QUOTE(Syie9^_^ @ Feb 16 2022, 11:56 PM)

Unfortunately not yetMultiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Feb 17 2022, 07:07 PM Feb 17 2022, 07:07 PM

Show posts by this member only | IPv6 | Post

#3841

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

|

|

|

Feb 21 2022, 10:29 AM Feb 21 2022, 10:29 AM

Show posts by this member only | IPv6 | Post

#3842

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Feb 20 2022, 11:01 PM) Updated list. 4 active lelong units in the market currently. Including 1 unit from the low rise "luxury" unit. A-18-05, Residensi Sembilan Cheras Reserve price 🔥🔥RM 306,180🔥🔥 Freehold 1124 sqft Auction: 25th Feb 2022 (Fri), 11.30AM A-02-10, Residensi Sembilan Cheras Reserve price 🔥🔥RM 720,000🔥🔥 Freehold 1211 sqft Auction: 21st Feb 2022 (Mon), 3.00PM A-21-08, Residensi Sembilan Cheras Reserve price 🔥🔥RM 415,530🔥🔥 Freehold 1502 sqft Auction: 25th Feb 2022 (Fri), 11.30AM B-01-03, Residensi Sembilan Cheras Reserve price 🔥🔥RM 650,000🔥🔥 Freehold 2758 sqft Auction: 21st Feb 2022 (Mon), 3.00PM QUOTE(AskarPerang @ Feb 20 2022, 11:06 PM) Never ending lelong units from here. 3 more cheap active lelong units in the market currently. Details as below: 1. T1-13-09, 1039sqft, RP: 406,782. Auction: 25th Feb 2022 (Fri), 11.30AM 2. T2-39-3A, 1127sqft, RP: 432,000. Auction in Mac 22. 3. T3-3A-09, 996sqft, RP: 401,400. Auction in Mac 22. QUOTE(AskarPerang @ Feb 20 2022, 11:12 PM) No bidder even at below 600K. Further price drop. Vacant unit. Updated details as below: B-13A-7, Residensi Andes Ria Reserve price🔥🔥RM 524,900🔥🔥 Freehold 1843 sqft (private lift) Auction: 10th Mac 2022 *Non bumi lot *Vacant unit » Click to show Spoiler - click again to hide... « QUOTE(AskarPerang @ Feb 20 2022, 11:20 PM) Another lelong unit check in at 3rd round re-auction. Drop from 1.3M. 08-3A, Residensi Sefina Mont' Kiara Reserve price🔥🔥RM 1,053,000🔥🔥 Freehold 1548 sqft Auction: 25-Feb-2022 *Vacant brand new condition » Click to show Spoiler - click again to hide... « QUOTE(AskarPerang @ Feb 20 2022, 11:25 PM) |

|

|

Feb 21 2022, 05:09 PM Feb 21 2022, 05:09 PM

Show posts by this member only | IPv6 | Post

#3843

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Jan 24 2022, 09:19 PM) Another cheap lelong unit check in. F-17-3A, Residensi Flora One South (Greenz @ One South) Reserve price 🔥🔥RM 351,000🔥🔥 Leasehold until year 2094 1082 sqft Auction: 17th Feb 2022 (Thu), 10.30AM *Vacant unit Layout: » Click to show Spoiler - click again to hide... « QUOTE(AskarPerang @ Feb 21 2022, 03:23 PM) |

|

|

Feb 22 2022, 12:18 AM Feb 22 2022, 12:18 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(scorptim @ Feb 21 2022, 11:57 PM) 1 mil above memang a lot of good deals. If you rich go for the 2m above ones even more better deals, more than 50% also. QUOTE(Icehart @ Feb 21 2022, 11:59 PM) Subsale 800k and above very hard to sell Puchong already got quite a few 700k and above end lot 22x75 but not moving for the past one year QUOTE(scorptim @ Feb 22 2022, 12:11 AM) If I kaya, I already sapu lo. Those are just mampu tengok for me which I come across when I scouting for poorfag houses. But seriously if you have the money, a lot of those 3-5m market price props going for 2m++. QUOTE(scorptim @ Feb 22 2022, 12:14 AM) |

|

|

Feb 22 2022, 10:54 AM Feb 22 2022, 10:54 AM

Show posts by this member only | IPv6 | Post

#3845

|

Senior Member

700 posts Joined: Nov 2009 |

I-zen II Mont Kiara also got good deal

Drop from 1M. No. 26-2, 26th Floor, Kiara II (I-Zen @ Kiara II), Jalan Kiara, Mont Kiara, Off Jalan Bukit Kiara, 50280 KL Reserve price🔥🔥RM 765,000🔥🔥 Freehold 1561 sqft Auction: 17-Mar-2022 |

|

|

Feb 22 2022, 10:56 AM Feb 22 2022, 10:56 AM

Show posts by this member only | IPv6 | Post

#3846

|

Junior Member

190 posts Joined: Feb 2021 |

Where to get all this lelong units info?

Other than askar perang posted ? |

|

|

|

|

|

Feb 22 2022, 06:01 PM Feb 22 2022, 06:01 PM

|

Junior Member

566 posts Joined: Oct 2012 |

|

|

|

Mar 1 2022, 03:04 PM Mar 1 2022, 03:04 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

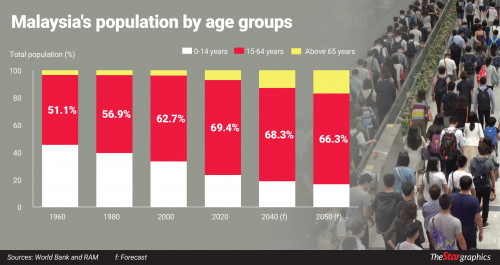

PETALING JAYA: Surging deflationary pressure, shrinking labour force and lower tax collection are set to be the scenario as corporate Malaysia transitions into an ageing society. With this scenario on the horizon, economists said it would have negative implications on the economy, thus proactive measures need to be mobilised to ensure economic sustainability. With around 7% of the population aged more than 65 in 2020, the country has met the World Bank’s threshold definition of an ageing country. The bank said that by 2044, 14% of the population is expected to be over the age of 65, making Malaysia an “aged society”. Come 2056, Malaysia would be a “super-aged society”, with over 20% of its population above the age of 65, it noted. https://www.thestar.com.my/business/busines...-retirement-age Home price is likely depressed in ageing nation. This post has been edited by icemanfx: Mar 1 2022, 03:04 PM |

|

|

Mar 4 2022, 11:02 PM Mar 4 2022, 11:02 PM

Show posts by this member only | IPv6 | Post

#3849

|

All Stars

21,457 posts Joined: Jul 2012 |

The average house price in KL for the year 2000 was RM245,249 and RM708,812 in 1Q2021, with a 5.6% average annual change over the 20 years. The most significant yearly change is in 2012, with a 17.48% increase. There were continuous declines in the pattern of price growth for 2018, 2019 and 2020 with -4.53%, -12.76% and -4.13%, respectively.

Selangor’s average house price in 2000 was RM204,105 and RM534,846 in 1Q2021. The average annual change over the 20 years was 4.8%. The average house price for Johor in 2000 was RM132,872, whereas in 1Q2021, it was RM350,000. The average annual change between the 20 years was 4.8%. The average house price for Penang in 2000 was RM174,279 and RM300,000 in 1Q2021, with an average annual change of 3.2% over the 20 years. There was a decline in 2018 and 2019 by 16.14% and 5.60% respectively, while prices stabilised in 2020. https://www.edgeprop.my/content/1901376/res...e-over-20-years In the long term, poorperly value rise at about inflation rate. This post has been edited by icemanfx: Mar 4 2022, 11:09 PM |

|

|

Mar 12 2022, 02:50 AM Mar 12 2022, 02:50 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Mar 11 2022, 11:53 PM) Few years after completion. Still got so many lelong units in the market. All dropping price each round drop 10%. Latest list of active lelong units as below: 1. 𝐓𝟑-𝟎𝟏-𝟏𝟎 Size: 586 sqft Auction Price: RM322,000 Auction Date: 16th March 2022 2. 𝐓𝟏-𝟏𝟑-𝟎𝟗 Size: 1039 sqft Auction Price: RM366,104 (BUMI LOT) Auction Date: 16th March 2022 3. 𝐓𝟐-𝟑𝟗-𝟑𝐀 Size: 1127 sqft Auction Price: RM432,000 Auction Date: 16th March 2022 4. 𝐓𝟑-𝟑𝐀-𝟎𝟗 Size: 996 sqft Auction Price: RM402,000 Auction Date: 17th March 2022 5. 𝐓𝟐-𝟐𝟕-𝟎𝟏 Size: 1150 sqft Auction Price: RM567,000 Auction Date: 21st March 2022 6. 𝐓𝟐-𝟑𝟕-𝟎𝟏 Size: 1127 sqft Auction Price: RM558,000 Auction Date: 21st March 2022 7. 𝐓𝟐-𝟑𝟐-𝟎𝟏 Size: 1127 sqft Auction Price: RM558,000 Auction Date: 21st March 2022 |

|

|

Mar 18 2022, 03:06 AM Mar 18 2022, 03:06 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Mar 17 2022, 02:43 PM) Another lelong unit sold yesterday. B-10-07, single bidder won unchallenged at 635K. Good catch. :thumbsup:  QUOTE(ck2chan @ Mar 18 2022, 12:35 AM) https://www.iproperty.com.my/property/chera...sale-101694250/ This post has been edited by icemanfx: Mar 18 2022, 03:07 AMRM572,000 for 2,027 sqft. Good for family own stay, big size. cannot find in KL areas. |

|

|

Mar 24 2022, 12:19 AM Mar 24 2022, 12:19 AM

Show posts by this member only | IPv6 | Post

#3852

|

All Stars

21,457 posts Joined: Jul 2012 |

The National Census 2020 revealed that the population percentage of senior citizens aged 65 and above has increased significantly in the past two decades.

It now stands at 6.8 percent or 2.2 million in 2020 compared to 3.9 percent in 2000. According to the United Nations standards, a country or region is defined as an ageing society if those aged 65 and above are between seven and 14 percent of the entire population. Therefore, Malaysia is on the cusp of becoming an ageing society. Although the percentage of the older population aged 65 and above increased steadily from 3.3 percent in 1970 to four percent in 2000, it suddenly spiked to 6.8 percent in 2020. https://newslab.malaysiakini.com/census-2020/en |

|

|

Mar 24 2022, 09:30 AM Mar 24 2022, 09:30 AM

Show posts by this member only | IPv6 | Post

#3853

|

All Stars

21,457 posts Joined: Jul 2012 |

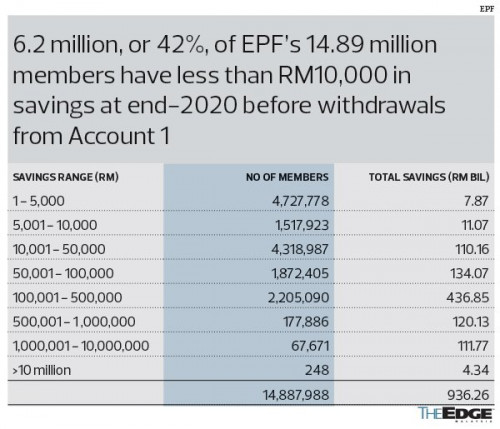

Only 3% of EPF contributors can afford retirement, an official of the Employees Provident Fund said today, noting that Covid-related withdrawals over the past two years have had a massive impact on the savings of contributors. In his presentation, Nurhisham said by the end of this year, 54% of EPF members aged 54 would have less than RM50,000 in their savings account; a majority of those who withdrew their entire EPF savings upon reaching age 55 would use it up within two to three years. https://www.freemalaysiatoday.com/category/...etire-says-epf/  This post has been edited by icemanfx: Mar 24 2022, 12:29 PM |

|

|

|

|

|

Apr 12 2022, 11:49 AM Apr 12 2022, 11:49 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(Chady @ Apr 12 2022, 12:29 AM) Launching 2022/2023: The more the merrier; more opportunity for suppliers, contractors, service providers, re agent, flippers, etc.Bangsar 1. Bangsar Rising Shah Alam 1. L&G - Aria Rimba - Terrace house Kwasa Damansara 1. YTL - Townhouses 2. Rimbun Damansara (AZRB) - Condo 3. Gadang Holdings Bhd - Terrace house and condo Mont Kiara 1. Kiaramas Dedaun - Asia Quest 2. Pavilion Mont Kiara 3. MK31 - UEM Sunrise 4. Bon Kiara - Bon Estate Bukit Bintang 1. SWNK House 2. The Orion Cheras 1. Sunway Alishan Taman Melawati 1. SkyWorld - SkyRia by the Hills |

|

|

Apr 16 2022, 06:13 PM Apr 16 2022, 06:13 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

The Employees Provident Fund (EPF) has received a total of 5.3 million applications worth RM40.1 billion under the special withdrawal facility as of 8pm Thursday (April 14).

“The number of applications received represented 44 percent out of the 11.95 million members who were eligible to withdraw their savings under the facility. “Breaking down by wage groups, this represented 55 percent of eligible B40 members (those earning less than RM1,700), 59 percent of M40 members (RM1,701 - RM4,900), and 39 percent of T20 members (earning above RM4,900),” it said. It said a further 29 percent of informal and inactive members also applied. https://m.malaysiakini.com/news/618282 https://www.theedgemarkets.com/article/epf-...drawal-facility This post has been edited by icemanfx: Apr 17 2022, 11:58 AM |

|

|

Apr 16 2022, 06:47 PM Apr 16 2022, 06:47 PM

Show posts by this member only | IPv6 | Post

#3856

|

Senior Member

1,923 posts Joined: Feb 2016 |

QUOTE(icemanfx @ Apr 16 2022, 06:13 PM) The Employees Provident Fund (EPF) has received a total of 5.3 million applications worth RM40.1 billion under the special withdrawal facility as of 8pm Thursday (April 14). Did read wrongly, T20 group earning 5k & above? Bila bar adjust downwards but still 20/100?“The number of applications received represented 44 percent out of the 11.95 million members who were eligible to withdraw their savings under the facility. “Breaking down by wage groups, this represented 55 percent of eligible B40 members (those earning less than RM1,700), 59 percent of M40 members (RM1,701 - RM4,900), and 39 percent of T20 members (earning above RM4,900),” it said. It said a further 29 percent of informal and inactive members also applied. https://m.malaysiakini.com/news/618282 |

|

|

Apr 17 2022, 12:33 PM Apr 17 2022, 12:33 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Apr 22 2022, 09:00 PM Apr 22 2022, 09:00 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(autodriver @ Apr 22 2022, 10:30 AM) I always held the belief that the housing property is good for own stay instead of investment. There are many new projects built for the past 5 yeras either high rise or landed look at the 2nd hand market most of these properties either are maintaining the initial selling price (or slightly higher due to renovated) or drop 10-20%. In year 2015 I almost bought the Koi Prima and the selling price started at RM 550k before 10% discount. I didn't buy because the location is far side of Puchong. Look at the 2nd market in 2022 the Koi Prima used value is as low as RM 350k. There was lelong unit which sold as low as RM 300k only in year 2021. I am lucky that I bought a double storey landed house in similar year even though it was outside KV but at least today 2nd hand value price is maintaining (it is losing still coz I have paid instalment for years). Will I invest in housing property, yes for own stay but won't buy for investment purpose. |

|

|

Apr 27 2022, 03:36 PM Apr 27 2022, 03:36 PM

Show posts by this member only | IPv6 | Post

#3859

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

May 8 2022, 05:25 AM May 8 2022, 05:25 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

| Change to: |  0.0486sec 0.0486sec

0.79 0.79

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 09:19 AM |