Outline ·

[ Standard ] ·

Linear+

FundSuperMart v16 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

SUSyklooi

|

Dec 13 2016, 11:13 PM Dec 13 2016, 11:13 PM

|

|

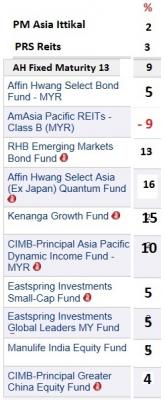

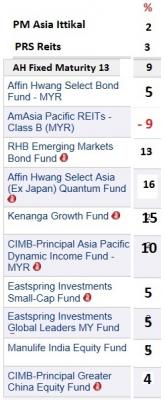

after 1 yr of dismay Small Caps performance..... reorganized my portfolio for the new 2017 year. currently only left with AMAsia Pac Reits that need to accumulate 9% most probably will get that in Mid Jan..... then will sit back and wait for the cake to be baked as mentioned by Avangelice  Attached thumbnail(s) Attached thumbnail(s)

|

|

|

|

|

|

Ramjade

|

Dec 14 2016, 08:11 AM Dec 14 2016, 08:11 AM

|

|

Wonder whether FSM MY involved with yesterday Selangor Public Holiday or not. Funds NAV still haven't update until today.

|

|

|

|

|

|

Avangelice

|

Dec 14 2016, 08:29 AM Dec 14 2016, 08:29 AM

|

|

QUOTE(Ramjade @ Dec 14 2016, 08:11 AM) Wonder whether FSM MY involved with yesterday Selangor Public Holiday or not. Funds NAV still haven't update until today. must be on leave for sure. if that's the case tomorrow we be getting the latest NAVs. |

|

|

|

|

|

Ramjade

|

Dec 14 2016, 08:41 AM Dec 14 2016, 08:41 AM

|

|

QUOTE(Avangelice @ Dec 14 2016, 08:29 AM) must be on leave for sure. if that's the case tomorrow we be getting the latest NAVs. What I meant is FSM MY may be on holiday but are the funds on holiday too? Public holiday is only for Selangor and Kelantan. Not whole of Malaysia. |

|

|

|

|

|

TSAIYH

|

Dec 14 2016, 08:43 AM Dec 14 2016, 08:43 AM

|

|

QUOTE(Ramjade @ Dec 14 2016, 08:11 AM) Wonder whether FSM MY involved with yesterday Selangor Public Holiday or not. Funds NAV still haven't update until today. QUOTE(Avangelice @ Dec 14 2016, 08:29 AM) must be on leave for sure. if that's the case tomorrow we be getting the latest NAVs. From my experience, KGF and kap chai NAV will be available on working day 9am that reflects previous working day NAV For others like Poniz 1 and 2, they will only reflect previous working day NAV around 6pm |

|

|

|

|

|

Avangelice

|

Dec 14 2016, 08:44 AM Dec 14 2016, 08:44 AM

|

|

QUOTE(Ramjade @ Dec 14 2016, 08:41 AM) What I meant is FSM MY may be on holiday but are the funds on holiday too? Public holiday is only for Selangor and Kelantan. Not whole of Malaysia. maybe it's because of Monday's public holiday and then yesterday's agong ceremony? kinda spill over to the weekend. never mind give it till this noon for it to refresh. it happens sometimes |

|

|

|

|

|

Ramjade

|

Dec 14 2016, 08:51 AM Dec 14 2016, 08:51 AM

|

|

QUOTE(AIYH @ Dec 14 2016, 08:43 AM) From my experience, KGF and kap chai NAV will be available on working day 9am that reflects previous working day NAV For others like Poniz 1 and 2, they will only reflect previous working day NAV around 6pm That I agreed. KGF and kapcai are the fastest. |

|

|

|

|

|

puchongite

|

Dec 14 2016, 08:56 AM Dec 14 2016, 08:56 AM

|

|

Wall St. adds to record rally, Dow approaches 20,000 http://mobile.reuters.com/article/idUSKBN1421BE |

|

|

|

|

|

SUSDavid83

|

Dec 14 2016, 08:58 AM Dec 14 2016, 08:58 AM

|

|

|

|

|

|

|

|

nexona88

|

Dec 14 2016, 09:01 AM Dec 14 2016, 09:01 AM

|

|

Add titan fund to my holdings  |

|

|

|

|

|

Avangelice

|

Dec 14 2016, 09:18 AM Dec 14 2016, 09:18 AM

|

|

QUOTE(puchongite @ Dec 14 2016, 08:56 AM) Wall St. adds to record rally, Dow approaches 20,000 http://mobile.reuters.com/article/idUSKBN1421BEI'm not pro in economics but with my simple understanding if a country's currency and economy becomes too expensive to trade and it affects the other nations, can this be sustainable until it collapses? and all this is based on speculation when the president elect hasn't even set foot in the white house. I'm really wondering how the he'll can they do all that based on words of promises |

|

|

|

|

|

Ramjade

|

Dec 14 2016, 09:24 AM Dec 14 2016, 09:24 AM

|

|

QUOTE(Avangelice @ Dec 14 2016, 09:18 AM) I'm not pro in economics but with my simple understanding if a country's currency and economy becomes too expensive to trade and it affects the other nations, can this be sustainable until it collapses? and all this is based on speculation when the president elect hasn't even set foot in the white house. I'm really wondering how the he'll can they do all that based on words of promises If all the money is coming back to america, he won't have trouble fulfilling his promise. If money is not coming back, then it's a different story. He can also impose tax on all stuff make in china to "force" company back to US (if the money is not coming back). By doing that, money sure will flow in. With money flowing in, he will have money to upgrade infrastructure. Even if they are expensive, the whole world depend on their currency for trade. That's why US can get away with printing money while other country cannot. This post has been edited by Ramjade: Dec 14 2016, 09:26 AM |

|

|

|

|

|

Vanguard 2015

|

Dec 14 2016, 10:04 AM Dec 14 2016, 10:04 AM

|

|

QUOTE(kimyee73 @ Dec 13 2016, 10:22 PM) I'm following FSM recommendation to overweight equity, start to move 10% from FI to EQ. Will be 60:40 EQ:FI ratio. Adding new fund RHB Asia Financials Fund recommended by FSM  Long time no see bro. Hope you are keeping well especially with your gold portfolio.  Yep, I am also opening more funds for the year 2017. I started off with a lot of funds, then trimmed down the funds and now back to expanding the funds again. It sounds like my waistline.  |

|

|

|

|

|

puchongite

|

Dec 14 2016, 10:11 AM Dec 14 2016, 10:11 AM

|

|

QUOTE(nexona88 @ Dec 14 2016, 09:01 AM) Add titan fund to my holdings  I don't have any titan. A bit worry might be catching the tail of it only. For you, is this just a starter dish or the main course ? |

|

|

|

|

|

Avangelice

|

Dec 14 2016, 10:16 AM Dec 14 2016, 10:16 AM

|

|

QUOTE(puchongite @ Dec 14 2016, 10:11 AM) I don't have any titan. A bit worry might be catching the tail of it only. For you, is this just a starter dish or the main course ? considered taking Titan and reminded myself why I threw it out in the first place. it's returns were sub par last year compared to the risk involved and that US was just recently upgraded to. neutral" |

|

|

|

|

|

dasecret

|

Dec 14 2016, 10:27 AM Dec 14 2016, 10:27 AM

|

|

QUOTE(TakoC @ Dec 13 2016, 10:36 PM) What's the difference between Ponzi 1.0 and 2.0 in terms of portfolio again? Anyone still doing top up (not DCA) on Ponzi 1.0? I realised I haven't touch it since 2014. LOL! QUOTE(Avangelice @ Dec 13 2016, 11:12 PM) I'm curious. how much did you make from two years in Ponzi 1 Let see... I have some since 3 years ago, and last top up end of last year My IRR is 10.95% for this fund  |

|

|

|

|

|

puchongite

|

Dec 14 2016, 10:33 AM Dec 14 2016, 10:33 AM

|

|

QUOTE(dasecret @ Dec 14 2016, 10:27 AM) Let see... I have some since 3 years ago, and last top up end of last year My IRR is 10.95% for this fund  I supposed the worst is over now for Malaysia exposed funds. At least for now there are some gains and some losses, not like previously just one way lao sai. This post has been edited by puchongite: Dec 14 2016, 10:37 AM |

|

|

|

|

|

Avangelice

|

Dec 14 2016, 10:44 AM Dec 14 2016, 10:44 AM

|

|

double post for no reason. Apologies

This post has been edited by Avangelice: Dec 14 2016, 10:45 AM

|

|

|

|

|

|

puchongite

|

Dec 14 2016, 10:48 AM Dec 14 2016, 10:48 AM

|

|

QUOTE(Avangelice @ Dec 14 2016, 10:16 AM) considered taking Titan and reminded myself why I threw it out in the first place. it's returns were sub par last year compared to the risk involved and that US was just recently upgraded to. neutral" Shows that sometimes over active rebalancing works against the return. The Trump effect is something really hard to predict. |

|

|

|

|

Dec 13 2016, 11:13 PM

Dec 13 2016, 11:13 PM

Quote

Quote

0.0296sec

0.0296sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled