QUOTE(sidefulnes @ Jun 20 2019, 09:14 PM)

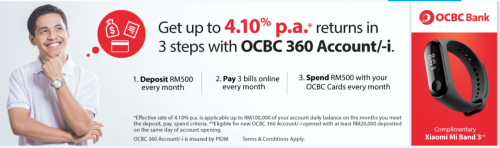

OCBC has revised the interest rates.... So it's time for me to apply for a credit card to get the 1.3% interest.

Choosing between OCBC 365 and OCBC Titanium.... Which credit card are you all using? 365 seems to be just teensy bit better but annual fee waive up to 3 years. Does it mean I have to call everytime to waive the fee or its automatic?

Why not both?Choosing between OCBC 365 and OCBC Titanium.... Which credit card are you all using? 365 seems to be just teensy bit better but annual fee waive up to 3 years. Does it mean I have to call everytime to waive the fee or its automatic?

QUOTE(vrek @ Jun 21 2019, 12:34 AM)

Alternatively, you can use the ATM debit card to reload eWallet. It counts towards the "1.3% interest when use credit card"

You can opt to use that amount in your eWallet or withdraw.

For ATM debit card, you need to pay annual fee of RM8.You can opt to use that amount in your eWallet or withdraw.

I have cancelled my debit card. Using credit card instead.

Yes you need to pay SST for credit card, but with OCBC Ti or 365 which gives 1% rebate, just swipe RM2500 over 12 months on BP and you are done.

You need to swipe RM500 per month anyway.

One day OCBC gonna remove BP from eligibility, but this trick still works right now.

Jun 21 2019, 01:59 PM

Jun 21 2019, 01:59 PM

Quote

Quote

0.0905sec

0.0905sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled