http://www.starproperty.my/index.php/artic...-while-you-can/

QUOTE

“IF YOUR grandfather did not do, your father forgot to do, you still do not want to do, your grandson will not know what to do,” joked MCT Bhd leasing director Teoh Eng Poh on the dilemma faced by property buyers.

In the recent inaugural Star-925, he suggested that properties in Malaysia are staring at a high possibility of a second wave of price hike, similar to the booming of house prices from 2009 to 2014, in which the compound annual growth rate stood at a whopping 10.1%.

“Two major boosters are going to affect the property prices. Firstly, Greater Kuala Lumpur is moving towards an infrastructural era with the upcoming mega transportation projects.

“Secondly, China’s One Belt One Road initiative will see Chinese investment pouring in our property market. Hence, a big wave is on its way,” Teoh said.

According to the latest data from JLL’s Global Capital Flows, China has hit a record of US$33bil (approximately RM146bil) in overseas commercial and residential property investment last year.

On top of that, Teoh touted Bandar Malaysia to be one of the main drivers for the property market in years to come, drawing comparisons to the success of Kuala Lumpur city centre (KLCC).

“Twenty years ago, KLCC was developed within a 100-acre land at RM400 per sq ft. Today, it is approximately RM3,000 per sq ft.

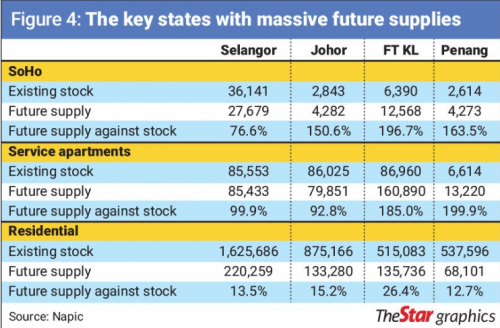

“Bandar Malaysia site covers a total area of 486 acres. The potential is huge,” he added.Teoh also said the property market slowdown in recent years was due to the mismatch in supply and demand.

“When we talk about supply and demand, there is a misconception. It is not a case of supply outstripping demand, but rather an oversupply of products not suited to the consumers’ demand,” he explained.

However, facing a soft market, property developers are now building more affordable houses, which opens the door for the younger generation to own a home.

“One who has the capacity to buy now should not wait till you miss out the opportunity of owning a home. The longer you wait, the tougher homeownership will become.

“In emerging markets like Malaysia, property remains an asset that can build wealth for multi-generations,” he said.

Teoh warned that in developed markets such as Hong Kong, where prices have shot through the roof, it can take generations to acquire a property.

The Property Market Outlook talk was jointly organised by Starproperty.my and the 925 movement. The Star-925 initiative is intended to help employees become more valuable at their workplace, which enables growth in their income stream. Thus, it will allow them to gain more leverage to build wealth through sustainable property ownership.

This initiative will run frequent events that bring together specialised speakers to benefit its members and the attendees.

In the recent inaugural Star-925, he suggested that properties in Malaysia are staring at a high possibility of a second wave of price hike, similar to the booming of house prices from 2009 to 2014, in which the compound annual growth rate stood at a whopping 10.1%.

“Two major boosters are going to affect the property prices. Firstly, Greater Kuala Lumpur is moving towards an infrastructural era with the upcoming mega transportation projects.

“Secondly, China’s One Belt One Road initiative will see Chinese investment pouring in our property market. Hence, a big wave is on its way,” Teoh said.

According to the latest data from JLL’s Global Capital Flows, China has hit a record of US$33bil (approximately RM146bil) in overseas commercial and residential property investment last year.

On top of that, Teoh touted Bandar Malaysia to be one of the main drivers for the property market in years to come, drawing comparisons to the success of Kuala Lumpur city centre (KLCC).

“Twenty years ago, KLCC was developed within a 100-acre land at RM400 per sq ft. Today, it is approximately RM3,000 per sq ft.

“Bandar Malaysia site covers a total area of 486 acres. The potential is huge,” he added.Teoh also said the property market slowdown in recent years was due to the mismatch in supply and demand.

“When we talk about supply and demand, there is a misconception. It is not a case of supply outstripping demand, but rather an oversupply of products not suited to the consumers’ demand,” he explained.

However, facing a soft market, property developers are now building more affordable houses, which opens the door for the younger generation to own a home.

“One who has the capacity to buy now should not wait till you miss out the opportunity of owning a home. The longer you wait, the tougher homeownership will become.

“In emerging markets like Malaysia, property remains an asset that can build wealth for multi-generations,” he said.

Teoh warned that in developed markets such as Hong Kong, where prices have shot through the roof, it can take generations to acquire a property.

The Property Market Outlook talk was jointly organised by Starproperty.my and the 925 movement. The Star-925 initiative is intended to help employees become more valuable at their workplace, which enables growth in their income stream. Thus, it will allow them to gain more leverage to build wealth through sustainable property ownership.

This initiative will run frequent events that bring together specialised speakers to benefit its members and the attendees.

Mar 5 2017, 09:28 PM

Mar 5 2017, 09:28 PM

Quote

Quote

0.0294sec

0.0294sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled