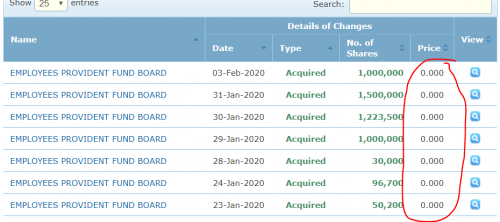

Hi, I am new to the stock market. Can I ask how do the big boys acquire the stocks at price of 0??

STOCK MARKET DISCUSSION V150

|

|

Apr 16 2020, 10:37 AM Apr 16 2020, 10:37 AM

Return to original view | Post

#1

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

|

|

|

Apr 22 2020, 08:42 AM Apr 22 2020, 08:42 AM

Return to original view | Post

#2

|

Senior Member

2,282 posts Joined: Sep 2019 |

Hi all, may I know how can we check how much foreign funds, local institutions and local retailers being invested in Malaysia share market now?

|

|

|

Jun 26 2020, 12:31 PM Jun 26 2020, 12:31 PM

Return to original view | Post

#3

|

Senior Member

2,282 posts Joined: Sep 2019 |

Come across this, what do you guys think? Is it wise to buy now?

https://klse.i3investor.com/servlets/stk/1155.jsp DeepValueInvestor https://www.marketwatch.com/story/bank-stoc...owerfully-onc... https://www.abc.net.au/news/2020-06-26/wall...nes-bank-stoc... Lai, time to fly, banks' QR2 reports will not be as bad as priced in expectations. 26/06/2020 12:15 PM DeepValueInvestor As for stock picks, KLCI blue chips like Axiata, Maybank, CIMB, GenM, Genting, Sime, MISC, Topglove and Harta should witness rotational buying interests to aid uptrend resumption ahead of the mid-year window dressing. Source: HLB research highlight Time to collect before buying interest switch from gloves and gaming to banks. Also, in 2008-2009, some banks despite having -eps in some quarters, the banking stocks just shot up when the recession ended on March 2009 (after QE started on Nov 2008) 26/06/2020 12:17 PM |

|

|

Jun 26 2020, 02:35 PM Jun 26 2020, 02:35 PM

Return to original view | Post

#4

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jun 30 2020, 01:58 PM Jun 30 2020, 01:58 PM

Return to original view | Post

#5

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(icemanfx @ Jun 30 2020, 12:57 PM) Retail traders prefer to chase trend, buy high and sell higher. until fresh money is exhausted, price continue to rise and likely to set new record. Once retail traders come to a realization that the funds are exhausted, all will start cutting loss and the share prices will plunge. Better go with long term dividends now, too much risk for too little reward.Just my 2 cents |

|

|

Jul 1 2020, 12:30 AM Jul 1 2020, 12:30 AM

Return to original view | Post

#6

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(oldsoulguy @ Jul 1 2020, 12:04 AM) Hello, a random question I would like to ask. How major of an affect would be on our market with the upcoming parliamentary meeting starting 13th July? I guess foreign fund will stay out of malaysia market until politic stabilizes (to avoid unnecessary risk) oldsoulguy liked this post

|

|

|

|

|

|

Jul 8 2020, 03:28 PM Jul 8 2020, 03:28 PM

Return to original view | Post

#7

|

Senior Member

2,282 posts Joined: Sep 2019 |

Banks are slowly making a comeback like how they did in 2009-2011?

|

|

|

Jul 8 2020, 03:48 PM Jul 8 2020, 03:48 PM

Return to original view | Post

#8

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jul 9 2020, 09:10 AM Jul 9 2020, 09:10 AM

Return to original view | Post

#9

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(foofoosasa @ Jul 8 2020, 07:50 PM) Have u wonder how does lower opr rate affect bank profitability and the 6 months loan deferment? Let's alone the rising default loan. Yes, I think I do. Banks (major income) earn the spread between deposits that it pays consumers and the rate it receives from their loans.Will loan moratorium affect banks' profitability? Yes, it delays their earnings until SEP 30. This is priced in and banks will resume their earnings from SEP 30. So perfect timing to collect before SEP 30. Why is it priced in? https://www.thestar.com.my/business/busines...l-144-on-waiver According to the source, net profit to fall 14.4%. But have a look at the banks' PE. Some PE (if not all) fell more than 14.4%. This means that the banks are oversold. Perfect opportunity to collect those oversold counters (single digit PE with double digit ROE) Will OPR affect banks' profitability? Not really. Why? Consider people who took loans pre-covid (i) Those who took floating (variable) rate loan - The spread remains the same with an exception which will be discussed below; no effect (ii) Those who took fixed rate loan - the spread widens now; increases profitability post SEP30. Yes, people might refinance the loan, but this requires them to pay an application fee (extra insignificant profit for banks) Other factors (i) Companies who have cash flow problem, now issues more bonds to raise cash. Now, more corporate bonds for the banks to sell (extra insignificant profit) (ii) Loan impairment. Yes, banks MIGHT lose money when they cant receive their loan repayments. Why 'might'? Because if banks auction off the collateral more than the remaining loan repayments, they are not making any losses (iii) With cheap loans available, more people might start taking loans; increases profitability post SEP 30. (iv) With banks' FD lowered, some might choose to go into riskier assets that pays dividend (treating them as higher risk FD). Lowering interest rate indirectly inflate the market's average PE. All I can see is massive earnings after SEP 30, and a lot of potential upside from KL Finance index. Banks totally carried KLSE on 8 July 2020. With the gloves hype slowly fading with lower ASP, banks should be a better investment in the longer run. https://www.thestar.com.my/business/busines...ce-to-normalise Look at the trading volume for bank stocks (especially cimb): 12mil rivals hartalega's and topglov's volume. https://finance.yahoo.com/quote/%5EKLSE/components/ Also foreign fund was the net buyer yesterday. Maybe foreign funds prefer bank stocks too? *The above shared info might be wrong* Please correct me if I am wrong so that I can learn better |

|

|

Jul 9 2020, 11:23 AM Jul 9 2020, 11:23 AM

Return to original view | Post

#10

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Vanguard 2015 @ Jul 9 2020, 10:47 AM) Good morning folks. Wise choice brother, the banks are carrying the market again.I have a bit of time this morning. So, I decided to sai lang all the bank counters. See how it goes. I just sailang some selected bank counters recently after studying the fundamentals and the historical patterns. To me, banks are still much safer than gloves in the long run. |

|

|

Jul 12 2020, 07:03 PM Jul 12 2020, 07:03 PM

Return to original view | Post

#11

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(BooYa @ Jul 12 2020, 06:53 PM) Stock price is only as good as what the next buyer (or punter) is willing to pay for. Going back to the fundamentals is a much safer option to invest. Buying undervalued stocks for the long term is a much safer option than buying overvalued stocks for short term trade. The only downside of buying undervalued stocks is that you cant make quick profit because the markets can remain irrational and inefficient longer than you can remain solvent. In layman terms, you might sell your undervalued stocks before the asset's prices truly reflect their values. LoTek liked this post

|

|

|

Jul 12 2020, 10:38 PM Jul 12 2020, 10:38 PM

Return to original view | Post

#12

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AVFAN @ Jul 12 2020, 07:15 PM) can u name a couple of these undervalued stocks? i mean those u think can truly buy-keep and not risk selling becos "low got lower"? YESi mean those u think can truly buy-keep and not risk selling becos "low got lower"? a lot of talk here about rising stocks. will be good if there is a good discussion on good undervalued stocks, how to pick them. and stocks that about to dive big time -give a warning to those who are maybe unaware..? The bank sector took a big hit from all the negativity in the market (OPR cut, possible NPLs). I personally think this is the perfect time to collect before the negativity fades. Banks will come back before the economy recovers (just look at how they came back in 2009-2011 after the sharp selling in 2008). I would say try looking for financial stocks that lost a lot of their market cap and read up the balance sheet, income and cash flow statement to pick banks that suits your risk appetite best. I am heavily invested in financial stocks because they are very resilient and will not go into PN17 like AA. My 3 biggest holdings are (i) BIMB and TAKAFUL as their past performance prior covid were superb, and their price look attractive. These 2 are the perfect growth stocks that give dividends better than the FDs (unlike most tech stocks - little to no dividends). (ii) CIMB because I am taking advantage of the hin leong and hontop exposure that causes the huge price drop (now extremely low P/B). Plan to sell after riding the wave when it comes back like how banks stocks did in 2009-2011 unless its ROE improves. Maybank and pbb are not my biggest holdings despite their superb performance prior covid because (i) pbb was way overvalued prior covid and still slightly is (ii) maybank share price now is already very close to their price prior covid, there is nothing to bottom fish here. My approach definitely cannot result in huge and quick profit like the gloves. But with fundamentals supporting my decisions, at least I wont panic sell if it drops but will continue to collect more. There are other undervalued stocks in other sectors too. But I am heavily invested in the financial sector NOW because there is a better opportunity to bottom fish HERE NOW. |

