Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

GrumpyNooby

|

May 27 2020, 12:32 PM May 27 2020, 12:32 PM

|

|

QUOTE(Human Nature @ May 27 2020, 12:31 PM) Okay okay, then i no need go to the branch this week. Else everytime i just withdraw RM10  Sotong Bank is my primary banking account which has the most activity. The rest is just for decoration. FYI, I hate to step in to the bank branches. This post has been edited by GrumpyNooby: May 27 2020, 12:33 PM |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 12:56 PM May 27 2020, 12:56 PM

|

|

QUOTE(peach_on_tea @ May 27 2020, 12:54 PM) Not sure. You may ask the bank directly and let us know. I believe the offer you got from UOB is branch specific whereby info is not really available in their official bank portal. Either you get it from your RM or via SMS from your preferred branch. |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 01:08 PM May 27 2020, 01:08 PM

|

|

QUOTE(peach_on_tea @ May 27 2020, 01:06 PM) I don’t have UOB acc. Got the info from fb group just now. Cuz I believe here d info are most updated so check with you all 😆. If really got that good rate I might go to open an acc there. I didn't receive SMS from UOB regarding any FD promo. But yesterday somebody has shared for UOB OTC FD: QUOTE(babysotong @ May 26 2020, 07:55 PM) FD promo rates at UOB till 31/5 7 months 2.6%pa 9 months 2.75% pa |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 01:42 PM May 27 2020, 01:42 PM

|

|

QUOTE(babysotong @ May 27 2020, 01:40 PM) I checked, the UOB promo is applicable to all branches till 31 May or when fund size are fully size. However, it is not listed in their website. Dunno why. Normally if there got such FD promo, I'll be notified via SMS. Probably that team has been disregarded as non-essential perhaps.  |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 06:06 PM May 27 2020, 06:06 PM

|

|

QUOTE(kyleen @ May 27 2020, 06:04 PM) Good response from MBB, but bad experience for this time. MBB eIFD system is no good ( didn't show promo rate, difficult to apply eIFD if FPX from other bank...). Next time if MBB if apply eFD for MBB still need to think twice. Did you get any further with this ? MBB says I need to check with HLB first HLB say it will get back to me in 2-3 days 🤦 now I'm seriously pissed off at how long it will take to resolve this. A rather large sum of money is in nowhere-land and both banks doesn't seem to care ! @wxpng I had bad experience with DuitNow. It took 3 weeks to get my fund back. |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 12:14 PM May 28 2020, 12:14 PM

|

|

QUOTE(zenwell @ May 28 2020, 12:13 PM) Looks like a few ppl got problem with Maybank promotional eFD. Guess i won't be going with that. what other options besides Maybank? QUOTE(yongs90 @ May 23 2020, 04:41 PM) Summary FD Promotion Refer post 16472 https://forum.lowyat.net/topic/4154481/+164603m at 3.15% for Alliance Online selected customer 4m at 2.58% for PBe 6m at 2.88% for Affin Online/OTC 10m at 2.70% for OCBC eFD Affin eFD 14 May 2020 to 30 June 2020 3mths 2.68% 6mths 2.88% min: RM10k max: RM10k https://www.alliancebank.com.my/promotions/...ed-deposit.aspxAlliance Bank Offer 1 (Valid until 31 May 2020 only) 12mths 2.80% non privilege banking customer 12mths 2.85% privilege banking customer min: RM50k fresh fund Fresh Funds in CASA: min RM10k Offer 2 5 months step up fd month 1: 2.7% month 2: 2.8% month 3: 2.9% month 4: 3.0% (effeective step up rate) month 5: 3.6% Min: RM50k fresh fund Fresh Funds in CASA: min RM10k Offer 3 Refer link above for info Unit Trust + Fixed Deposit Bancassurance + Fixed Deposit https://www.hlb.com.my/en/personal-banking/...fd-i-promo.htmlHLBB eFD 15 May 2020 – 30 Jun 2020 3mths 2.6% min: RM5k fresh fund (FPX) https://www.cimbclicks.com.my/efd-may20.htm...FD%20May%202020CIMB eFD 18 May until 30 June 2020 3mths 2.45% 6mths 2.5% 12mths 2.55% min: RM5k use this to place: https://www.cimbclicks.com.my/fdratehttps://www.ocbc.com.my/personal-banking/ac...ed-deposit.htmlOCBC eFD 13 May till 31 May 2020 10mths 2.7% min: RM1k https://www.pbebank.com/pdf/Promotions/tc_efdviafpx-en.aspxPBB eFD 1 May 2020 to 31 May 2020 4mths 2.58% min: RM10k fresh fund (FPX) |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 02:14 PM May 28 2020, 02:14 PM

|

|

QUOTE(kinwawa @ May 28 2020, 02:09 PM) Thanks for sharing but none of of them even touches 3% pa. EIR is lower than the promo FD rate. |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 02:36 PM May 28 2020, 02:36 PM

|

|

QUOTE(hwachong @ May 28 2020, 02:35 PM) UOB taipan 3.39% 12m with 10% in casa Great rate. EIR is above 3% |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 08:00 PM May 28 2020, 08:00 PM

|

|

QUOTE(batsashimi @ May 28 2020, 07:56 PM) i just checked the tac for pbe fd via fpx, it says "The maximum deposit amount per FPX transaction is RM30,000 or the Eligible Participant’s individual Internet Banking Limit maintained with the respective bank, whichever is lower." If im placing 120k, does it mean i have to do the transaction 4 times? So there will be 4 placement? Correct. |

|

|

|

|

|

GrumpyNooby

|

May 29 2020, 01:16 PM May 29 2020, 01:16 PM

|

|

QUOTE(hwachong @ May 28 2020, 10:17 PM) asked my relationship manager. not on website So no RM, no access to such rate? QUOTE UOB taipan 3.39% 12m with 10% in casa |

|

|

|

|

|

GrumpyNooby

|

May 30 2020, 04:49 PM May 30 2020, 04:49 PM

|

|

QUOTE(kfchanx @ May 30 2020, 04:39 PM) What is CASA? Do we need to pay any service fees for Casa? CASA is either saving or current account. 10% needs to be earmarked into CASA. |

|

|

|

|

|

GrumpyNooby

|

May 31 2020, 08:50 AM May 31 2020, 08:50 AM

|

|

QUOTE(babysotong @ May 31 2020, 01:13 AM) I believe so as New-To-Bank customers would have to open a new FD and CASA. So, there would be paperwork and documents to verify. Anyway, UOB doesn't have eFD in this digital arena... 😂 UOB got eFD but they have don't eFD promo and placement via FPX. |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 10:54 AM Jun 1 2020, 10:54 AM

|

|

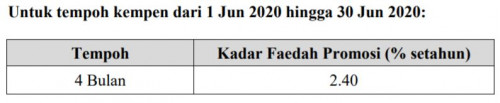

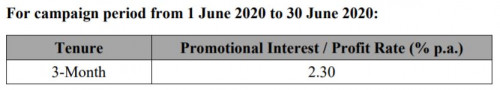

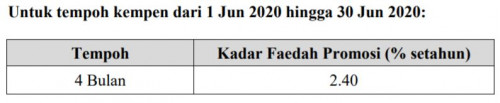

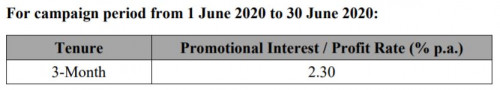

PB 2020 Double Bonus CampaignPlease be informed that the Fixed Deposit promotional interest rate for the “PB FD Bonus” under the “PB 2020 Double Bonus” Campaign has been revised with effect from 1 June 2020.  Click here for the revised Terms and Conditions in English. https://www.pbebank.com/pdf/Promotions/PB-2...-REV010620.aspxPB Fixed Deposit / Term Deposit-i CampaignPlease be informed that the Campaign Period of “PB Fixed Deposit / Term Deposit-i” has been extended to 30 June 2020. The promotional interest / profit rate under the “PB Fixed Deposit / Term Deposit-i” Campaign has been revised with effect from 1 June 2020.  Click here for the revised Terms and Conditions in English. https://www.pbebank.com/pdf/Promotions/PB-F...Di-T-C_ENG.aspxThis post has been edited by GrumpyNooby: Jun 1 2020, 10:56 AM

|

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 08:08 PM Jun 1 2020, 08:08 PM

|

|

QUOTE(fishmango @ Jun 1 2020, 08:06 PM) MBB e-ifd rate? month? can share QUOTE(cybpsych @ May 19 2020, 07:46 PM) Maybank Islamic Fixed Deposit-i (eIFD-i) - FPX Campaign [ MBB | T&Cs ] » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 10:48 PM Jun 1 2020, 10:48 PM

|

|

QUOTE(PJng @ Jun 1 2020, 10:46 PM) Sorry 1st time step to FD thread I place FD on CIMB at branch last year, maturity date is today If i leave it rate will drop or no interest at all? Will be renewed at board rate according to your previous placement tenure. |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 10:53 PM Jun 1 2020, 10:53 PM

|

|

QUOTE(PJng @ Jun 1 2020, 10:51 PM) Tenure is 12 month, so i can leave it and still have interest? Interest is masuk my salary acc, also CIMB For example: let's say your previous placement is 4% pa for 12m If you don't do anything, it'll be auto-renewed at 2.5% pa for 12m (example only; please check the board rate from CIMB website) As for the interest crediting instruction, I believe it shall follow your previous placement instruction. This post has been edited by GrumpyNooby: Jun 1 2020, 10:55 PM |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 12:01 PM Jun 2 2020, 12:01 PM

|

|

QUOTE(maxguy @ Jun 2 2020, 11:46 AM) Last month it was 2.7% pa for 10m  |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 03:35 PM Jun 2 2020, 03:35 PM

|

|

QUOTE(Yzarc @ Jun 2 2020, 03:31 PM) Hi all, I am new to the fd placement. I have placed e-fixed deposit with MBB since last year. Recently, the interest rate took a massive drop to 1.9% for 1 month. I've never seen a massive interest shift like this before. Does anyone know usually how long it will take for the rates to recover? Or anyone just as curious with the estimation on time for recovery? Would love to hear some thoughts. Thanks in advance. Fitch Rating excepts that BNM still has room to drop OPR further to 1% from current 2%. OPR rate recovery won't be that soon; probably 1 to 2 years from now. |

|

|

|

|

|

GrumpyNooby

|

Jun 3 2020, 06:38 PM Jun 3 2020, 06:38 PM

|

|

QUOTE(Vickyle @ Jun 3 2020, 06:37 PM) In one of the Affin's t&c, term 4: https://www.affinonline.com/AFFINONLINE/med...ampaign-Eng.pdfWhy minimum is the same as maximum? Typo? If not typo, why such trouble? Want to place 50k, have to do it 5 times?  No typo. Yes, have to do 5 times. |

|

|

|

|

|

GrumpyNooby

|

Jun 3 2020, 06:44 PM Jun 3 2020, 06:44 PM

|

|

QUOTE(rocketm @ Jun 3 2020, 06:41 PM) How to get the code for the Alliance Bank eFD promo? QUOTE(??!! @ May 21 2020, 05:46 PM) 3 months 3.15% ..promo for alliance online banking app user. U need to dl the app. The TnC refers to 'selected customers' who will receive a promo code on the inbox when u log into alliance online. No definition of the bank selection criteria. The code is for 1 x use only. Tried to place 2nd time...tak holeh Try and see if you can open this TnC document https://www.alliancebank.com.my/Alliance/me...MPAIGN-16042020. Place eFd via Alliance online (not the online app) .there's a dropdown to enter promo code after select 3 month tenure. Then u can see the 3.15 % rate |

|

|

|

|

May 27 2020, 12:32 PM

May 27 2020, 12:32 PM

Quote

Quote

0.0517sec

0.0517sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled