Excessive auction units show need for sustainable valuation model

SINCE 2019, the property market has been flooded with auction units spanning from Kuala Lumpur to Johor Baru.

According to property agents, 4,000 to 6,000 units of properties are flooding the market every year. Some units still fail to be sold off despite five or six rounds of price reduction. I came across one apartment in Puchong, Selangor, that went through almost 10 rounds of price reduction before it could be sold off.

To put this into perspective, every reduction usually amounts to 10 per cent off the previous price. The heaviest consequence is faced by property owners, whose dream-come-true moment of purchasing a new property ends in a nightmare.

Additionally, the number of auctions is not just high, but has surged to a new level, turning individual purchasers' nightmare into a nationwide one. I say so because property purchase is typically the biggest life decision for most people. As such, a wrong decision will definitely entail consequences severe enough to ruin one's family and even nation. Worse still, property transactions are gearing base, meaning that almost all transactions are sealed via bank borrowing by the purchaser.

Therefore, a plunge in property prices not only erodes owners' wealth, but pushes the borrower into limbo as well. If momentum builds in this direction, banks will encounter plenty of non-performing loans, jeopardising their balance sheet.

Ultimately, if we let this trend continue without any effective measures, individual purchasers, banks, and the nation will pay a costly price and may even slump into a crisis. We need to study the problem to determine the critical factors attributed to this phenomenon.

Once identified, effective measures can be rolled out to ensure the sustainability of property development nationwide. Most importantly, the harmony of the family unit can be sustained.

From my in-depth analysis of the property market over the last two decades, property prices started to gain an upward momentum in the 2010s, after almost a decade of inactive or stagnant prices.

The soaring prices became even more significant between 2014 and 2016. As a result, most developers started launching new properties with sky-high pricing. The booming economy and easy credit acquisition also contribute d to high property prices. Such an increase in property prices is in fact good for households, as it uplifts their social status.

However, property price hikes must fundamentally be economically supported. From 2015 to 2016, some property developers set prices at an extremely high level.

While they generate handsome profits, the adverse and nightmarish effects of their actions are what households and the nation are facing now — a record number of auction unit s and countless bankrupt purchasers, many of whom are still young. I noted a real case of this scenario that played out in Cyberjaya.

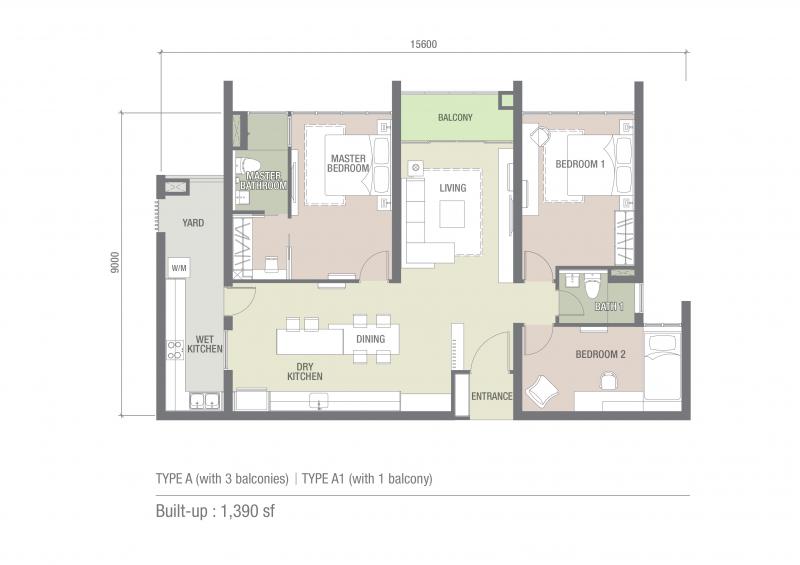

A few years ago, a young individual (A), in his 30s, bought a luxury apartment unit at a staggering price of RM900,000 for 775 sq ft — approximately RM1,161.29 per square foot.

This pricing rate in Cyberjaya is shocking, but what is even more alarming is that there were many more properties launched at the time with such prices.

Purchasers were still bullish in their outlook despite sky-rocketing prices. Unsurprisingly, these property purchasers' bullish stance has turned into a catastrophe, particularly in the last two years. To illustrate, A had secured a loan for RM800,000, equivalent to approximately a RM4,000 monthly loan installment.

However, the market rental price could only stretch up to RM1,500 a month for that unit. Expectedly, after three years, A was unable to serve the loan commitment. In 2020, A's unit was auctioned off at a mere RM265,000.

In conclusion, A did not just lose the apartment unit through the forced auction sale, but has also slumped into outstanding debt of around RM500,000 that will impact his life. Certainly, this case depicts only the tip of the gargantuan iceberg that is the property market. Two questions stand out in my mind.

How were developers possibly allowed to sell at outrageous prices? How did banks allow such high valuations?

Therefore, parties ranging from regulators and developers to bankers and valuers must formulate a sustainable valuation model for property values to achieve mutually beneficial and interdependent social, environmental, and economic goals.

Only a sustainable valuation model can guarantee sustainable property development and a harmonious society.

https://www.nst.com.my/opinion/columnists/2...valuation-model

Feb 25 2021, 12:56 AM

Feb 25 2021, 12:56 AM

Quote

Quote

0.0438sec

0.0438sec

0.96

0.96

6 queries

6 queries

GZIP Disabled

GZIP Disabled