|

|

Jul 14 2020, 10:03 AM Jul 14 2020, 10:03 AM

Return to original view | Post

#13

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(zstan @ Jul 14 2020, 09:20 AM) whole klci is carried by gloves. if gloves crash all die man. wonder other countries who are doing well which counters are supporting their index. Things will get very ugly when the bubble pops. But on the bright side, it offers a good opportunity to short FKLI ESPECIALLY IF the funds removed from gloves are NOT reinvest into other stocks. |

|

|

|

|

|

Jul 14 2020, 05:11 PM Jul 14 2020, 05:11 PM

Return to original view | Post

#14

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(kereta @ Jul 14 2020, 04:56 PM) I hate to say this, but i got a feeling and wonder how these ppl get their funds for gloves? If they liquidate from other stocks then just to feed into this gloves bubble? If fund via margin will collateral damage is just on the gloves stocks themselves. In the end only bankers/market maker and some of the earlier and/or luckier ones will make out of this bubble richer.It's a bubble just a matter of time and until price is too high to make up the monstrous volume (did i see some ppl say open counter slow/hang af) then that's the end of goreng goreng. Fellow LYN please do not distort other stocks by liquidating just to feed into the bubble. Play with it, happy ending then pull out. Last person pull out will be the loser. |

|

|

Jul 14 2020, 05:13 PM Jul 14 2020, 05:13 PM

Return to original view | Post

#15

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jul 15 2020, 09:12 AM Jul 15 2020, 09:12 AM

Return to original view | Post

#16

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jul 16 2020, 12:11 AM Jul 16 2020, 12:11 AM

Return to original view | Post

#17

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(RenuPlus @ Jul 15 2020, 11:49 PM) For trading, anything can be a good buy!For quicker gains, FKLI because you can make money in both up and down directions. For investing, look for the fundamentally good beaten down stocks that will recover with economy recovery. |

|

|

Jul 16 2020, 12:11 AM Jul 16 2020, 12:11 AM

Return to original view | Post

#18

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jul 16 2020, 02:09 PM Jul 16 2020, 02:09 PM

Return to original view | Post

#19

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(ZeroSOFInfinity @ Jul 16 2020, 12:30 PM) In investing, always remember that Rome was not built in a day. In trading always remember that Hiroshima and Nagasaki were destroyed in a dayIts alright man, at least you have locked in some profits in the early gloves run. Start collecting the undervalued shares, once the fund managers are done gorenging gloves. They will rotate to goreng other. Just pray that your undervalued shares will get gorenged. If they dont get gorenged, as least you still have a decent dividends better than the FDs. Also, if they drop, you will never panic sell because you truly know the underlying value of your shares. Try getting some good dividends stock with good dividends growths in the long run. |

|

|

Jul 16 2020, 07:49 PM Jul 16 2020, 07:49 PM

Return to original view | Post

#20

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(CoronaV @ Jul 16 2020, 07:24 PM) Need help https://mplusonline.com/help/i-already-have...cca-securities/I have cimb CDS account opened years back but not in use at all . Dormant account. Can I register for M+ trading account ? Do I need to cancel my existing CDS account first? Thank you aerotec liked this post

|

| Change to: |  0.0838sec 0.0838sec

0.38 0.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 08:11 PM |