QUOTE(??!! @ Jan 15 2021, 05:58 PM)

ok greatFixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jan 15 2021, 07:47 PM Jan 15 2021, 07:47 PM

Return to original view | IPv6 | Post

#181

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jan 16 2021, 11:11 AM Jan 16 2021, 11:11 AM

Return to original view | IPv6 | Post

#182

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

Jan 16 2021, 11:50 AM Jan 16 2021, 11:50 AM

Return to original view | IPv6 | Post

#183

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(Chrono-Trigger @ Jan 16 2021, 11:21 AM) I read that it depends on your risk appetite and your financial goal. yaya correct. for me i will then adjust fund percentage for stocks. i personally feel ut is too slow in increasing, too fast is decreasing. plus the fee and yearly fee to burnt across time.If you are young , you can take a bit more risks. Older people , being almost out of the competitive job market will definitely have to be more conservative. Imagine losing 50% of your money when you are 50 is different from when you are 35. |

|

|

Jan 17 2021, 12:57 AM Jan 17 2021, 12:57 AM

Return to original view | IPv6 | Post

#184

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

Jan 18 2021, 08:44 PM Jan 18 2021, 08:44 PM

Return to original view | Post

#185

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(kplaw @ Jan 18 2021, 08:26 PM) i tried to insist for free debit card at rhb when opening the smart saver account, the customer service then showed me the statements from bank negara on the basic saving account without any fee. it seems that from the statements, this type of account does not have any other features than basic banking transaction. that means it doesn't come with internet banking facility! i couldn't argue more after seeing this and had to take the non-free debit card in order to have the internet banking facility. but luckily they have the joy@work program which waives the annual fee for me. but from my experience, other banks do have internet facility for basic saving accounts. my bi, cimb, affin all with basic saving accts, with atm cards (max 8 times a month) and internet acct access. bi and cimb without credit cards. but what you wanted is smart saver acct? then no free atm card ba by bank product definition. |

|

|

Jan 19 2021, 01:27 PM Jan 19 2021, 01:27 PM

Return to original view | IPv6 | Post

#186

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jan 20 2021, 03:19 PM Jan 20 2021, 03:19 PM

Return to original view | Post

#187

|

Senior Member

1,709 posts Joined: Feb 2011 |

ah good. waiting affin good deal

|

|

|

Jan 20 2021, 09:04 PM Jan 20 2021, 09:04 PM

Return to original view | Post

#188

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(Deal Hunter @ Jan 20 2021, 07:07 PM) Don't understand why forummers like placing at lower uncompetitive rates so much or what they are doing about getting best available rates. u managing tia portfolio with hongleong kah? I just take the best rates all the time, never even below 2.4 %, so why all this talk of 2.35 %, and 2 %. Is this a forum for people to choose and promote savings rates, board rates or second or third rate promo rates? Do you have so much money or so rich that already too much at 2.4 % and need to place at no 3 or no 4 or lower ranked rates as safety diversification or seeking PIDM protection? Or have some problems making a switch? Maybe don't like or mistrust some banks? Or maybe caught unready without prior bank arrangements? to your questions. yes, no, no, always ready ahead. This post has been edited by cclim2011: Jan 20 2021, 09:09 PM Deal Hunter liked this post

|

|

|

Jan 20 2021, 10:51 PM Jan 20 2021, 10:51 PM

Return to original view | Post

#189

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(Deal Hunter @ Jan 20 2021, 10:31 PM) I already gone in and out of Hong Leong totally a few times. Absolutely no loyalty to any banks and fully dedicated to scraping desperately at small differences by jumping to whatever bank offer highest real return. as a seasoned buyer, you shld know there are more than one factors that decide buyers' decision for a product. |

|

|

Jan 21 2021, 12:26 AM Jan 21 2021, 12:26 AM

Return to original view | IPv6 | Post

#190

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(Deal Hunter @ Jan 21 2021, 12:17 AM) I had a post about the different types of FD placers formerly. dude, sometime the interest difference is just too small to cover other cost including time. if those without pidm or those without fixed interest protection wants to get more customer, they have to have enough differentiation (like much higher interest, ease of doing business etc). you are just addicted to words and putting ur thoughts into frames.Why one is in a particular type is a measure of risk appetite according to some ideas. However, there had also been some disagreement on this as had been put that this is simply a measure of financial literacy, access to info and views, or pure intellectual laziness or floating along or education or experiences. According to this school of thought, this are merely inefficient market distortions due to to lacks in participants due to information access problem or disinformation or widely held fallacies. Let us not get too much into what students discuss/argue about as some people will think this is arrogance and not an exchange of views for those who write about why some are better or worse off in the long run. The extremists in the poor rich school leans more on the ideas of self-inflicted blind and unquestioning acceptances of fallacies as truth, and relegate traditional ideas about market capitalism to the dustbin. These questions are not just academic exercise and idle rubbish to teach in investment, economic, marketing, psychology classes or for writing self improvement books. They do affect policies for good or bad and how perception and responses occur. The question is how good at second guessing or reasoning what happens next, or is this too difficult to actually improve the score of prediction through some research and experiments? |

|

|

Jan 21 2021, 08:44 AM Jan 21 2021, 08:44 AM

Return to original view | Post

#191

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(Deal Hunter @ Jan 21 2021, 01:17 AM) That used to be a problem for me too in the past. I recognized and accepted it for a long time just like any other FD placer, until I finally figured out how to beat it after some thinking and questioning. Luckily I did not die accepting the status quo. Necessity is a great spur to invention and looking for solutions. Of course, this is not to say that everybody can solve it in the same way as there may be factors which are just too unsolvable for them for some reason. for other who have different thoughts than you, you are in yoyr own status quo. 😊 yygo liked this post

|

|

|

Jan 21 2021, 09:41 AM Jan 21 2021, 09:41 AM

Return to original view | Post

#192

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(yygo @ Jan 21 2021, 09:14 AM) y one sifu tink he knows best? frankly, i think he/she just want to have some communications/responses going on over online forums. the topics of discussion could be secondary. respond at our own comfort then. 😁we place fd at differen bank for differen reasons at differen rates. get extra 0.05%, 0.1%? all eggs in 1 busket, 1 bank? efforts to get 0.05% for 10k fd? y not get more at ut, stocks at 10 to 30%? more risks... |

|

|

Jan 21 2021, 10:00 AM Jan 21 2021, 10:00 AM

Return to original view | IPv6 | Post

#193

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jan 21 2021, 12:31 PM Jan 21 2021, 12:31 PM

Return to original view | IPv6 | Post

#194

|

Senior Member

1,709 posts Joined: Feb 2011 |

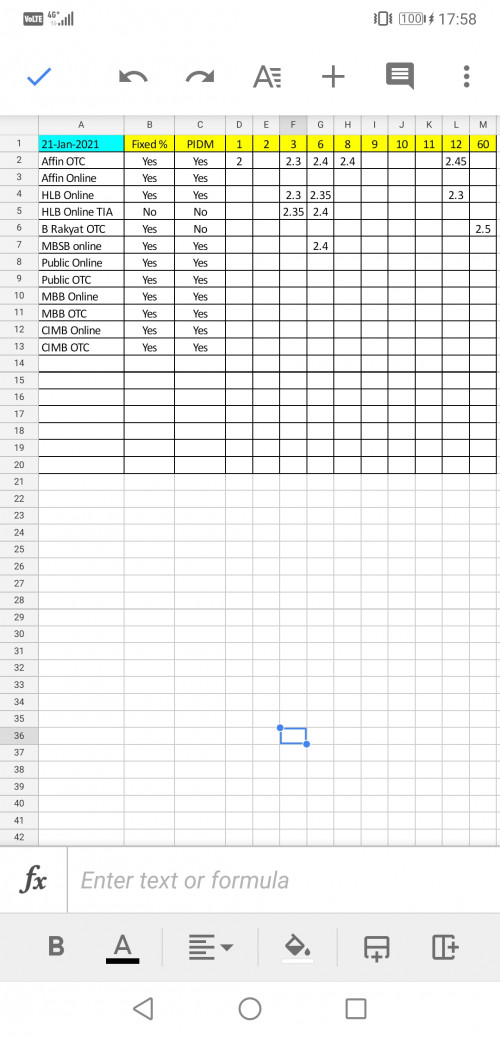

QUOTE(bbgoat @ Jan 21 2021, 12:07 PM) Below from Affin great... hope the efd follow soon Good morning~ Our latest Affin Bank FD promotion rate as below: 1 month 2.00%p.a. 3 months 2.30%p.a. 6 months 2.40%p.a. 8 months 2.40%p.a. 12 months 2.45%p.a. Promotion period from 21 January 2021 until 15 February 2021 Minimum amount RM10K Maximum amount RM1million *Terms and conditions apply* |

|

|

Jan 21 2021, 05:01 PM Jan 21 2021, 05:01 PM

Return to original view | IPv6 | Post

#195

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

Jan 21 2021, 05:58 PM Jan 21 2021, 05:58 PM

Return to original view | IPv6 | Post

#196

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(Deal Hunter @ Jan 21 2021, 05:44 PM) Nice table. Like. Just hope you are not making a mistake, but MBSB online e-Prime Term Deposit-i Campaign is PIDM protected according to flyer below.. https://www.mbsbbank.com/storage/misc/FA%20...yer%20(ENG).pdf  |

|

|

Jan 21 2021, 10:54 PM Jan 21 2021, 10:54 PM

Return to original view | Post

#197

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

Jan 24 2021, 11:41 PM Jan 24 2021, 11:41 PM

Return to original view | IPv6 | Post

#198

|

Senior Member

1,709 posts Joined: Feb 2011 |

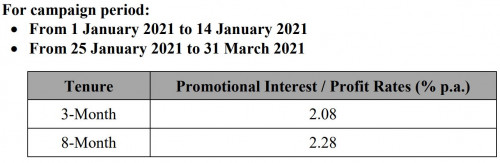

QUOTE(GrumpyNooby @ Jan 24 2021, 08:47 PM) Revision of Promotional Rates for Campaigns Please be informed that the promotional interest / profit rates for the following Campaigns will be revised with effect from 25 January 2021: PB Fixed Deposit / Term Deposit-i Campaign  Click here for the revised T&C https://www.pbebank.com/pdf/Promotions/tc-f...i-en250121.aspx  |

|

|

Jan 25 2021, 09:45 AM Jan 25 2021, 09:45 AM

Return to original view | IPv6 | Post

#199

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

Jan 25 2021, 12:37 PM Jan 25 2021, 12:37 PM

Return to original view | IPv6 | Post

#200

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

| Change to: |  0.0527sec 0.0527sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:47 PM |