QUOTE(abcn1n @ Nov 21 2020, 01:00 AM)

Need help. I bought a fund a few days ago. Usually before this new website design, it will automatically deduct from my FSM cash account (it will say as cheque payment--don't know why FSM use such term).

However, noticed that till date, it is still pending for payment and choice of payment is only fpx online or upload deposit slip. I tried paying with the fpx online just now but decided to cancel it halfway as was wondering if there would be double payment as don't understand why they are not deducting from my cash account as per previously before this stupid new website. Now, its not letting me pay using fpx online anymore (as I cancelled the earlier one) and I'm supposed to mail proof of payment to them and then do a stupid upload or mail them proof of payment when pay. Guess they are expecting me to go to my bank account and do payment from there

Really mad as I got a good price for the fund a few days ago. Most likely will just cancel the order. Really dislike this stupid new website design.

1) So question is how do we get FSM to use our cash account for payment next time I want to buy?

2) Also, will I still get the price based on date of order if I make payment today as it has been a few working days already or will it be base on the working day that I made payment which will then be on Monday?

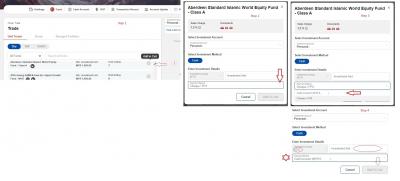

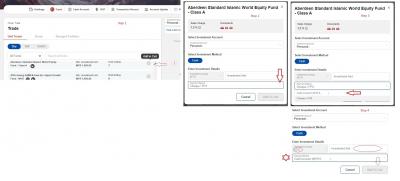

try this (per image) for your question 1

as per your question 2...as per their FAQs:

"Your buy orders will only be transacted when payment is received.....before the cut off time and any buy order received after cut off time will process on the next business day".

"If we receive your payment before the cutoff time on a business day, your units will be priced as of the closing price of the market on that day itself. For payments received after the cutoff time or on a non-business day, your units will be priced based on the next business day.

Given that the fund management companies require time to consolidate, calculate and verify unit prices with independent trustees, you will only know the exact unit price two working days later. You will receive an email from us once your units have been priced."

Attached thumbnail(s)

Nov 20 2020, 09:29 AM

Nov 20 2020, 09:29 AM

Quote

Quote

0.0592sec

0.0592sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled