Outline ·

[ Standard ] ·

Linear+

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

mamamia

|

Jun 26 2019, 10:15 PM Jun 26 2019, 10:15 PM

|

|

QUOTE(kaiserreich @ Jun 21 2019, 01:59 PM) Why not both? For ATM debit card, you need to pay annual fee of RM8. I have cancelled my debit card. Using credit card instead. Yes you need to pay SST for credit card, but with OCBC Ti or 365 which gives 1% rebate, just swipe RM2500 over 12 months on BP and you are done. You need to swipe RM500 per month anyway. One day OCBC gonna remove BP from eligibility, but this trick still works right now. Can I choose not to get the debit card when I apply the acc? Bcoz I notice when u open the acc, it will charge RM8 + annual fee of RM8 annually.. without debit card, can I still get the access for online banking? I didn’t have any OCBC product yet This post has been edited by mamamia: Jun 26 2019, 10:15 PM |

|

|

|

|

|

mamamia

|

Jun 26 2019, 10:48 PM Jun 26 2019, 10:48 PM

|

|

QUOTE(kaiserreich @ Jun 26 2019, 10:41 PM) You need to ask. Probably can sign up first, then cancel later. I had the ATM card initially. Then they changed to debit card, and I chose not to renew. So mean first year must pay RM8, subsequent year only can cancel b4 the annual fee kick in |

|

|

|

|

|

mamamia

|

Jun 27 2019, 08:12 AM Jun 27 2019, 08:12 AM

|

|

QUOTE(kaiserreich @ Jun 26 2019, 11:05 PM) On 2nd thought, you need the ATM/Debit card to register your phone number for OTP and online banking login. So either way, you have to pay the first RM8 Ok, in this case, I will just get debit card first.. credit card can be later since I d have debit card for the bonus interest |

|

|

|

|

|

mamamia

|

Jun 28 2019, 07:38 AM Jun 28 2019, 07:38 AM

|

|

QUOTE(kaiserreich @ Jun 27 2019, 11:06 PM) ATM card already deactivated and can no longer be used. IBFT cannot be used as I do not have ATM card. However, I can use DuitNow which is the same as instant transfer  How about IBG? |

|

|

|

|

|

mamamia

|

Jun 30 2019, 04:24 PM Jun 30 2019, 04:24 PM

|

|

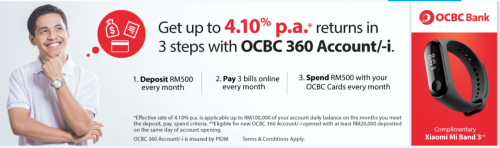

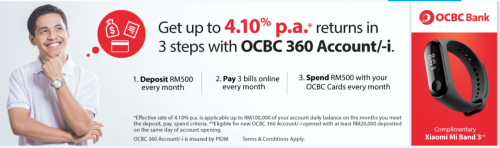

QUOTE(kaiserreich @ Jun 28 2019, 05:29 PM) No problem with IBG Ringgitplus promo for OCBC 360 Link This promo mean I need to maintain RM20k balance in the acc? |

|

|

|

|

|

mamamia

|

Jul 4 2019, 06:44 PM Jul 4 2019, 06:44 PM

|

|

QUOTE(tadashi987 @ Jun 15 2019, 01:39 PM) yes u r right, I do that every month QUOTE(avinlim @ Jul 4 2019, 06:00 PM) Means that if my balance is RM25000 (assuming after all the transaction below done in 1st day of month), I can enjoy 3.9%+(base) on the RM25000 ??? from 1st-31st of the month, credited following month? -I just need to: 1. transfer RM500 from other bank. 2. Pay RM1 to 3 bill / same bill 3 times. 3. Reload bigpay RM500 |

|

|

|

|

|

mamamia

|

Jul 4 2019, 07:31 PM Jul 4 2019, 07:31 PM

|

|

QUOTE(majorarmstrong @ Jul 4 2019, 06:49 PM) yeah Just do Instant Transfer 3x also counted as bill payment -  Instant transfer to CASA also consider as bill payment? |

|

|

|

|

|

mamamia

|

Jul 9 2019, 02:20 PM Jul 9 2019, 02:20 PM

|

|

QUOTE(avinlim @ Jul 9 2019, 02:14 PM) Just open this OCBC 360 account. I found out that I am unable to transfer out from this bank. Do u have debit card associate with the bank acc? |

|

|

|

|

|

mamamia

|

Jul 9 2019, 02:32 PM Jul 9 2019, 02:32 PM

|

|

QUOTE(avinlim @ Jul 9 2019, 02:31 PM) I got one saving account previously. Banker said already help tag the debit card to OCBC360. But when I want to do transfer from my 360...not available to select from. Just the saving account. GG.com. Sound like they didn’t link the debit card properly.. u might need to call them to check again.. |

