Here are 3 SGD ETFs which you will find useful soon

In this article, FSM will introduce some unique and interesting ETFs that can be found in SGX to our Malaysian investors

iFAST Research Team

22 Dec 2021

CSOP iEdge S-REIT Leaders Index ETF

Lion-OCBC Securities China Leaders ETF

UOB APAC Green REIT ETF

CSOP iEdge S-REIT Leaders Index ETF

The ETF aims to replicate the performance of the SGX iEdge S-REIT Leaders Index, a liquidity-adjusted free-float market capitalisation-weighted index that measures the performance of the most liquid large and mid-cap S-REITs, enabling investors to gain exposure to the sector via a diversified and cost-efficient approach.

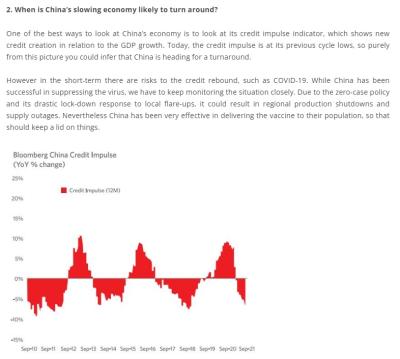

Lion-OCBC Securities China Leaders ETF, which replicates the performance of Hang Seng Stock Connect China 80 Index. The ETF aims to providing investors with easy access via the local exchange to gain exposure to 80 largest Chinese companies from 12 different sectors, and many of these companies are also among global leaders in their respective industries.

The UOB APAC Green REIT ETF aims to replicate the performance of iEdge-UOB APAC Yield Focus Green REIT Index, which covers 50 higher-yielding REITs listed across the region that display relatively better environmental performance, bringing unique opportunities in environmentally-sound real estate assets with growth potential to investors.

more ,....

https://www.fsmone.com.my/funds/research/ar...-soon?src=funds

Aug 30 2021, 10:24 AM

Aug 30 2021, 10:24 AM

Quote

Quote

0.0731sec

0.0731sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled