buy land, dont buy houses.

maintenance alone sakit kepala.

rent out hoping make money, but if your tenant spoilt your house, more repair bills.

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Feb 24 2023, 12:04 PM Feb 24 2023, 12:04 PM

|

Junior Member

118 posts Joined: Nov 2022 |

buy land, dont buy houses.

maintenance alone sakit kepala. rent out hoping make money, but if your tenant spoilt your house, more repair bills. |

|

|

|

|

|

Feb 24 2023, 12:06 PM Feb 24 2023, 12:06 PM

|

Junior Member

820 posts Joined: Aug 2006 |

QUOTE(kidmad @ Feb 23 2023, 08:21 PM) one thing stays the same, the same group of ppl in the last 11 years and more to go.. they always use figures which doesn't make sense. don't compare base on your own narrative, it's literally plucking figures out from thin air.. some says ass. you shouldn't call yourself kidmad... 1. fd ever give you 5%? which investment instrument give you 5% gurantee for god damn 30 years!. don't tell me kwsp i have 5000+ going into it monthly. i don't want all my money in the same basket. 2. you want to use a property as comparison can do abit homework? what shit investment rm550k fully furnished and getting only rm1.6k back. now let me give you a realistic one with the damn condo name. serin residence 144sft, 550k fully furnished unit rental rm2.2k - 2.5k. i have few.. not one of two but few colleagues renting there. verdi 990sft, 420k basic Ikea furnishing my contract staff is renting for rm2k! i have more to share but all these are in Cyberjaya.. they are not even in hotspots like bukit jalil, kl or pj. add in one more.. kota warisan bought at rm550k landed, empty unit! rental rm1.6k. of course if you have a prop bought in 2018 like me you would have make a lost but that's the same with all kind of investment. the same property i had while I'm debating with this numb skull iceman in 2012 it's still generating me surplus income in the last 11 years. prop name puri aiyu condo. 3. you dare give a span of 30 years to compare. my god property has a good track record they don't lie. 40 years - PJ - property once sold for rm120k is now rm900k.. maybe rm850k 30 years - subang - property once sold for rm200k is now approx 700k 20 years - puchong - those sold at 300k+ is now all > rm500k i dont want to mention other places like bukit jalil, setia alam, kota kemuning but you get the idea.. anyway they're also bad property investment. one very good example is those who bought rm720k - 780k for Savannah in bukit jalil. someone brought it up here.. those are the properties which i call bad investment cause during that period, that time of the year the place isn't really a hotspot and selling at those kind of prices and still ppl buy em. well they just gotta hold longer period of time. i so happen have a colleague who owns a unit there. we told him to hold and get others but somehow he kind the place so he gave to bite the bullets and continue on with his dream home idea. This post has been edited by coyouth: Feb 24 2023, 12:07 PM |

|

|

Feb 28 2023, 05:57 PM Feb 28 2023, 05:57 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

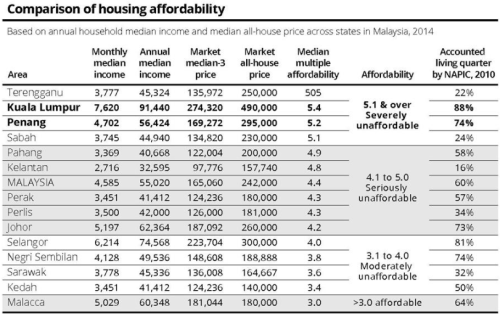

QUOTE(CoolStoryWriter @ Feb 28 2023, 12:36 PM) Malaysia's average house prices are more than 4 times the median income of its population, making them "seriously unaffordable", research by Khazanah Research Institute (KRI) has revealed. Kuala Lumpur has especially been branded as "severely unaffordable" with house prices 5.4 times higher than the median income in the capital city. The maximum median range for housing prices compared to median income should not be more than 3 times the median income. But only one state in Malaysia fits the maximum median range: Malacca, where housing prices are 3 times higher than the median range. The rest are rated between "moderately" and "severely" unaffordable. Terengganu is the most severely unaffordable of all the states, with median multiple affordability standing at 5.5. In Kuala Lumpur, the median house price is now RM490,000 per unit, almost double the median house price ranges in all other states. Penang was also rated as severely unaffordable while Selangor, Malaysia's wealthiest state, has a median house price of RM300,000, putting it at the moderately unaffordable level. CORRECT INCOME AND HOUSE PRICE ACCORDING TO KRI: Household income RM5,000/month = RM180,000 RM8,000/month = RM288,000 RM10,000/month = RM360,000 RM15,000/month = RM540,000 RM20,000/month = RM720,000 Reference: http://www.themalaysianinsider.com/malaysi...azanah-research  Sihambodoh and michaelchang liked this post

