2021, 04:49 PM

Return to original view | IPv6 | Post

#1381

|

Senior Member

5,143 posts Joined: Jan 2015 |

ironman16 liked this post

|

|

|

|

|

|

Jan 26 2021, 04:54 PM Jan 26 2021, 04:54 PM

Return to original view | IPv6 | Post

#1382

|

Senior Member

5,143 posts Joined: Jan 2015 |

just some after work/dinner read.... What and Where to Invest 2021? - A Summary of Fund Houses' View Last week, FSM have organized our annual flagship event — What and Where to Invest. In this article, FSM summarize the key points of each fund house. https://www.fsmone.com.my/funds/research/ar...-view?src=funds TaiGoh liked this post

|

|

|

Jan 29 2021, 10:13 PM Jan 29 2021, 10:13 PM

Return to original view | IPv6 | Post

#1383

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(yklooi @ Jan 29 2021, 07:31 PM) it is HERE.... SC, Bursa Malaysia sound warning as GameStop inspired battle spreads to glove stocks - - - -Friday, 29 Jan 2021, 9:29 PMKUALA LUMPUR (Bloomberg): The manic ride in GameStop sparked by American amateur traders on Reddit has inspired some Malaysians to form a similar group targeting shares of glove makers -- one of Asia's hottest pandemic trades in 2020. The online community by the name of Bursabets was created on Thursday (Jan 28) and is already boasting more than 4,800 members. The moderators of the group have defined it as the "Malaysian version" of Reddit's WallStreetBets forum, to discuss stocks listed on Bursa Malaysia. The discussions so far have centered on glove makers and calls to rally against institutional investors who have kept valuations of the sector low. Shares of Top Glove Corp jumped as much as 15 per cent on Friday, the most since Sept 11. GameStop stock frenzy spreads to Malaysia as amateur traders target glove makers ASEANPLUS NEWS - Friday, 29 Jan 2021 https://www.thestar.com.my/aseanplus/aseanp...et-glove-makers KUALA LUMPUR: Stock market regulators Securities Commission (SC) and Bursa Malaysia Bhd said on Friday they will take the "necessary measures" to curb disruptive trading practices and market abuse on the local bourse. This includes pursuing legal actions under existing laws. "Malaysian investors are advised to be cautious of social media chatrooms that try to influence investors to buy or sell certain stocks based on speculation or rumours," they said in a joint statement today. "Investors should also be wary of discussions in these social media chatrooms that may trigger securities breaches such as the provision of investment advice or stock recommendations without a licence." "Any person found guilty, may be liable to a fine not exceeding RM10mil or imprisonment not exceeding ten years or both." they said. https://www.thestar.com.my/business/busines...ed-battle-looms |

|

|

Feb 3 2021, 03:14 PM Feb 3 2021, 03:14 PM

Return to original view | IPv6 | Post

#1384

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(victorian @ Feb 3 2021, 03:11 PM) This is FSM MY thread. If you are keen on FSM SG may I suggest you to open a separate thread? Not all of us are interested in going the extra miles just to save a few pennies. just a note,...there is one already Fundsupermart Singapore, Let's have a separate thread https://forum.lowyat.net/topic/3757612 WhitE LighteR liked this post

|

|

|

Feb 7 2021, 03:08 PM Feb 7 2021, 03:08 PM

Return to original view | IPv6 | Post

#1385

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(KingArthurVI @ Feb 7 2021, 02:39 PM) Wow, didn't expect to receive so many great responses, thanks to all of you for taking the time to explain the differences between investing via RM vs. investing on our own through FSM. I think I'll start by opening an account and take a look around to see what's out there. There are certain funds (actually it's an ETF lol so I guess I'm looking for a fund based on it) like the Ark Innovation Fund that I'm interested in, but doesn't look like FSM carries it or its feeder funds (someone please point me to it if there is one).............. FSM has one … Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged, a feeder fund of Nikko Am ARK Disruptive Innovation Fund.................. https://www.fsmone.com.my/funds/tools/facts...c=global-search KingArthurVI liked this post

|

|

|

Feb 7 2021, 06:19 PM Feb 7 2021, 06:19 PM

Return to original view | IPv6 | Post

#1386

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(KingArthurVI @ Feb 7 2021, 05:56 PM) Depends on which currency you think will go up, depends also if you want to bet on currency gain too or just want a less volatile forex factor, KingArthurVI liked this post

|

|

|

|

|

|

Feb 8 2021, 08:21 AM Feb 8 2021, 08:21 AM

Return to original view | IPv6 | Post

#1387

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Conslow2020 @ Feb 8 2021, 08:07 AM) Nice now i know i can invest in RHB Artificial Intelligence via FSM i try search but cant find it before this thanks for the link . So now you managed to get the link? If not, Try type in the full name of the fund in the search box? This post has been edited by T231H: Feb 8 2021, 08:24 AM |

|

|

Feb 8 2021, 11:48 PM Feb 8 2021, 11:48 PM

Return to original view | IPv6 | Post

#1388

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(yycclin @ Feb 8 2021, 11:25 PM) At least 60% of my UT investment are recommendation funds from various fund houses. ( Ifast, eUnittrust, PMO, and FSM ) 3 Misconceptions Of FSM Recommended Unit Trusts ListI this a safe way of investing ? 1. RECOMMENDED UNIT TRUSTS = BEST RETURNS 2. IT'S THE ONLY SET OF UNIT TRUSTS ONE CAN BUY 3. I HAVE TO OWN THEM ALL! read indepth about it... https://www.fsmone.com.my/funds/research/ar...o=6041&isRcms=N |

|

|

Feb 13 2021, 07:47 PM Feb 13 2021, 07:47 PM

Return to original view | IPv6 | Post

#1389

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(amateurinvestor @ Feb 13 2021, 07:38 PM) Hi all, some consideration......I would like to ask about your opinion that some are saying stocks are at a high price. Most are saying in relation to US stocks. Hence, for unit trusts focusing on equities, do you think this is the same? Or Asean/Tech/China/Apac has still much room for growth? Reason I am asking is coz 95% of my money is in Amanah Saham (non-bumi), but everytime I think of putting more in unit trust, some are also saying everything is in the high price. Not sure if this is gonna be a continuous bull market for at least next two years, or a correction is soon. I understand no one can predict the future, but would appreciate any insights….so I can strategize my fund allocations considering the sub par dividends of amanah saham <4 percent… Thanksssss what is high can still go higher what is low can still be low for a period of time what is high may not be applicable to the stocks being held by your unit trusts. Also, Prices is just a metric,...should NOT be the only factor that decide if you should buy, hold or sell.... For at FSM, they look at key valuation metrics like PE and PB ratios, expected earnings growth, along with excess earnings yield to determine how attractive a particular market is. In addition, they consider the economic outlook, generational reforms as well as fiscal and monetary policies in a particular market and tie those stories with our estimates. https://www.fsmone.com.my/funds/research/star-rating |

|

|

Feb 14 2021, 05:11 PM Feb 14 2021, 05:11 PM

Return to original view | IPv6 | Post

#1390

|

Senior Member

5,143 posts Joined: Jan 2015 |

Trustee for Unit Trust Funds

A unit trust fund is a collective investment scheme, which pools the savings of investors with similar investment objectives in a special "trust" fund managed by professional fund managers. The pooled monies in the unit trust fund will then be invested in a diversified portfolio of securities and other assets in accordance with the unit trust fund's investment objectives and as permitted under the Securities Commission's (SC) Guidelines on Unit Trust Funds. The Trustees play a crucial role in protecting the unitholders by ensuring that the fund is operating in accordance to what is stipulated in the Trust Deed and by holding all assets of the said fund for the unitholders. https://www.maybank2u.com.my/maybank2u/mala...e%20unitholders. |

|

|

Feb 15 2021, 12:26 PM Feb 15 2021, 12:26 PM

Return to original view | IPv6 | Post

#1391

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(WhitE LighteR @ Feb 15 2021, 12:18 PM) I think for non feeder fund, RHB Shariah China Focus & RHB Big Cap China Fund so far doing quite well. Just one thing I dont like is RHB funds have the rm25 withdrawal charge. But this will be less of an issue as the portfolio amount becomes larger. this RM25 should be Switching fees? |

|

|

Feb 24 2021, 10:04 AM Feb 24 2021, 10:04 AM

Return to original view | IPv6 | Post

#1392

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(JimK @ Feb 24 2021, 10:02 AM) according to this FAQs...6. How do I know what price I’m getting? The prices displayed on FSMOne are indicative prices, which is usually dated two working days ago. As the name goes, indicative price is NOT the actual transaction price of the fund that you are buying. Most of the funds on FSMOne are priced based on Forward Pricing method. If we receive your payment before the cutoff time on a business day, your units will be priced as of the closing price of the market on that day itself. For payments received after the cutoff time or on a non-business day, your units will be priced based on the next business day. Given that the fund management companies require time to consolidate, calculate and verify unit prices with independent trustees, you will only know the exact unit price two working days later. You will receive an email from us once your units have been priced. more https://www.fsmone.com.my/support/frequentl...tions?faq=Funds |

|

|

Mar 13 2021, 08:19 AM Mar 13 2021, 08:19 AM

Return to original view | IPv6 | Post

#1393

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(blstz @ Mar 13 2021, 08:02 AM) hi! newbie here to fsm and interested to sign up to do mainly medium to long term UT investment. may i know what is the difference between buying through fsm compared to if i open investor account directly with public mutual or affin hwang? ....much lower sales charge, availability of credit point systemsn informative website fsm get more choice of funds to buy? .... Yes, alot more choices to choose also, will i get double charged by paying both UT and fsm on the service fee and maintenance fee? ... .. No, for normal DIY unit trust funds, fsm only charge sales charge, the rest are charged by the fund house for the mgmt of the fund and these charges will still be there even if you buy direct from the fund house. FSM will impose additional charge for their managed portfolio subscription service |

|

|

|

|

|

Mar 13 2021, 12:38 PM Mar 13 2021, 12:38 PM

Return to original view | IPv6 | Post

#1394

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(victorian @ Mar 13 2021, 11:33 AM) QUOTE(ironman16 @ Mar 13 2021, 12:27 PM) R u sure u r talking about RSP from fsm? this RSP of yours are money deducted direct from Cash a/c or CMF2 to buy?X pernah pun I dpt RSP on 10th, normally is 15th every month or later if 15th is holiday. 😁 or from bank instruction like monthly FPX auto deduct? |

|

|

Mar 13 2021, 06:17 PM Mar 13 2021, 06:17 PM

Return to original view | IPv6 | Post

#1395

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(eenong89 @ Mar 13 2021, 05:57 PM) a week ago MUM posted this,...QUOTE(MUM @ Mar 7 2021, 08:39 AM) look at this image, i think it can helps you to come out with clear and informed conclusion about the correlation between past US treasury yield rate movement and the markets movement just a note though,...it does not shows the correlation of any of them in relation to your emotional feelings of how you want your emotional life to be at any stage of the mkts trends Attached thumbnail(s)

|

|

|

Mar 14 2021, 03:58 PM Mar 14 2021, 03:58 PM

Return to original view | IPv6 | Post

#1396

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 19 2021, 08:02 AM Mar 19 2021, 08:02 AM

Return to original view | IPv6 | Post

#1397

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Mar 19 2021, 09:28 AM Mar 19 2021, 09:28 AM

Return to original view | IPv6 | Post

#1398

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(ganesh1696 @ Mar 19 2021, 07:53 AM) .................... something fresh from the oven for you because you asked....Is there any sign of rebound? Most of news are likely downgrading CHINA's stock market performance as CHINA government is interfering in china stock valuation and so on. Can we hope for recovery anytime soon? Or we should use this "dip" to top up more.? Still considering to top up. Thanks. Chinese equities was one of the worst affected markets in terms of performance in the month of February. So what’s next for Chinese equities? Will the selling continue? iFAST Research Team 19 Mar 2021 https://www.fsmone.com.my/funds/research/ar...ld-st?src=funds |

|

|

Mar 19 2021, 10:19 AM Mar 19 2021, 10:19 AM

Return to original view | IPv6 | Post

#1399

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(ericlaiys @ Mar 19 2021, 10:16 AM) as per posted in post 273355. The first 1,000 eligible investors who invested a successful trade in any stock or ETF within the campaign period and fulfilled T&C 4 will enjoy RM100 worth of Cash Management Fund 2. |

|

|

Mar 23 2021, 07:18 PM Mar 23 2021, 07:18 PM

Return to original view | IPv6 | Post

#1400

|

Senior Member

5,143 posts Joined: Jan 2015 |

just a note for those holding any of these Bond funds....

Downgrade of MEX I Capital Sukuk On 19 March 2021, RAM Ratings downgraded MEX I Capital Bhd’s RM1.35 billion Sukuk Musharakah (2014/2031) by 8 notches to C3 (which is one notch above Default) from BB1 due to the company’s continued liquidity problems and increased default risk due to lower Maju Expressway (MEX) traffic volumes and delays in the restructuring exercise. iFAST Research Team 23 Mar 2021 https://www.fsmone.com.my/funds/research/ar...sukuk?src=funds Attached thumbnail(s)

|

| Change to: |  0.0665sec 0.0665sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 06:08 AM |