QUOTE(icemanfx @ Apr 27 2022, 04:36 PM)

Robertson and D'Sara Sentral. Not totally failed but subsale price 40% below SPA price. Room partitioning and airbnb also not enough to cover installment.

can share robertson where can buy 40% below spa price?Multiple Signs of Malaysia Property Bubble V20

|

|

May 8 2022, 09:42 AM May 8 2022, 09:42 AM

|

All Stars

10,722 posts Joined: Nov 2011 |

|

|

|

|

|

|

May 9 2022, 01:10 PM May 9 2022, 01:10 PM

Show posts by this member only | IPv6 | Post

#3862

|

Senior Member

2,282 posts Joined: Sep 2019 |

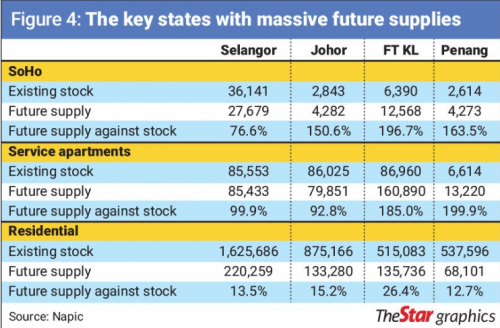

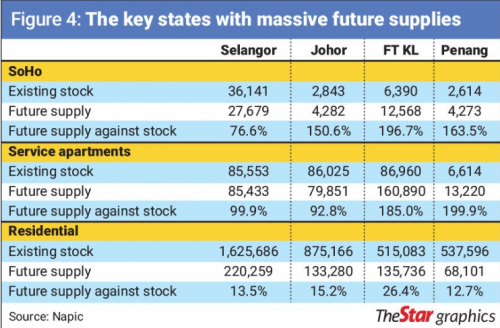

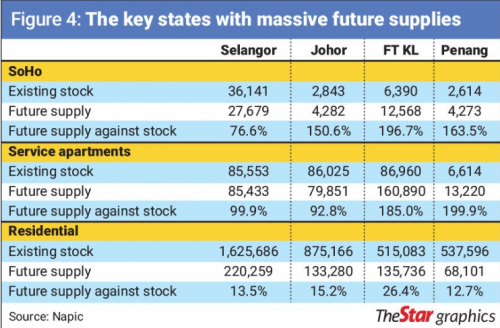

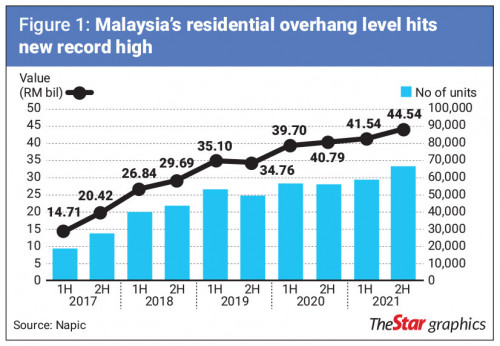

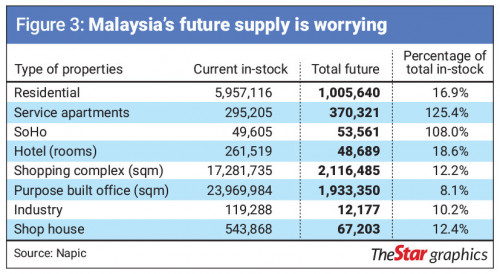

Just updating the numbers Year - number of overhang residential units 2017 - 24k units 2018 - 32k units 2019 - 48k units 2020 - 57k units 2021 - 64k units (184k total unsold) 2022 - still waiting for data More supplies to come! Source: https://www.thestar.com.my/business/busines...that-never-pops "despite the massive amount of overhang that we see in the service apartments and Soho segments, developers remained optimistic to build even more of them and future supply is expected to be more than the current inventory"  Think thrice before invest into properties Mr Gray, langstrasse, and 3 others liked this post

|

|

|

May 9 2022, 01:29 PM May 9 2022, 01:29 PM

|

Junior Member

436 posts Joined: Dec 2021 |

QUOTE(HereToLearn @ May 9 2022, 01:10 PM) Just updating the numbers Many flippers still delusional to think the price will only keep going up. Year - number of overhang residential units 2017 - 24k units 2018 - 32k units 2019 - 48k units 2020 - 57k units 2021 - 64k units (184k total unsold) 2022 - still waiting for data More supplies to come! Source: https://www.thestar.com.my/business/busines...that-never-pops "despite the massive amount of overhang that we see in the service apartments and Soho segments, developers remained optimistic to build even more of them and future supply is expected to be more than the current inventory"  Think thrice before invest into properties Let's see what happens when we enter recession. |

|

|

May 9 2022, 01:38 PM May 9 2022, 01:38 PM

Show posts by this member only | IPv6 | Post

#3864

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

May 9 2022, 04:09 PM May 9 2022, 04:09 PM

Show posts by this member only | IPv6 | Post

#3865

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Sihambodoh @ May 9 2022, 01:29 PM) Many flippers still delusional to think the price will only keep going up. Already dropping since 2014-2016. Maybe they just didnt study enough and got duped by "gurus" Let's see what happens when we enter recession. langstrasse and KenM liked this post

|

|

|

May 16 2022, 01:16 AM May 16 2022, 01:16 AM

|

Junior Member

51 posts Joined: Mar 2011 |

QUOTE(AskarPerang @ Mar 17 2022, 02:43 PM) Hi Auction God AskarPerang |

|

|

|

|

|

May 16 2022, 01:44 AM May 16 2022, 01:44 AM

Show posts by this member only | IPv6 | Post

#3867

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

QUOTE(xianw @ May 16 2022, 01:16 AM) Hi Auction God AskarPerang The unit was called off last month. Reserve price was at 1.89M. Owner managed to save the unit from being auctioned off. |

|

|

May 16 2022, 02:18 AM May 16 2022, 02:18 AM

|

Senior Member

2,725 posts Joined: Jan 2021 |

what are some risks of auction housing?

got risk like paying 20% downpayment? thats what i knew only |

|

|

May 16 2022, 08:24 AM May 16 2022, 08:24 AM

Show posts by this member only | IPv6 | Post

#3869

|

Junior Member

916 posts Joined: Sep 2016 |

|

|

|

May 16 2022, 08:43 AM May 16 2022, 08:43 AM

Show posts by this member only | IPv6 | Post

#3870

|

Senior Member

1,590 posts Joined: Oct 2010 |

QUOTE(HereToLearn @ May 9 2022, 01:10 PM) Just updating the numbers Thanks for sharing, but the article is behind a paywall. Any chance of posting the full article text here please?Year - number of overhang residential units 2017 - 24k units 2018 - 32k units 2019 - 48k units 2020 - 57k units 2021 - 64k units (184k total unsold) 2022 - still waiting for data More supplies to come! Source: https://www.thestar.com.my/business/busines...that-never-pops "despite the massive amount of overhang that we see in the service apartments and Soho segments, developers remained optimistic to build even more of them and future supply is expected to be more than the current inventory"  Think thrice before invest into properties |

|

|

May 18 2022, 09:01 PM May 18 2022, 09:01 PM

Show posts by this member only | IPv6 | Post

#3871

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ May 18 2022, 07:56 PM) Lelong unit sold below 300K today. Size: 586sqft (studio) Sold at 261K. Single bidder won unchallenged. Good catch.  QUOTE(AskarPerang @ May 18 2022, 08:17 PM) |

|

|

May 18 2022, 09:41 PM May 18 2022, 09:41 PM

Show posts by this member only | IPv6 | Post

#3872

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(-mystery- @ May 16 2022, 02:18 AM) It’s 10% downpayment, burn if you can’t settle your loan disbursement within 90 or 120 days (depends on the terms in POS).Main risk is still previous owner refuse to move out or sabo the property before moving out. Hence, always go for either vacant or tenanted unit (not owner stay). |

|

|

May 18 2022, 09:53 PM May 18 2022, 09:53 PM

|

Senior Member

2,725 posts Joined: Jan 2021 |

QUOTE(scorptim @ May 18 2022, 09:41 PM) It’s 10% downpayment, burn if you can’t settle your loan disbursement within 90 or 120 days (depends on the terms in POS). so normally bankers are not willing to accept lelong offer?Main risk is still previous owner refuse to move out or sabo the property before moving out. Hence, always go for either vacant or tenanted unit (not owner stay). if owner refuse to move out have to sue them as well using own money? |

|

|

|

|

|

May 18 2022, 10:05 PM May 18 2022, 10:05 PM

Show posts by this member only | IPv6 | Post

#3874

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(-mystery- @ May 18 2022, 09:53 PM) so normally bankers are not willing to accept lelong offer? Bankers will give you the loan as long as you are eligible but the thing about lelong properties is that you need to sort out all the paperwork and red tape completely e.g. settle all land office, maintenance fees, any unpaid taxes etc which usually you can claim bank from the auctioning bank first then the bank will disburse your funds. It’s a lot more work to be done compared to buying normal new or subsale properties.if owner refuse to move out have to sue them as well using own money? If prev owner refuse to move out then you need to take legal action using own money to evict them and your loan repayment starts from the month the loan is disbursed so you gotta pay loan for a place you can’t live in yet plus whatever legal fees. |

|

|

May 18 2022, 10:36 PM May 18 2022, 10:36 PM

|

Senior Member

2,725 posts Joined: Jan 2021 |

QUOTE(scorptim @ May 18 2022, 10:05 PM) Bankers will give you the loan as long as you are eligible but the thing about lelong properties is that you need to sort out all the paperwork and red tape completely e.g. settle all land office, maintenance fees, any unpaid taxes etc which usually you can claim bank from the auctioning bank first then the bank will disburse your funds. It’s a lot more work to be done compared to buying normal new or subsale properties. gamble for a far lower price property laIf prev owner refuse to move out then you need to take legal action using own money to evict them and your loan repayment starts from the month the loan is disbursed so you gotta pay loan for a place you can’t live in yet plus whatever legal fees. no wonder its rich people game |

|

|

May 18 2022, 10:43 PM May 18 2022, 10:43 PM

Show posts by this member only | IPv6 | Post

#3876

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(-mystery- @ May 18 2022, 10:36 PM) Rich and not rich also can play but if you not rich then put in more effort to stalk the property properly la. Personally I would recommend going for tenanted properties as it is so easy to strike a deal with the tenant when they know their owner house is about to kena auction and whenever I find a tenanted unit it’s almost as if you’re buying a normal subsale unit where you can go in and view the whole unit entirely first before going for the auction. |

|

|

May 22 2022, 06:12 PM May 22 2022, 06:12 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

May 22 2022, 07:59 PM May 22 2022, 07:59 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(-H20- @ May 22 2022, 07:23 PM) Malehsian are poorer than most expected. |

|

|

May 24 2022, 02:34 PM May 24 2022, 02:34 PM

Show posts by this member only | IPv6 | Post

#3879

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(anson@ryan @ May 24 2022, 09:25 AM) |

|

|

May 29 2022, 08:05 PM May 29 2022, 08:05 PM

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(icemanfx @ May 9 2022, 01:38 PM)   Future supply against stock of high rise in % is the scary part. until overhang is reduced substantially, price will remain suppressed. Huge increase of supply incoming, property overhang to get worse and worse, especially for the high rise. langstrasse liked this post

|

| Change to: |  0.0333sec 0.0333sec

1.52 1.52

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 05:16 PM |