|

|

|

Feb 28 2023, 06:23 PM Feb 28 2023, 06:23 PM

|

Junior Member

916 posts Joined: Sep 2016 |

|

|

|

Feb 28 2023, 06:42 PM Feb 28 2023, 06:42 PM

Show posts by this member only | IPv6 | Post

#4125

|

Junior Member

436 posts Joined: Dec 2021 |

QUOTE(michaelchang @ Feb 28 2023, 06:23 PM) but KL youngster nowadays earning RM$4000/month but buying RM$600K property. Education failure or IQ too low? Easy credit. Once central banks tightens, then you'll see more lelongs.Another sign of a bad property market is when Developers or Property agencies come out to say these things 1. Property market on the way to recover by year 202X 2. Government should loosen bank loan requirement 3. Government should lower minimum price for foreign purchase 4. Government should bring back HOC physdude and michaelchang liked this post

|

|

|

Feb 28 2023, 07:37 PM Feb 28 2023, 07:37 PM

Show posts by this member only | IPv6 | Post

#4126

|

Junior Member

241 posts Joined: Oct 2021 |

Hey is the HOC campaign still ongoing? Or ended. The recent budget 2023 dont have HOC

|

|

|

|

|

|

Feb 28 2023, 08:01 PM Feb 28 2023, 08:01 PM

Show posts by this member only | IPv6 | Post

#4127

|

Junior Member

436 posts Joined: Dec 2021 |

|

|

|

Mar 5 2023, 01:32 PM Mar 5 2023, 01:32 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

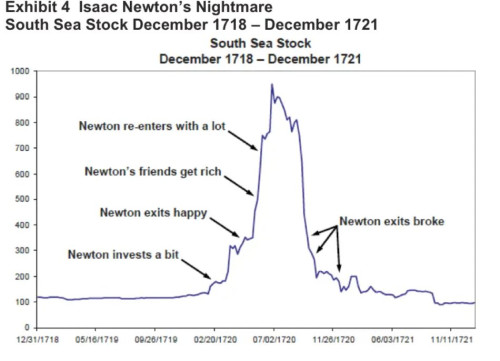

Fairly typical for most in crypto, glove share, poorperly, etc. This post has been edited by icemanfx: Mar 5 2023, 01:36 PM michaelchang liked this post

|

|

|

Mar 5 2023, 06:36 PM Mar 5 2023, 06:36 PM

|

Junior Member

916 posts Joined: Sep 2016 |

|

|

|

Mar 7 2023, 09:37 AM Mar 7 2023, 09:37 AM

Show posts by this member only | IPv6 | Post

#4130

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(premier239 @ Mar 7 2023, 09:04 AM) KUALA LUMPUR: Affordability issues continue to be a concern among homebuyers as the disparity between income and house prices widen. Overpriced poorperly will either drop to meet demand or remain stagnant until inflation catch up.According to the PropertyGuru Malaysia Consumer Sentiment Study for the first half of 2023, almost half of the 1,000 respondents polled or 47 per cent had a budget of less than RM350,000 for buying properties. The study found that half of the Malaysian consumers consider themselves unable to buy a house without government assistance, with nearly three in four respondents called for more government support to address the rising inflation. PropertyGuru.com.my and iProperty.com.my country manager Sheldon Fernandez said the continued financial challenges that consumers faced as seen in the study further highlighted the importance of government financial assistance for Malaysians' journeys toward homeownership. "Although the recent increase in minimum wage was a welcome relief, the rising inflation also brought higher daily household expenses, leaving Malaysians with lesser monthly savings and a need to minimise additional expenditures," he said. Among calls for government-led financial support, the study revealed that two in five Malaysians continued to not have a clear understanding of the eligibility terms for affordable housing. It also revealed that this was more prevalent among low-income earners and those within the age range of 20 to 29. On the other hand, the study also found that over half (58 per cent) of Malaysian consumers with the intention to purchase a property have achieved the halfway point of their savings target, driven mostly by millennials between the ages of 22 to 41 and mid-income earners. "What we are seeing in the market lately is that potential homebuyers do have the intention to buy, though that intention is hampered by affordability issues that are expected to linger until the overall cost of living has stabilised. "With this, we expect consumers to continue prioritising renting over purchasing property in the upcoming year," said Fernandez. Following the Batang Kali landslide tragedy in December last year, climate change continued to be a significant concern for 98 per cent of Malaysian respondents, especially among respondents aged 50 and above. Meanwhile, the study saw that 52 per cent of consumers were willing to pay a higher insurance premium for protection against climate change effects on their property. Considering the recent surge in weather-related disasters, 70 per cent of Malaysians expressed dissatisfaction with national efforts to mitigate the effects of climate change in the country. "With the recent tragedy of floods across the country that has affected families nationwide, Malaysians are especially concerned about the topic of natural disasters. "Measures to reflect the changing needs of consumers due to external factors from climate change and the ongoing economic recession need to be taken to enable consumers to achieve their homeownership goals," said Fernandez. He added that such initiative that the company supported was the continued stamp duty exemption, as announced under 2023 Budget, which aimed to assist first-time homebuyers to get onto the property ladder. "We believe that this, along with the Government's Syarikat Jaminan Kredit Perumahan home loan scheme to assist borrowers with unstable incomes, will provide crucial support for Malaysians struggling to maintain a good quality of life. "This is particularly so for young Malaysians who are just beginning their property journeys, and we look forward to being part of the journey in achieving their homeownership dreams," he said. The study's respondents comprised a mix of white-collar professionals, blue-collar workers and businessmen, with respondents in the mid to high-income segment (65 per cent) and low-income (35 per cent). GravityFi3ld liked this post

|

|

|

Mar 13 2023, 03:32 PM Mar 13 2023, 03:32 PM

Show posts by this member only | IPv6 | Post

#4131

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(munak991 @ Mar 13 2023, 08:21 AM) Hi all, https://forum.lowyat.net/topic/5363709Asking for family member. Currently they have try to ask around for buyer, no buyer interest. There's multiple unit on bank lelong and also many units sells below market price. This just example The leasehold property initial price is 1 mil. Loan at 900k Bank lelong around the area unfurnish 800k, online property price tag around 800-850k. Urgently need to dispose this property. Due to not able to coop with it. Few question, 1) if the property sell at loss, how does the offset amount been paid? The bank will still give another loan for that offset? 2) it's RPGT still in effect if sell at a loss? Appreciate the answer iEatCuteDogs and Sihambodoh liked this post

|

|

|

Mar 13 2023, 03:45 PM Mar 13 2023, 03:45 PM

|

Junior Member

2 posts Joined: Aug 2022 |

hmm TS what is this thread for? tl;dr this is about property bubble? it burst around 2017-2018, recovered a bit during 2019 but came crashing down in 2020, 2021 and 2022. now recover but really slow like 2% capital gains. rental is at an all time low. hard to find renters. eg. i got a service apartment in pucheong, that one cant find any tenants since VP. too much supply, no demand, and renters lowball rent. fully furnished, with carpark, aircon, etc. asking price is RM1000-1100 per month, 1200+ sqft. i rather keep it empty to bring chicks home for 1nightstands. i did a rant post recently of my stay in house taman, so many unsold units and developer goreng price till -17-19% discount. then BuyNowPayLater schemes by developer made it even worst, buyers with shit pay like RM3000 celery buying RM500k homes after discount. now they cant pay the bank back, and bank lelong prices -40% original value. This post has been edited by iEatCuteDogs: Mar 13 2023, 03:49 PM langstrasse, michaelchang, and 1 other liked this post

|

|

|

Mar 13 2023, 04:26 PM Mar 13 2023, 04:26 PM

Show posts by this member only | IPv6 | Post

#4133

|

Senior Member

2,746 posts Joined: Mar 2006 From: 21st century |

QUOTE(icemanfx @ Mar 13 2023, 03:32 PM) Thanks for tagging for more answer and help Any help and answer is appreciated |

|

|

|

|

|

Mar 22 2023, 12:53 AM Mar 22 2023, 12:53 AM

Show posts by this member only | IPv6 | Post

#4134

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Apr 5 2023, 05:27 PM Apr 5 2023, 05:27 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Nov 18 2020, 11:33 AM) sap price >700kThis post has been edited by icemanfx: Apr 5 2023, 05:29 PM Sihambodoh liked this post

|

|

|

Apr 5 2023, 08:49 PM Apr 5 2023, 08:49 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Apr 9 2023, 03:38 PM Apr 9 2023, 03:38 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

8th round reauction.

Drop from 800K.  |

|

|

Apr 9 2023, 03:43 PM Apr 9 2023, 03:43 PM

Show posts by this member only | IPv6 | Post

#4138

|

Junior Member

149 posts Joined: May 2022 From: Cyberjaya |

|

|

|

Apr 9 2023, 03:46 PM Apr 9 2023, 03:46 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

|

|

|

Apr 9 2023, 05:28 PM Apr 9 2023, 05:28 PM

Show posts by this member only | IPv6 | Post

#4140

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(AskarPerang @ Apr 9 2023, 03:38 PM) Whoever valued it at rm800k need to tell me what they are smoking... About rm400k lah, that unit. michaelchang and Sihambodoh liked this post

|

| Change to: |  0.0420sec 0.0420sec

1.48 1.48

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 10:11 AM |