|

|

|

|

|

mamamia

|

Jul 9 2019, 02:45 PM Jul 9 2019, 02:45 PM

|

|

QUOTE(Kcee @ Jul 9 2019, 02:42 PM) Will be activated tomorrow latest by evening. Try again tomorrow. Been there done that. Just in case it doesn't work by tomorrow, it's not too late to contact CS. But I just wonder how come must link debit card only can do transfer? If u do not have debit card, u still can do online transfer such as IBG, am I right? |

|

|

|

|

|

mamamia

|

Jul 9 2019, 03:09 PM Jul 9 2019, 03:09 PM

|

|

QUOTE(avinlim @ Jul 9 2019, 02:53 PM) Luckily just need to call n not ask u to go to branch to do another round of verification.. so, after the call, u can now transfer ur fund from ocbc to other bank or u still need to wait? |

|

|

|

|

|

mamamia

|

Jul 9 2019, 03:32 PM Jul 9 2019, 03:32 PM

|

|

QUOTE(avinlim @ Jul 9 2019, 03:24 PM) Omg, in this case, when I collect my credit card at branch later, I must make sure my online banking working b4 I leave the branch.. bcoz I didn’t apply for debit card as the officer told me that without debit card also can do internet banking such as fund transfer or bill payment.. gonna try it out in front of the officer, don wan to do double work.. thanks for ur alert |

|

|

|

|

|

mamamia

|

Jul 9 2019, 04:16 PM Jul 9 2019, 04:16 PM

|

|

QUOTE(asd5139 @ Jul 9 2019, 04:05 PM) Without debit card/bankcard you can only do ibg transfer not instant transfer. Some people dont mind doing transfer that require +- 2 days only to fulfill the criteria for the dividend and can skip the rm8 annual fees. But cc need rm25 for sst. When I check with the officer during my acc opening, she said can do IBFT even without debit card.. but I’m doubtful on her info since I get the details from sifu here.. Info from lowyat forum is always much better than bank officer.. |

|

|

|

|

|

mamamia

|

Jul 9 2019, 04:38 PM Jul 9 2019, 04:38 PM

|

|

QUOTE(kaiserreich @ Jul 9 2019, 04:28 PM) DuitNow works with or without ATM card. It is instant anyway. So, will duitnow fulfill the 3 bill payment requirement for the bonus interest? |

|

|

|

|

|

mamamia

|

Jul 9 2019, 05:08 PM Jul 9 2019, 05:08 PM

|

|

QUOTE(asd5139 @ Jul 9 2019, 04:56 PM) Im not sure what was the arrangement between you and the banker. But im ok with just ibg albeit a bit slow. I’ve no idea too.. I’m waiting for my credit card to get the online banking access.. will report back whether I can do IBFT.. |

|

|

|

|

|

mamamia

|

Jul 9 2019, 09:25 PM Jul 9 2019, 09:25 PM

|

|

QUOTE(IzaakC @ Jul 9 2019, 09:14 PM) Duitnow qualifies for the bonus interest. tried it last month when I first got my 360 account. Thanks for ur sharing, so, I no need to worry about IBFT not working for my acc without debit card |

|

|

|

|

|

mamamia

|

Jul 22 2019, 06:24 PM Jul 22 2019, 06:24 PM

|

|

My OCBC 360 acc has no debit card.. today I try to do IBFT, it goes through smoothly..

|

|

|

|

|

|

mamamia

|

Jul 23 2019, 07:07 PM Jul 23 2019, 07:07 PM

|

|

QUOTE(rojakwhacker @ Jul 23 2019, 09:35 AM) I have some questions, maybe can help answer  : 1)For those who open OCBC 360 saving account recently, may i know do they need company letter(To identify you work in that city) if own IC do not match the city that you are in now? Yes, I was asked to show co letter or any utilities bill at KL.. ended up I show my EPF stmt |

|

|

|

|

|

mamamia

|

Aug 2 2019, 04:58 PM Aug 2 2019, 04:58 PM

|

|

QUOTE(abcn1n @ Aug 2 2019, 01:18 PM) sidefulnes Only got 1.3% *2 instead of 1.3%*3 which was reflected in August. That's because although I did spend $500 in July but some of my spending was only captured in August. Thus, OCBC deemed that I didn't meet the $500 spending criteria in July. Mean ur July transaction posted in Aug instead of July.. So, eligible card spending is based on posting date |

|

|

|

|

|

mamamia

|

Aug 3 2019, 10:23 AM Aug 3 2019, 10:23 AM

|

|

QUOTE(rojakwhacker @ Aug 3 2019, 08:28 AM) For Islamic, only can use debit card for card spend bonus, since no Islamic credit card This post has been edited by mamamia: Aug 3 2019, 10:23 AM |

|

|

|

|

Jun 26 2019, 10:15 PM

Jun 26 2019, 10:15 PM

Quote

Quote

0.0891sec

0.0891sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled