QUOTE(senghock @ May 20 2020, 04:29 PM)

I think shouldn't be a problem:QUOTE(ewingcher @ May 20 2020, 03:42 PM)

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

May 20 2020, 04:30 PM May 20 2020, 04:30 PM

Return to original view | Post

#221

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(senghock @ May 20 2020, 04:29 PM) I think shouldn't be a problem:QUOTE(ewingcher @ May 20 2020, 03:42 PM) |

|

|

|

|

|

May 20 2020, 10:47 PM May 20 2020, 10:47 PM

Return to original view | IPv6 | Post

#222

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Anangie @ May 20 2020, 10:35 PM) https://www.rhbgroup.com/~/media/images/mal...t-2017ver4.ashxIgnoring the INVEST bonus, it'll be first RM 100k. Not much details for the INVEST, perhaps you need to sit down with their WPM to ensure what're the eligible WMPs |

|

|

May 21 2020, 12:35 AM May 21 2020, 12:35 AM

Return to original view | IPv6 | Post

#223

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(yklooi @ May 20 2020, 09:29 PM) UOB board rate has been revised down to 1m at 1.7%, 6m a t1.9% and 12m at 2% effective from15/5/2020Same goes to Alliance board rate: 1m at 1.95%, 6m at 2.05% and 12m at 2.1% effective from 15/5/2020 This post has been edited by GrumpyNooby: May 21 2020, 12:35 AM |

|

|

May 21 2020, 12:01 PM May 21 2020, 12:01 PM

Return to original view | Post

#224

|

All Stars

12,387 posts Joined: Feb 2020 |

Finally their campaign info is out! Campaign ends 30/6/2020.

Campaign T&C: https://www.affinonline.com/AFFINONLINE/med...ampaign-Eng.pdf |

|

|

May 21 2020, 12:14 PM May 21 2020, 12:14 PM

Return to original view | Post

#225

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(chiwawa10 @ May 21 2020, 12:12 PM) 31/05/2020 https://www.ocbc.com.my/personal-banking/ac...ed-deposit.html This post has been edited by GrumpyNooby: May 21 2020, 01:11 PM |

|

|

May 21 2020, 01:00 PM May 21 2020, 01:00 PM

Return to original view | Post

#226

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(WaCKy-Angel @ May 21 2020, 12:58 PM) Just wondering would it better to go for 12m FD now even slightly lower than this Affin 2.88% 6m ? Different people has different purpose for the money flow or liquidity.Since like the rate will be going down trend? im bad at calculating pls someone advise me If you foresee yourself has no other usage of the money for that tenure, it's better to lock-in with the rate since the possibility of more OPR cuts is high. |

|

|

|

|

|

May 21 2020, 01:04 PM May 21 2020, 01:04 PM

Return to original view | Post

#227

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(chiwawa10 @ May 21 2020, 01:02 PM) Any eFD promo from Hong Leong. Tired of transferring funds especially now that banks are so crowded. 3m at 2.6% pa ending 30/6/2020 https://www.hlb.com.my/en/personal-banking/...fd-i-promo.html T&C: https://www.hlb.com.my/content/dam/hlb/my/d...romo-tnc-en.pdf This post has been edited by GrumpyNooby: May 21 2020, 01:05 PM |

|

|

May 21 2020, 01:13 PM May 21 2020, 01:13 PM

Return to original view | Post

#228

|

All Stars

12,387 posts Joined: Feb 2020 |

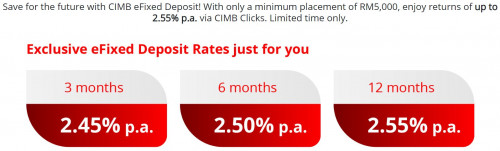

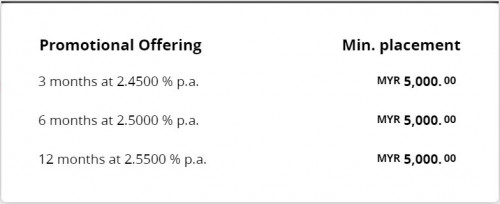

QUOTE(WaCKy-Angel @ May 21 2020, 01:07 PM) Yeah i foresee will not be using the money. Except for BI, only CIMB has promo rate for 12m at 2.55% paSo which 12m or more now that has the highest rate? I have MBB, PBB, CIMB, MBSB, Affin, BI, thats all i think. Next to that tenure is OCBC with 10m @ 2.7% pa Many banks don't want to do promo rate for tenure above 6m which they may expect OPR cuts. We still got 3 more MPC meetings which falls on July, September and November 2020. |

|

|

May 21 2020, 01:47 PM May 21 2020, 01:47 PM

Return to original view | Post

#229

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 21 2020, 02:16 PM May 21 2020, 02:16 PM

Return to original view | Post

#230

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(WaCKy-Angel @ May 21 2020, 02:12 PM) Already shared few days back. QUOTE(GrumpyNooby @ May 19 2020, 06:37 PM)  This campaign is only applicable for conventional (CIMB) Current Account and Savings Account (CASA) holders. Campaign valid from 18 May until 30 June 2020. Placement link: https://www.cimbclicks.com.my/clicks/#/  Campaign link: https://www.cimbclicks.com.my/efd-may20.htm...FD%20May%202020 T&C link: https://www.cimbclicks.com.my/efd-may20.htm...ay%202020#terms ENG T&C link (detailed): https://www.cimbclicks.com.my/efd-may20.htm...ay%202020#terms |

|

|

May 21 2020, 02:45 PM May 21 2020, 02:45 PM

Return to original view | Post

#231

|

All Stars

12,387 posts Joined: Feb 2020 |

Imagine what you can do for your family with more returns. With our higher rates for Commodity Murabahah Deposit-i (CMD-i) account*, your savings will now benefit your loved ones in a bigger way that’ll bring smiles from one and all.

Promotion Period: 21 May 2020 until 30 June 2020  *Over The Counter only & FF needed Campaign T&C: https://www.rhbgroup.com/280/files/CMD-i_TnC.pdf |

|

|

May 21 2020, 05:31 PM May 21 2020, 05:31 PM

Return to original view | IPv6 | Post

#232

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jonoave @ May 21 2020, 05:18 PM) Someone posted it a while back, can't find it. Islamic FD or term deposit-i and term investment account are not the same.Just login to Connect -> Apply -> investment term account Then select the options like what you do for conventional eFD. Except the source of funds is from one your HLB accounts. Just google or search this thread for some past discsussion of FD versus Islamic FD/term-investment. |

|

|

May 21 2020, 09:12 PM May 21 2020, 09:12 PM

Return to original view | IPv6 | Post

#233

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(adele123 @ May 21 2020, 09:10 PM) Yes. They call it mature after 2 years la. If withdraw early high penalty. Usually can get back around 90%+ Why I couldn't find that MaxSure 2 plan at GE portal?I know it's off topic but it is pretty good deal if you ok to set it aside for 2 years. Withdraw early is painful. I dont have ocbc account, so abit ma fan. Else i'm unsure how they arrange for transfer of such huge sum of money Ps: i neither work for ocbc or great eastern. |

|

|

|

|

|

May 21 2020, 10:15 PM May 21 2020, 10:15 PM

Return to original view | IPv6 | Post

#234

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 21 2020, 11:09 PM May 21 2020, 11:09 PM

Return to original view | IPv6 | Post

#235

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 22 2020, 07:22 AM May 22 2020, 07:22 AM

Return to original view | Post

#236

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(adele123 @ May 22 2020, 01:26 AM) The guarantee on the 3.9% is from GE. And despite what the flyer say about potential bonus after 2 years, probably the amount gonna be zero or very low. But 3.9% pa for a 2-year plan is rather high at current interest rate environment.Important note is no early withdrawal, you can lose part of the capital. I'm not sure how ocbc promotes it or sell it. They may have a way to ask you to pay one shot instead of 2 separate years. I am not familiar on mechanism but such plans are not out to con you. I bought etiqa last year pay 2 years kena tahan for 5 years. The issue for me is... i just have to make sure 5 years i cant touch the money. Else lose 10% of the money during the 1st 2 years. While i'm mildy surprise they (GE/ ocbc) did not withdraw despite the interest rate cut, this one is not a fishy plan. You can always ask them for the product disclosure sheet and sales illustration if you worry. Sales person got commission ba, but very low, 0.2%? I got the flyer before mco. But i dont have full details. Usual insurance caveat is dont surrender early. Full 2 years required for the money to be there. Better get info from ocbc. The annoying thing is they want you walk in to get more info. This is the usual tactic la. But the plan itself is legit la. Unless you dont trust GE. Edit: Let me caveat slightly, last year when GE did this, i was told only offer to bank customer, usually priority banking. So i never bothered to find out also i dont have 20k lying around. And i really not GE or OCBC staff just want to let everyone know, not all insurance savings plan is evil. Just need to understand. And yes such plans dont make much money for the insurance company. I share you the promo last year lo. 4.5% but last year when you hear 4.5% maybe not as wow la. UOB offered only me a 3-year plan with 3%% pa and I believe the plan is underwritten by Prudential (their insurance and wealth management partner), |

|

|

May 22 2020, 01:52 PM May 22 2020, 01:52 PM

Return to original view | Post

#237

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(eujin @ May 22 2020, 01:51 PM) I tried today using my CIMB clicks for 5k @ 6 months, but the interest rate written there is only 2.05%? CIMB always uses special link for its promotional eFD.Placement link also shared in my earlier post: https://www.cimbclicks.com.my/clicks/#/ |

|

|

May 22 2020, 01:57 PM May 22 2020, 01:57 PM

Return to original view | Post

#238

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(eujin @ May 22 2020, 01:56 PM) Use this link: https://www.cimbclicks.com.my/fdrateIt'll redirect you to the placement link  |

|

|

May 22 2020, 02:01 PM May 22 2020, 02:01 PM

Return to original view | Post

#239

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 22 2020, 02:17 PM May 22 2020, 02:17 PM

Return to original view | Post

#240

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Tobyby @ May 22 2020, 02:13 PM) Thanks for rate sharing. For Alliance related matters:I'm don't have an Affinbank bank account, can I create one online and then do the eFD placement? All can be done online? Actually I'm using OCBC 360 Account, treating it like a FD account, but currently the rate drop to 2.75%, so I'm thinking of other options... QUOTE(??!! @ May 18 2020, 09:38 AM) QUOTE(??!! @ May 18 2020, 01:22 PM) Copy ---' Here’s an exclusive offer that you can be proud of as an allianceonline mobile user. Earn 3.15% p.a. interest rate when you place a 3 months e-Fixed Deposit (“e-FD”) with a minimum placement of RM5,000. Sign up today! Here’s how: Campaign steps *As the last step allianceonline mobile registration, perform a balance inquiry at any MEPS-enabled ATM within 3 days (only applicable for new allianceonline user). This preferential interest rate is available for a limited time only so don’t miss out. Campaign Period: 30 March 2020 to 30 June 2020 Terms and Conditions apply. QUOTE(??!! @ May 21 2020, 05:46 PM) 3 months 3.15% ..promo for alliance online banking app user. U need to dl the app. The TnC refers to 'selected customers' who will receive a promo code on the inbox when u log into alliance online. No definition of the bank selection criteria. The code is for 1 x use only. Tried to place 2nd time...tak holeh Try and see if you can open this TnC document https://www.alliancebank.com.my/Alliance/me...MPAIGN-16042020 . Place eFd via Alliance online (not the online app) .there's a dropdown to enter promo code after select 3 month tenure. Then u can see the 3.15 % rate QUOTE(a.lifehacks @ May 19 2020, 09:47 PM) Click the link below, https://www.alliancebank.com.my/banking/per...us-account.aspx Select “Apply Now”, Enter your personal details and most importantly, Choose your “Preferred Branch”, You’ll get an SMS sent to your mobile no (which you have entered in the online application form). Print out / screenshot the submission confirmation & the SMS you received. Walk to your preferred branch, grab a queue number for account opening- For ID verification. |

| Change to: |  0.0600sec 0.0600sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 10:57 AM |