Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

cclim2011

|

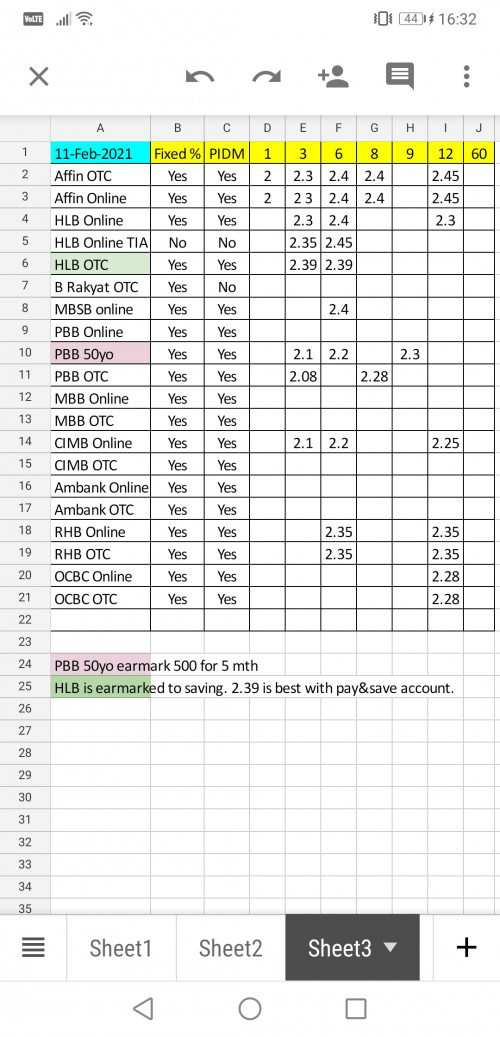

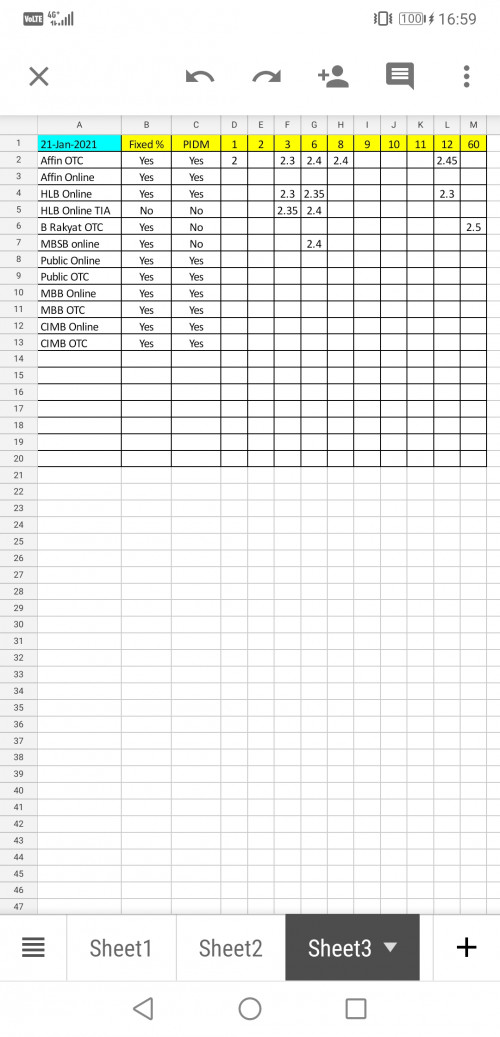

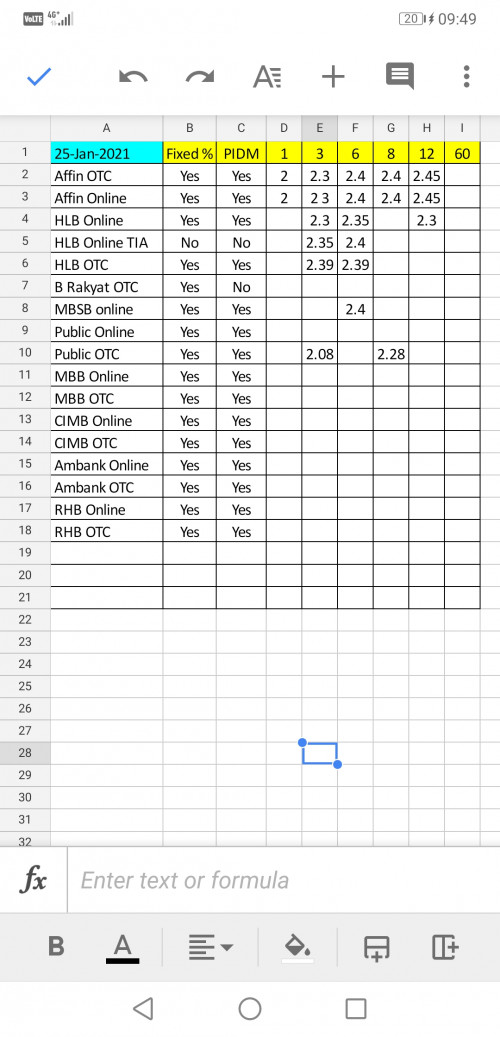

Jan 25 2021, 03:46 PM Jan 25 2021, 03:46 PM

|

|

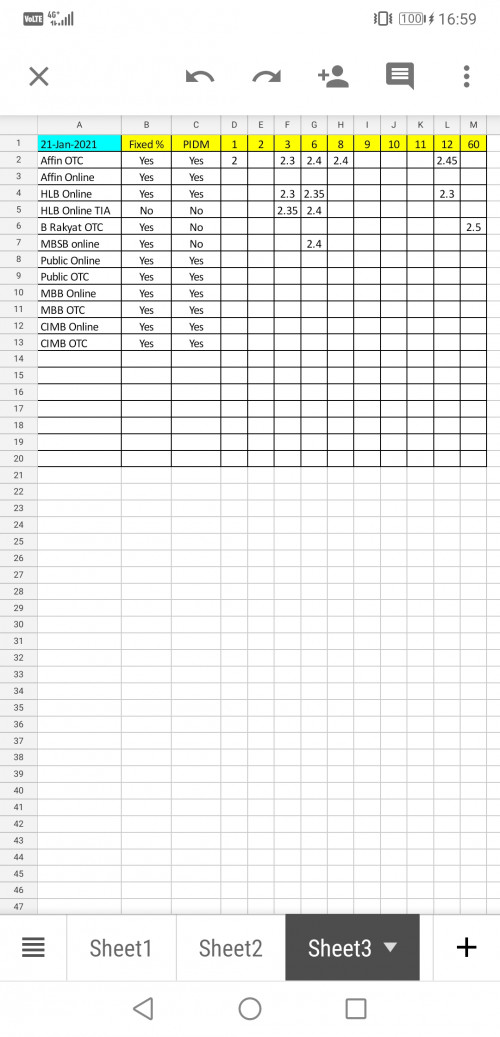

[quote=sweetpea123,Jan 25 2021, 03:29 PM] [quote=cclim2011,Jan 21 2021, 05:01 PM]  trying this. if rajin enough update more. 🤣 [/quote ] eh, Affin bank 2.45% @12mths till when ya? Just check with Affin, said no more  [/quote] ha? just updated last week by someone here for branch. i think ur branch officers are not updated? not usre though, please report back. thanks. |

|

|

|

|

|

cclim2011

|

Jan 25 2021, 05:53 PM Jan 25 2021, 05:53 PM

|

|

QUOTE(sweetpea123 @ Jan 25 2021, 03:53 PM) I just checked on Affin website, it's on e-FD still. Apparently the officer wasnt aware it's STILL on e-FD, better hurry and grab before it's gone. But Affin e-FD sucks a little, need 2 days before it takes effect if I remember correctly. the efd has just new interest has just came into effect yesterday. i think will stay for a while. unless system error. |

|

|

|

|

|

cclim2011

|

Jan 25 2021, 08:10 PM Jan 25 2021, 08:10 PM

|

|

QUOTE(sweetpea123 @ Jan 25 2021, 04:14 PM) oh, the effective date on the same day as well now. Cos the last i deposited couple of years back, effective date is 2-3 days later. If it's immediate, then it's good enough for me. Doesnt matter when it shows on Affin Online. Thanks for the input. shld be due to weekends, avoiding weekends maturity. |

|

|

|

|

|

cclim2011

|

Jan 26 2021, 09:50 AM Jan 26 2021, 09:50 AM

|

|

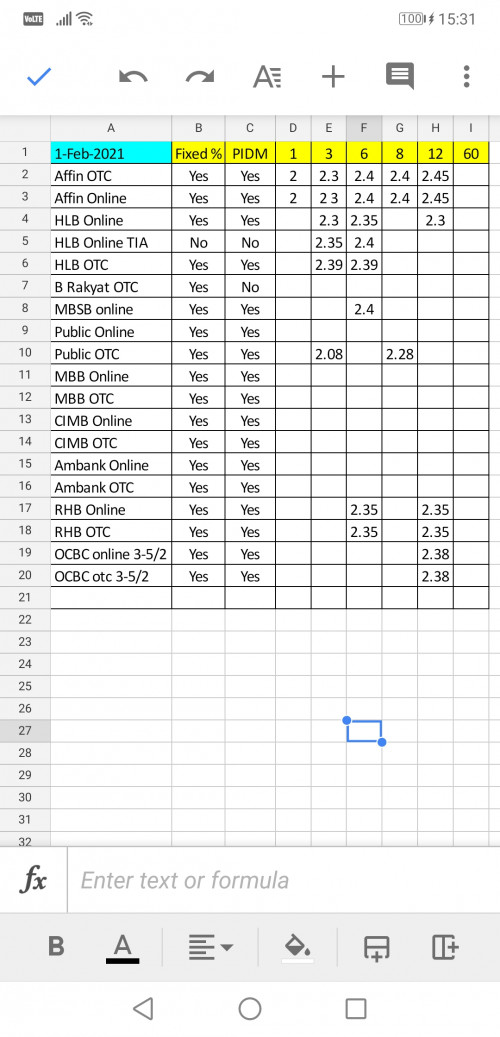

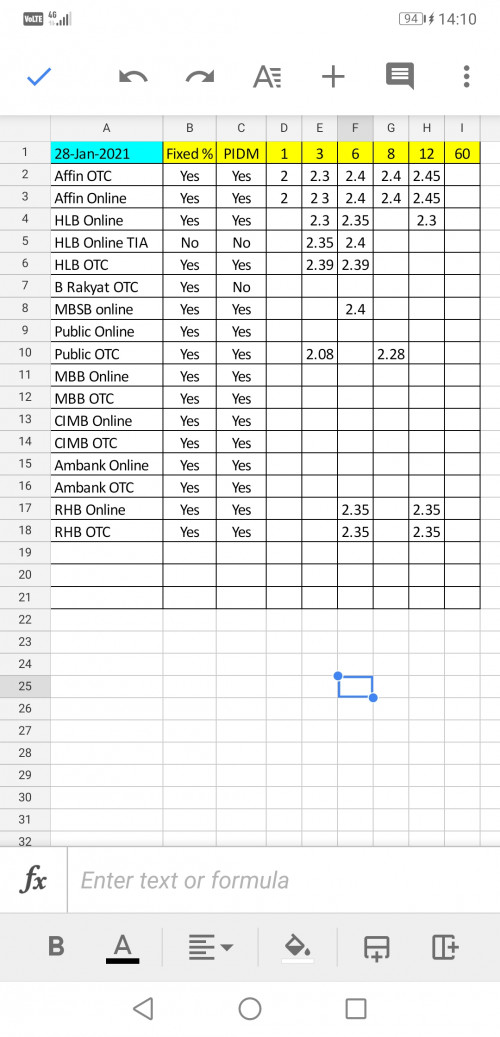

QUOTE(GrumpyNooby @ Jan 26 2021, 08:23 AM) Affin eFD campaign (campaign poster & TnC not out yet) Chinese New Year eFD/eTD-i CampaignPromotion Period : 21 January 2021 to 15 February 2021 Promotional Rate: a. 1 month - 2.00% p.a.

b. 3 months - 2.30% p.a.

c. 6 months - 2.40% p.a.

d. 8 months - 2.40% p.a.

e. 12 months - 2.45% p.a.Minimum Placement Amount For Each Certificate RM10,000 Maximum Placement Amount For Each Certificate RM200,000  |

|

|

|

|

|

cclim2011

|

Jan 29 2021, 02:10 PM Jan 29 2021, 02:10 PM

|

|

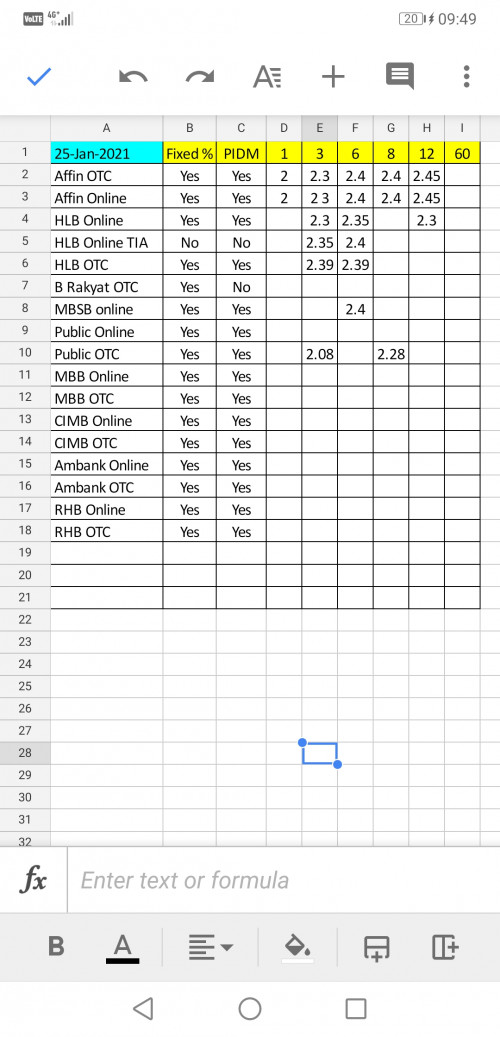

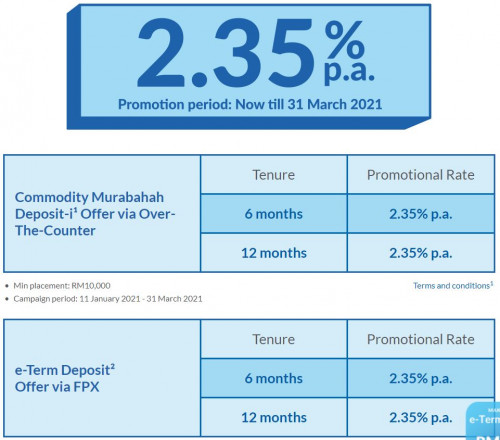

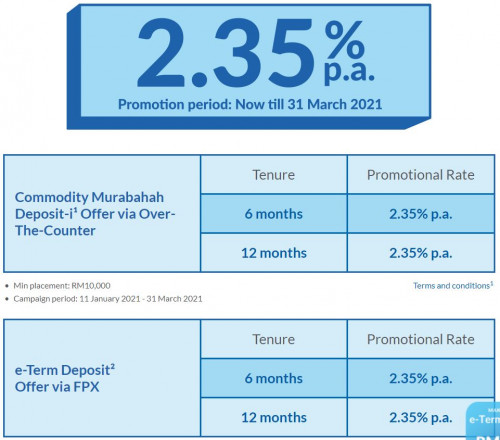

QUOTE(GrumpyNooby @ Jan 29 2021, 12:58 PM) Spend your retirement doing the things you love with a peace of mind. Enjoy higher returns when you invest your wealth in RHB Commodity Murabahah Deposit-i (CMD-i)* and RHB e-Term Deposit account* now.  CMD-i T&C: https://www.rhbgroup.com/235/files/TnC1_CMD...r_12_months.pdfeTDi T&C: https://www.rhbgroup.com/235/files/TnC2_eTe...12%20months.pdfhttps://www.rhbgroup.com/235/index.html?utm...tm_campaign=235 |

|

|

|

|

|

cclim2011

|

Jan 29 2021, 03:53 PM Jan 29 2021, 03:53 PM

|

|

QUOTE(Daylight2018 @ Jan 29 2021, 03:18 PM) The rates are bad Can't believe I was enjoying >4% rates prior to this Covid-19 crisis yeah... :|| my running average has down from 4.xx to 3.2328 now 😬😬 |

|

|

|

|

|

cclim2011

|

Feb 2 2021, 03:32 PM Feb 2 2021, 03:32 PM

|

|

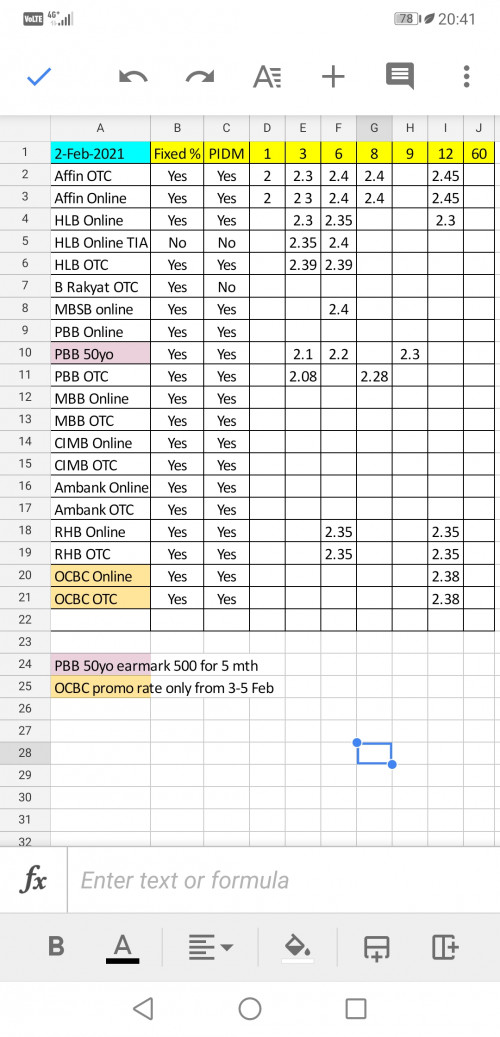

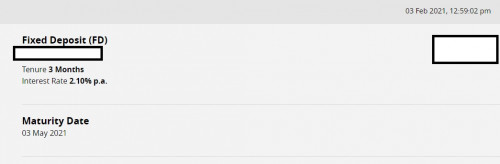

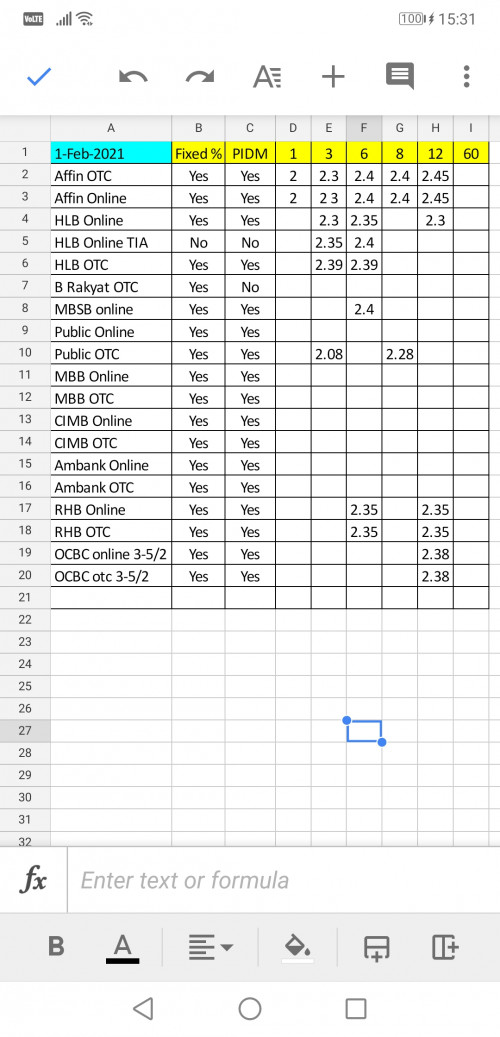

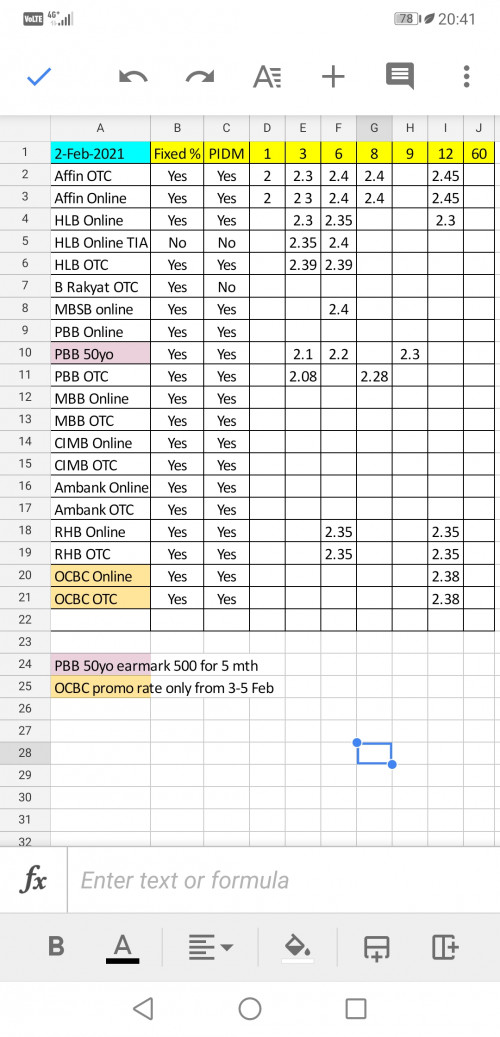

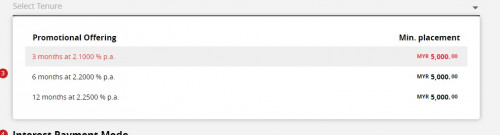

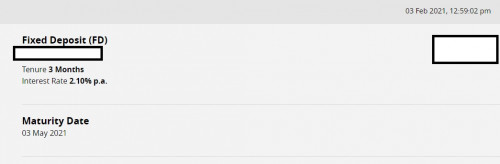

QUOTE(David_Yang @ Feb 2 2021, 12:04 AM) OCBC Take advantage of this Fixed Deposit promotion Currency Malaysian Ringgit Tenure 12 months Interest rate 2.38% p.a. Min. Placement Amount RM1,000 This promotion is only valid from 3 February 2021 – 5 February 2021 between 9am to 9pm daily for online placement and 9.30am to 3pm daily for placement at the branch.  |

|

|

|

|

|

cclim2011

|

Feb 2 2021, 08:40 PM Feb 2 2021, 08:40 PM

|

|

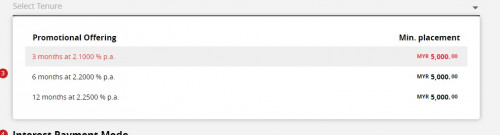

QUOTE(cybpsych @ Feb 2 2021, 04:29 PM) PB Journey Golden Savers Campaign [ PBB | T&Cs ]   This post has been edited by cclim2011: Feb 2 2021, 08:42 PM This post has been edited by cclim2011: Feb 2 2021, 08:42 PM |

|

|

|

|

|

cclim2011

|

Feb 3 2021, 03:02 PM Feb 3 2021, 03:02 PM

|

|

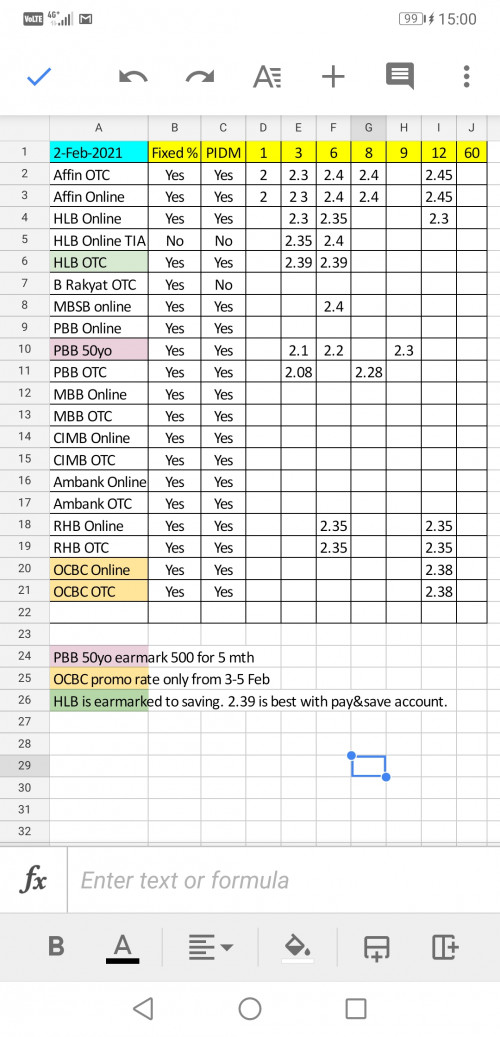

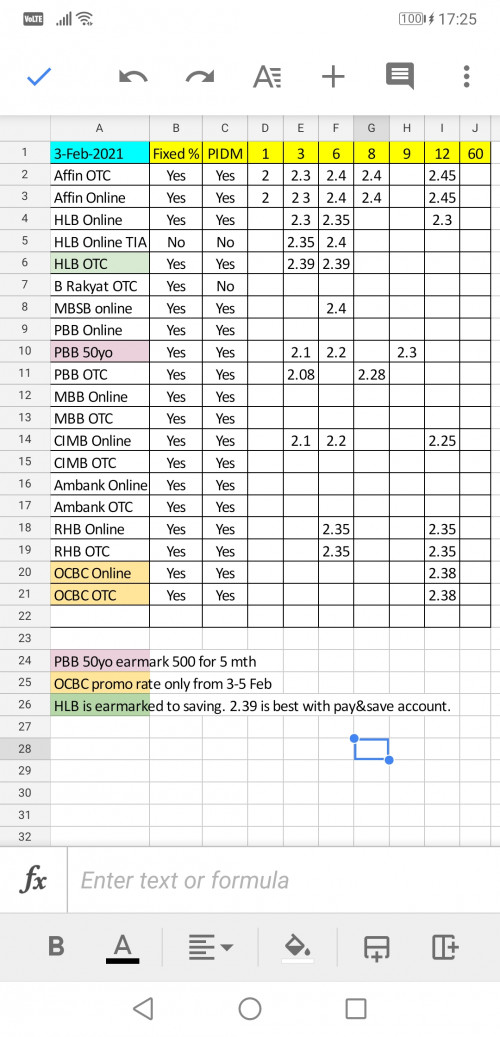

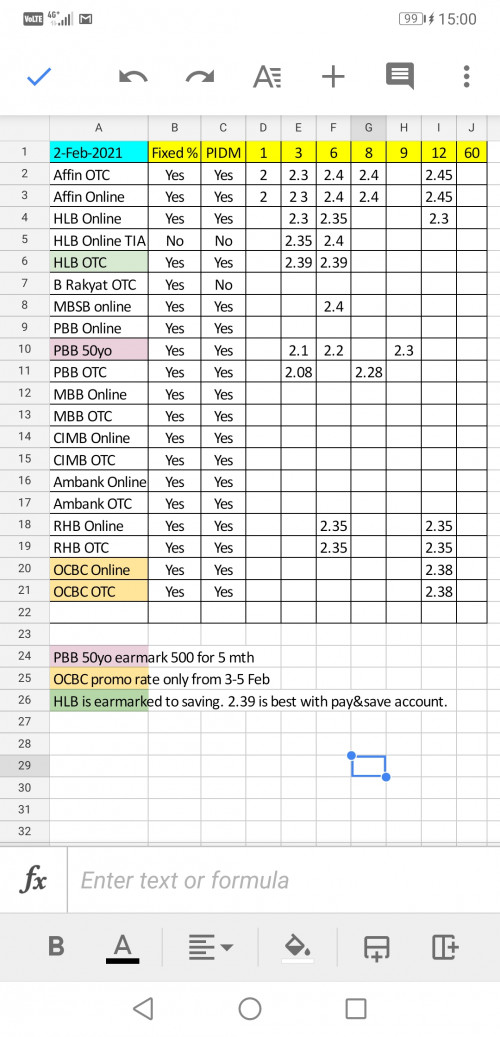

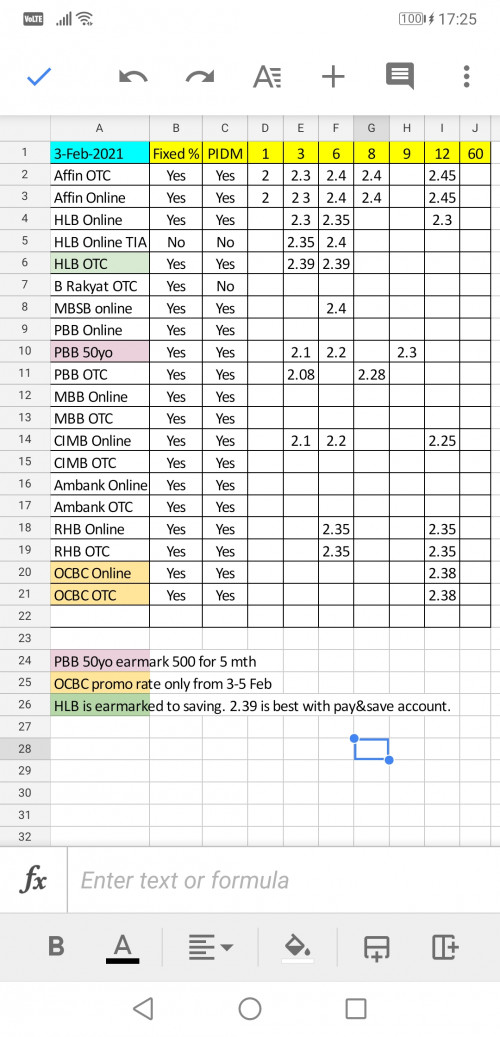

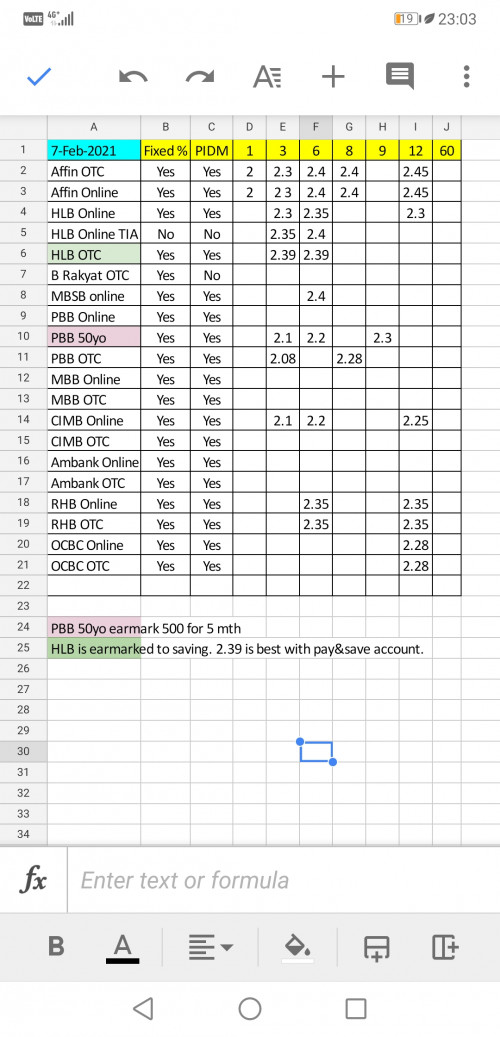

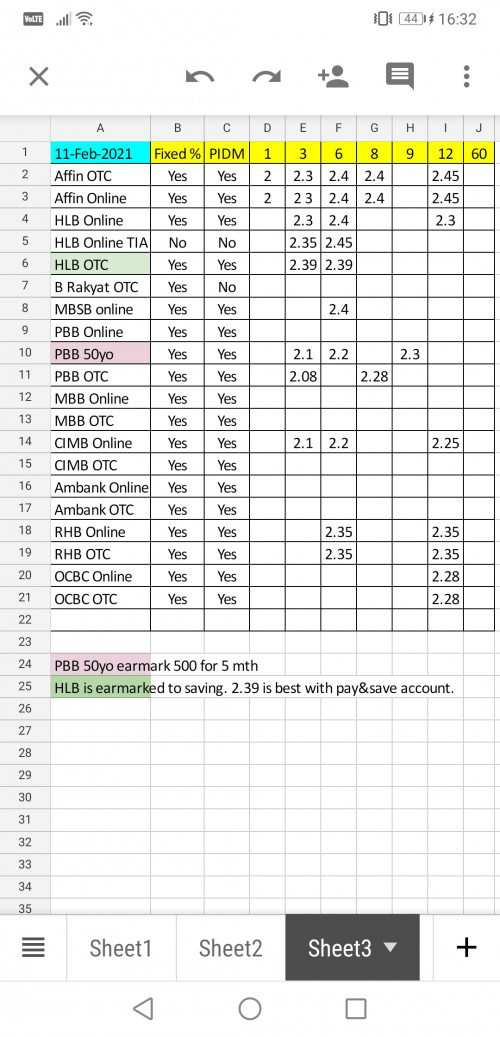

QUOTE(coolstore @ Feb 3 2021, 01:43 PM) ops sorry..updated table. hlb is earmarked promo. 2.39 is best effectivr rate with pay&save account.  |

|

|

|

|

|

cclim2011

|

Feb 3 2021, 05:24 PM Feb 3 2021, 05:24 PM

|

|

QUOTE(fantasy1989 @ Feb 3 2021, 01:01 PM) Hi guys.. just sharing ..tested below URL for CIMB https://www.cimbclicks.com.my/efd-nov20.htmlable to do placement for below rates no need fresh fund ..no FPX ..i just uplift existing FD and do placement   updated crab. jk, hokkien. guys let me know if promo ended ya. thanks.  This post has been edited by cclim2011: Feb 3 2021, 05:25 PM This post has been edited by cclim2011: Feb 3 2021, 05:25 PM |

|

|

|

|

|

cclim2011

|

Feb 7 2021, 11:34 PM Feb 7 2021, 11:34 PM

|

|

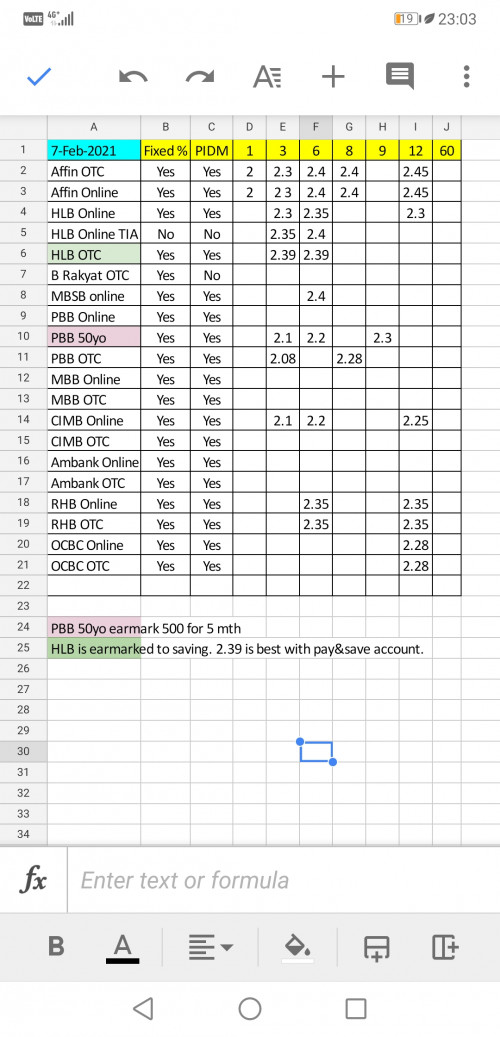

QUOTE(roarus @ Feb 5 2021, 09:03 PM)  For OCBC, 9PM on the dot replaced with another campaign at lower 2.28% valid until 31 Mar 2021  |

|

|

|

|

|

cclim2011

|

Feb 11 2021, 04:26 PM Feb 11 2021, 04:26 PM

|

|

i forecast bnm increase rate. 😁😀

Happy CNY folks. Wish all the best!

|

|

|

|

|

|

cclim2011

|

Feb 11 2021, 04:33 PM Feb 11 2021, 04:33 PM

|

|

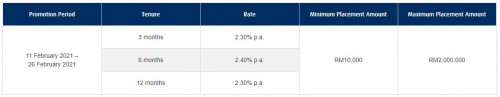

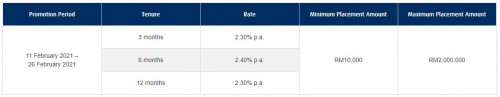

QUOTE(GrumpyNooby @ Feb 11 2021, 07:50 AM) CNY exclusive! [for Hong Leong]Grow your savings even more at 2.40% p.a. interest/profit rate for 6 months with eFixed Deposit/-i.   HLB CONNECT | DEPOSIT | 11 FEBRUARY 2021-26 FEBRUARY 2021 Save and grow your money with convenient eFixed Deposit/eFixed Deposit-i placements. Campaign link: https://www.hlb.com.my/en/personal-banking/...fd-i-promo.htmlT&C link: https://www.hlb.com.my/content/dam/hlb/my/i...tion-tnc-en.pdf  |

|

|

|

|

|

cclim2011

|

Mar 3 2021, 01:35 PM Mar 3 2021, 01:35 PM

|

|

I believe the ability to get higher interest by walk in is, is order

1. how much the specific bank branch need money reserve to hit target

2. way of approaching and interpersonal (relation) skill - getting to the right person

2. amount of money

itu saja i think. 😁

but then it's more convenient get promotion rate from other banks (start opening whatever online saving acct / basic savinh acct at our convenient time/place)

|

|

|

|

|

|

cclim2011

|

Mar 4 2021, 07:23 PM Mar 4 2021, 07:23 PM

|

|

QUOTE(Human Nature @ Mar 4 2021, 06:27 PM) Nice, blessing in disguise and can put the FD to good use. I am steering clear from Ambank for a moment unless they give a really good promo rate. ambank... i think... enjoying renewing fd of seniors not going to bank renewing paper based fd. 😅 |

|

|

|

|

|

cclim2011

|

Mar 11 2021, 04:45 PM Mar 11 2021, 04:45 PM

|

|

QUOTE(Barricade @ Mar 11 2021, 02:19 PM) I'm surprised so many of you still bother to put in FD. Just dump into SSPN.... you have the liquidity and interest is higher than bank. No brainer.... sspn for singles above 29yo can? or for kids > 29yo cannot also right? |

|

|

|

|

|

cclim2011

|

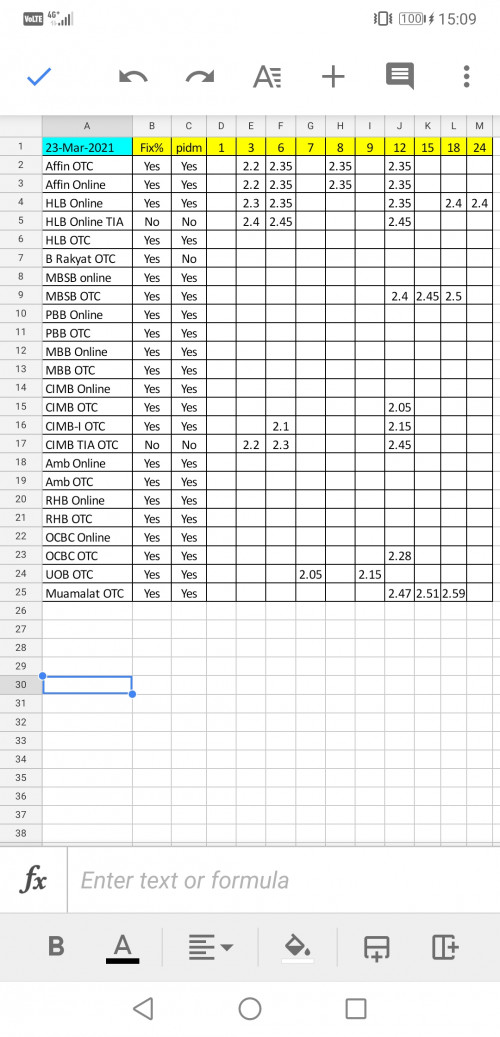

Mar 23 2021, 03:10 PM Mar 23 2021, 03:10 PM

|

|

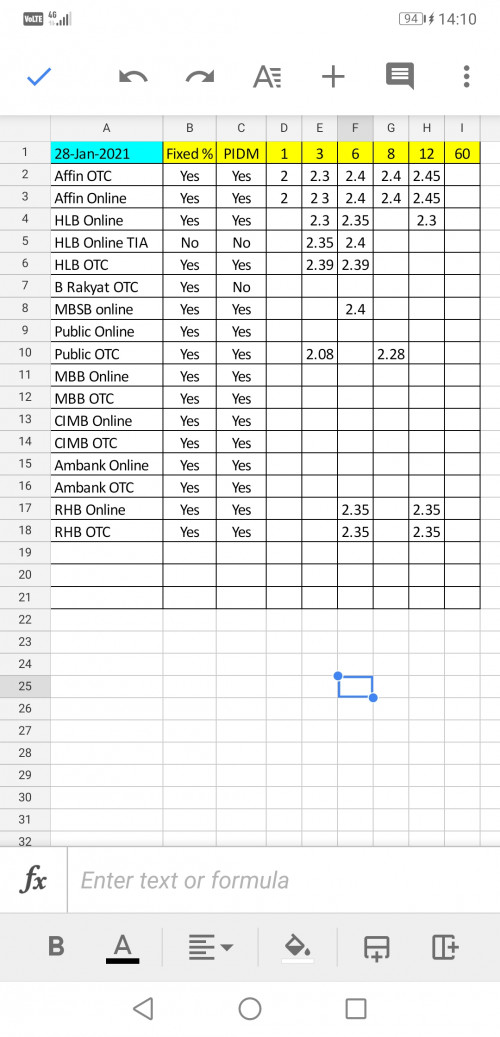

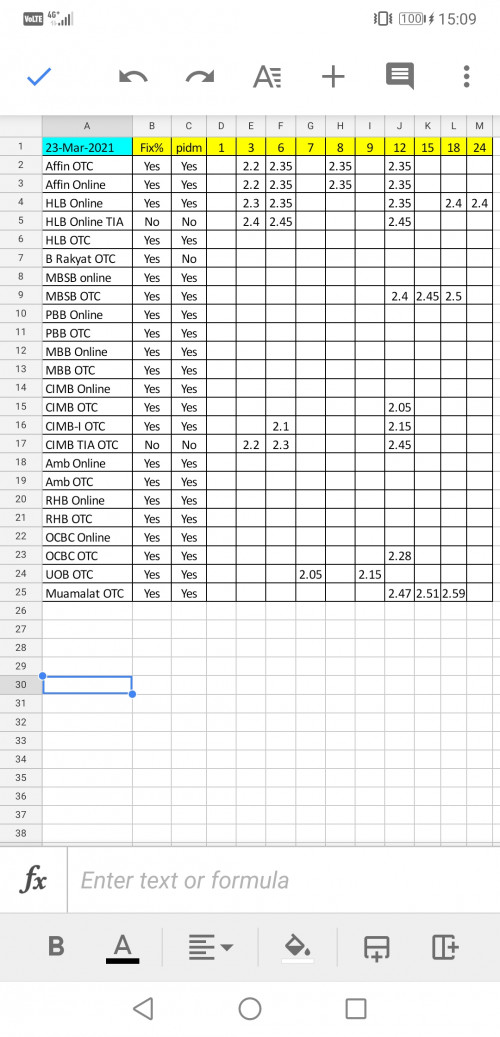

long no update. please check. only record those above 2.0. 😁  |

|

|

|

|

|

cclim2011

|

Mar 24 2021, 08:21 AM Mar 24 2021, 08:21 AM

|

|

QUOTE(KopiMalaysiano @ Mar 23 2021, 11:31 PM) canupdate main stream bank as well? MBB PBB no promo/>2.0 eh. pbb got? |

|

|

|

|

|

cclim2011

|

Mar 24 2021, 02:15 PM Mar 24 2021, 02:15 PM

|

|

QUOTE(a.lifehacks @ Mar 24 2021, 01:11 PM) QUOTE(a.lifehacks @ Mar 24 2021, 01:18 PM) CIMB eFD promo (22 March 2021- 6 May 2021) ( https://www.cimbclicks.com.my/efd-mar21.html ) [ https://www.cimbclicks.com.my/pdf/tc-efd-mar21-en.pdf ] -Min 5k 3-months 2.05%pa 6-months 2.15%pa 12-months 2.20%pa thanks.  |

|

|

|

|

|

cclim2011

|

Mar 24 2021, 04:09 PM Mar 24 2021, 04:09 PM

|

|

QUOTE(joeblow @ Mar 24 2021, 03:02 PM) Hi there, I have two joint saving accounts at Affin, one conventional and one Islamic. Both need to pay RM10, in fact I asked before in this thread. Affin collects RM10 for joint, nothing for single. Yes one can only have one BSA because it is not chargeable. ie free atm card with no charges. Though personally I don't have an atm card at Affin. i have two BSA with one joint, but it's Affin Islamic. I have two atm cards... but it took very long and multiple requests to have the joint account shown up in my internet page. i cannot recall if i paid rm10 for joint. may be i did but cant really recall.  This post has been edited by cclim2011: Mar 24 2021, 04:11 PM This post has been edited by cclim2011: Mar 24 2021, 04:11 PM |

|

|

|

|

Jan 25 2021, 03:46 PM

Jan 25 2021, 03:46 PM

Quote

Quote

0.7453sec

0.7453sec

0.22

0.22

7 queries

7 queries

GZIP Disabled

GZIP Disabled