Outline ·

[ Standard ] ·

Linear+

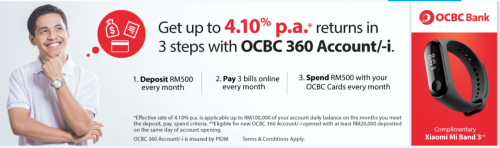

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

ProxMatoR

|

Jun 30 2019, 12:54 PM Jun 30 2019, 12:54 PM

|

|

QUOTE(Ancient-XinG- @ Jun 30 2019, 11:48 AM) Anyone here know about Citibank acceleration saving account? Seems like conditional but higher interest than 4.1 higher rate, but 4.38% is only on your incremental AVERAGED BALANCE... so if you have already 30k inside, you added extra 10k this month and leave inside for whole month, your this new 10k gets 4.38%, not towards total RM40k. |

|

|

|

|

|

kaiserreich

|

Jun 30 2019, 12:54 PM Jun 30 2019, 12:54 PM

|

|

QUOTE(Ancient-XinG- @ Jun 30 2019, 11:48 AM) Anyone here know about Citibank acceleration saving account? Seems like conditional but higher interest than 4.1 QUOTE Receive Bonus Interest of 4.38% p.a. on your Incremental Balance versus previous month’s Average Balance*. On incremental balance only. If that month no incremental balance, then you out of luck lor. So far, this 360 with 4.1% is nice. Stand Chart 4.0% is not bad too. |

|

|

|

|

|

koala225

|

Jun 30 2019, 01:11 PM Jun 30 2019, 01:11 PM

|

|

QUOTE(kaiserreich @ Jun 30 2019, 12:54 PM) On incremental balance only. If that month no incremental balance, then you out of luck lor. So far, this 360 with 4.1% is nice. Stand Chart 4.0% is not bad too. standard chartered promo only until 31 December 19. I asked cs what happened after that, they are not having any info yet. so better stick with ocbc |

|

|

|

|

|

ProxMatoR

|

Jun 30 2019, 01:16 PM Jun 30 2019, 01:16 PM

|

|

QUOTE(koala225 @ Jun 30 2019, 01:11 PM) standard chartered promo only until 31 December 19. I asked cs what happened after that, they are not having any info yet. so better stick with ocbc I believe that's just a standard term used by SCB, where T&C states till end of this year... so they can change heavily if they want to next year... but if they got good responds, I think they will keep it... just like what they did end of last year, the extended it to end of this year... |

|

|

|

|

|

koala225

|

Jun 30 2019, 01:21 PM Jun 30 2019, 01:21 PM

|

|

QUOTE(ProxMatoR @ Jun 30 2019, 01:16 PM) I believe that's just a standard term used by SCB, where T&C states till end of this year... so they can change heavily if they want to next year... but if they got good responds, I think they will keep it... just like what they did end of last year, the extended it to end of this year... I'm not sure about this. But I'm having bad experience of their esaver account after account opening few years back. After few months the interest drop to 0.x wasting my time. |

|

|

|

|

|

ProxMatoR

|

Jun 30 2019, 01:23 PM Jun 30 2019, 01:23 PM

|

|

QUOTE(koala225 @ Jun 30 2019, 01:21 PM) I'm not sure about this. But I'm having bad experience of their esaver account after account opening few years back. After few months the interest drop to 0.x wasting my time. I believe that's because they started to push this privilege saver account since 2016.... just guessing... at least you have few months of interest earned, not as bad as just 1 month.  after all, this OCBC 360 is still steady all these while, just till recent change on interest rate calculation without affecting the final 4.1% |

|

|

|

|

|

koala225

|

Jun 30 2019, 01:51 PM Jun 30 2019, 01:51 PM

|

|

QUOTE(ProxMatoR @ Jun 30 2019, 01:23 PM) I believe that's because they started to push this privilege saver account since 2016.... just guessing... at least you have few months of interest earned, not as bad as just 1 month.  after all, this OCBC 360 is still steady all these while, just till recent change on interest rate calculation without affecting the final 4.1% I'm still thinking whether to get 360 or booster account with ocbc. My concern of 360 if i failed to fulfil either 1 the interest rate get lower than booster. Concern of booster, if BNM lower opr rate the base rate will be lower since it reduce from 3.25% to 3%. Not much affect to 360 because 360 base rate is low. |

|

|

|

|

|

ProxMatoR

|

Jun 30 2019, 01:57 PM Jun 30 2019, 01:57 PM

|

|

QUOTE(koala225 @ Jun 30 2019, 01:51 PM) I'm still thinking whether to get 360 or booster account with ocbc. My concern of 360 if i failed to fulfil either 1 the interest rate get lower than booster. Concern of booster, if BNM lower opr rate the base rate will be lower since it reduce from 3.25% to 3%. Not much affect to 360 because 360 base rate is low. to fulfil it, it can be easily done by just performing all the "needs" by beginning of every month, within same day. so you can put it aside for the rest of every month  in terms of the eligible "needs", if there is changes, high likely will be reported here, and we will know  This post has been edited by ProxMatoR: Jun 30 2019, 01:58 PM This post has been edited by ProxMatoR: Jun 30 2019, 01:58 PM |

|

|

|

|

|

koala225

|

Jun 30 2019, 02:01 PM Jun 30 2019, 02:01 PM

|

|

QUOTE(ProxMatoR @ Jun 30 2019, 01:57 PM) to fulfil it, it can be easily done by just performing all the "needs" by beginning of every month, within same day. so you can put it aside for the rest of every month :thumbsup: Is that pay other banks credit card via ift count as bill payment? or I have to pay utility bills / ift to other bank account to fulfill? |

|

|

|

|

|

ProxMatoR

|

Jun 30 2019, 02:03 PM Jun 30 2019, 02:03 PM

|

|

QUOTE(koala225 @ Jun 30 2019, 02:01 PM) Is that pay other banks credit card via ift count as bill payment? or I have to pay utility bills / ift to other bank account to fulfill? try search "bill payment", you will get the answer  |

|

|

|

|

|

koala225

|

Jun 30 2019, 02:45 PM Jun 30 2019, 02:45 PM

|

|

QUOTE(ProxMatoR @ Jun 30 2019, 02:03 PM) try search "bill payment", you will get the answer :thumbsup: ok. thanks |

|

|

|

|

|

[Ancient]-XinG-

|

Jun 30 2019, 02:51 PM Jun 30 2019, 02:51 PM

|

|

Looks like so far this is still the best SA...

|

|

|

|

|

|

koala225

|

Jun 30 2019, 02:57 PM Jun 30 2019, 02:57 PM

|

|

QUOTE(Ancient-XinG- @ Jun 30 2019, 02:51 PM) Looks like so far this is still the best SA... Yes. Unless u want to combine with investment then standard chartered will be the best in 6%. I had study uob one account still can't compete these. They have tricks inside the tnc. So always read the example how they gonna calculate the interest. |

|

|

|

|

|

mamamia

|

Jun 30 2019, 04:24 PM Jun 30 2019, 04:24 PM

|

|

QUOTE(kaiserreich @ Jun 28 2019, 05:29 PM) No problem with IBG Ringgitplus promo for OCBC 360 Link This promo mean I need to maintain RM20k balance in the acc? |

|

|

|

|

|

fantasy1989

|

Jul 1 2019, 10:51 AM Jul 1 2019, 10:51 AM

|

|

QUOTE(mamamia @ Jun 30 2019, 04:24 PM) This promo mean I need to maintain RM20k balance in the acc? open account with 20k to get this band |

|

|

|

|

|

fantasy1989

|

Jul 1 2019, 10:56 AM Jul 1 2019, 10:56 AM

|

|

QUOTE(ProxMatoR @ Jun 30 2019, 12:54 PM) higher rate, but 4.38% is only on your incremental AVERAGED BALANCE... so if you have already 30k inside, you added extra 10k this month and leave inside for whole month, your this new 10k gets 4.38%, not towards total RM40k. just a quick question on citibank if my initial deposit is 1000 ...so if i deposit 30k at Jun... then i will get 30k punya @4.38% right? then July i withdraw all back to 1000 ..i will only get 0.5%p.a (keep 30k at other place for 1month) then Aug i deposit back 30k ..will it entitled another 4.38%? would like to understand whether ocbc 360 better or citibank This post has been edited by fantasy1989: Jul 1 2019, 10:57 AM |

|

|

|

|

|

koala225

|

Jul 1 2019, 02:34 PM Jul 1 2019, 02:34 PM

|

|

QUOTE(fantasy1989 @ Jul 1 2019, 10:56 AM) just a quick question on citibank if my initial deposit is 1000 ...so if i deposit 30k at Jun... then i will get 30k punya @4.38% right? then July i withdraw all back to 1000 ..i will only get 0.5%p.a (keep 30k at other place for 1month) then Aug i deposit back 30k ..will it entitled another 4.38%? would like to understand whether ocbc 360 better or citibank Read the faq u will get your answer. citibank cannot compete with ocbc 360. This post has been edited by koala225: Jul 1 2019, 03:00 PM |

|

|

|

|

|

tadashi987

|

Jul 1 2019, 02:46 PM Jul 1 2019, 02:46 PM

|

|

QUOTE(Ancient-XinG- @ Jun 30 2019, 02:51 PM) Looks like so far this is still the best SA... this is no doubt, somemore i like the feature of OCBC e-banking which u can create your own saving plans, park your money inside that cannot be used (e-banking/debit/atm), very convenient for you to manage your money in different purpose. hope the rate remains, as it is really superior even compared with FD, the three requirements are really not difficult to fulfill at all |

|

|

|

|

|

cclim2011

|

Jul 1 2019, 05:18 PM Jul 1 2019, 05:18 PM

|

|

hello guys, me again. i started my account mid last month and i think i fulfill the 3 criteria to get 4.1, average shoukd be around 80k for the, say, 15 daya. i noticed there is a small interest rm8.xx posted yesterday. this is not the 4.1% right?

|

|

|

|

|

|

AIYH

|

Jul 1 2019, 05:27 PM Jul 1 2019, 05:27 PM

|

|

QUOTE(cclim2011 @ Jul 1 2019, 05:18 PM) hello guys, me again. i started my account mid last month and i think i fulfill the 3 criteria to get 4.1, average shoukd be around 80k for the, say, 15 daya. i noticed there is a small interest rm8.xx posted yesterday. this is not the 4.1% right? this is 0.2%, you will see the split of 1.3% interest transactions (1 for each criteria fulfilled) on the second calendar of the month (usually) |

|

|

|

|

Jun 30 2019, 12:54 PM

Jun 30 2019, 12:54 PM

Quote

Quote

0.0153sec

0.0153sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled