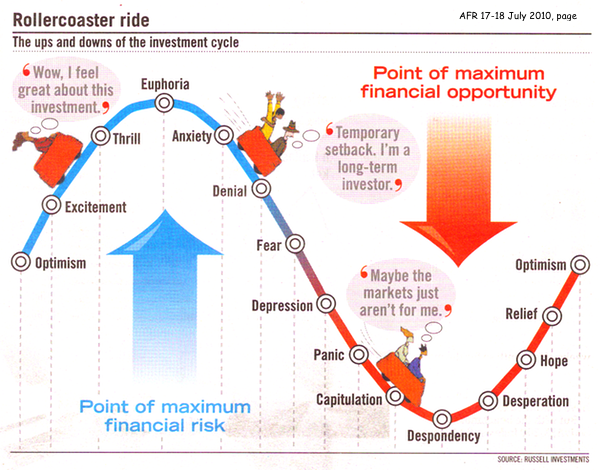

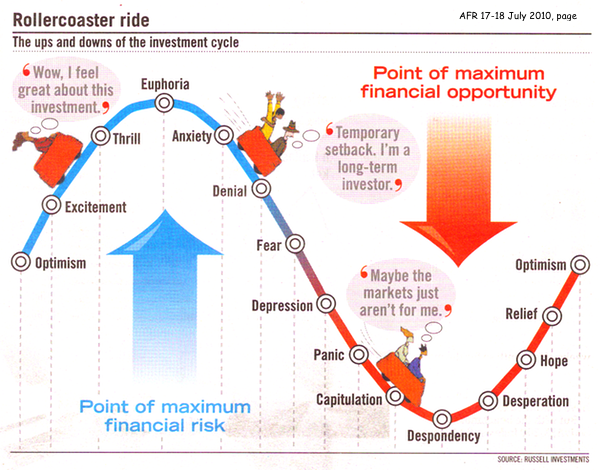

KV property is at early stage of down trend, many are in denial.

This post has been edited by icemanfx: Dec 24 2016, 12:04 AM

Multiple Signs of Malaysia Property Bubble V20

|

|

Dec 23 2016, 11:57 PM Dec 23 2016, 11:57 PM

Show posts by this member only | IPv6 | Post

#21

|

All Stars

21,456 posts Joined: Jul 2012 |

KV property is at early stage of down trend, many are in denial. This post has been edited by icemanfx: Dec 24 2016, 12:04 AM |

|

|

|

|

|

Dec 24 2016, 07:51 AM Dec 24 2016, 07:51 AM

|

Senior Member

9,616 posts Joined: Dec 2013 |

|

|

|

Dec 24 2016, 10:55 AM Dec 24 2016, 10:55 AM

Show posts by this member only | IPv6 | Post

#23

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Dec 24 2016, 11:08 AM Dec 24 2016, 11:08 AM

|

Junior Member

352 posts Joined: Mar 2009 |

|

|

|

Dec 25 2016, 11:57 AM Dec 25 2016, 11:57 AM

|

Senior Member

9,533 posts Joined: Jun 2013 |

|

|

|

Dec 25 2016, 06:57 PM Dec 25 2016, 06:57 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(goks @ Dec 25 2016, 05:19 PM) If u r a yield investor, see which one makes investment sense, new is nice but u may get 3% yield, old maybe u can get 7-8% then why worry? If one knows where to look, could find dead chicken even during property bullrun. Bravo!I have not bought a new property in the last 7 years, but I have purchased 4 properties, all on auction and 30-40% under prevailing market rate. I like new properties but I am not emotional, I only buy when I can get minimum 7% yield. So put ur emotions aside and make a business decision. Many think new properties will have tremendous capital gain, not always true except 1st buyer but tha too no one does a nett investment calculation after all the interest u have paid during construction if the capital gain is great or not. QUOTE(goks @ Dec 25 2016, 10:59 PM) It's always a calculated risk. My margin of loan is only 70% so 10% down isn't an issue. If I can be blunt, if u can't afford 10% of purchase price you should not be buying a property. This is the bull shit developers now created by illegal discounts which by law is illegal but no enforcement. I saved like hell 16 years back to buy my first property, 2 years saving, no car, then BY luck I got a decent relocation bonus from company, then I dumped 10% into a house. Today young Turks want everything fast and easy. This post has been edited by icemanfx: Dec 25 2016, 11:14 PMMaintenance is almost always paid by bank for all outstanding. I have not seen cases where buyer pays. Repairs - again no different then buying a sub sale. Any property u buy u will spend money to dget it up to ur taste, even new one. Vacant possession - can be an issue, keep 5k as contingency if u need to get court order. A good auction agent is key, don't ever trust normal real estate agents who only do auction part time as they only want to rip u off some commission , i work only with full time auction agents like auction list or Lelong tips. They help me sort out allot of issues and th y do this day in and out. Finally auction u can gain allot but it's also not something for people who are cash strapped. Example I may end up buying touts and syndicates out or give my agent some money to sort matters out, on average each auction cost me 5-8k of the addition cost but that gives me peace of mind. Property is a life long, illiquid, hard commitments. Many young Malaysians in general dive into it without and exit plan or holding plan. |

|

|

|

|

|

Dec 26 2016, 02:53 PM Dec 26 2016, 02:53 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Dec 30 2016, 12:49 PM Dec 30 2016, 12:49 PM

|

Senior Member

1,548 posts Joined: Apr 2005 |

QUOTE(axisresidence17 @ Dec 23 2016, 07:22 PM) Omg!!! ..just found out my fren condo is up for an auction from browsing the auction site 😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱 I had the same shock a while ago, when I noticed a house on auction in my neighborhood. After checking it was very close to my own house. Then after a while I noticed they started removing everything they possibly could from the house.So shocking! |

|

|

Dec 30 2016, 01:34 PM Dec 30 2016, 01:34 PM

|

Junior Member

352 posts Joined: Mar 2009 |

QUOTE(prody @ Dec 30 2016, 12:49 PM) I had the same shock a while ago, when I noticed a house on auction in my neighborhood. After checking it was very close to my own house. Then after a while I noticed they started removing everything they possibly could from the house. Omg! 😱😱😱 Must be traumatising especially if it is for families! |

|

|

Dec 30 2016, 01:46 PM Dec 30 2016, 01:46 PM

|

Junior Member

8 posts Joined: Aug 2016 |

worst to come. please get UUU to show you how many VP projects for 2017, 2018, and 2019

especially those pigeon holesssss |

|

|

Dec 30 2016, 01:48 PM Dec 30 2016, 01:48 PM

|

Junior Member

551 posts Joined: May 2013 |

Now renting also got good choices. Best

|

|

|

Dec 31 2016, 12:31 PM Dec 31 2016, 12:31 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

Invest in u.s stocks a few years ago could be a better option than kV property even without considering depreciating rm. |

|

|

Jan 3 2017, 10:28 AM Jan 3 2017, 10:28 AM

|

Junior Member

352 posts Joined: Mar 2009 |

So any bargain to be made in property yet? I was busy shopping at Zara to get items at 50% off 😂😂😍

|

|

|

|

|

|

Jan 3 2017, 06:13 PM Jan 3 2017, 06:13 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(TOMEI-R @ Jan 3 2017, 04:00 PM) How are the 'crooks' going to catch themselves? You already know who are the biggest 'crooks' in siphoning big sums of money out of the country. Expect banks to tighten lending with rising npl. Those hoping for quick flip is in for the long haul.buying domestic assets could never hedge against forex loss. Like mentioned, its just another better way of parking one's money other than saving it in the bank. You are right on the High NPL rates. This I confirmed with my bankers. Not only NPL high on residential loans, car loans, personal loans and credit cards are also recording high NPLs. This post has been edited by icemanfx: Jan 3 2017, 06:15 PM |

|

|

Jan 3 2017, 06:15 PM Jan 3 2017, 06:15 PM

Show posts by this member only | IPv6 | Post

#35

|

All Stars

24,219 posts Joined: Mar 2007 From: Kuala Lumpur |

QUOTE(icemanfx @ Jan 3 2017, 06:13 PM) Expect banks to tighten lending with rising npl. Those hoping for quick flip is in for the long haul. Bro you tagged my comment in the wrong thread. Btw, loans are sibeh hard to solicit right now. Bankers all giving stupid excuses for rejecting loans. Little bit reject, little bit ask for guarantor. This post has been edited by TOMEI-R: Jan 3 2017, 06:17 PM |

|

|

Jan 3 2017, 06:48 PM Jan 3 2017, 06:48 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(icemanfx @ Dec 31 2016, 12:31 PM)  Invest in u.s stocks a few years ago could be a better option than kV property even without considering depreciating rm. Ayam more worry if us not doing good Ayam may get lesser return but at much lower risk (currency risk?), less mistakes to be made (not all us stock make money) and less leveraged risk, long term wise property is a BBB UUU and easily outperform U.S. market. Nothing can stop it. Keep waiting for the bubble. |

|

|

Jan 5 2017, 03:31 AM Jan 5 2017, 03:31 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 3 2017, 06:48 PM) Sure us market is doing good Instead of individual stock, one could choose etf and brk.b.Ayam more worry if us not doing good Ayam may get lesser return but at much lower risk (currency risk?), less mistakes to be made (not all us stock make money) and less leveraged risk, long term wise property is a BBB UUU and easily outperform U.S. market. Nothing can stop it. Keep waiting for the bubble. On forex, rm already depreciated by over 30% in one year and likely to depreciates further. Most bought property on leverage. Profit as well as losses is magnified by leverage. Unless market sentiment changed, kV property is on downtrend. With oversupply and bank tightening residential loan, kV property is unlikely to uuu anytime soon. This post has been edited by icemanfx: Jan 5 2017, 03:37 AM |

|

|

Jan 5 2017, 04:51 AM Jan 5 2017, 04:51 AM

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

Challenging times ahead for property sector

|

|

|

Jan 5 2017, 11:16 PM Jan 5 2017, 11:16 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(icemanfx @ Jan 5 2017, 03:31 AM) Instead of individual stock, one could choose etf and brk.b. House do not exposed to any of the risk.On forex, rm already depreciated by over 30% in one year and likely to depreciates further. Most bought property on leverage. Profit as well as losses is magnified by leverage. Unless market sentiment changed, kV property is on downtrend. With oversupply and bank tightening residential loan, kV property is unlikely to uuu anytime soon. And Ayam is getting guaranteed 10-15% income every year? Why do Ayam need to worry about the risk? |

|

|

Jan 5 2017, 11:29 PM Jan 5 2017, 11:29 PM

Show posts by this member only | IPv6 | Post

#40

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 5 2017, 11:16 PM) House do not exposed to any of the risk. Every investment carry certain risks.And Ayam is getting guaranteed 10-15% income every year? Why do Ayam need to worry about the risk? If kv property could guaranteed 10-15% income every year, funds manager like Blackrock and every obasans would have invested, developers need not spend millions of RM on advertisement. |

| Change to: |  0.0279sec 0.0279sec

0.61 0.61

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 02:17 PM |