QUOTE(theberry @ Jan 8 2021, 02:22 PM)

ok. I shut up.

STOCK MARKET DISCUSSION V150

|

|

Jan 8 2021, 02:30 PM Jan 8 2021, 02:30 PM

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

|

|

|

|

|

|

Jan 8 2021, 02:31 PM Jan 8 2021, 02:31 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

QUOTE(skty @ Jan 8 2021, 02:21 PM) well thats when ppl use PE, NTA etc etc to value it....What i cannot accept is that ppl are not using 2021 earning as basis, but using 2022 as basis.... Its like today i own a company sdn bhd that earn RM 10mil per year on 2021@ worth RM 10 per shares, but foresee the earning will become RM 2 mil in 2022, then ppl ask telling me that they'll buy my company today at 2022 price @ RM 2 per shares......wth? Then i might as well earn the RM 10 mil 1st untill year 2021 then next year only sell? Of course stock market doesnt work that way. That why probably i cant be an wise investor in stock market after all |

|

|

Jan 8 2021, 02:37 PM Jan 8 2021, 02:37 PM

Show posts by this member only | IPv6 | Post

#43463

|

Junior Member

175 posts Joined: Nov 2020 |

hi. why my CIMB CDS account unable to buy US stock ? no problem with other exchanges. but only for US exchanges the Order Pad is greyed out.

|

|

|

Jan 8 2021, 02:37 PM Jan 8 2021, 02:37 PM

Show posts by this member only | IPv6 | Post

#43464

|

Senior Member

3,501 posts Joined: Dec 2007 |

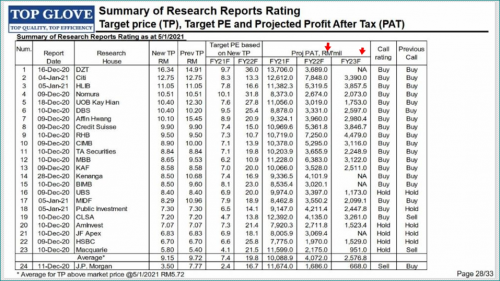

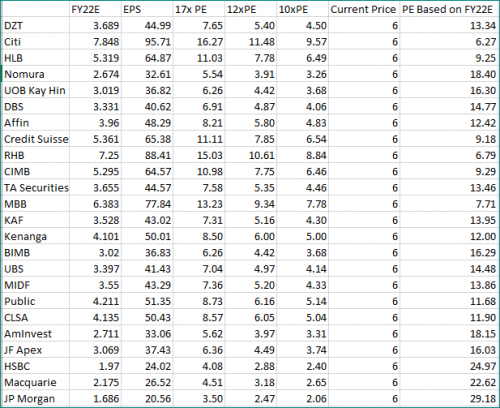

QUOTE(Boon3 @ Jan 8 2021, 01:18 PM) We have CIMB and TA Securities already valuing based on FY22 numbers already, which isn't surprising considering the next quarter, TG is already reporting its Q2 FY 2021 numbers already. Expensive if you buy for fy22 and beyond based on the analyst eps fy22. Current single digit p/e might tempt a few to go in or those who think profit normalisation will not come so fast.Now the numbers used in the table are from TG's own table...  Now using the fy 2022 estimates profits from TG table, we have the following table.... NOSH used here is 8.2 billion shares  so for example... IF we think/assume the boys/gals from CLSA has always the most consistent/most fair estimates then using CSLA estimate profit of 4.135 billion will equate to an eps of 50.43 sen. Now we can use the table ... maybe in the following way... 1. Now if we think TG should trade based on a 17x PE, then based on CLSA numbers, TG should be worth ..... 6.05 2. Or if we say... we wanna go fishing ... we think a 10x fy21 eps is a good fising price... then we should fish TG when it's around 5.00 as suggested by the table.... 3. Or based on current price ... we want to know based on fy 22 eps, what's the current PE? well, the table suggests 11.9x .. 4. Fart this nonsense table.... now is 2021.... TG should be valued based on 2021 numbers. ChAOoz .... comments? But ultimately future is expensive and kinda hard to resell it out when the time come when eps start going down. Someone will be catching tomorrow falling knife if unable to timed it well. |

|

|

Jan 8 2021, 02:39 PM Jan 8 2021, 02:39 PM

|

Junior Member

252 posts Joined: Aug 2018 |

|

|

|

Jan 8 2021, 02:39 PM Jan 8 2021, 02:39 PM

Show posts by this member only | IPv6 | Post

#43466

|

All Stars

12,273 posts Joined: Oct 2010 |

QUOTE(Rinth @ Jan 8 2021, 02:31 PM) well thats when ppl use PE, NTA etc etc to value it.... i think the abnormal event of Covid fueling the glove frenzy is what is causing theese ppl tp be cautious about the sustainability of the earnings when a non covid year arrives and normality is observed. What i cannot accept is that ppl are not using 2021 earning as basis, but using 2022 as basis.... Its like today i own a company sdn bhd that earn RM 10mil per year on 2021@ worth RM 10 per shares, but foresee the earning will become RM 2 mil in 2022, then ppl ask telling me that they'll buy my company today at 2022 price @ RM 2 per shares......wth? Then i might as well earn the RM 10 mil 1st untill year 2021 then next year only sell? Of course stock market doesnt work that way. That why probably i cant be an wise investor in stock market after all Will such gargantuan numbers of gloves will still be required? Who knows? |

|

|

|

|

|

Jan 8 2021, 02:45 PM Jan 8 2021, 02:45 PM

|

Newbie

30 posts Joined: Aug 2018 |

QUOTE(brokenbomb @ Jan 8 2021, 02:24 PM) Everyone enter their trade using TA Well, this is true one way or another..Then when the price drops Everyone hold or didn’t cut loss because of FA To determine what Company to invest based on their fundamental & entry with TA, and hold for a very very very long time |

|

|

Jan 8 2021, 02:45 PM Jan 8 2021, 02:45 PM

Show posts by this member only | IPv6 | Post

#43468

|

Senior Member

3,501 posts Joined: Dec 2007 |

QUOTE(Rinth @ Jan 8 2021, 02:09 PM) The company earning everyone know whats the level d......nothing to discuss edi....problem is ppl taking 2022 earning as current stock price......thats why need to see the price now and not worry much on the fundamental... Fundamentally the big4 is a 800m and below per annum PAT company. 800m also kinda high side already.Compare this to similar 800m pat company and their market cap, you will roughly get your true value if no additional market participant like the glove craze involve. Just have a look at similar earnings co like klk, scientex, simedarby and their market cap. |

|

|

Jan 8 2021, 02:45 PM Jan 8 2021, 02:45 PM

Show posts by this member only | IPv6 | Post

#43469

|

Junior Member

370 posts Joined: Jan 2017 |

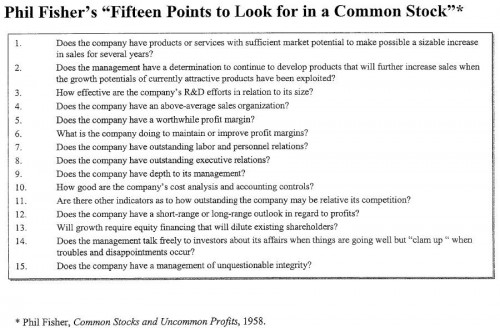

QUOTE(skty @ Jan 8 2021, 02:21 PM) This reply is actually for the silent readers who are interested in fundamental analysis, for I don’t doubt your ability in valuing a company bro I think FA is an intricate process and requires meticulous calculation and thinking,definitely not as easy as the metrics of valuation (PE,PB,DE,ebita,NPM etc.) you commonly see online. Secondly you need to think independently and separate yourself from the crowd,yup, easy said than done, especially when emotions are in play. There are many books written by fund managers/investors worth a read, you may find yourself benefit more from these people than the usual suspect of Benjamin Graham, Warren Buffet lol. In fact, I’d go so far to say Warren Buffett isn’t always transparent with his investment strategy, he commonly uses analogies that sound simple but offer no concrete benefit to investors who want to learn the technical part of investment. Personally, my investment philosophy is inspired by Peter Lynch and Howard Marks. Anyone interested I FA can search up their books. Btw, Philip Fisher’s common stock uncommon profit is worth a read too. Here are 15 points you need to ask yourself when you value a company,according to Philip Fisher. Good luck!  |

|

|

Jan 8 2021, 02:46 PM Jan 8 2021, 02:46 PM

|

All Stars

24,461 posts Joined: Nov 2010 |

QUOTE(Rinth @ Jan 8 2021, 02:31 PM) well thats when ppl use PE, NTA etc etc to value it.... all kinds la... some even use 2023 or 2024 - sure "normalize", ASP crash, too many players, over supply, no earnings, worthless la.What i cannot accept is that ppl are not using 2021 earning as basis, but using 2022 as basis.... Its like today i own a company sdn bhd that earn RM 10mil per year on 2021@ worth RM 10 per shares, but foresee the earning will become RM 2 mil in 2022, then ppl ask telling me that they'll buy my company today at 2022 price @ RM 2 per shares......wth? Then i might as well earn the RM 10 mil 1st untill year 2021 then next year only sell? Of course stock market doesnt work that way. That why probably i cant be an wise investor in stock market after all but for say, tesla... in 5 years time, got laser blasters, anti gravity cars, teleport machines... nothing is too high. QUOTE(halotaikor. @ Jan 8 2021, 02:37 PM) hi. why my CIMB CDS account unable to buy US stock ? no problem with other exchanges. but only for US exchanges the Order Pad is greyed out. CDS is for bursa.for US or any foreign bourse, u need to sign separate forms - talk to yr broker. |

|

|

Jan 8 2021, 02:48 PM Jan 8 2021, 02:48 PM

|

Senior Member

1,046 posts Joined: Nov 2014 |

Wow, what happen to glove counter today?

Careplus 20% Supetmsx 6% |

|

|

Jan 8 2021, 02:49 PM Jan 8 2021, 02:49 PM

|

All Stars

24,461 posts Joined: Nov 2010 |

QUOTE(prophetjul @ Jan 8 2021, 02:39 PM) i think the abnormal event of Covid fueling the glove frenzy is what is causing theese ppl tp be cautious about the sustainability of the earnings when a non covid year arrives and normality is observed. that has always been the big question.Will such gargantuan numbers of gloves will still be required? Who knows? becos it has so many uncertainties, it is very open, u get all kinds of views, estimates, earnings, PER, etc. since nobody "really know", will u consider actual current data from QRs, info from the glove makers/sellers? or the chartists, artists, analysts, IB's or "JPM 3.50"? immobile liked this post

|

|

|

Jan 8 2021, 02:51 PM Jan 8 2021, 02:51 PM

|

All Stars

24,461 posts Joined: Nov 2010 |

|

|

|

|

|

|

Jan 8 2021, 02:53 PM Jan 8 2021, 02:53 PM

|

Senior Member

2,116 posts Joined: Mar 2009 |

|

|

|

Jan 8 2021, 02:54 PM Jan 8 2021, 02:54 PM

|

All Stars

24,461 posts Joined: Nov 2010 |

|

|

|

Jan 8 2021, 02:59 PM Jan 8 2021, 02:59 PM

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(HereToLearn @ Jan 8 2021, 01:46 PM) that one was because of Aspion issue |

|

|

Jan 8 2021, 03:01 PM Jan 8 2021, 03:01 PM

|

Senior Member

1,264 posts Joined: Aug 2009 |

|

|

|

Jan 8 2021, 03:02 PM Jan 8 2021, 03:02 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(squarepilot @ Jan 8 2021, 02:59 PM) It fluctuated between 15-20 from 2013 to 2018 thoughhttps://www.msn.com/en-my/money/stockdetail...pglov/fi-alav7w immobile liked this post

|

|

|

Jan 8 2021, 03:05 PM Jan 8 2021, 03:05 PM

|

Senior Member

7,617 posts Joined: Mar 2009 |

Another big blow https://www.thestar.com.my/news/world/2021/...variants--study

|

|

|

Jan 8 2021, 03:06 PM Jan 8 2021, 03:06 PM

Show posts by this member only | IPv6 | Post

#43480

|

Junior Member

370 posts Joined: Jan 2017 |

QUOTE(pinksapphire @ Jan 8 2021, 03:01 PM) Buying force (driving the price up) is so strong, that those who bet the stock price will plummet give up betting because if the buying force continues to be so strong, their loss will be uncapped. Sky is the limit lol. Now without the resistance from “shorting”, the price will go up without...resistance...lol This post has been edited by MedElite23: Jan 8 2021, 03:08 PM |

| Change to: |  0.0322sec 0.0322sec

0.71 0.71

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 12:33 PM |