QUOTE(langstrasse @ Jul 25 2020, 09:39 AM)

imagine how much the owner lose.Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Jul 25 2020, 12:22 PM Jul 25 2020, 12:22 PM

Return to original view | Post

#1

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

|

|

|

Sep 23 2020, 12:38 AM Sep 23 2020, 12:38 AM

Return to original view | Post

#2

|

Junior Member

720 posts Joined: Oct 2008 |

All this lelong unit are new development?

Any old unit like seapark, oug Sri Petaling or taman sri muda? |

|

|

Jan 13 2021, 08:03 PM Jan 13 2021, 08:03 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

720 posts Joined: Oct 2008 |

QUOTE(Jliew168 @ Jan 13 2021, 03:45 PM) development rely much on bank loan, bank release loan base on occupancy rate.if unit not selling bank no release loan developer no water come in, development have to stop or delayed and the earliest buyer will lost confident in property purchase. what would you do if you are the developer? your development are halfway and you hair are soaking wet. |

|

|

Jan 13 2021, 08:13 PM Jan 13 2021, 08:13 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

Feb 22 2021, 11:02 AM Feb 22 2021, 11:02 AM

Return to original view | IPv6 | Post

#5

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

Mar 31 2021, 01:02 PM Mar 31 2021, 01:02 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

720 posts Joined: Oct 2008 |

QUOTE(icemanfx @ Mar 31 2021, 12:32 PM) A few years ago, a young individual (A), in his 30s, bought a luxury apartment unit at a staggering price of RM900,000 for 775 sq ft — approximately RM1,161.29 per square foot. This pricing rate in Cyberjaya is shocking, but what is even more alarming is that there were many more properties launched at the time with such prices. Purchasers were still bullish in their outlook despite sky-rocketing prices. Unsurprisingly, these property purchasers' bullish stance has turned into a catastrophe, particularly in the last two years. To illustrate, A had secured a loan for RM800,000, equivalent to approximately a RM4,000 monthly loan installment. However, the market rental price could only stretch up to RM1,500 a month for that unit. Expectedly, after three years, A was unable to serve the loan commitment. In 2020, A's unit was auctioned off at a mere RM265,000. In conclusion, A did not just lose the apartment unit through the forced auction sale, but has also slumped into outstanding debt of around RM500,000 that will impact his life. Certainly, this case depicts only the tip of the gargantuan iceberg that is the property market. Two questions stand out in my mind. How were developers possibly allowed to sell at outrageous prices? How did banks allow such high valuations? https://www.nst.com.my/opinion/columnists/2...valuation-model |

|

|

|

|

|

Apr 6 2021, 12:09 PM Apr 6 2021, 12:09 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

720 posts Joined: Oct 2008 |

QUOTE(Zoo Howl @ Apr 6 2021, 11:04 AM) I think its great that developer offer this kind of rebate that can be converted to downpayment Yeah, developer so good sell you markup price and give you rebate, the rebate goes back into developer pocket.Imagine young buyers with 2k-3k salary, how much can they save a month? With so low salary, things are getting pricier, some just manage to save rm200-400 per month While the property price is getting expensive, downpayment usually are 5 figures somewhere between 30k (assuming) If u are saving RM200-400 per month, u will need to work till ur ass off just to get enough money to pay downpayment! By that time u are already old, MRTA will be more expensive. Dont forget all these while the RM200-400 savings are for downpayment, how about those legal fee / SPA fee and etc? Those could come up to 5 figures as well Hence, developer offering certain fees for free + cash rebate is a great move , else it would takes 10-20 years to own a house... If you earning 2-3k and only manage to save 400/month means you are not ready to own a property, not ready to start family. Rent a room and stay alone. John00 and michaelchang liked this post

|

|

|

Apr 8 2021, 01:20 PM Apr 8 2021, 01:20 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

720 posts Joined: Oct 2008 |

QUOTE(Syie9^_^ @ Apr 8 2021, 01:14 PM) Does the rent included management fee? 8020life and michaelchang liked this post

|

|

|

Jun 10 2021, 09:41 AM Jun 10 2021, 09:41 AM

Return to original view | IPv6 | Post

#9

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

Jul 15 2021, 11:34 AM Jul 15 2021, 11:34 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

Jul 15 2021, 09:41 PM Jul 15 2021, 09:41 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

720 posts Joined: Oct 2008 |

QUOTE(AhBoy~~ @ Jul 15 2021, 09:12 PM) 2 side of the coin~ https://youtu.be/9iUanyq3ErE?t=120 developer need cash flow to survive. they keep launching new more expensive project to cover previous overhang unsold unit.pessimistic people vs the market is going boom, missing the boat soon~ thats why guru promoting bbb they literately korek a hole to cover another hole. its just matter of time when they gonna fall. |

|

|

Aug 10 2021, 06:20 PM Aug 10 2021, 06:20 PM

Return to original view | Post

#12

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

Sep 7 2021, 11:47 AM Sep 7 2021, 11:47 AM

Return to original view | IPv6 | Post

#13

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

|

|

|

Oct 6 2021, 08:38 PM Oct 6 2021, 08:38 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

Jan 19 2022, 05:58 PM Jan 19 2022, 05:58 PM

Return to original view | IPv6 | Post

#15

|

Junior Member

720 posts Joined: Oct 2008 |

|

|

|

Feb 15 2022, 07:18 PM Feb 15 2022, 07:18 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

720 posts Joined: Oct 2008 |

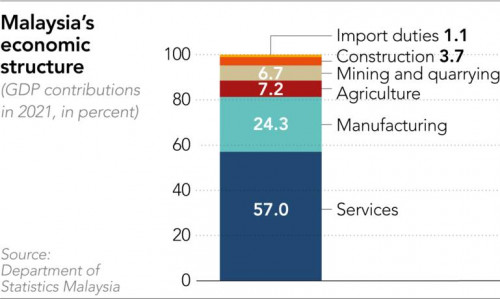

QUOTE(icemanfx @ Feb 15 2022, 11:02 AM)  Construction industry is smaller than most realized. It is better for the gomen to focus on services and manufacturing sector. agriculture and manufacturer can be international platform doing export. kevyeoh liked this post

|

|

|

May 29 2022, 08:32 PM May 29 2022, 08:32 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

720 posts Joined: Oct 2008 |

QUOTE(Mr Gray @ May 29 2022, 08:05 PM) Looks like the market will be stagnant for a really long time. i dont understand why bank still release loan with so many over hang unit in KV?Huge increase of supply incoming, property overhang to get worse and worse, especially for the high rise. bank being squeeze by developer? if developer fall they gonna drag along together with the bank. |

|

|

Jun 7 2022, 06:05 PM Jun 7 2022, 06:05 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

720 posts Joined: Oct 2008 |

Jun 7 2022, 10:11 PM |

|

|

|

|

|

Oct 2 2022, 11:18 AM Oct 2 2022, 11:18 AM

Return to original view | IPv6 | Post

#19

|

Junior Member

720 posts Joined: Oct 2008 |

i see almost all auction property. auction price sure cheaper 150k from bank value. how accurate is the bank value? can the evaluation trustable and every bank also evaluated the same amout?

|

|

|

Oct 2 2022, 11:50 AM Oct 2 2022, 11:50 AM

Return to original view | IPv6 | Post

#20

|

Junior Member

720 posts Joined: Oct 2008 |

QUOTE(Bendan520 @ Oct 2 2022, 11:21 AM) auction property is because a lot of compress loan, then people run away with cashout. those sohai compress loaner or bank die i dont care lar.you should blame developers for starting the trend “cash out” in the first place, people do compress loan for the sake of it. then can’t afford my concern is does those ban value price trustable? any legit department to justify the amout of bank value is correct? for example Auction price : 350k Bank value : 500k then bank suka suka raise the bank value Bank value : 700k Auction price : 550k This post has been edited by blek: Oct 2 2022, 11:52 AM |

| Change to: |  0.0286sec 0.0286sec

0.36 0.36

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 01:22 PM |