QUOTE(elimi8z @ Oct 2 2022, 11:08 PM)

By that time economy is bad enough for many to lose jobs, maybe it's you tooMultiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Oct 3 2022, 05:59 PM Oct 3 2022, 05:59 PM

Show posts by this member only | IPv6 | Post

#4021

|

Senior Member

4,998 posts Joined: Dec 2010 |

|

|

|

|

|

|

Oct 3 2022, 06:12 PM Oct 3 2022, 06:12 PM

Show posts by this member only | IPv6 | Post

#4022

|

Junior Member

940 posts Joined: Dec 2007 From: Shah Alam,Selangor |

|

|

|

Oct 3 2022, 06:13 PM Oct 3 2022, 06:13 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 5 2022, 11:04 PM Oct 5 2022, 11:04 PM

Show posts by this member only | IPv6 | Post

#4024

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(theberry @ Oct 5 2022, 08:28 PM) https://www.nst.com.my/news/nation/2022/10/...malaysians-save malusians are poorer than most people thought.THE National Higher Education Fund Corporation (PTPTN) on Saturday, kicked off its annual signature programme, Bulan Menabung Simpan SSPN (BMS) 2022, to empower parents to save for their children's future education. Held in conjunction with World Savings Day, which is celebrated on Oct 31 annually, the nationwide programme will offer a variety of activities and educational sub-programmes throughout October. PTPTN chairman Dr Apli Yusoff said the programme, which was introduced in 2018, was one of the corporation's efforts to foster smart financial savings and planning among parents for their children's future education through Simpan SSPN. "The campaign is designed and implemented as a promotional programme to introduce Simpan SSPN products as the community's main choice when starting their financial savings. "Looking back at our history, PTPTN was established 25 years ago as part of the government's efforts to ensure no students were left behind in pursuing higher education due to financial problems. "With this, PTPTN will continue to stay committed to carrying out its duty to provide loan facilities, manage loan payments and cultivate saving practices for the human development capital," he said in his keynote address during the launch of the campaign at Sunway Velocity Mall on Saturday. Apli said Simpan SSPN was the only scheme under PTPTN that offered tax relief up to RM8,000 annually. "Aside from saving for their children's future education, parents are also able to get tax relief and takaful protection." He said the scheme had also introduced two savings units — Simpan SSPN Prime and Simpan SSPN Plus — that offered numerous advantages to Malaysians. "The Simpan SSPN Prime account consists of a savings instrument without a monthly commitment that provides advantages such as tax relief up to RM8,000, free takaful coverage, competitive dividends, matching grants of up to RM10,000 and syariah-compliant government-guaranteed savings. "The Simpan SSPN Plus account, on the other hand, offers six affordable packages and benefits to depositors, including takaful benefits of up to RM1.2 million and coverage up to the age of 69 for depositors, apart from the existing benefits." Meanwhile, Higher Education Minister Datuk Seri Dr Noraini Ahmad said the BMS 2022 would help enhance financial literacy in the community. "Through this, I can see efforts have been made and I am certain that they will further fuel the practice of saving among Malaysians," she said at launch. Citing a survey conducted by Bank Negara Malaysia (BNM), Noraini said 75 per cent of the population did not have at least RM1,000 in savings. "At the same time, the Malaysian RinggitPlus Financial Literacy Survey (RMFLS) 2021 found that Malaysians who could not save money on a monthly basis had increased to 21 per cent in 2021 compared with 19 per cent in the previous year. "These two studies are a serious reminder for us to plan our finances wisely, especially with the economic uncertainty." The BMS 2022, with the tagline "Jom Jadi Superhero Anak Anda" will see activities being held online from Oct 1 to 31 with attractive prizes. Among the activities are the BMS e-Sport Competition, Simpan SSPN Colouring Contest, the #BMS TikTok Challenge 2022, Happy Hour Simpan SSPN and the Creative Fund Design Competition. The programme also offers the Cabutan WOW! 25 Tahun PTPTN, which the public can join by opening a new Simpan SSPN account or making an additional deposit into Simpan SSPN Plus or Simpan SSPN Prime. It offers prizes worth almost RM1 million for 350 winners who participate in any of the three campaigns, including the Silver Series Draw, Silver Jubilee Yearly Draw, and Babyku Simpan Special Draw. For more information on BMS 2022, the public can log on to www.ptptn.gov.my or visit PTPTN's official social media platforms. |

|

|

Oct 5 2022, 11:06 PM Oct 5 2022, 11:06 PM

|

Junior Member

395 posts Joined: Mar 2011 |

if you guys notice some of the newly launch project price are cheaper/sqft,in same area compare to last few year proj noice..

|

|

|

Oct 15 2022, 01:06 AM Oct 15 2022, 01:06 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

https://www.malaymail.com/news/malaysia/202...-year-low/33380 Declining population growth and ageing population means poorperly price will likely depressed in the long term. This post has been edited by icemanfx: Oct 15 2022, 01:10 AM |

|

|

|

|

|

Oct 23 2022, 01:28 AM Oct 23 2022, 01:28 AM

Show posts by this member only | IPv6 | Post

#4027

|

All Stars

21,457 posts Joined: Jul 2012 |

3 element. Sold RM 198,000. 504sf

https://www.facebook.com/Selangorauctionproperty studio near klcc for <200k |

|

|

Oct 24 2022, 02:26 PM Oct 24 2022, 02:26 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

langstrasse liked this post

|

|

|

Oct 30 2022, 11:14 AM Oct 30 2022, 11:14 AM

Show posts by this member only | IPv6 | Post

#4029

|

All Stars

21,457 posts Joined: Jul 2012 |

https://www.credit-suisse.com/media/assets/...tabook-2022.pdf It seems number of adults in this country that have >usd 100k net worth has dropped in 2021. |

|

|

Oct 30 2022, 11:39 AM Oct 30 2022, 11:39 AM

|

Junior Member

436 posts Joined: Dec 2021 |

QUOTE(icemanfx @ Oct 30 2022, 11:14 AM) https://www.credit-suisse.com/media/assets/...tabook-2022.pdf Reading on my phone, which page?It seems number of adults in this country that have >usd 100k net worth has dropped in 2021. Edit: found it This post has been edited by Sihambodoh: Oct 30 2022, 11:41 AM |

|

|

Nov 3 2022, 11:52 AM Nov 3 2022, 11:52 AM

Show posts by this member only | IPv6 | Post

#4031

|

All Stars

21,457 posts Joined: Jul 2012 |

PRIOR to the Covid-19 special withdrawal schemes, about 3.3 million or 22% of Employees Provident Fund (EPF) members were able to meet the basic savings target.

Following the withdrawal schemes, this number had dropped to 2.3 million or 14.9% of all EPF members, as at July 2022. As of the same period, about half or 51.7% of the total 12.78 million EPF members aged below 55 years old have minimal retirement savings of less than RM10,000. .... Basic savings refer to the amount that is considered sufficient to support members’ basic needs for 20 years upon retirement. It is benchmarked against the minimum pension for public sector employees, which is RM1,000 per month. This rate of RM1,000 can only cover basic needs and is lower than the estimated minimum monthly expenses of RM2,500 required for a senior citizen to lead a reasonable standard of living, as recommended in the Belanjawanku Guide. This translates into an adequate savings target of about RM600,000 to last for 20 years of retirement, said the EPF. As of July 2022, only about 15.6% of active members in the 25 to 29 age category are able to meet basic savings; 30 to 34 (34.4%), 35 to 39 (43.6%), 40 to 44 (44.9%), 45 to 49 (41.4%) and 50-plus (33.2%). Overall, only 28.3% of active members are able to meet basic savings over the same period. https://www.thestar.com.my/business/busines...ancial-literacy Over half of epf members will need to work beyond retirement age. those laughing at sg oap working at restaurant and hawker center may end up like them. |

|

|

Nov 18 2022, 01:29 PM Nov 18 2022, 01:29 PM

|

Junior Member

155 posts Joined: May 2006 |

Based on this thread activity it's safe to say property bubble is deflating hard and all those bbb are under water. 😂

|

|

|

Nov 25 2022, 10:01 PM Nov 25 2022, 10:01 PM

Show posts by this member only | IPv6 | Post

#4033

|

All Stars

21,457 posts Joined: Jul 2012 |

Oxford Economics calculated this week that prices for newly built homes across China reached 8.5 times average household disposable income last year. In the United States, that ratio peaked at 5.8 times in 2007, before the American housing bubble burst.

.... Oxford Economics estimated this week that housing demand was 8 million units per year from 2010 through 2019, but would drop to only 4.6 million per year from next year through 2030. https://www.nytimes.com/2022/11/25/business...developers.html Think tank Emir Research head of social, law and human rights Jason S.W. Loh said the present price-to-income ratio was around 4.5 to five times (or six times in some sub-cases). “A price-to-income ratio of 4.1 times and above is considered ‘seriously unaffordable’ based on the Median Multiple method recommended by the World Bank and the United Nations. “In 2020, the median house price was at RM295,000 and median annual household income was RM62,508. Our house price-to-income ratio was at 4.72 times that year. https://www.thesundaily.my/home/high-price-...sians-XK9408198 According to the Central Bank of Malaysia, a house is considered affordable if its cost does not exceed 30% of an individual’s gross income. The price-to-income ratio should not exceed 3.0, but from 2014 onwards, the range of the ratio is 4.0–4.4. Unsurprisingly, a 2019 report by Khazanah Research Institute asserted that houses in the country are “seriously unaffordable”. https://www.krinstitute.org/assets/contentM...%20Multiple.pdf This post has been edited by icemanfx: Nov 25 2022, 10:04 PM |

|

|

|

|

|

Nov 25 2022, 10:05 PM Nov 25 2022, 10:05 PM

Show posts by this member only | IPv6 | Post

#4034

|

Senior Member

1,757 posts Joined: Oct 2005 |

Tf is this thread of sign of property bubble about?

Rent rate this month sudah naik. What bubble. Ive been hearing 5 years ago. Nothing happen even during pandemic |

|

|

Nov 25 2022, 10:18 PM Nov 25 2022, 10:18 PM

|

Senior Member

1,590 posts Joined: Oct 2010 |

|

|

|

Nov 26 2022, 09:02 AM Nov 26 2022, 09:02 AM

Show posts by this member only | IPv6 | Post

#4036

|

Senior Member

577 posts Joined: Aug 2005 |

|

|

|

Nov 26 2022, 05:29 PM Nov 26 2022, 05:29 PM

Show posts by this member only | IPv6 | Post

#4037

|

Senior Member

1,757 posts Joined: Oct 2005 |

|

|

|

Nov 26 2022, 05:35 PM Nov 26 2022, 05:35 PM

|

Junior Member

128 posts Joined: Aug 2021 |

|

|

|

Nov 28 2022, 10:16 PM Nov 28 2022, 10:16 PM

Show posts by this member only | IPv6 | Post

#4039

|

All Stars

21,457 posts Joined: Jul 2012 |

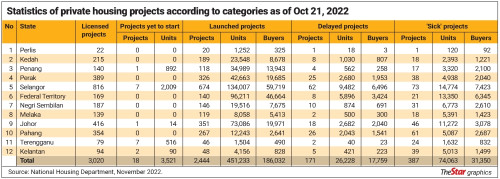

SELANGOR has the most number of abandoned or “sick” housing projects based on statistics released by the National Housing Department as at Oct 21, 2022. According to the Housing and Local Government Ministry, a “sick” housing project is one that has been delayed by more than 30% of its scheduled process or where the sale and purchase agreement (SPA) has lapsed. There are 387 “sick” projects in the country. Out of this number, the department listed 73 in Selangor with 14,774 units involving 7,423 buyers. Selangor also has 62 delayed projects comprising 9,842 units and affecting 6,496 buyers. Despite holding pole position with the most number of “sick” housing projects in the country, statistics further show that in the same period 674 housing projects with 134,007 units were launched in Selangor involving 59,710 buyers. .... “With 387 ‘sick’ projects against 2,444 launched projects, it indicates that the fate of nearly 16% of house buyers is determined by errant developers. “Hence for every 100 housing projects launched, 16 projects are diagnosed as ‘sick’.” https://www.thestar.com.my/metro/metro-news...jects-fall-sick This post has been edited by icemanfx: Nov 28 2022, 10:17 PM |

|

|

Dec 15 2022, 10:57 PM Dec 15 2022, 10:57 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

From Hong Kong to Malaysia, property markets set to decline: IMF

https://asia.nikkei.com/Business/Markets/Pr...-to-decline-IMF |

| Change to: |  0.0276sec 0.0276sec

1.16 1.16

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 02:08 AM |